Sponsored spotlight: Mithril Silver and Gold Ltd is a precious metals exploration company developing one of the highest-grade silver jurisdictions in Mexico’s Sierra Madre Gold Silver Trend with multi-million ounce district potential for silver and gold.

Find out more: Mithril Silver and Gold Ltd

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

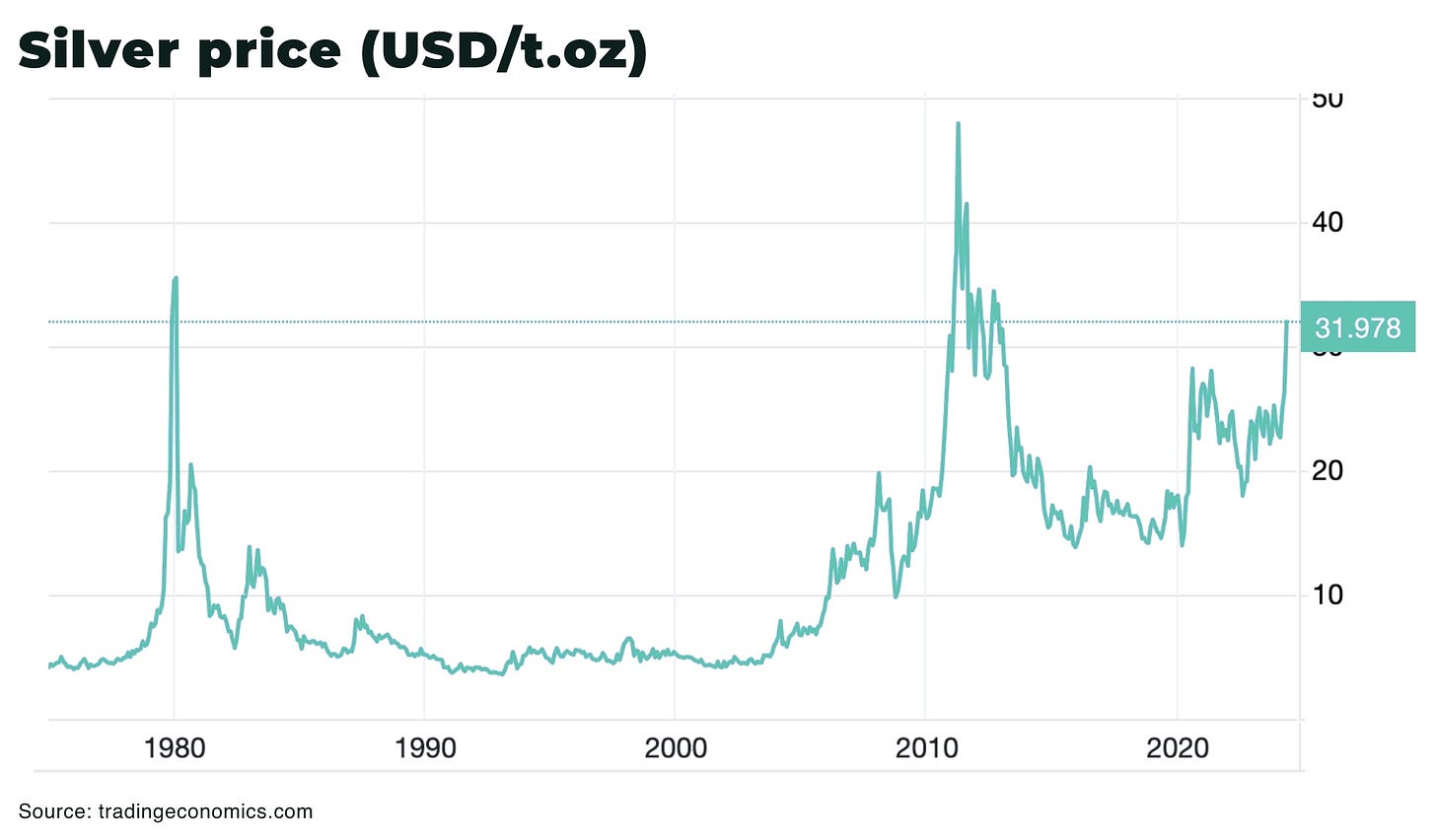

The silver market’s deficit is forecast to grow by 17% in 2024, which would be the fourth consecutive year of deficit for the metal since 2021.

