Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Simon Marcotte has more than 25 years of experience in the mining and finance sectors, with key roles at companies such as CIBC World Markets, Sprott and Cormark Securities. He has been instrumental in founding and leading multiple successful mining ventures. He is currently the President and Chief Executive Officer of Northern Superior Resources.

https://www.linkedin.com/in/simon-marcotte-macro-mining

A bubble doesn’t bounce; it bursts. We are now facing the simultaneous unwinding of both the “Everything Bubble” and the “American Exceptionalism trade”.

The idea for this article originated from a conversation with a high-profile investor who requested that I articulate why I believed gold is on track to reach levels far beyond what is currently being discussed in mainstream circles. What began as a presentation evolved into a broader reflection.

President Trump may appear unpredictable, but these policies are the product of a structured agenda now shaping our future—an agenda formalized in “Project 2025” as well as in Stephen Miran’s published economic blueprint, both of which carry far-reaching implications for gold; Stephen Miran is now Chairman of President Trump’s Council of Economic Advisers.

A gold price above $30,000 may sound like sensationalism, but the fundamentals driving this projection are not rooted in speculation—they are grounded in policies and precedents. What lies ahead is not merely another gold cycle; It represents a profound repricing of gold, driven by a global realignment of the world order and the deliberate imposition of financial crisis–like market conditions by the United States.

The magnitude is far from unprecedented. From 1999 to 2008, oil went from $12 to $140; an eleven-fold increase. Moreover, so much liquidity has been injected in the system since then, that everything seems to turn into financial tsunamis; Bitcoin and Mag-7 serving as obvious examples.

The catalyst? A deliberate shift in U.S. economic policy aimed at triggering a cycle of sustained negative real interest rates and deep currency devaluation.

President Trump’s vision to re-industrialize America is both bold and forward-looking. Rather than relying on low-cost labor to compete with countries like Vietnam, his approach points to a more ambitious path—one that embraces cutting-edge technologies, such as robotics and A.I., advancements that are uniquely positioned to ignite a new era of American innovation and industrial leadership.

Every true “moonshot” in history has been driven by government leadership. The Apollo program catalyzed a wave of technological breakthroughs that were later commercialized by the private sector—transforming entire industries in the process. The U.S. government has arguably been the most effective engine of large-scale innovation in modern history. Yet it is difficult to envision such a unifying national effort emerging from today’s polarized political landscape and a mounting disdain for a political class seen as disconnected and ineffective. That disconnect—between bold policy ambitions and a fractured social consensus—renders the current suite of high-risk economic strategies even more precarious, since this vision requires the private sector’s leadership.

Having said this, gold is poised to benefit regardless of the success of those policies.

Lastly, while this analysis focuses strictly on market-related economics, it would be a mistake to overlook the broader geopolitical backdrop. The global order is undergoing a significant realignment, and the risk of Chinese retaliation—economic or otherwise—should not be taken lightly.

We are now at war with China. The fact that militaries are not directly engaged does not diminish the severity of the confrontation. We are now at war with a nation shaped by the legacy of its “Century of Humiliation” (1839–1949), a period that instilled a deep and enduring political culture centered on one guiding principle: never bow again to foreign powers. It won’t end well.

