Critical Minerals and Energy Intelligence

Copper

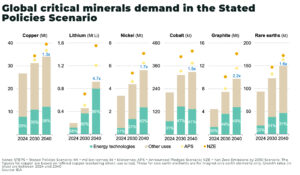

Copper demand is projected to double — to 50 million metric tons by 2035 — with demand driven by overhauling national electricity grids, renewable power expansion, and the tech and electric vehicle boom.

To put the demand increase in perspective: the energy transition will need more copper than all the world has consumed from 1900-2021.

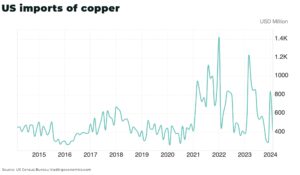

If you plan to trade, get ready for plenty of volatility in the copper market as prices face a variety of risks including: inflation, concerns over recession, as well as manufacturing contractions in Europe and China.

However, the fundamentals are strong in the long-term with government commitments and challenges in building out secure copper supply.

copper Insights

Industry copper report

Global supply of copper, essential for a host of industries and crucial to green technology and the global energy transition, is expected to face a supply gap of nearly 10 million mt within the next ten years, according to a new report.

Report: Copper, at the centre of the metal supercycle

Latest infographics on copper:

Copper (Cu)

Copper, atomic number 29, is a reddish-orange metal renowned for its superior electrical conductivity, corrosion resistance, and versatility. With a melting point of 1,085°C, copper is essential across industries ranging from energy to construction.

As global electrification accelerates, copper’s role in technology, data centers, electric grids, renewable energy and electric vehicles solidifies its status as a critical material.

Why copper matters: strategic applications

Electrification and renewable energy

Copper is indispensable in the global transition to clean energy due to its high conductivity and durability:

-

electric vehicles (EVs): EVs require 2-4 times more copper than traditional cars, with an average EV containing 83kg of copper in batteries, motors, and charging systems

-

renewable energy infrastructure: wind turbines and solar panels are copper-intensive. A single wind turbine can use up to 5 tons of copper in its generator coils and wiring

-

grid modernization: copper plays a key role in upgrading power grids to support renewable energy integration and electrification

Construction and infrastructure

Copper is widely used in building materials due to its durability and antimicrobial properties:

-

electrical wiring: copper wiring dominates residential, commercial, and industrial construction projects

-

plumbing systems: copper pipes resist corrosion and microbial growth, ensuring safe water delivery

-

architectural features: Copper is used for roofing and cladding due to its aesthetic appeal and longevity

Electronics Manufacturing

Copper is vital in electronics for its conductivity:

-

printed circuit boards (PCBs): copper traces are integral to PCBs found in smartphones, computers, and appliances

-

semiconductors: copper interconnects enhance performance in microchips used for AI, data centers, and consumer electronics

Supply and demand dynamics

Demand drivers

Global copper demand is projected to grow by 50% by 2040 due to the clean energy transition3. Key drivers include:

-

electrification: EV adoption and renewable energy installations are fueling demand for copper-intensive components

-

urbanization: rapid infrastructure development in emerging markets drives demand for construction-grade copper

-

technology growth: expanding electronics markets require increasing volumes of copper for semiconductors and PCBs

Supply Challenges

Copper faces significant supply constraints due to limited mining capacity:

-

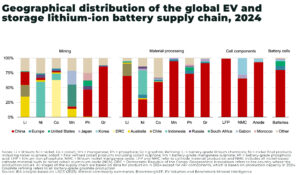

mining concentration: Chile and Peru dominate global copper production but face operational challenges such as water scarcity and political instability

-

declining ore grades: many mines are experiencing lower ore grades, increasing production costs

-

new mine development: industry estimates suggest substantial new mine development is required to prevent severe shortages by 2040

Major producers

The copper mining sector includes several key players:

-

Codelco (Chile): the world’s largest copper producer with extensive operations across Chile

-

Freeport-McMoRan (USA): pperates large-scale mines such as Grasberg in Indonesia

-

Glencore (Switzerland): a diversified miner with significant copper output from African operations

Market trends shaping copper’s future

Clean energy transition

Copper demand will continue surging as countries invest heavily in renewable energy infrastructure and EV manufacturing. Innovations such as ultra-efficient solar panels and next-generation EV batteries will further increase copper usage.

Recycling growth

Copper recycling is gaining traction as an alternative supply source. Scrap copper accounts for around 30% of global consumption today, with efforts underway to expand recycling capacity.

Geopolitical dynamics

Trade policies, environmental regulations, and resource nationalism are reshaping the global copper market. Countries rich in reserves are tightening control over mining operations to maximize economic benefits.

Copper’s unmatched conductivity makes it indispensable for electrification, renewable energy systems, construction, and electronics manufacturing. As industries shift toward sustainability and technological innovation, demand for this versatile metal will remain robust — cementing its role as a cornerstone of modern industrial society.

G7 to agree strategy to secure critical minerals supply

G7 leaders have agreed a new, draft strategy to secure global supply chains for critical minerals in response to China’s growing use of export restrictions,

Mining needs $500–600 billion by 2040 to meet Energy Transition goals

Between US$500 – US$600 billion in new capital investment is required for mining between 2024-2040 to meet global energy transition targets, as demand for critical

Trump signs Executive Order to accelerate deep-sea mining

President Donald Trump has signed a sweeping executive order accelerating deep sea mining permits and licenses in areas beyond national jurisdiction under the Deep Seabed

LME explores price premium on sustainable metal production

The London Metal Exchange (LME) has announced a significant step towards recognizing and incentivizing sustainable metal production, as it is currently engaging closely with physical

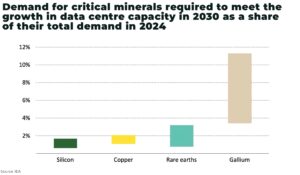

AI data centers to drive 2% of global copper demand by 2030

Global demand for critical minerals from data center development is set to rise significantly by 2030, compared to 2024 levels: According to a new Energy

The Saudi mining gambit: from Oil Kingdom to Mineral Might?

Saudi Arabia, already the world’s largest oil exporter, is making an ambitious pivot to become a global mining player, by tapping into the country’s estimated