And prices have reacted accordingly, hitting an 11-year high.

The challenge is that silver is no longer a precious metal as demand is increasingly dominated by the industrial sector, in particular solar power, electric vehicles, as well as power generation and process controls.

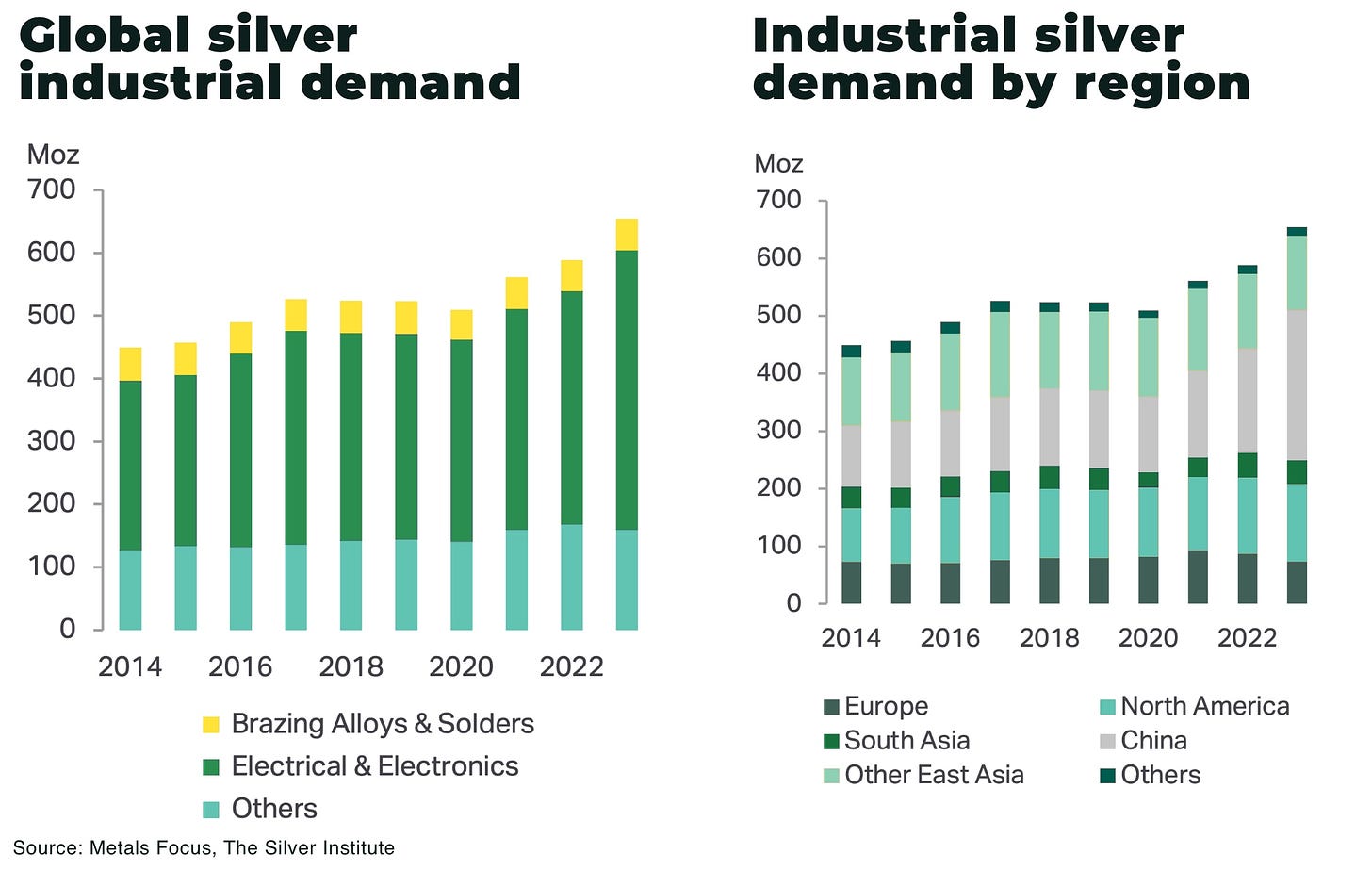

Industrial Demand

Demand for silver from industry hit record highs in 2023, rising 11% to 20,353t. And this growth is expected to continue with industrial demand gains of 9% forecast for 2024.

