Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Anna Dalaire has 17 years of experience in exploration and junior mining. She is a recognized specialist in mining marketing and investor communications, guiding public companies to refine their messaging, leverage digital platforms, and stand out in a competitive market. Passionate about bridging mining and modern marketing, Anna challenges the industry to move beyond outdated IR tactics and embrace bold, strategic Storytelling that builds lasting investor trust and value.

Junior mining companies will wait years for permits and approvals, yet they expect marketing results overnight. This stark contrast in timelines underscores the need to shift from short-term fixes to long-term branding and marketing strategies.

After one podcast appearance and a week of social media posting, the CEO asks, “Why hasn’t the stock moved?”

This mindset highlights a fundamental misunderstanding of branding and marketing. It’s not a quick fix but a long-term strategy that compounds over time.

The Pitfall of One-Off, Short-Term Marketing

Many junior mining companies either neglect branding and marketing entirely or burn through six-figure budgets on one-off digital campaigns, only to watch their momentum disappear faster than you can say ‘smoke and mirrors.’

Both approaches often follow a similar pattern:

- blast out press releases and paid IR campaigns → Hoping for a share price jump

- announce a financing → Scramble to attract investors

- close financing → Go back to exploration work and neglect marketing until more money is needed

This feast-or-famine approach does more harm than good. Standalone Investor Relations campaigns may generate short-term spikes but fail to build lasting investor relationships. Savvy investors see through last-minute marketing pushes.

A high-net-worth investor said, “I don’t read press releases. I get all my stock information from X.“

Investors today are self-sufficient and well-informed and expect companies to communicate directly with them through digital channels.

- about 80% of institutional investors use social media in their regular workflow. (Greenwich, 2025)

- 22% of retail investors make investment decisions based on digital promotions or celebrity endorsements on social media. (IR Impact, 2023)

- 46% of Canadian investors report encountering investment opportunities on social media. (CSA, 2024)

- about 81% of institutional investors have made investing recommendations or decisions based on information they received on social media (Chase, 2025)

Marketing isn’t a short-term play; it’s a long-term commitment to building credibility and engagement. Companies that consistently educate, communicate, and foster investor trust will add lasting value to their brand and the market.

Does the Industry Misunderstand Branding and Marketing?

Most junior mining companies believe branding and marketing are a luxury, but they aren’t. When done effectively, branding and marketing are assets that build credibility, boost corporate awareness, and attract long-term investors. Whether you sell lipstick or lithium, attention drives success in today’s market.

Gary Vaynerchuk, a well-known entrepreneur, social media expert, and investor, says, ‘Attention is the #1 currency.’

In a world where visibility drives success, those who command attention win. And where is attention being captured by professionals today? On LinkedIn.

The platform boasts over 1 billion users, including decision-makers, bankers, investors, and buyers. However, according to LinkedIn statistics, fewer than 1% of users post weekly. Therefore, companies and executives who consistently post relatable content have a significant advantage in terms of visibility and influence. With so little competition for attention, a single well-crafted post can generate exponentially more reach and impact than a traditional corporate update.

Luxury, finance, and tech leaders understand the power of branding. Consider companies like Rolex, Ferrari, BlackRock, Goldman Sachs, Apple, Amazon, and Microsoft. These companies don’t just sell products; they sell trust, credibility, and longevity.

While these companies operate with massive budgets, the principles of brand equity apply at every scale. You don’t need deep pockets to start building a strong brand. You need strategic, consistent effort. Even in a smaller pond, maintaining high standards with a thoughtful and disciplined approach has a significant impact over time.

In the junior mining space, brand equity means establishing a recognizable identity that conveys trust and expertise to investors, stakeholders, and the broader market. It’s what separates serious companies from speculative plays.

A strong brand builds confidence in long-term project execution, facilitates easier financing, and attracts strategic partnerships. It lowers acquisition costs, increases investor appeal, and compounds value over time.

Avoid Cookie-Cutter Marketing

When budgets allow, I collaborate with marketing firms, podcasters, and writers, many of whom deliver thoughtful, creative, and strategic work tailored to their clients. These partnerships can be powerful when firms take the time to truly understand the story, value, and vision behind a company. That said, not all marketing approaches are created equal. Some agencies rely on templated strategies and recycled content, which does not connect with investors.

When choosing to work with an agency or creative partner, here are a few red flags to watch for:

- generic, copy-paste social media posts or content

- websites and investor presentations that fail to answer the essential ‘Why invest?’

- dull, uninspired, or generated AI content that fails to differentiate

Investors are paying attention and can quickly spot surface-level, one-size-fits-all messaging. As a public company, consider partnering with a firm that has a deep understanding of the industry, a track record of results, and a custom-first mindset.

Marketing isn’t all or nothing. Even with limited budgets, junior miners can establish credibility by focusing on clarity, consistency, and the fundamentals of brand building, then scaling strategically over time.

Here are three key areas to build a strong, credible brand that will help you cost-effectively scale your message, content, and investor trust.

1. Strategic Organic Content: Low Cost, High Impact

Your project, leadership team, and vision are unique. Your content should be too. Unlike expensive paid campaigns, organic content is the most cost-effective way to build investor trust and awareness over time.

