Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Simon Marcotte has more than 25 years of experience in the mining and finance sectors, with key roles at companies such as CIBC World Markets, Sprott and Cormark Securities, and has been instrumental in founding and leading multiple successful mining ventures. He is currently the President and Chief Executive Officer of Northern Superior Resources Inc.

https://www.linkedin.com/in/simon-marcotte-macro-mining

John Paulson, the billionaire investor who rose to fame by shorting the US housing market ahead of the 2008 crisis, is once again making headlines. This time, it’s not for another macro call — but for how decisively he’s putting his capital behind one.

Paulson, one of Donald Trump’s top donors — having raised over US$50 million for the 2024 campaign during a single dinner at his Palm Beach residence — was even rumored to be a contender for Treasury Secretary. Suffice it to say, he likely has a good sense of what to expect from the second Trump administration.

And what is he doing with that insight? He’s going all-in on gold

While Paulson has long been a gold advocate — investing in bullion, ETFs, and major producers — his latest move marks a shift in strategy. He’s acquiring 80% of Barrick Gold’s interest in the Donlin Gold Project, a massive, undeveloped deposit in Alaska, in a deal reportedly worth US$1 billion in cash.

This isn’t a short-term trade. Nor is it a play for exposure to established producers with cash flow. It’s the ultimate long-duration gold investment: a project that will require US$7.4 billion in capex just to begin production.

Ever wondered why so many hospitals and research institutes in downtown Toronto bear the names of mining entrepreneurs? It’s because when you catch the commodity cycle just right — and back high-quality gold projects — the wealth creation can be generational. Fortunes aren’t made by simply owning gold; they’re made by owning the right gold equities in companies advancing viable projects.

The real story

I recently published a detailed article explaining why gold could surpass US$30,000 per ounce in the coming years — driven not by hype, but by the policy platform taking shape around Project 2025 and the economic playbook being laid out by Stephen Miran, now Chairman of Trump’s Council of Economic Advisers.

At the heart of this thesis is the deliberate imposition of negative real interest rates. When interest rates fall below inflation, bonds become destructive to hold — offering returns that fail to keep pace with the erosion of purchasing power. Gold, in contrast, transforms itself into a vehicle for passive value creation: borrowing below the rate of inflation, to acquire gold—an asset that historically preserves its value amid inflationary pressures. Given the immense size of the bond market relative to the gold market, even a modest reallocation of capital can cause explosive outcomes.

The last time this happened — during the inflationary 1970s — gold surged. A ratio of the value of the gold reserves to the government debt level implies a fair value north of US$24,000. And that assumes the rule of law and U.S. institutional credibility, pillars of the US Dollar, remain intact — something that wasn’t in question during the last gold super-cycle but may be increasingly under scrutiny now.

Why is the equity market ignoring the rally in gold?

Despite gold’s recent highs, gold equities remain deeply undervalued. This is not irrational, and it’s a mirror of what happened in the late 1990s when oil stocks lagged oil’s early surge as the stage was being set for its rally to US$140. Investors didn’t believe the price was sustainable.

Gold miners today remain under-appreciated, largely due to lingering skepticism in the West — driven by the fact that real rates have yet to turn negative. So far, gold’s strength has been fueled almost entirely by Asian demand and central bank accumulation. But when real rates do turn negative, Western investors will follow, accelerating the rally in gold, and buy into gold equities, which will finally begin to close the valuation gap.

We already saw a preview of this during COVID’s early days. With a prolonged phase of negative real rates on the horizon, expect gold equities to follow the metal sharply higher.

Major gold producers are well aware of the current dynamics and are operating with substantial free cash flow. At the same time, they’ve drawn down nearly a third of their in-situ reserves over the past 15 years. With the valuation gap between producers and companies holding defined resources at near-record levels, consolidation is not just returning — it’s gaining momentum, as acquisitions increasingly offer better value than organic discovery.

My money is here: the Chibougamau Gold Camp

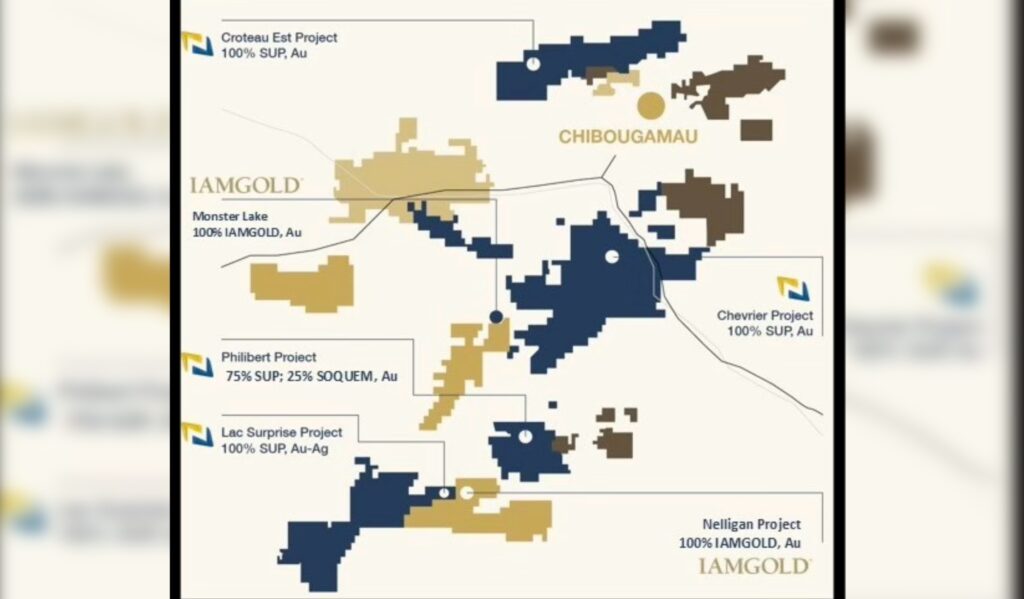

One of the most promising new gold camps is emerging in Chibougamau, Quebec.