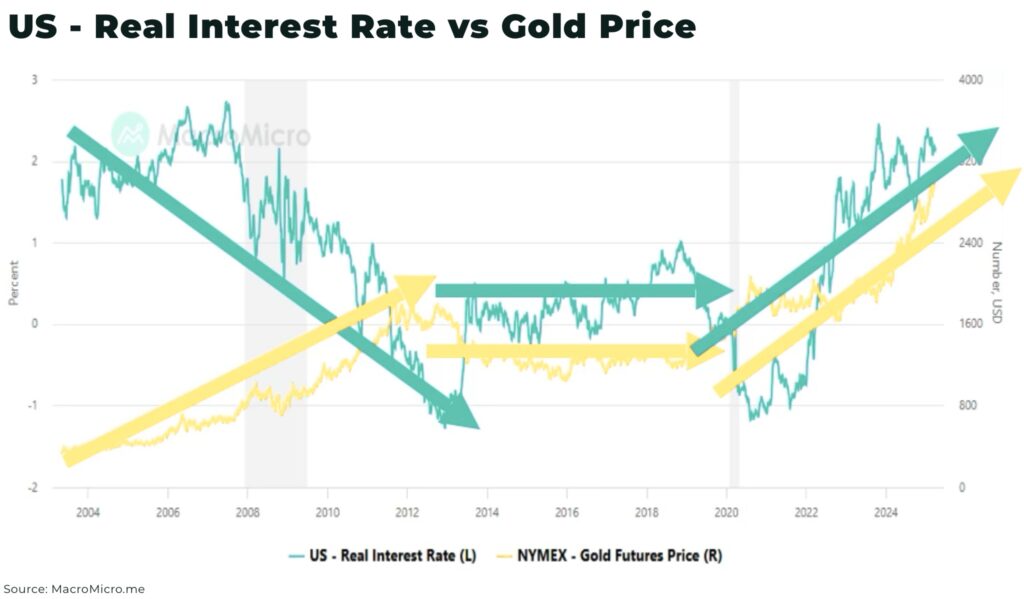

Real Rates: The Main Gold Driver

To understand why gold is poised for a revaluation, one must first understand Real Rates, the single most powerful driver of gold prices. Real Rates are defined as Interest Rates minus Inflation. Gold tends to rise when Real Rates fall—and especially when they turn negative. Historically, holding gold has made little sense in a positive real rate environment. Unlike bonds, gold does not pay interest and carries storage costs.

When real interest rates are negative, bonds become value-destructive assets: the yield they offer fails to outpace the rate of inflation, resulting in a net loss of purchasing power. In contrast, gold transforms itself into a vehicle for passive value creation: with borrowing costs below the rate of inflation, it becomes economically rational to borrow capital to acquire gold—an asset that historically preserves its value amid inflationary pressures. Given the immense size of the bond market relative to the gold market, even a modest reallocation of capital can cause gold prices to rise sharply, with potentially explosive outcomes.

The Return of Inflation, This Time by Design

The economic framework now emerging is not aiming for stability. Instead, it is inflationary by design.

Tariffs will increase prices and disrupt supply chains. Reduced immigration will push wages higher. Tax cuts will expand deficits. Simultaneously, there are explicit efforts to devalue the U.S. dollar, such as those proposed in Stephen Miran’s paper. All of this is likely to fuel inflation—unless the economy deteriorates significantly, which would bring down Real Rates.

Project 2025: Opening the 2008 Floodgates

Since the 2008 financial crisis, the Federal Reserve’s balance sheet has ballooned from under $1 trillion to nearly $7 trillion today. Roughly half of that—about $3 trillion—is parked in the form of bank reserves at the Fed. These reserves earn interest, a mechanism introduced with the Emergency Economic Stabilization Act of 2008 to prevent runaway inflation during quantitative easing, which was necessary to prevent a banking collapse.

Put simply, if a bank like Bank of America earns 5% risk-free interest by keeping funds on deposit with the Fed, it has little incentive to lend that same money for a mortgage at 4%—especially when doing so would involve credit risk.

In reference to the payment of interest on Bank Reserves, Project 2025’s Chapter 24 reads:

“This amounts to a transfer to Wall Street at the expense of the American public (…) The Federal Reserve should immediately end this practice and (…) stop paying interest so that banks instead lend the money.”

This would increase lending and boost the economy and inflation, as well as help lower yields as banks also allocate capital to buy bonds. Either outcome will be just as favorable for gold as what matters is the Real Rates.

To put this in context, consider that this $3 trillion compares to the Coronavirus Aid, Relief, and Economic Security Act of 2020 ($2.2T) and the American Rescue Plan ($1.9T)—both of which produced enormous economic distortions and ultimately resulted in an increase in household wealth of $50 trillion, more than the entire debt of the United States. This time, the injection could be even more potent as it would be combined with further tax cuts, which are necessary to counter tariffs and a shaken investment climate.

It’s not far-fetched to believe that this $3 trillion is precisely what President Trump envisioned when he spoke of ushering in a new “golden age” of economic growth.

Stephen Miran: “A User’s Guide to Restructuring the Global Trading System”

In the days following the election of President Trump, Stephen Miran published an article discussing several draconian tools to lower yields and weaken the US Dollar.

Among the more aggressive policy proposals under consideration are measures that would directly target foreign holders of U.S. debt and the value of the dollar. These include forcing foreign central banks to extend the maturity of U.S. Treasury bonds they hold, thereby increasing their exposure to duration risk.

