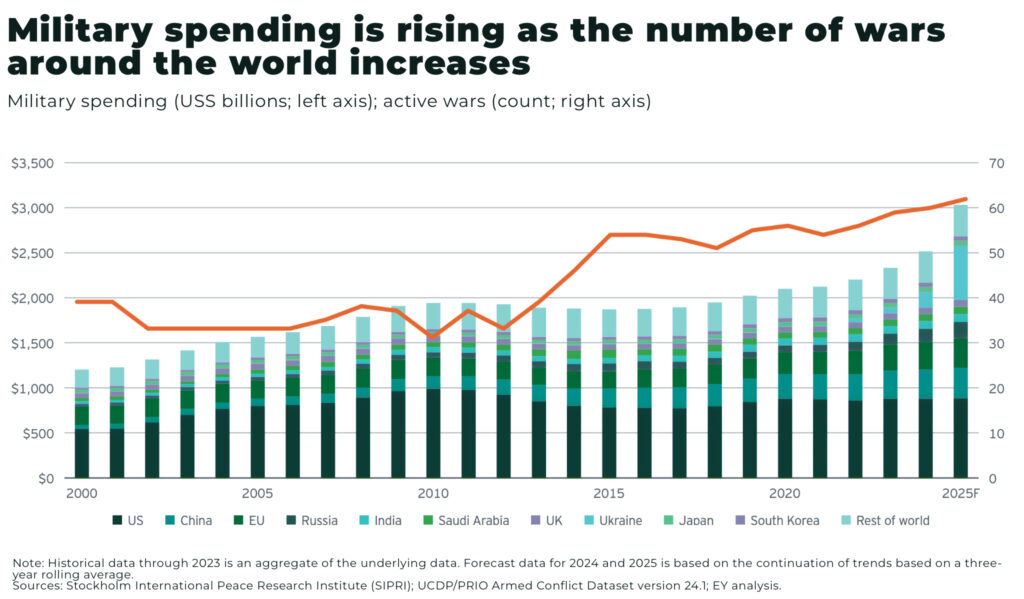

Global defence spending hit USD2.46 trillion in 2024 — with the 7.4% real-terms increase outpacing increases of 6.5% in 2023 and 3.5% in 2022 — and is expected to increase further in 2025 as geopolitical tensions continue to rise:

- the EU has announced an €800bn defence fund called The ReArm Europe fund

- Germany plans to spend US$1 trillion on defense and infrastructure

- China plans to boost its defence spending by 7.2% this year

- Russia is increasing spending on national defence to 6.3% of GDP in 2025

- the UK has committed to increase spending to 2.5% by 2027

The spiral of geopolitical risk and this massive rearmament cycle has created severe supply chain constraints — especially with critical minerals.

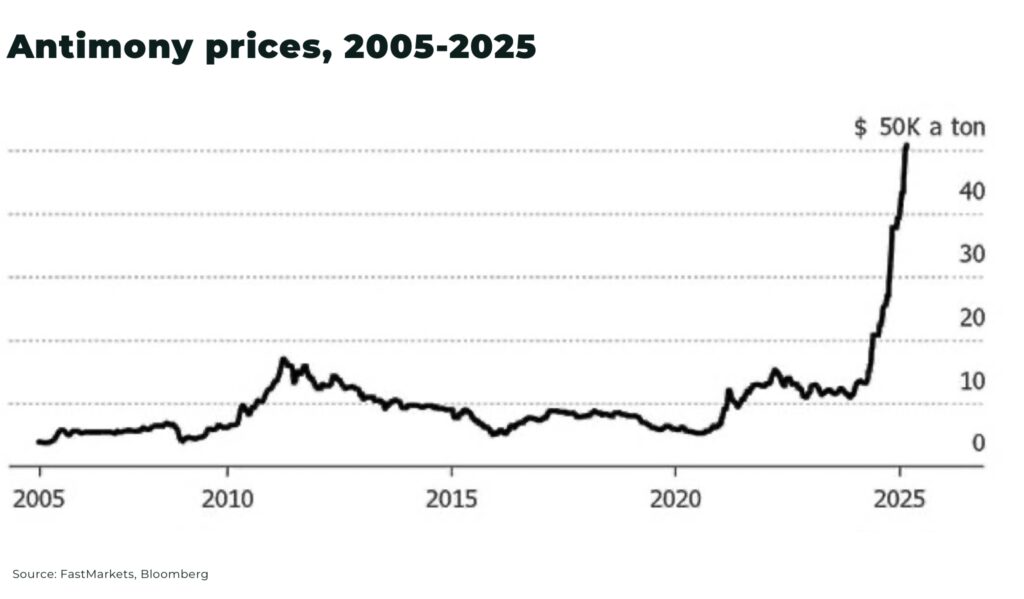

And one critical mineral in particular is essential for rearmament: antimony, which has seen prices rise more than 350% since 2024 to US$51,500 per tonne.