- organic content isn’t just about visibility; it’s about building trust before you ever need to raise capital

- your posts will compound over time. Today’s content drives value months or years later

- use storytelling to transform data into compelling, investor-focused messaging because numbers alone don’t inspire trust or action

Studies show:

- content marketing costs 62% less than paid ads but generates 3x more leads. (Neil Patel Blog, 2025)

- 78% of users consume content on LinkedIn to keep up with industry news and 73% to discover new ideas. (Cognism, 2025)

- a single LinkedIn post from a CEO can reach 10x the audience of a company press release. (personal comparison, 2025)

- posts published on personal profiles receive up to 561% more interaction than company page posts. (Social Insider, 2024)

In a tight-budget environment, organic content is like a high-grade discovery; it continues to deliver long after it’s published.

2. From Boardroom to Newsfeed: Why CEO Visibility Matters

Investors trust people, not corporate entities. This is especially true for smaller companies, where personal credibility and direct engagement are crucial.

Every website and presentation in this industry highlights “The Team” because people invest in people.

In today’s world, your best people must be visible online.

- 74% of Fortune 500 CEOs have at least one social media account in 2024. LinkedIn is the top contender. (Influential Executive, 2024)

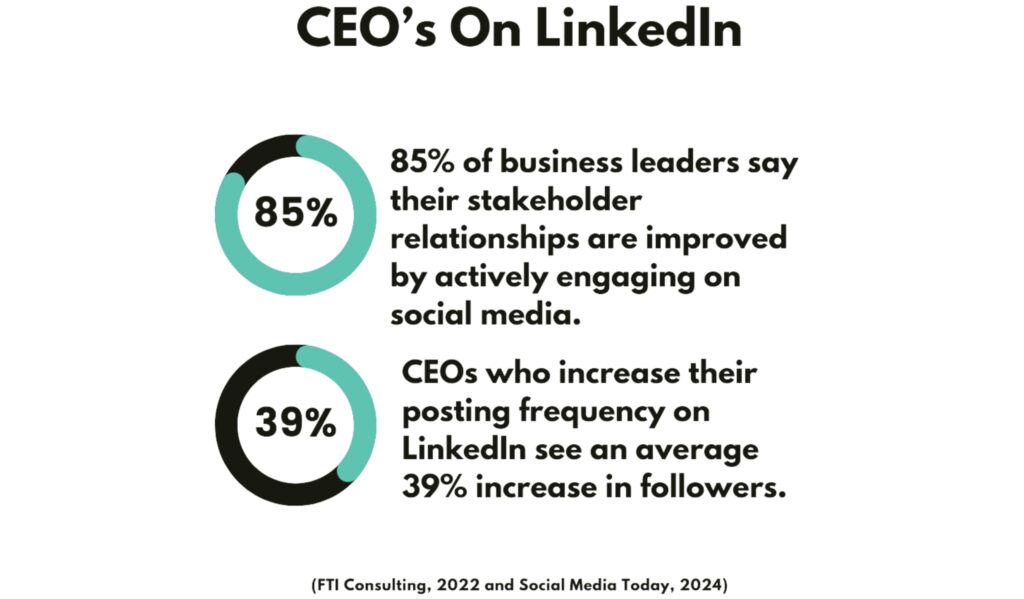

- 85% of business leaders say their stakeholder relationships are improved by actively engaging on social media (FTI Consulting, 2022)

- companies with visible leadership get 4x more investor engagement than those relying solely on corporate pages. (H-Advisors, 2023)

- CEOs who increase their posting frequency on LinkedIn see an average 39% increase in followers. (Social Media Today, 2024)

Executives should be actively engaging by:

- posting insights on LinkedIn (with a cohesive message that ties to the corporate message)

- engage in discussions and establish themselves as thought leaders

- participating in interviews, podcasts, and digital (and live) investor and industry events

3. Mining Marketing’s Future: Build From Within

Strong, consistent messaging starts internally; it’s the foundation for authenticity and long-term impact.

The junior miners that will stand out today are those empowering their teams, investing in internal content talent, and upskilling management to master social media, storytelling, and digital branding. Your team is your greatest asset. When the people who live your mission shape the message, you gain clarity, agility, and a brand voice that genuinely resonates.

In-house teams also eliminate lag time. You’re not waiting on external contributors to draft and approve content; your team can move in real-time. But with that speed comes responsibility: compliance must be built into the process from the start.

Training IR and marketing staff is essential, but leadership must also be equipped to represent the company’s voice online and ensure messaging stays consistent across all channels.

To ensure compliance and flexibility, companies should create internal social media guidelines:

- equip management with digital engagement skills

- set clear communication standards

- build a streamlined content approval process

- ensure all staff understand compliance regulations

Branding and marketing aren’t the job of one department. They’re part of a company-wide culture. Build the foundation internally, scale when you can, but never outsource your voice.

The marketing landscape has changed. Today’s strongest industry leaders don’t just stake claims in the ground. They stake them online.

In a sector built on discovery, the real motherlode is digital credibility.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.