Miran also suggests imposing a so-called “user fee” on foreign holders of U.S. Treasuries where the U.S. would pay only a portion of the interest due on a U.S. Treasury and keep the rest as a “user fee”; a move that would function as a partial default in all but name.

Miran suggests deploying a new round of Quantitative Easing specifically aimed at purchasing foreign currencies, with the explicit goal of weakening the U.S. dollar, and leveraging the authority granted by the Gold Reserve Act of 1934 to sell U.S. gold reserves in exchange for foreign currencies

Miran writes: “In this world, both the dollar and long yields can come down together, instead of moving in opposite directions.”

I can’t imagine a better scenario for gold.

These proposals are not fringe musings. Miran now chairs the Council of Economic Advisers, and many of his ideas are already being implemented. If executed further, these policies will guarantee a structurally weaker U.S. dollar, which historically translates to structurally higher gold prices.

The real story lies not only in the policies themselves, but in the mindset of the Administration—and in its apparent comfort with advancing ideas that, until recently, would have been considered politically or economically unthinkable.

From the Plaza Accord to the Mar-a-Lago Accord

Miran advocates for an optimal tariff level of 20%.

In a historical nod to the Plaza Accord of 1985, Miran proposes a “Mar-a-Lago Accord”, in which the U.S. would negotiate tariff reductions in exchange for currency strengthening by its trading partners.

What Happens When the U.S. Dollar Is No Longer the Safety Trade?

Periods of negative real rates often coincide with crises—leading to a flight to safety. But historically, that “safety” has been the U.S. dollar. This time, the U.S. is engineering crisis conditions while simultaneously devaluing its currency. For global capital, this creates an unprecedented scenario.

In early 2025, we began seeing the cracks. Equity market selloffs were no longer accompanied by U.S. dollar strength. Bond yields rose, even as risk aversion increased. These are major developments and point to a world where gold—not the dollar—becomes the new safety trade.

$30,000 Gold: The Floor Price of the Fiat Currency

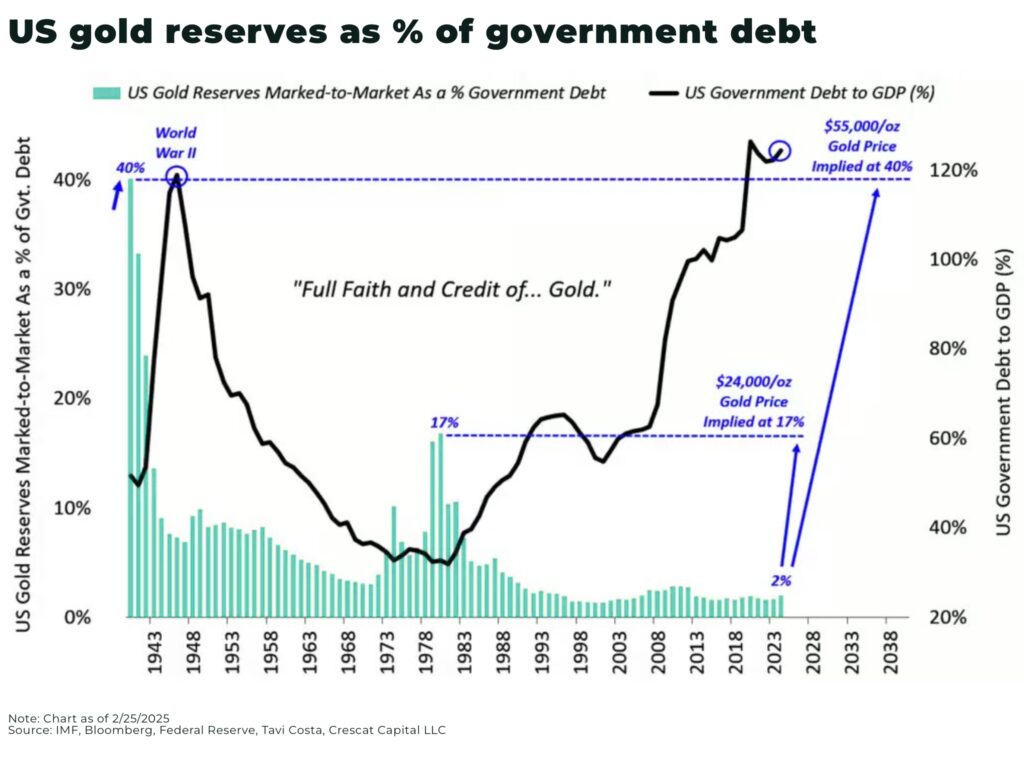

In equity markets, when a company’s share price is performing well, that valuation typically reflects expectations about the company’s future earnings potential. Conversely, when a stock experiences a sharp decline, investors often shift their focus to the company’s book value (or its liquidation value) as a way to determine a plausible floor for the share price. A similar logic can be applied to national currencies. In this context, the value of U.S. gold reserves can be viewed as the “book value” of the U.S. dollar.