Antimony: the military’s critical mineral

Antimony (Sb) is a silvery-white, brittle metalloid that rarely occurs in its native form and is primarily extracted from the mineral stibnite.

The semi-metal is now classified as a critical mineral in the US, the EU, Japan, Australia, Canada, and the UK, as it is crucial across defense and industrial applications:

- to harden the lead in ammunition

- improve penetration capacity of armor-piercing rounds

- night-vision goggles and infrared sensors

- explosives

- flame retardants

- as, well as lead-acid batteries, semiconductors, and solar PV panels

In the US, in 2024, the leading uses of antimony were metal products, including antimonial lead and ammunition,40%; flame retardants, 39%; and nonmetal products, including ceramics and glass and rubber products, 21%.

Antimony caught in the geopolitical crossfire

In August 2024, China announced export restrictions on antimony, and other related minerals, because of “national security”. . In December 2024, China banned all exports of antimony to the US.

Prices skyrocketed more than 250% in 2024, ending the year at almost US$40,000 per tonne. Current prices for antimony in 2025 are now at $55,000 per tonne.

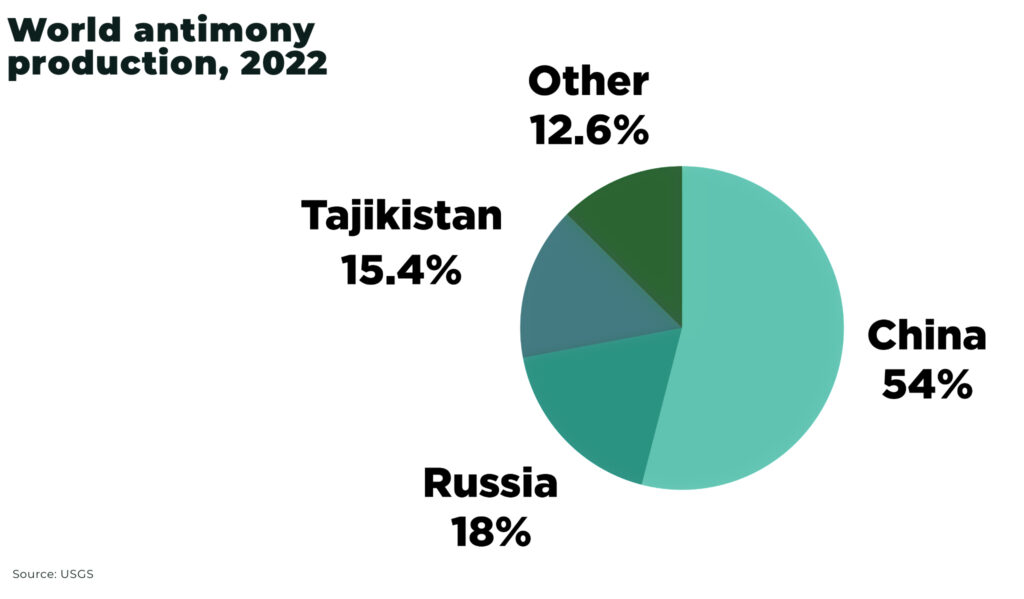

The challenge for the West, is that 90% of global mined antimony in 2024 was concentrated in China, Russia and Tajikistan — the US had no commercial levels of mined production.

The geopolitical tensions impacting antimony’s prices are against a backdrop of falling supply across the world. The West currently faces several challenges regarding antimony supply:

1. Lack of Domestic Production

- no active antimony mines in the “West”

- reliance on imports for primary supply from China and Russia

- limited processing capabilities within North America

2. Limited Alternative Sources

- few major producers outside Asia

- long lead times for new mine development

- complex regulatory requirements for new mining operations

China

In particular, China may dominate supply, but its share is stagnating with increasingly depleted reserves, as well as rising costs with tighter environmental regulation and decreasing ore quality.

For example, environmental inspections were conducted in Hunan province from March to June 2024 leading to closure of illegal mines.

This is now putting pressure on other global suppliers.

According to Project Blue estimates, the industry fell into a deficit in 2021 and for the first time in history, Chinese ingot smelters had become critically reliant on imported antimony concentrates. New supply from Russia’s top gold producer, Polyus, helped lift the deficit in 2023 — but the market is forecast to fall back into deficit in 2024. Project Blue forecasts that market balance may not return until 2026, assuming new supply sources can be accelerated.

Antimony demand patterns outside of military demand is also shifting. Traditional applications in flame retardants continue to decline gradually, but demand from solar installations is expected to remain high with new global capacity forecast to reach 493 GW.

USA

The USA has not produced antimony domestically since the closure of its last mine in Idaho in 2001, and stockpiles in 2003 were reportedly just 1,100 tons (vs consumption of 23,000 tons).

The critical shortages of antimony for the US has catalyzed significant investment opportunities in non-China supply sources.