The reason: silver is the world’s most conductive metal, a much sought after property in a world trying to move away from fossil fuels to the “electrification of everything” to meet net-zero targets.

The main sectors for industrial demand for silver include:

- solar power

- power grid constructions

- electric batteries

Solar

Silver is critical to photovoltaic (PV) power — solar energy — with silver added to silicon wafers which, when hit by sunlight, excites elections creating an electric current that is conducted by the silver.

In 2023, silver recorded a new high of 6,018.5t last year, an increase of 64% from 2022.

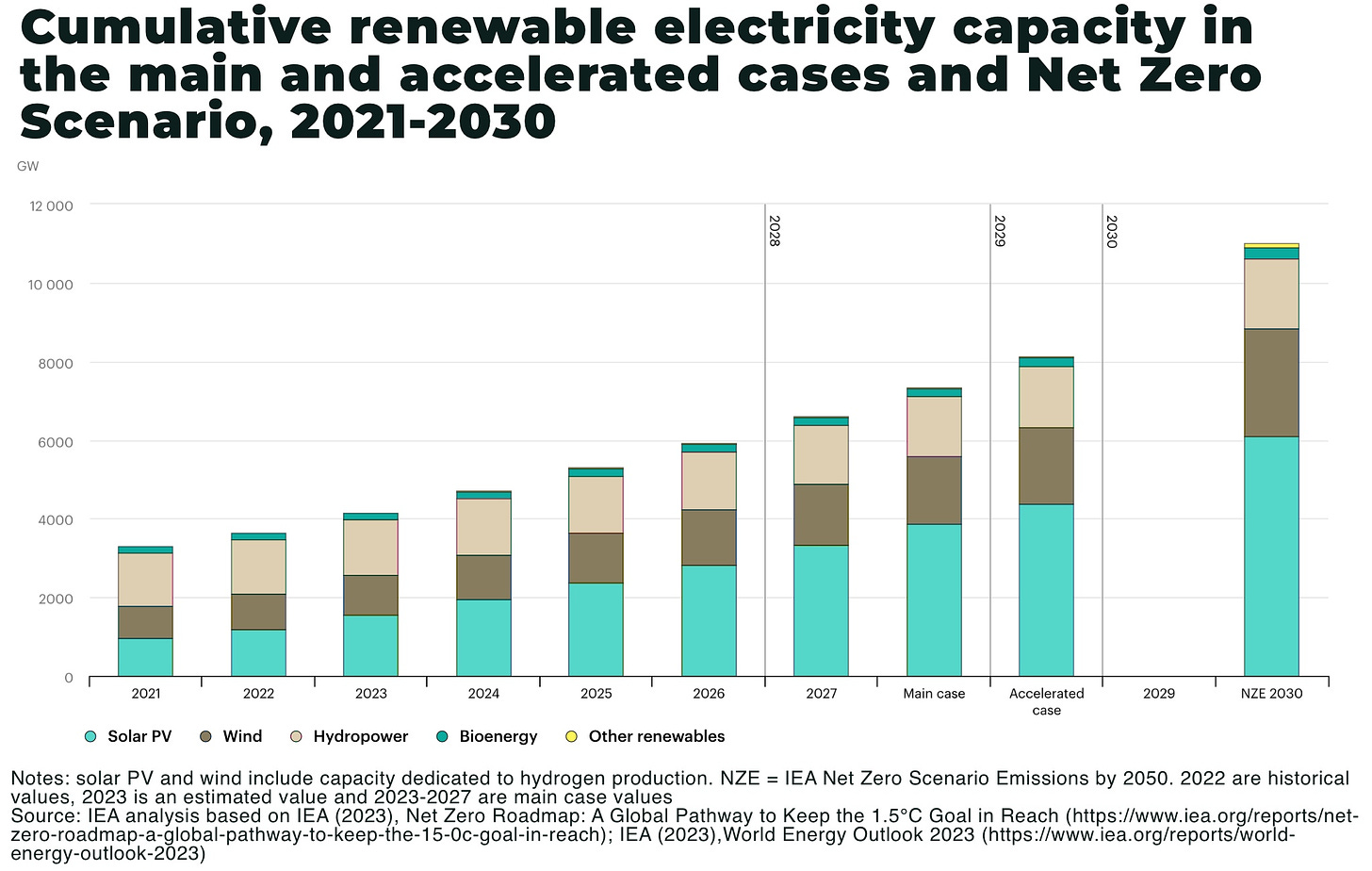

Solar demand was largely driven by China which commissioned as much solar PV in 2023 as the entire world did in 2022 — but solar PV additions are expected to double across the US, EU, China, India and Brazil by 2028.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Electric Vehicles and Batteries

Silver also plays a crucial role in the automotive sector, particularly in electric vehicles (EVs) and batteries, improving performance through use across various contacts, conductors and connectors.

Electric vehicles contain, on average, 25-50 grams of silver, compared to 15-28 grams for internal combustion engines. And, similar to solar, electric vehicle demand is forecast to increase x12 by 2035 under stated policies.

Artificial Intelligence

Due to its conductivity properties, silver is essential for a range of technologies across the Artificial Intelligence boom (see our report, Artificial Intelligence and the next Critical Mineral Supercycle), including:

- energy demand from data centers that power Artificial Intelligence is forecast to double from 17GW in 2022 to 35GW by 2030 — and this means more solar as governments struggle to meet net-zero targets

- AI servers and switches: for example, silver is used in multi-layer ceramic capacitors (MLCCs) that are essential for high-power components in advanced servers and switches

- electronic components: for example, silver is used in silver-palladium (Ag-Pd) MLCCs, which are crucial for high-frequency and high-speed data transmission in AI devices

- circuit boards and bonding wires: for example, silver is also used in printed circuit boards (PCBs) and as bonding wire in chip and memory packages. These applications are vital for the efficient functioning of AI hardware

