Critical Minerals and Energy Intelligence

Tin

Tin remains one of the most strategically important yet supply-constrained metals in the global market.

Its critical role in electronics, renewable energy technologies, and advanced manufacturing continues to drive robust demand growth year after year.

However, tin supply is persistently challenged by a combination of aging mines, geopolitical risks in key producing regions, and a lack of significant new project development.

With inventories often at multi-year lows and few large-scale discoveries in the pipeline, tin’s supply-demand balance is inherently volatile, underscoring the importance of supply security and offering compelling opportunities and risks for investors.

Tin Insights

Industry tin report

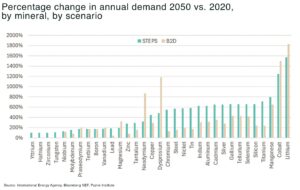

The explosion of Artificial Intelligence (AI) expected to spark a 10-year critical mineral supercycle as the massive energy needs of new AI data centers will increase pressure on global supply chains already under strain to meet global net-zero targets.

report: Artificial Intelligence and the next critical mineral supercycle

Tin (Sn)

Tin, atomic number 50, is a soft, silvery-white metal known for its ductility, malleability, and exceptional resistance to corrosion. With a low melting point of 231.93°C, tin forms a protective oxide layer that makes it ideal for coating other metals, especially steel, to prevent rust. Tin’s unique properties have made it a vital industrial material for thousands of years, from ancient bronze alloys to today’s high-tech applications.

Why tin matters: strategic applications

Electronics and energy transition

-

solder: tin’s primary use is in solder, which connects and secures electronic components in everything from smartphones and computers to electric vehicles and renewable energy infrastructure. As the world electrifies, demand for tin solder is set to rise significantly

-

solar panels: tin coatings are essential in solar panel manufacturing, supporting the global shift to clean energy

-

electric batteries: tin is used as an alloy in lead-acid batteries and is being explored for next-generation battery chemistries

Industrial and consumer uses

-

protective coatings: tin plating is widely used to protect steel cans and containers in the food industry, ensuring product safety and longevity

-

alloys: tin is a key ingredient in bronze (with copper) and pewter, valued for strength, durability, and resistance to corrosion

-

chemicals and catalysts: tin compounds are used as catalysts, stabilizers in plastics, and in ceramics manufacturing

Supply and demand dynamics

Demand drivers

-

electronics growth: the proliferation of consumer electronics, EVs, and renewable energy systems is driving steady growth in tin demand, projected at 2–3% annually through 2030

-

clean energy transition: tin’s role in solder and solar panels is increasingly critical as countries invest in decarbonization and grid modernization

Supply challenges

-

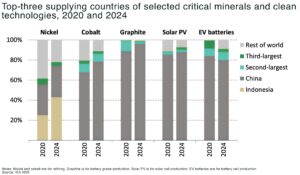

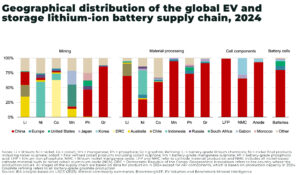

concentrated production: tin supply is highly concentrated, with China and Myanmar leading global output. Indonesia, a major producer, is shifting toward downstream processing but faces regulatory and operational hurdles

-

supply risks: disruptions in Myanmar and Indonesia, along with limited new mining projects, threaten to create a structural supply deficit-projected at 13,000 tons by 2030 if new investment lags

-

resource nationalism: Western nations are seeking to diversify supply chains and reduce reliance on Asian producers, creating opportunities for new projects in stable jurisdictions

Major producers

-

Yunnan Tin Company (China): the world’s largest tin producer, with over 80,000 metric tons of refined tin output in 2023

-

Minsur (Peru): South America’s leading tin miner, operating the San Rafael mine

-

Malaysia Smelting Corporation: a key player in Southeast Asia, with over a century of tin production

Market trends shaping tin’s future

-

energy transition: tin demand will continue to rise as electrification, renewable energy, and advanced electronics expand globally

-

supply chain security: geopolitical tensions and resource nationalism are pushing Europe and the U.S. to secure new sources of tin outside Asia

-

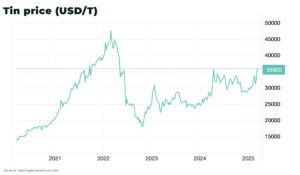

volatility and investment: tin prices remain volatile, but the long-term outlook is bullish due to supply constraints and robust demand fundamentals

Tin’s unmatched versatility and essential role in electronics, energy, and industry make it a strategic material for the 21st century. As the world accelerates its transition to clean energy and digital technologies, tin’s importance-and the need for secure, sustainable supply-will only grow.

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

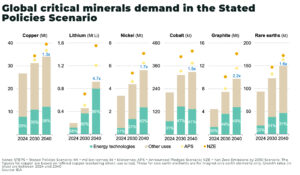

Key takeaways The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are

Critical minerals demand to surge up to 135% on defense and 400% on power generation and storage

Key Takeaways The estimated demand growth for ten key critical minerals for defense through 2035 is between 80%-250%, rising on average 135% over the next

Is this the “shale moment” for critical mineral mining in the US?

A quiet revolution is underway in the bedrock of the global economy. The mining and processing of critical minerals — from lithium to rare earths,

G7 to agree strategy to secure critical minerals supply

G7 leaders have agreed a new, draft strategy to secure global supply chains for critical minerals in response to China’s growing use of export restrictions,

Mining needs $500–600 billion by 2040 to meet Energy Transition goals

Between US$500 – US$600 billion in new capital investment is required for mining between 2024-2040 to meet global energy transition targets, as demand for critical

Tin price hit 3-year high on Congo supply disruption

The price of tin has surged to a three year high after Alphamin Resources announced the temporary closure of its Bisie tin mine in Walikale