In 2024, Perpetua Resources (TSE: PPTA) received a letter of interest from the US Export-Import Bank (EXIM) for a loan worth up to US$1.8 billion to develop an antimony and gold mine in northern Idaho. It comes after the Department of Defence, through the Defense Production Act Investments Program, awarded US$24.8 million to complete an environmental study and US$60 million to fund the permitting process. According to the company, the mine has the capacity to meet 35% of US demand in the first 6 years. Perpetua plans to begin production 2028, hoping final permits are signed this year but, with China’s new restrictions on exports, the company is looking at starting operations sooner.

“We are looking at things that we can do during construction to get antimony out the door sooner for some of these strategic needs,” Jon Cherry, Perpetua’s CEO, told Reuters.

However, we must note, the company is currently under investigation concerning possible violations of federal securities laws.

Strategic opportunities in securing the antimony supply chain

In an interview with The Oregon Group, Scott Eldridge, CEO of Military Metals Corp (CSE: MILI | OTC: MILIF), underscored the challenge:

“China, they’re basically weaponizing our mineral insecurity by turning off the tap on critical minerals. They they control the market. It’s not just antimony. Governments are realizing how dependent we are on China and, when they turn off the tap, we see how vulnerable we are to disruption. In meeting with officials, you can see it with the sweat on the brow and the money that’s being put on the table” — Scott Eldridge, CEO, Military Metals Corp

Military Metals Corp is developing a portfolio of advanced exploration antimony-gold and tin properties:

- their flagship asset in Slovakia boasts a high-grade Soviet-era resource with an average grade of 2.5% antimony and a gold kicker, representing a potentially significant deposit within the EU, which is developing a fast-track permitting process. With a historical resource of over 61,000 tons of antinomy at today’s spot price of $55,000 US the company has over $3 billion in situ value of antimony in the ground. SLS engineering is currently update their historical resource for a 43-101 complaint resource.

- West Gore, in Nova Scotia in Canada, in WW1 was North Americas biggest producer of Antimony in the early 1900’s where records document nearly 32,000 metric tons of production between 1914-1917, yielding over 7,000 metric tons of antimony concentrate grading 46%

- and the company just completed the acquisition of the Last Chance project in Nevada, USA. It was discovered in 1880, with intermittent recorded production between 1917-1965 totaling 6,139 tons at an average grade of 29% antimony (sorted ore) for recovery of 1,782.7 tons of antimony metal

Russia

According to the USGS, Russia has the second largest antimony reserves in the world, at 350,000 (after China’s 640,000), and is currently the fifth largest producer in the world.

Russia also operates one of the largest antimony mines in the world.

The Olimpiada mine in Russia, operated by Polyus, is primarily a gold mine but was responsible for more than 20% of global antimony mine supply in 2023.

This level of production means Polyus has considerable influence over the price of antimony when, for example in 2023, Polyus helped bring the market out of deficit. Several of China’s main antimony miners and some gold smelters have reportedly adjusted processing flow sheets to accommodate lower-grade antimony and higher-grade gold concentrates from Polyus.

However, Polyus has been subjected to Western sanctions, imposed after Russia invaded in Ukraine in 2022, disrupting supply to the West.

Myanmar

From 2013, Myanmar emerged as a significant and consistent exporter of antimony, the world’s fourth largest producer in 2023, with approximately 4,600 tonnes. For example, Japan’s antimony ingot imports from Myanmar surged in December 2024, with no purchases from major supplier China for a second straight month.

However, just as with supply concerns over tin from the region, so the civil war in Myanmar has disrupted supply chains, key trade routes and small-scale artisanal mining. Sources have told Fastmarkets that smelters in southeast Asia are offering lower quantities of antimony metal for sale at higher prices, since December 2023.

Tajikistan

Tajikistan is the world’s second largest antimony producer, producing 21,000 tonnes, with the “Anzob” company (established as the Tajikistan-U.S. joint venture in 2005) a significant seller of antimony to Europe.

China’s metals mining firm Huayu Mining also has a joint venture with Tajik Aluminium Co (Talco) with a gold-antimony mine in the country, but has been hit by delays.

In February 2024, the US Department of State initiated efforts to foster closer critical minerals partnerships with Central Asian nations, including Tajikistan. The Anzob mining company, owned entirely by US investor Comsup Commodities Inc, is the sole extractor of antimony in Tajikistan, having invested US$300 million over 15 years to modernize a Soviet-era ore processing plant.

Australia

Australia has emerged as another promising alternative partner in diversifying global antimony supply. Larvotto Resources is scheduled to open a new antimony mine in Australia in 2026, with its Hillgrove deposit boasting the 8th largest antimony deposit in the world.

Conclusion

Companies with antimony assets in politically stable jurisdictions are particularly well-positioned as defense contractors and governments seek to establish secure supply chains outside Chinese and Russian influence.

For investors, the antimony market presents a rare opportunity in a critical mineral with clear supply constraints, growing strategic importance, and robust government support for new production.