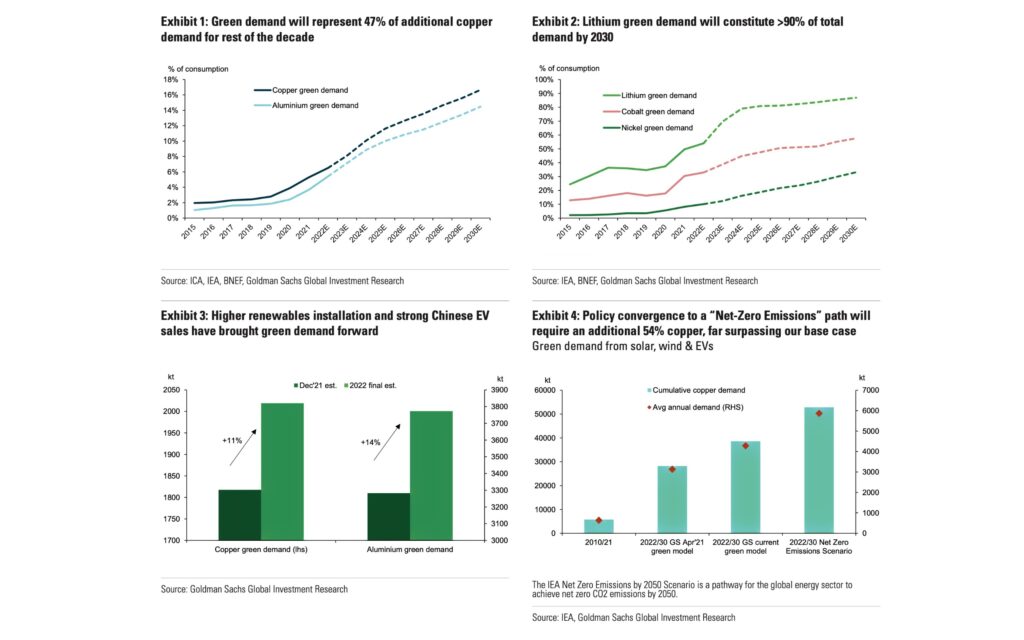

Goldman Sachs expects demand for green metals (aluminium, copper, nickel, lithium and cobalt) to accelerate, driven by China and the energy transition in the US and EU, as well as a slowing of aggressive rate hikes by the Fed.

The impact on prices remains under-appreciated, with Goldman Sachs expecting commodities (S&P GSCI TR) to return 43% in 2023.

Solar installations and electric vehicle sales in China account for more than half of global green metals demand.

Over the long term, China’s path stated policies will require 2.4Mty of copper (12% of annual Chinese demand), 4.4Mty of aluminium (10% of annual Chinese demand) and 900kty LCE of lithium between 2026-2030.

Demand is also increasing in the US with the Inflation Reduction Act and the EU with the RePowerEU and Net-Zero Industry Act.

“As losses mounted, it spilled into commodities”

— Jeff Currie, global head of commodities for Goldman Sachs, told the Financial Times Commodities Global Summit