Critical Minerals and Energy Intelligence

Latest News

Insights

Latest Boom, Bust and BS Podcast

Industry reports

Commodity infographics

Latest Investment Insights

Mining investment tightens as geopolitics and oversupply shape 2026 — Wood Mackenzie

Global mining investment will be dominated by three main drivers in 2026: geopolitics, the energy transition, cautious capital investment, according to the latest report by

Trump orders negotiations with foreign suppliers on critical mineral imports, warns tariffs if deals stall

US President Trump has signed an Executive Order directing US trade and commerce officials to begin talks with foreign suppliers to secure critical mineral imports,

Can nickel prices hit $25,000 in 2026?

Indonesia’s new nickel supply strategy Indonesia — the world’s dominant producer with two-thirds of nickel supply — has signaled major supply cuts for 2026, triggering

Tokenized Assets: The Next Frontier For Corporate Treasuries

Over the past several years, tokenization has transformed from a niche technological experiment into a major development in global finance. While much of the conversation has centered

Why Tetra Zone has us more excited than ever (Guest Post by Dev Randhawa)

By Dev Randhawa, Chairman, F3 Uranium (TSXV: FUU, OTCQB: FUUFF) Nuclear power is back in a big way — clean, reliable, high-throughput energy. As reactors

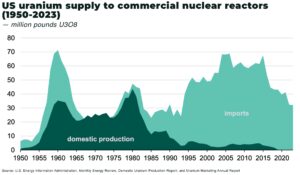

US plans $2.7 billion investment to restore uranium enrichment

The US US Department of Energy has awarded US$2.7 billion to restore American uranium enrichment capacity, largely abandoned three decades ago, aiming to reduce reliance