A reversion to the gold-to-debt ratio observed during the last major inflationary cycle would imply a gold price of approximately $24,000 per ounce. Importantly, that earlier period did not include any material loss of institutional credibility or erosion of the rule of law, which are the main reasons why the U.S. dollar has become the main reserve currency. If confidence in the U.S. dollar were to decline to the levels witnessed when the dollar was first established as the world’s primary reserve currency—following the Bretton Woods agreement of 1944—the implied price of gold would be substantially higher.

Even Pierre Lassonde, founder of Franco-Nevada, forecasts a return to a 1:1 Dow-to-Gold ratio. Given the Federal Reserve’s current mandate and policy toolkit, a collapse in the Dow akin to that of the Great Depression is highly improbable. A significant upward repricing of gold appears to be the far more plausible outcome

Likely Recession

The American consumer has long been the cornerstone of U.S. economic growth—a veritable engine of global demand. For decades, globalization delivered disinflationary tailwinds and low interest rates, which in turn allowed consumers to refinance mortgages at favorable terms and tap into expanding credit. The result was a virtuous cycle of consumption, debt-financed expansion, and rising living standards.

This period was followed by the Covid stimulus, which triggered a booming housing market, and surging equity valuations created an unprecedented surge of $50 trillion in household wealth, which exceeds the entire U.S. national debt—a staggering figure that underscores the scale of monetary and fiscal intervention.

But this “consumer miracle” may now be approaching its limits. Equity markets have turned volatile, real estate appreciation is slowing, and government spending is showing signs of constraint. As each of these pillars weakens, the risk grows that the consumer’s ability—and willingness—to drive the economy forward could diminish sharply.

Since the credit crisis of 2008, economic growth has become increasingly reliant on government stimulus. Credit creation—once the private sector’s domain—collapsed, and government spending filled the void. Today, federal outlays account for roughly 23% of U.S. GDP. This level of intervention is far from ideal, but without it, the U.S. economy would have likely fallen into another Great Depression following both the 2008 financial crisis and the COVID-19 pandemic.

Calls to sharply reduce government spending as a remedy for economic imbalance miss a critical point. It would be akin to halting chemotherapy midway through cancer treatment. Certainly, “waste, fraud, and abuse” must be addressed—but the solution lies in reallocating those funds toward productive public investments, not in pursuing blunt austerity for the sake of deficit reduction. The United States cannot shrink to greatness. Now more than ever, sustainable deficit reduction must come from economic expansion, which lowers the deficit-to-GDP ratio.

There remains hope that deregulation and lower interest rates might eventually compensate for a pullback in spending. But betting on that outcome in advance is a precarious gamble—especially when all the contractionary policies appear to be arriving first.

What If There’s No Recession?

