Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

China has announced new export controls on 25 rare metals, including tungsten, in retaliation to a new 10% tariff by Trump on all US imports from China.

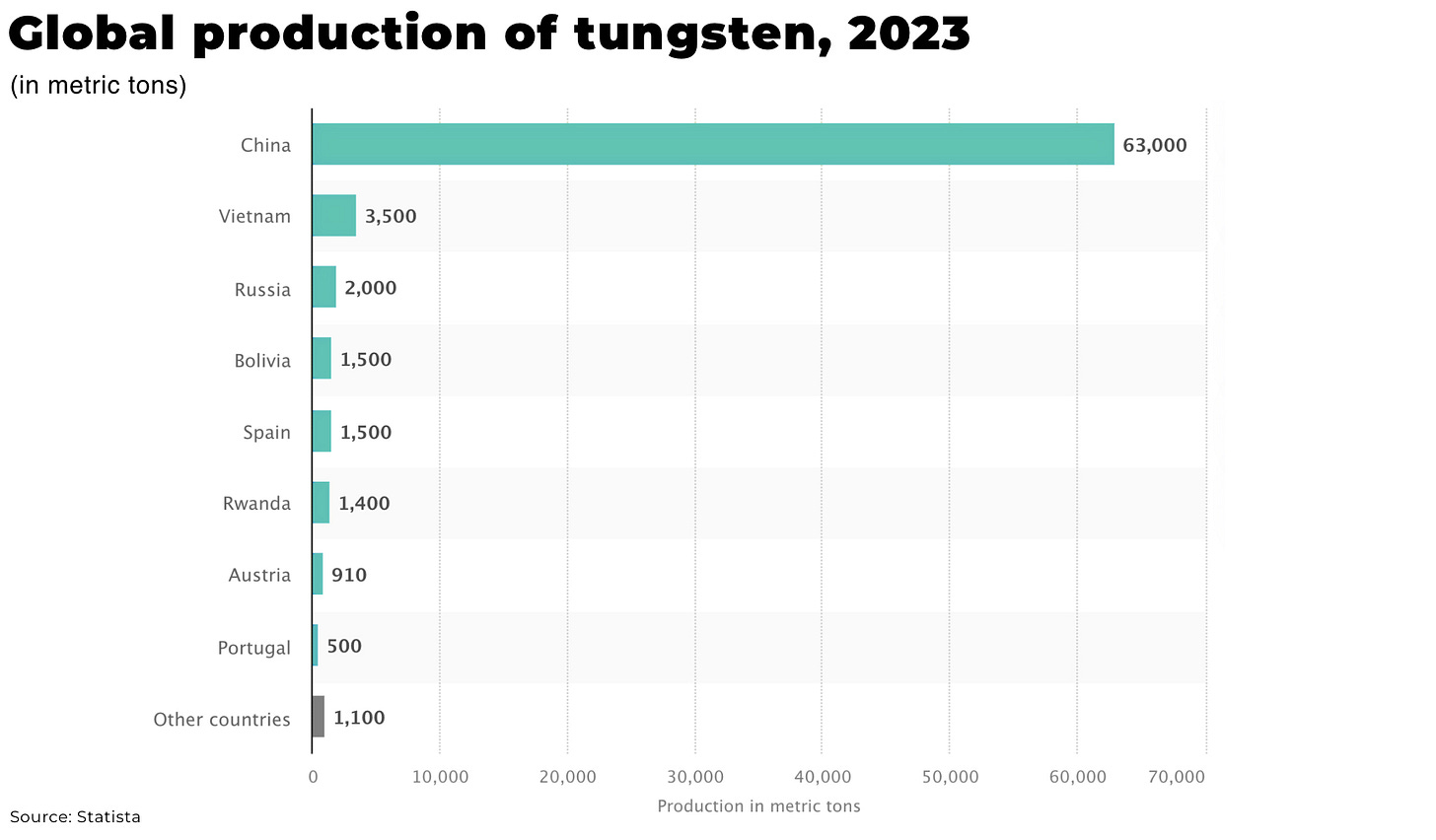

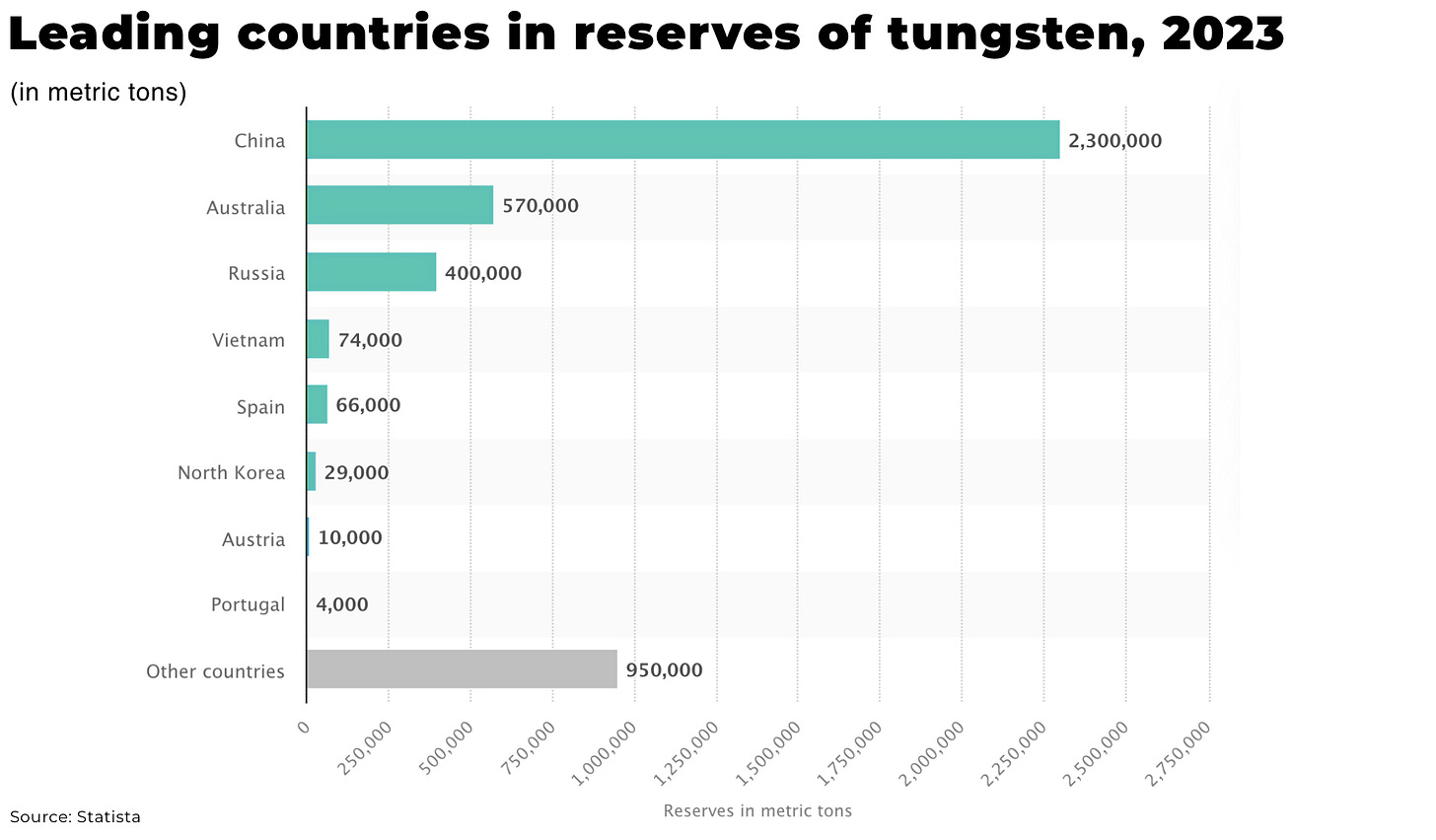

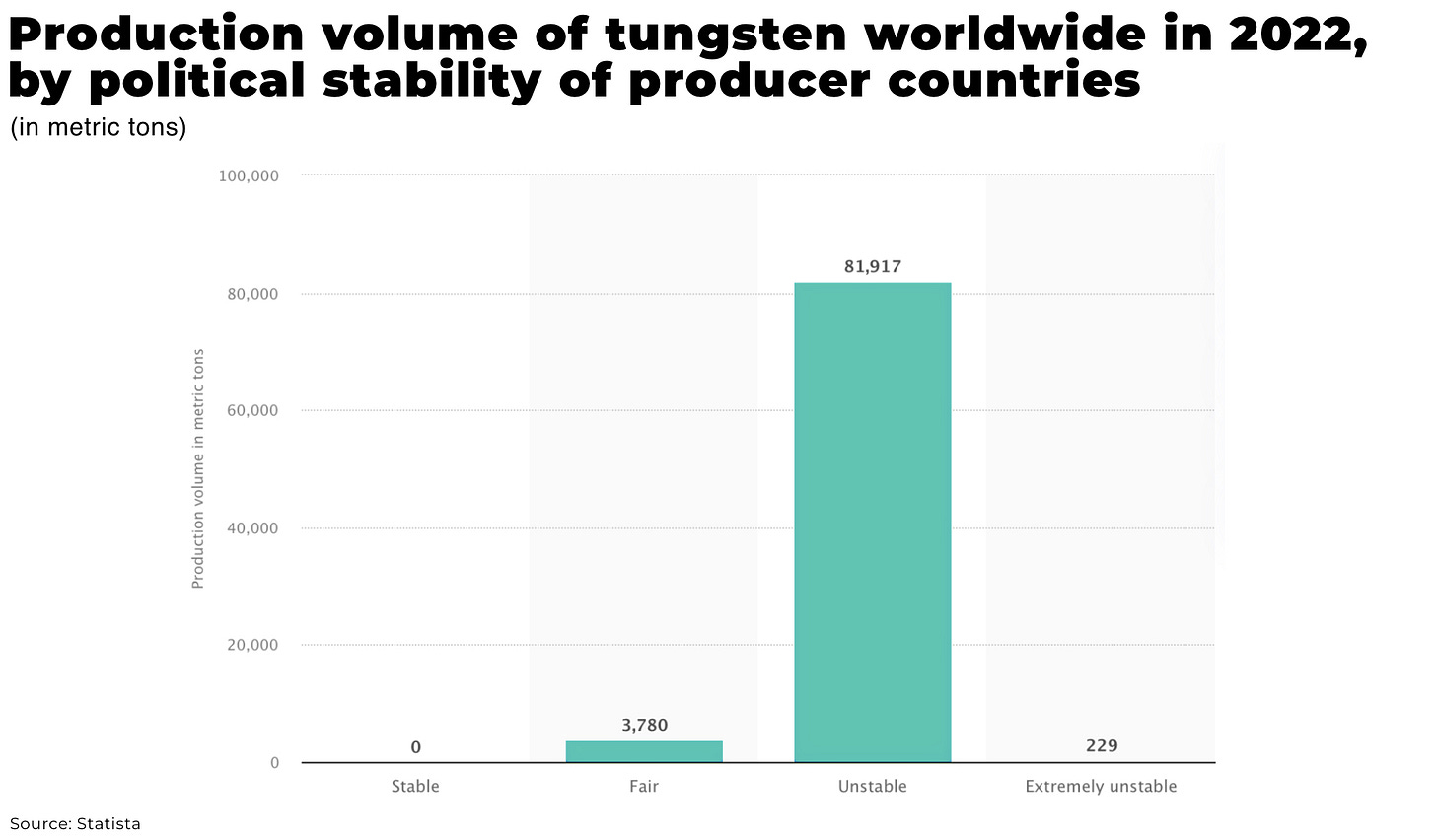

The problem: China dominates global tungsten supply — accounting for more than 80% of the world’s mining and processing in 2023, as well as 58% of the world’s reserves at 2.3 million metric tons.

However, China’s dominance is increasingly seen as a strategic vulnerability by the US, EU and Japan amid escalating geopolitical tensions.

What is tungsten

Tungsten is known as one of the strongest-known naturally-occurring materials and is critical across modern technology, from smart phones to hypersonic missiles.

It is listed as a critical mineral in the US, EU, China, UK, Australia, Japan and others for good reason:

- military: accounting for an estimated 12% of demand, with the highest melting-point of any metal, tungsten is essential across a range of military applications, including armour-piercing munitions, tank armour, and missiles

- technology: tungsten is crucial in the efficiency and durability of solar panels, semiconductors, robotics, and potentially even for the walls of nuclear fusion reactors due to its capacity to withstand extreme heat and radiation