IAMGOLD (TSX:IMG NYSE:IAG)‘s Nelligan discovery — awarded “Discovery of the Year” in 2019 — has already surpassed 8 million ounces and is expected to grow further. Meanwhile, Northern Superior Resources (TSXV:SUP | OTCQB:NSUPF), which I lead, has spent the downturn consolidating the rest of the camp. Together, IAMGOLD and Northern Superior control 12.4 million ounces of gold resources* across different projects in close proximity — close enough to be developed through a shared mill.

This is, to my knowledge, the largest gold camp not under the control of a major producer. To put it in perspective, Donlin Gold, now partly owned by Paulson, holds 33.8 million ounces of reserves (with feasibility study in hand) and just sold a 50% stake for CAD$1 billion.

IAMGOLD’s quiet strategic shift

Until recently, IAMGOLD had been entirely focused on the construction of its Côté Lake Gold mine in Ontario — a monumental undertaking that tested the company through some of its most challenging years. However, coincidently with the appointment of Renaud Adams as CEO, the execution has been nothing short of flawless. The market has rewarded it, with the stock rising from CAD$3 to above CAD$10 in a little more than a year. Mr Adams recently purchased CAD$250,000 worth of stock — a signal that confidence remains high.

With Côté Lake now in ramp-up mode, IAMGOLD appears to be shifting its development focus. A research note from National Bank — who recently led IAMGOLD’s CAD$300 million equity financing — identifies the Chibougamau camp as the company’s next major growth engine.

Northern Superior’s strategic value

In our latest financing — fully underwritten by Cormark Securities — insiders including Victor Cantore, Michael Gentile, and myself, invested CAD$1 million, bringing insider ownership to 25%, highly unusual for a company of this size.

While Northern Superior’s projects all have the potential to become standalone operations, the Philibert project in particular could play a pivotal role as the starter pit of a unified camp. Located just 9 km from Nelligan, with a mill situated halfway, trucking distances would be minimal. To put things in perspective, both the Nelligan and Philibert pits are expected to stretch roughly 3 kilometers.

IAMGOLD’s Nelligan is already a substantial asset, with strong potential for continued growth. But from this point forward, I believe the real value will come not just from increasing scale, but from strategically optimizing the broader camp. In such bulk-tonnage operations (similar to Côté Lake), the payback period is the defining metric—the factor that ultimately determines whether a project attracts the capital required for development. And to shorten the payback period, maximizing profitability in the early years of production becomes absolutely critical.

Two key factors make Philibert a highly strategic asset in the context of a unified operation — both of which could significantly reduce the project’s overall payback period.

First, the grade. Nelligan currently carries a grade of 0.95 g/t gold, while Philibert boasts a higher grade of 1.1 g/t. While that difference may seem modest at first glance, it translates to a 15% increase in gold output per tonne of ore processed — a critical advantage in the early years of production. Further, the Philibert resource shows strong optimization potential: according to the technical report, raising the cut-off grade from 0.35 to 0.50 g/t (the grade below which material is classified as waste) increases the average grade to 1.32 g/t — a 40% improvement over Nelligan’s, while sacrificing only about 10% of the total ounces, which speaks to the quality of Philibert’s ounces.

Second, the metallurgy. Philibert delivers exceptionally strong processing recoveries in the range of 93–95%, further enhancing the economic value of each ounce recovered and reinforcing its role as a high-margin contributor to any potential joint development.

IAMGOLD has been quietly expanding its footprint — acquiring Vanstar (25% of Nelligan), and other privately held assets — all near Northern Superior’s core assets. The Vanstar deal valued the in-situ ounces at ~CAD$40/oz when gold was US$2,000. Northern Superior trades at approximately half this valuation, while gold is comfortably above US$3,000.

National Bank believes Chibougamau assets could ultimately be valued at over CAD$130/oz — a common figure in Val-d’Or, a more mature gold camp in the same province.

What comes next

Both IAMGOLD and Northern Superior are advancing exploration programs, in support of strong news flow expected in the months ahead. More importantly, the same National Bank research note speculates that IAMGOLD’s Chibougamau complex could be moved into a joint venture with another producer:

“We could also see the mine complex project moved into a JV between IAMGOLD and another Intermediate producer, which could act as a strong share price catalyst through an immediate value recognition event”, notes the National Bank analyst. If that does prove to be IAMGOLD’s preferred path forward, the size and location of the camp would undoubtedly attract strong interest from a long list of intermediate and major producers.

With real rates heading negative, gold moving higher, and major producers hunting for growth in safe jurisdictions, the timing couldn’t be better.

When a chart says It all

* mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred Resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.