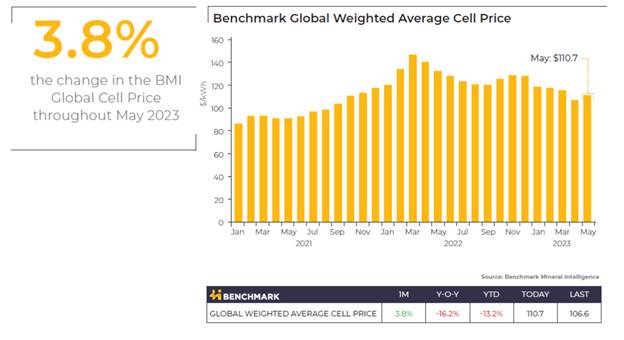

According to Benchmark Minerals, the global average price for lithium-ion batteries rose 3.8% in May, landing at $110.70 per kilowatt-hour. Admittedly, that’s not a major jump, however, when automakers are piling pressure on the battery sector to bring battery prices way down (as part of the drive for EVs to hit parity with gas vehicles), rising battery prices are an unwelcome shock.

The issue this time around is that lithium carbonate prices in China rose by 55% in May. That surge came as the country’s electric vehicle market began bouncing back, pushing demand for lithium even higher, with a knockon effect for battery prices. Now, battery prices are down 13.2% overall for the year so far which means the trend is still headed in the right direction but it’s another reminder that until the mining industry is given sufficient help by governments, sudden price movements are to be expected.

Benchmark CEO Simon Moores made that very point at the Battery Gigafactories USA 2023 “Volatility in prices is here to stay.” Moores pointed out that bridging the gap between raw material supply and EV battery demand will require and estimated $920 billion in investment between now and 2035, a major percentage of which will be needed for mining. “The mine supply is moving at about half the pace of battery EV demand,” Moores warned.

Anthony Milewski

Chairman, Nickel 28 Capital