Supply Constraints

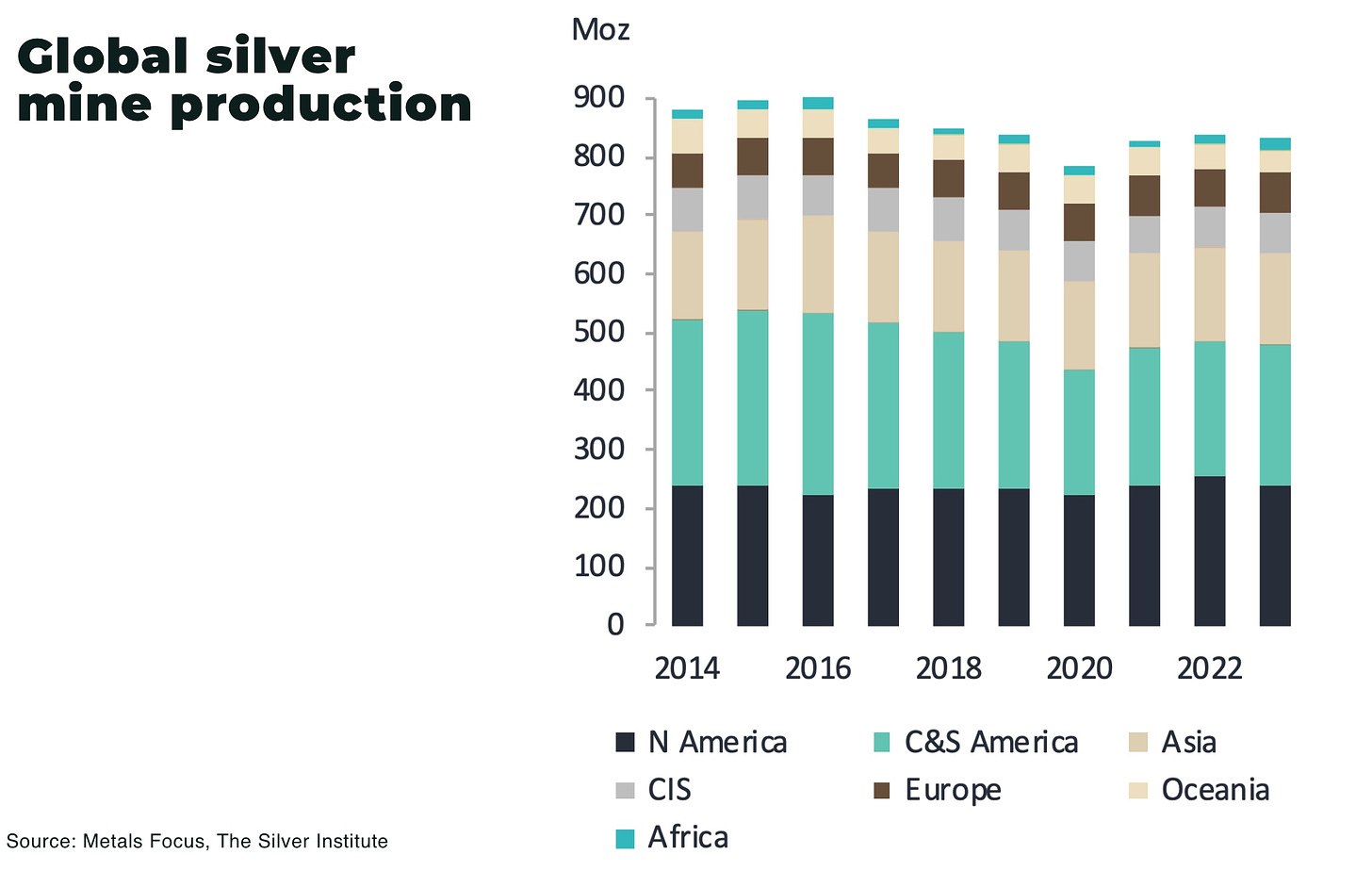

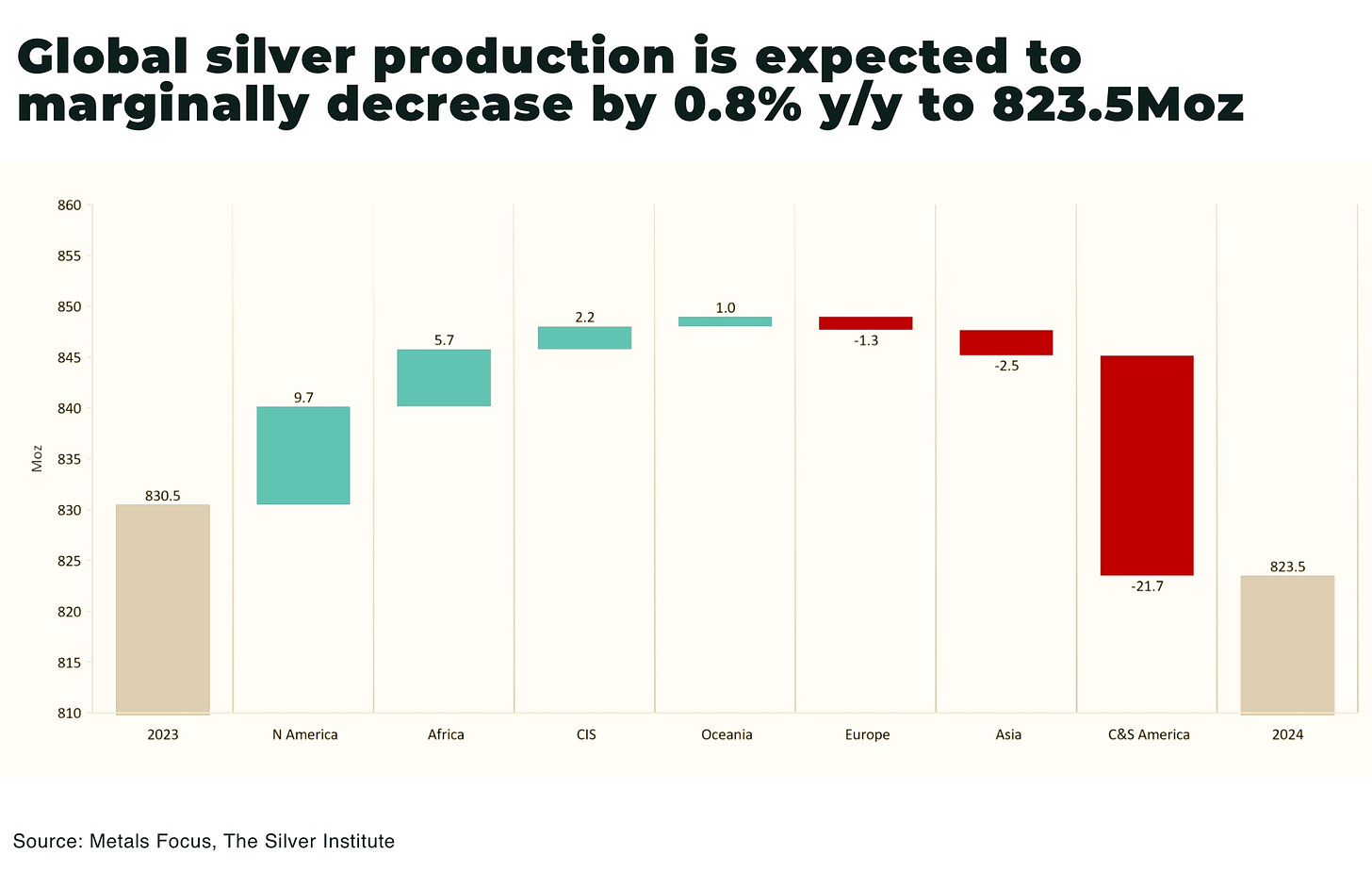

The challenge, as demand soars, is that silver mine production declined in 2023, falling 0.7%, from 26,020t in 2022 to to 25,830t in 2023.

Last year’s decline in supply is due to a variety of issues, from operation disruptions to regulatory challenges in key producing countries. For example, Hecla’s Lucky Friday mine was temporarily closed after a shaft fire, and, Peru saw a substantial drop in output due to permitting delays and operational challenges at key mines like Pallancata and El Brocal.

But, it is a rare year when there are no operational challenges in the industry.

Meanwhile, silver production has been largely stagnant over the last decade and is expected to decrease again by 0.8% year-on-year to 25,620t in 2024.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

There are two principal ways silver is mined, each putting their own specific constraints on supply:

- approximately 71% of mined silver supply comes as a byproduct from polymetallic gold, lead, zinc and copper mines. This means higher silver prices do not necessarily translate to higher production, though they may incentivize more scrap generation and liquidation of investment positions

- approximately 29% comes from primary producers, but all-in sustaining costs(AISC) increased by 25% year-on-year as costs rose with interest rates and inflation

And new mines can now take an estimated 18 years to build.