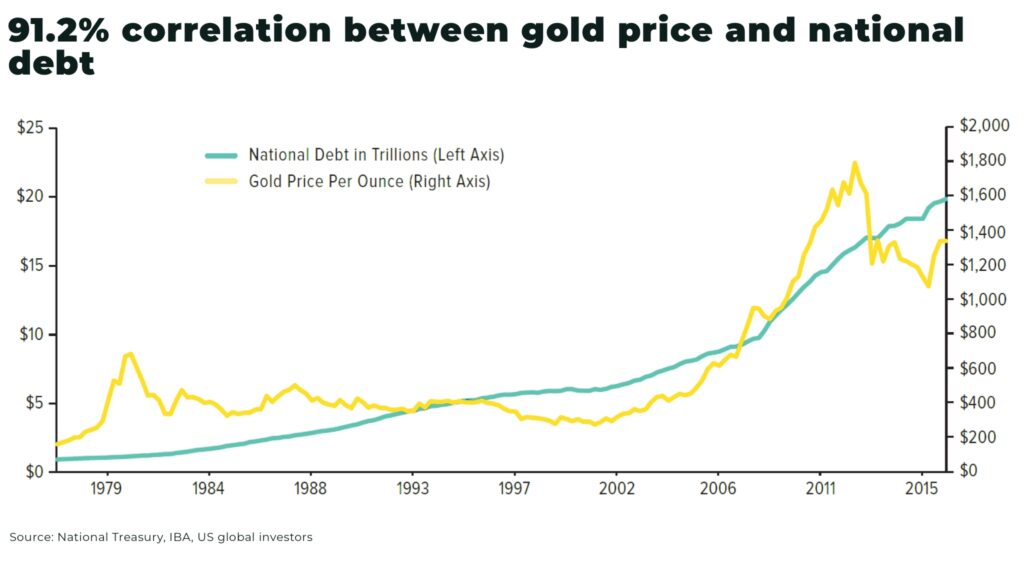

One might argue that tax cuts and deregulation could offset the weakness in consumer spending, investments, government spending and trades; all currently being negatively impacted. However, consider the scale: the tariffs introduced on “Liberation Day” represent a $6 trillion tax increase over ten years. To offset this via tax cuts, the United States would require roughly $10 trillion in cuts, factoring in a 35% savings rate; the saving rate observed with the Covid stimulus. This figure does not include the tax cuts required to offset the decline in government spending, investments, and consumer spending. So, if there is no recession, it will be because the tax cuts will have been massive. As gold is highly correlated with the national debt, it is difficult to see this as a bearish case for gold.

Given that U.S. tax revenues total just $5 trillion annually—and debt interest alone is nearing $1 trillion—these cuts are fiscally improbable. If attempted, the U.S. could face a “Liz Truss” moment, the UK Prime Minister who attempted something similar and had to resign after 50 days in office. Unless this kind of high-tariffs policy is abandoned, a recession is likely inevitable, reinforcing the case for lower rates, more stimulus, and higher gold prices.

Gold Stocks Will Play Catch up to Gold Price

While gold’s price has already been rising, the equity markets have not caught up—yet. Historically, we’ve seen this kind of lag before. In the late 1990s, oil prices rose from $12 to $140, but oil stocks remained undervalued for years, until reality caught up. The same is true today for gold equities. As Real Rates fall and turn negative, western investors will join central banks in accumulating gold.

But the market hasn’t been incoherent.

Starting around 2020, something unusual began to happen: gold started rising even as real interest rates were moving higher. Historically, the two tend to move in opposite directions—so by all accounts, gold should have stayed flat or even gone down. But it didn’t. Central banks around the world have been accumulating gold, likely in anticipation of the very economic dynamics we’re starting to see play out today.

In that light, it’s not entirely surprising that investors didn’t rush into gold stocks. If gold wasn’t supposed to be climbing, it made sense to assume those strong cash flows weren’t sustainable—so why pay for them? And with the broader equity market performing well, there was little reason to question that thinking.

With real interest rates falling and equity markets turning volatile, western investors are now beginning to rotate into gold and gold equities, as the fundamental case for higher gold prices becomes increasingly clear. As this shift accelerates, it is only a matter of time before gold mining stocks begin to catch up, closing the valuation gap in the face of a persistently rising gold price; in a nutshell, gold now “deserves” to be moving up.

The M&A cycle is already underway. Major gold producers, flush with cash, are in need of reserves. Over the last 15 years, they’ve depleted nearly one-third of their in-ground reserves. For them, it is now cheaper to acquire defined deposits than to explore. This dynamic favors junior gold companies, which remain dramatically undervalued.

2026

It is worth emphasizing that May 2026 could become a moment of extraordinary significance. If President Trump succeeds in appointing a loyalist as Federal Reserve Chair, it would represent one of the most consequential developments in modern U.S. history—one that could have a profound impact on market dynamics. While a new Chair would not have unilateral control over monetary policy, the institution’s messaging—a key pillar of global financial stability—would be profoundly impacted.

Under the current process, the President nominates the Fed Chair, who must first gain approval from the Senate Banking, Housing, and Urban Affairs Committee before being confirmed by a majority vote in the Senate. While some Republican senators may choose to brake ranks, it is notable that the Banking Committee is currently chaired by Senator Tim Scott, a known Trump loyalist.

Whether through crisis, currency devaluation, central bank policy, or geopolitical uncertainty, the path ahead leads to one inevitable outcome—gold will surpass $30,000 in the years ahead.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.