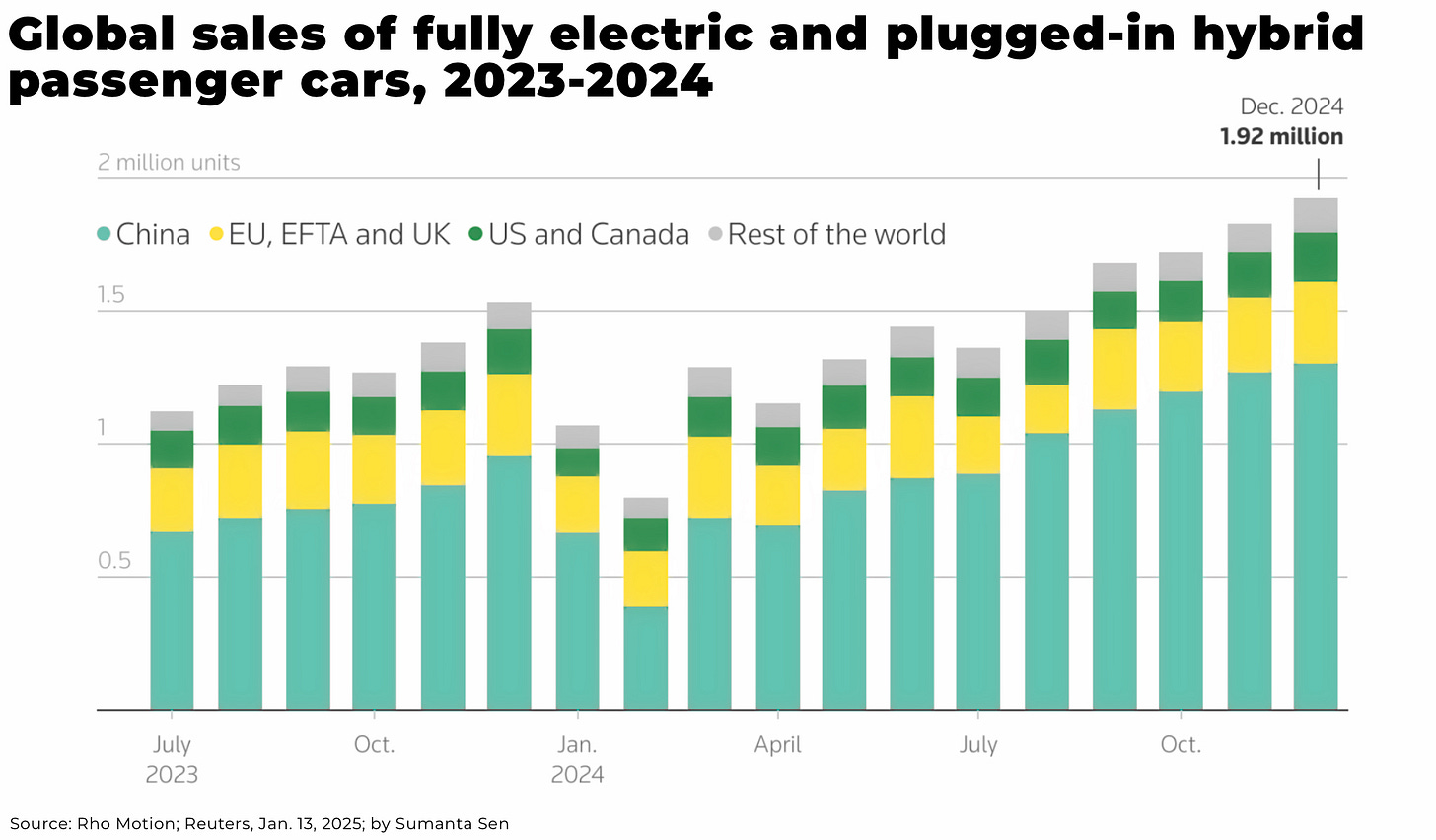

- electric vehicles: electric vehicles require approx 2kg of tungsten for gearing systems, battery anodes and cathodes, as well as about 2,000 wiring looms in the vehicle’s semiconductors

- tungsten is also used in mining equipment, energy production, construction, and aerospace