Declining ore grades and reserves

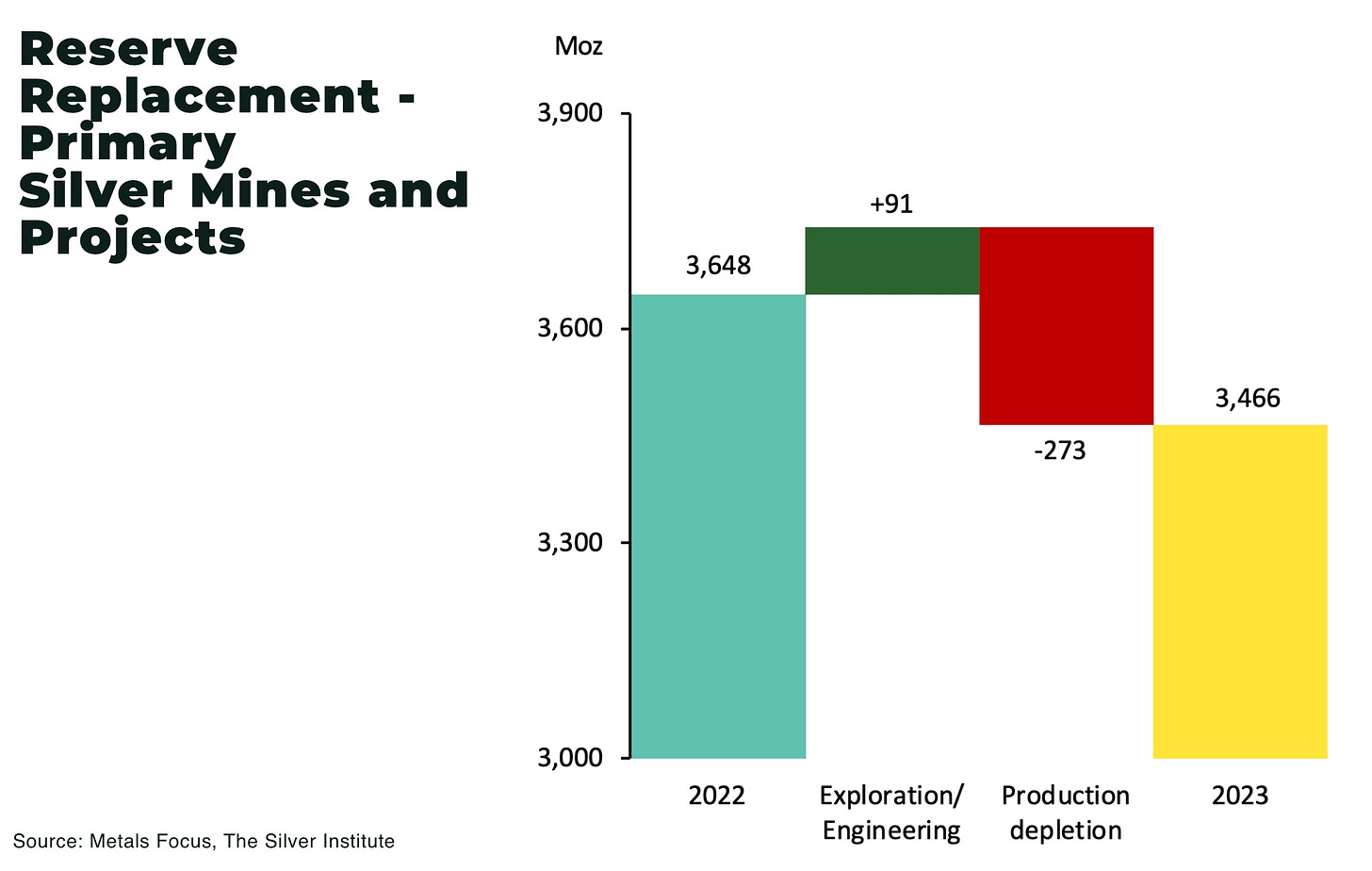

In the meantime, high-grade silver deposits at established mines are increasingly depleted, forcing mining companies to process lower grades — increasing production costs and reducing output, as well as exploration costs to find new deposits.

But, reserves are also declining with, for example, a drop of 5% year-on-year in 2023.

Operational and Regulatory Challenges

A primary challenge to increasing silver supply is the operational and regulatory environment in key producing countries, including:

- in Mexico, the implementation of new mining legislation, known as The Mining Reform, has created uncertainty for many mining companies in the country. The reforms aim to increase state control over the mining sector and impose stricter environmental regulations.

