Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

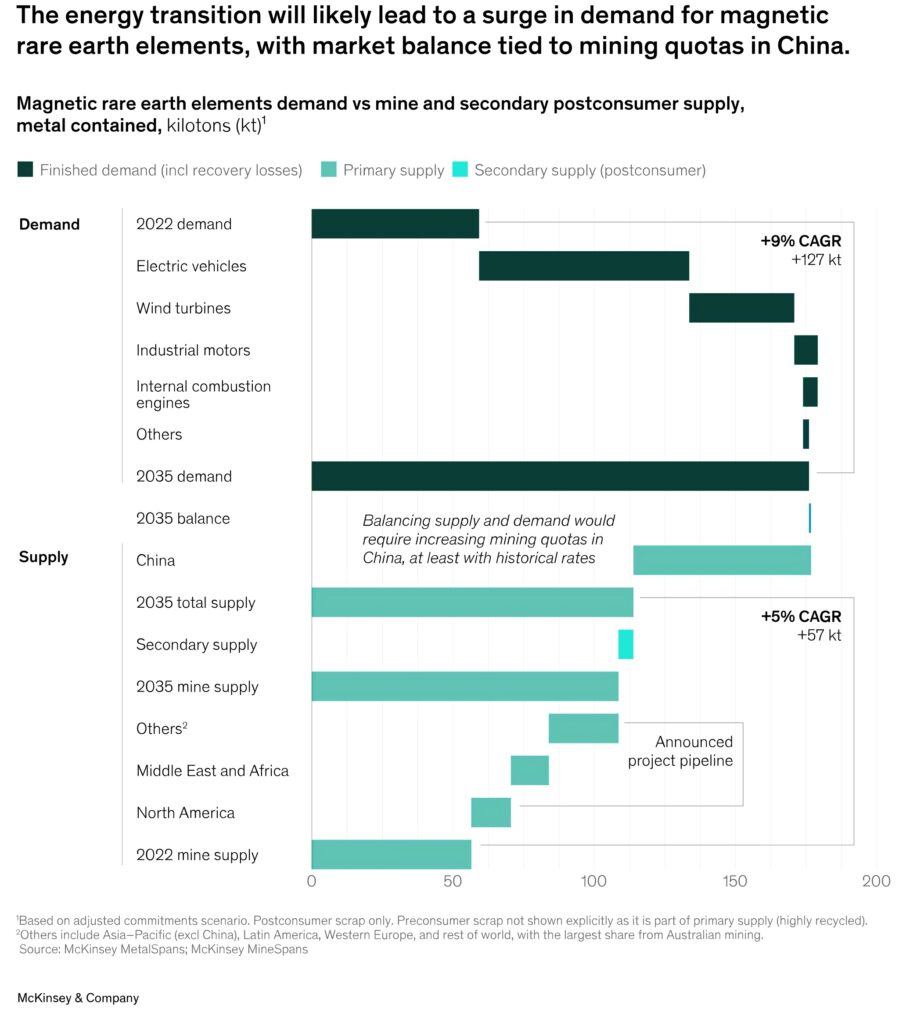

Demand for Rare Earth Elements (REEs) is expected to triple from 59 kilotons (kt) in 2022 to 176 kt in 2035, driven by strong growth in electric vehicle (EV) adoption, according to a new report by McKinsey.

However, as demand is expected to surge, the currently announced project supply pipeline could fall short of demand requirements by 60 kt, or roughly 30% of total estimated demand in 2035.

REEs include 17 elements, with a particular demand for the four most commonly used in REE magnets:

- neodymium (Nd)

- praseodymium (Pr)

- dysprosium (Dy)

- and terbium (Tb)

The demand by electric vehicles is expected to outpace the substitution of REEs with copper coil magnets, as well as the high rate of renewable capacity expansions in wind. Today, magnetic REEs make up around 30 percent of overall REE volume, but they capture more than 80% of the value.

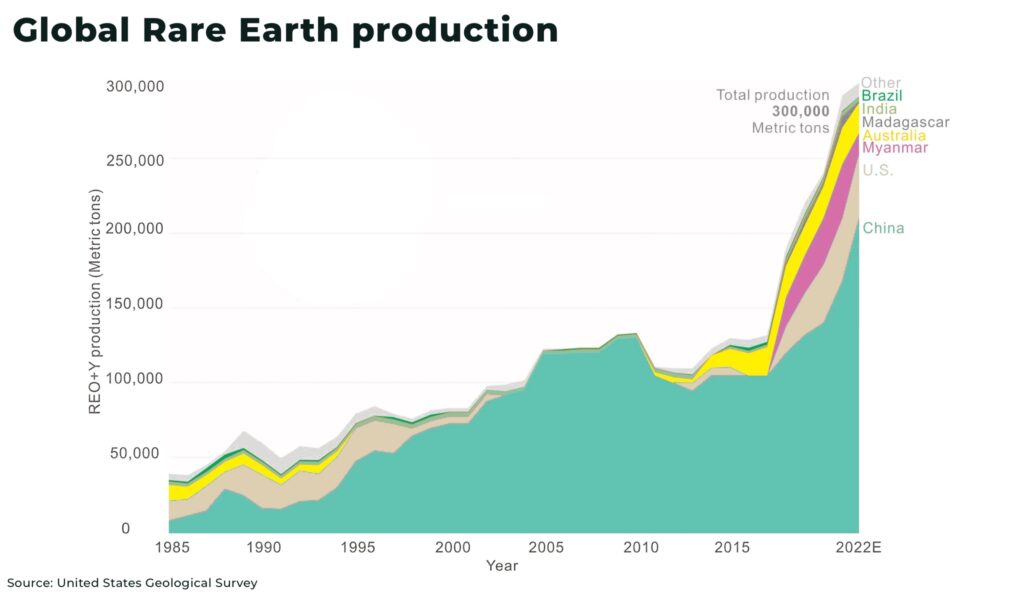

Attempts by the West to diversify and secure supply chains from China may reduce China’s share in mining to less than 50% but are more likely to fall short over the next 5-10 years. If supply from China manages to fill the supply gap until 2035, then geopolitical tensions will likely only accelerate.

China, which accounts for over 90% of global rare earth magnet production, introduced tighter export controls in April 2025, requiring licences for seven rare earths and related magnets. The move was a direct response to US tariffs and broader tech export restrictions.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.