Critical Minerals and Energy Intelligence

Rare Earths

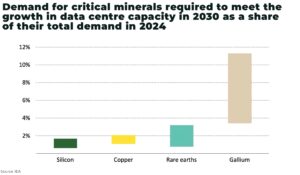

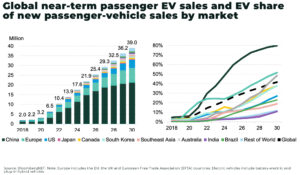

Rare earth demand is expected to surge over the next decade, driven by the global race to electrify transport, expand renewable energy, and power next-generation technologies. Permanent magnets made from rare earths like neodymium and dysprosium are essential for electric vehicles, wind turbines, robotics, and advanced electronics.

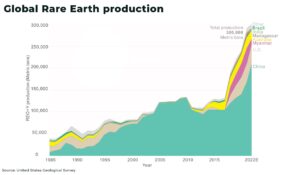

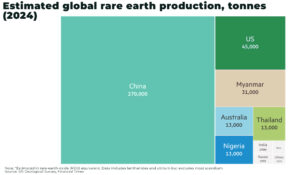

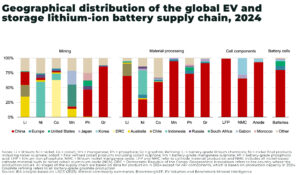

Yet, supply remains highly concentrated: China controls roughly 90% of refined rare earths and dominates both mining and processing, creating persistent geopolitical and supply chain risks. While global rare earth output has jumped from 240,000 to 350,000 metric tons since 2020, new supply outside China has lagged, and heavy rare earths face looming deficits as demand outpaces new project development.

Expect rare earth prices to remain volatile, whipsawed by Chinese policy, inventory swings, and shifting EV and renewable demand. But the long-term fundamentals are clear: the energy transition and technology boom are set to drive rare earth demand, and supply security, to the top of the global critical minerals agenda

Rare earth Insights

Latest News

Rare Earth Elements (REEs)

Rare earth elements, often called the “Group of 17,” are a set of metals critical to the technologies powering the global clean energy transition, advanced electronics, and defense systems. These elements-including neodymium, praseodymium, dysprosium, and terbium-are prized for their unique magnetic, luminescent, and electrochemical properties. Despite their name, rare earths are relatively abundant in the Earth’s crust, but are rarely found in economically viable concentrations, making mining and refining both challenging and costly.

Why rare earths matter: strategic applications

Clean energy and electrification

-

permanent magnets: Neodymium-iron-boron (NdFeB) magnets, which use neodymium, praseodymium, dysprosium, and terbium, are essential for high-efficiency motors in electric vehicles (EVs), wind turbines, and robotics. These magnets provide unmatched strength and energy efficiency, enabling smaller, lighter, and more powerful devices

-

renewable energy: Rare earths are vital for wind turbine generators and other renewable energy infrastructure, supporting the decarbonization of global power grids

Defense and advanced technology

-

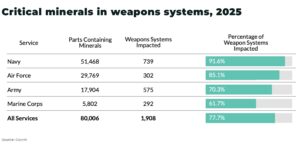

military and aerospace: Rare earth compounds are used in missile guidance systems, radar, night vision, fiber optics, and solid-state lasers-making them irreplaceable for modern defense and aerospace applications

-

electronics and communications: REEs are found in smartphones, computers, medical imaging, and advanced semiconductors, underpinning the digital economy

Supply and demand dynamics

Demand drivers

-

surging global demand: Rare earth magnet demand is expected to keep rising in 2025 and beyond, driven by growth in EVs, hybrids, renewable energy, and emerging technologies like humanoid robotics and passenger drones

-

price outlook: While prices have been volatile and are currently subdued due to high inventories and macroeconomic uncertainty, experts forecast a sharp rebound-especially for heavy rare earths like dysprosium. By 2034, dysprosium prices could surge by up to 450% if supply remains constrained

Supply challenges

-

China’s dominance: China accounts for 58% of global rare earth mine production and dominates refining, controlling prices and supply for the rest of the world. Recent export controls and a strategic shift toward domestic use have heightened concerns about supply security

-

geopolitical risk: The rare earths supply chain is exposed to policy risks, such as export restrictions and regional conflicts. Disruptions in Myanmar, a major supplier of heavy rare earths, have already caused price spikes and supply shortages

-

environmental and social impact: Traditional rare earth extraction is energy- and water-intensive, with significant environmental footprints. New projects in South America and technological advances are aiming to address these challenges with more sustainable practices

Major producers and emerging projects

-

Lynas Rare Earths (Australia/Malaysia): the largest non-Chinese REE producer, supplying key markets in Asia, Europe, and North America

-

China Northern Rare Earth Group: the world’s largest rare earth miner and processor

-

Aclara Resources (Chile/Brazil): developing innovative, low-impact extraction methods to diversify global supply

Market trends shaping rare earths’ future

-

decoupling from China: For the first time, rare earth prices are beginning to decouple from Chinese benchmarks, signalling a structural shift as new supply chains emerge in the Americas, Australia, and Africa

-

investment in recycling and alternatives: companies and governments are ramping up investment in recycling rare earths from end-of-life products and developing alternative materials to reduce dependence on primary supply

-

technological innovation: advances in extraction, processing, and magnet manufacturing are improving efficiency and reducing environmental impact, supporting sustainable market growth

Rare earth elements are the backbone of the clean energy revolution, advanced manufacturing, and modern defense. As demand accelerates and supply risks intensify, the race is on to build resilient, diversified, and sustainable rare earth supply chains-cementing their role as a linchpin of the 21st-century global economy.

53 million tons of battery metals needed by 2040 to meet EV boom

Global electric vehicle (EV) sales are on track to hit 22 million units in 2025 — up 25% from 2024 — according to BloombergNEF’s latest

Trump orders Federal Agencies to fast-track critical mineral and energy funding

President Trump has signed a new Presidential Memorandum instructing over a dozen US federal agencies to streamline and accelerate the funding process for energy infrastructure

US and Asia partners launches Critical Minerals Initiative amid rising tensions with China

The Quad — comprising the US, Australia, India, and Japan — has formally launched a new Critical Minerals Partnership, aimed at securing supply chains for

China’s rare earth restrictions easing but US supply still de-prioritized

The approval rate for rare earth export licences from China has climbed from 25% to 60%, according to European supplier group CLEPA. But shipments destined

G7 to agree strategy to secure critical minerals supply

G7 leaders have agreed a new, draft strategy to secure global supply chains for critical minerals in response to China’s growing use of export restrictions,

US and EU automakers warn “urgent” action needed on China rare earth export restrictions

America’s MEMA, the Vehicle Suppliers Association, and CLEPA, the European Association of Automotive Suppliers, have issued calls for urgent action to be taken to limit