Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Exports of rare earths placed under export restrictions from China on April 4 have reportedly “ground to a halt” almost immediately as exporters have been forced to wait for government licence approval.

The impacted rare earths are:

- Samarium

- Gadolinium

- Terbium

- Dysprosium

- Lutetium

- Scandium

- Yttrium

The critical minerals are used across the defense, energy and automotive industries.

Reuters reports exporters must now apply to China’s Ministry of Commerce for licenses, a process that can months. For example, Reuters reported last month there had been no antimony exports to European Union countries since China put the metal on a control list in September.

The New York Times quotes Michael Silver, the chairman and chief executive of American Elements, a chemicals supplier based in the USA, who said his company had been told it would take 45 days before export licenses could be issued and exports of rare earth metals and magnets would resume. Mr. Silver said that his company had increased its inventory last winter in anticipation of a trade war between the US and China, and could meet its existing contracts while waiting for the licenses — however, companies vary widely in the size of their emergency critical mineral stockpiles.

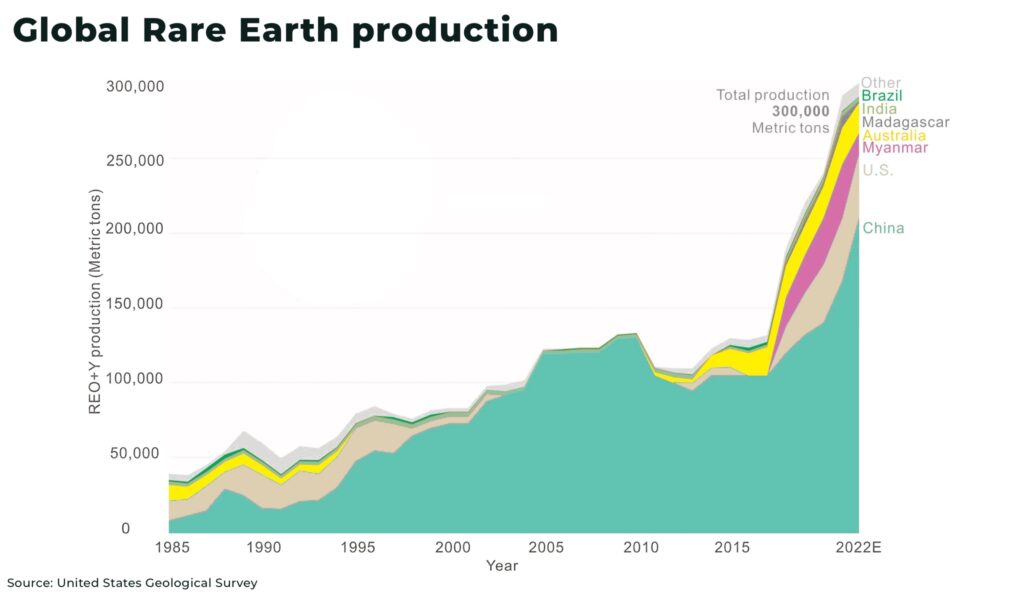

China dominates the rare earth market: it’s responsible for 70% of global production and nearly 90% of processing of global output, as well as 90% of rare earth element permanent magnet production.

The tariffs are in retaliation against US President Trump’s tariff of up to 145% on imports from China.