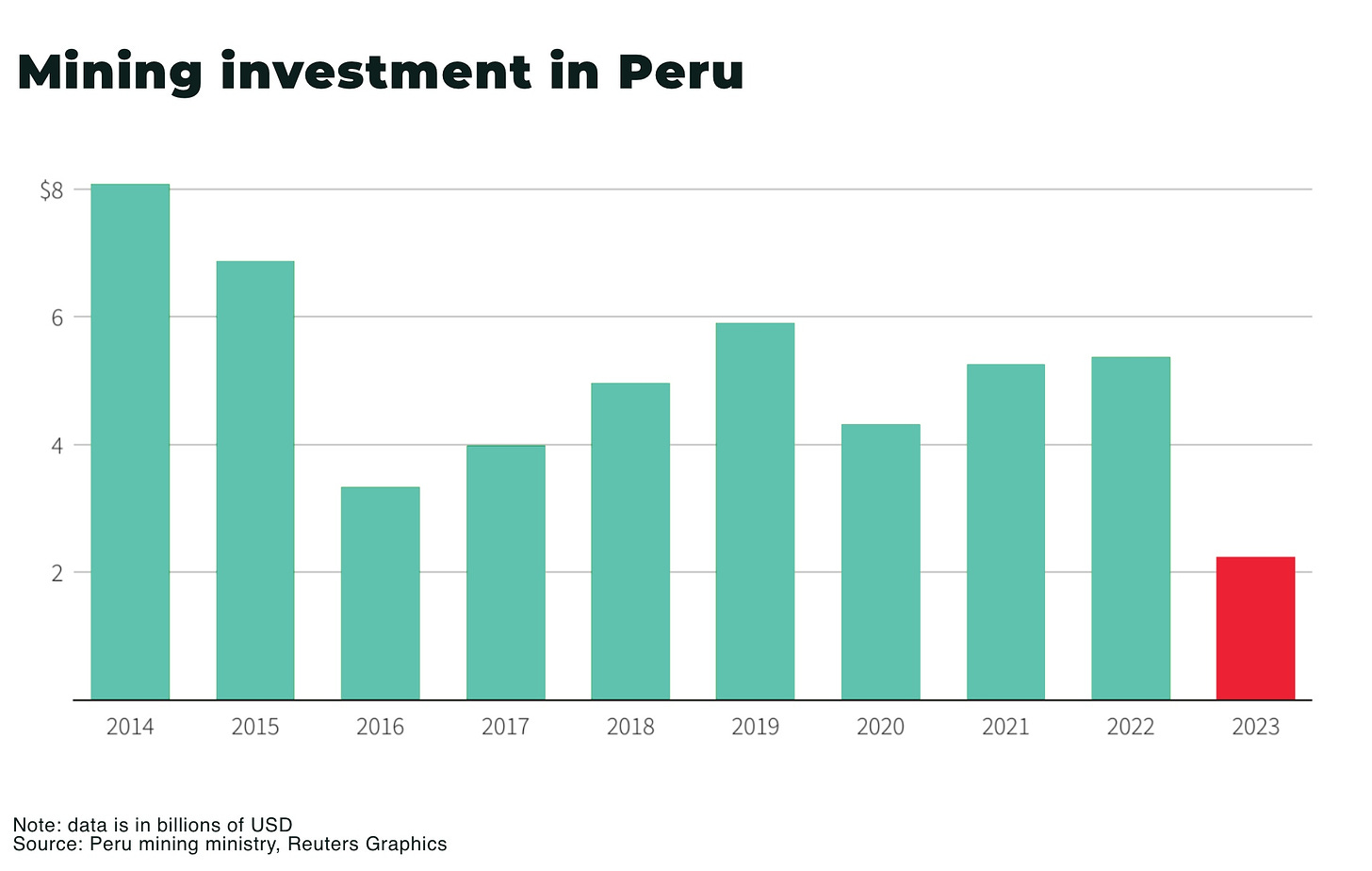

However, the Supreme Court has temporarily suspended the laws for now, and Mexico will hold an election in June with the current president stepping down - in Peru, the world’s third largest silver producer, mining investment fell sharply, by 18%, in 2023 over political uncertainty and unrest, as well as regulatory concerns

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Jewelry and dollars

A variety of other factors are weighing on price and investment in new supply, including:

- high interest rates boosting the strength of the dollar — however expectations suggest there are unlikely to be any more rate rises in the near future and the Federal Reserve may cut later this year

- global jewelry fabrication in 2023 fell by 13% to 6,318t, although this steep decline largely reflected the record high in 2022 — and is forecast to rise 4% in 2024

Conclusion

Silver still largely trades as a precious metal — with price movements significantly influenced by expectations of loosening monetary policy ahead; while usage is now dominated by industrial use — with expectations of rising demand.

The challenge is supply — with expectations that the price will continue to rise.

Sponsored spotlight: Mithril Silver and Gold Ltd is a precious metals exploration company developing one of the highest-grade silver jurisdictions in Mexico’s Sierra Madre Gold Silver Trend with multi-million ounce district potential for silver and gold.

Mithril is currently progressing a fully funded drill program in the Copalquin District following its successful maiden JORC resource estimate delivered in November 2021 after only 15 months of drilling and with an all-in discovery cost of USD14.30 per ounce gold equivalent.*

Our Maiden JORC Mineral Resource — just the first target area of several in the district — the estimate summary:

2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver (6.81g/t AuEq*) for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

28.6% of the resource tonnage is classified as indicated

*AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com

Find out more: Mithril Silver and Gold Ltd

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.