Tungsten demand

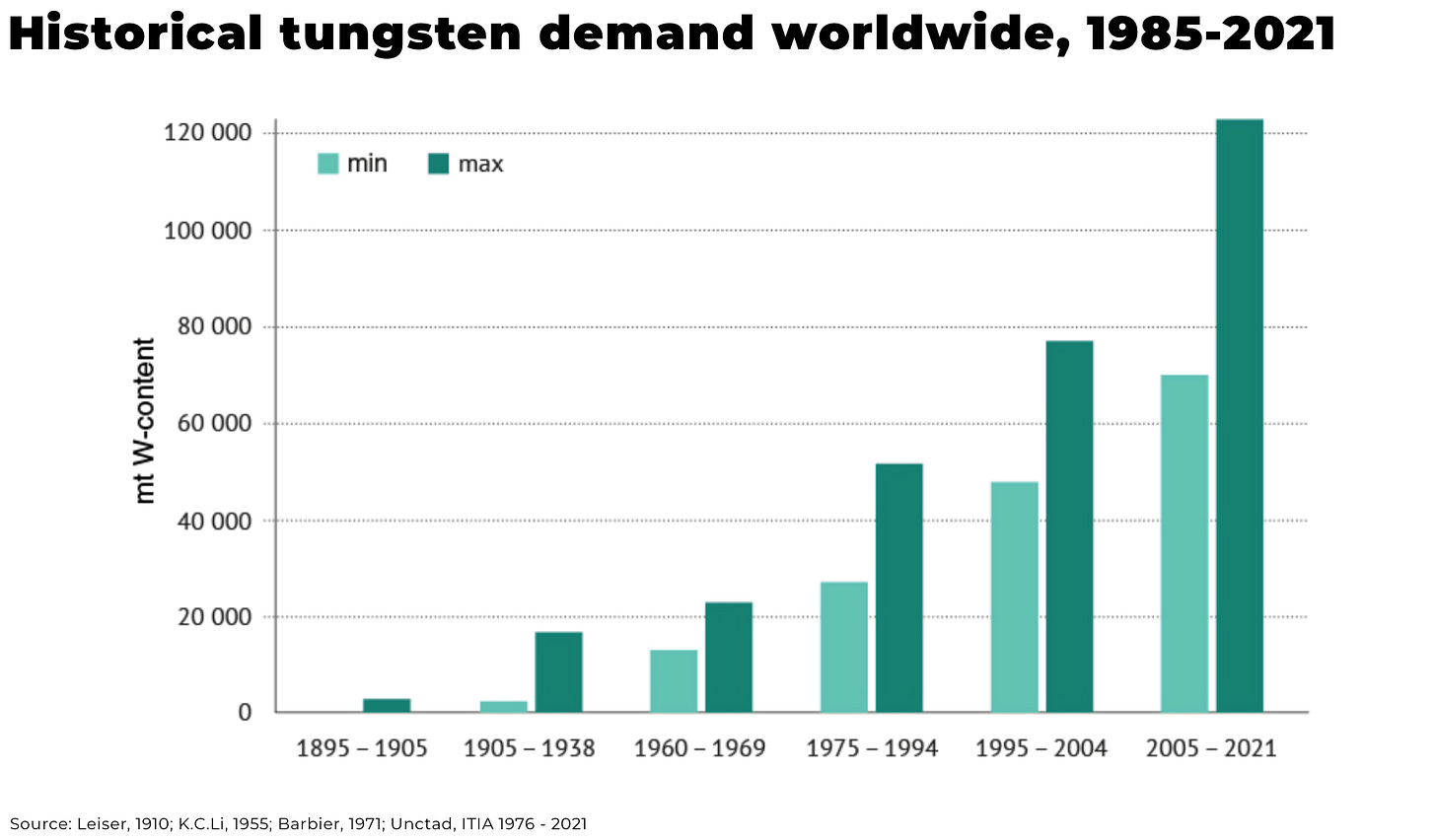

The global market value of tungsten was valued at more than US$5billion US dollars in 2022 — but, with each of the main use cases for tungsten, forecast to see significant growth over the next decade, we expect the tungsten’s market valuation to increase.

Total global military expenditure reached US$2443 billion in 2023, an increase of 6.8% from 2022 as regional conflict exploded across Ukraine, the Middle East, and countries like Sudan. And, now, Donald Trump demands allies, from NATO to East Asia, significantly increase their defence budgets.

Solar panel production and electric vehicle sales are also hitting record highs.

The challenge is maintaining a growing, stable supply of tungsten to meet this demand.

A model by MacroOps suggests tungsten is already in (a slight) deficit, and, in 2025, the supply deficit could increase to 16%, or 19,000 tons.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Volatile supply

Global tungsten production totalled approx 78,000 metric tons in 2023, with China accounting for approx 63,000 metric tons; Vietnam, second, with 3,500 metric tons of tungsten; and Russia, the third largest producer, with 2,000 metric tons.

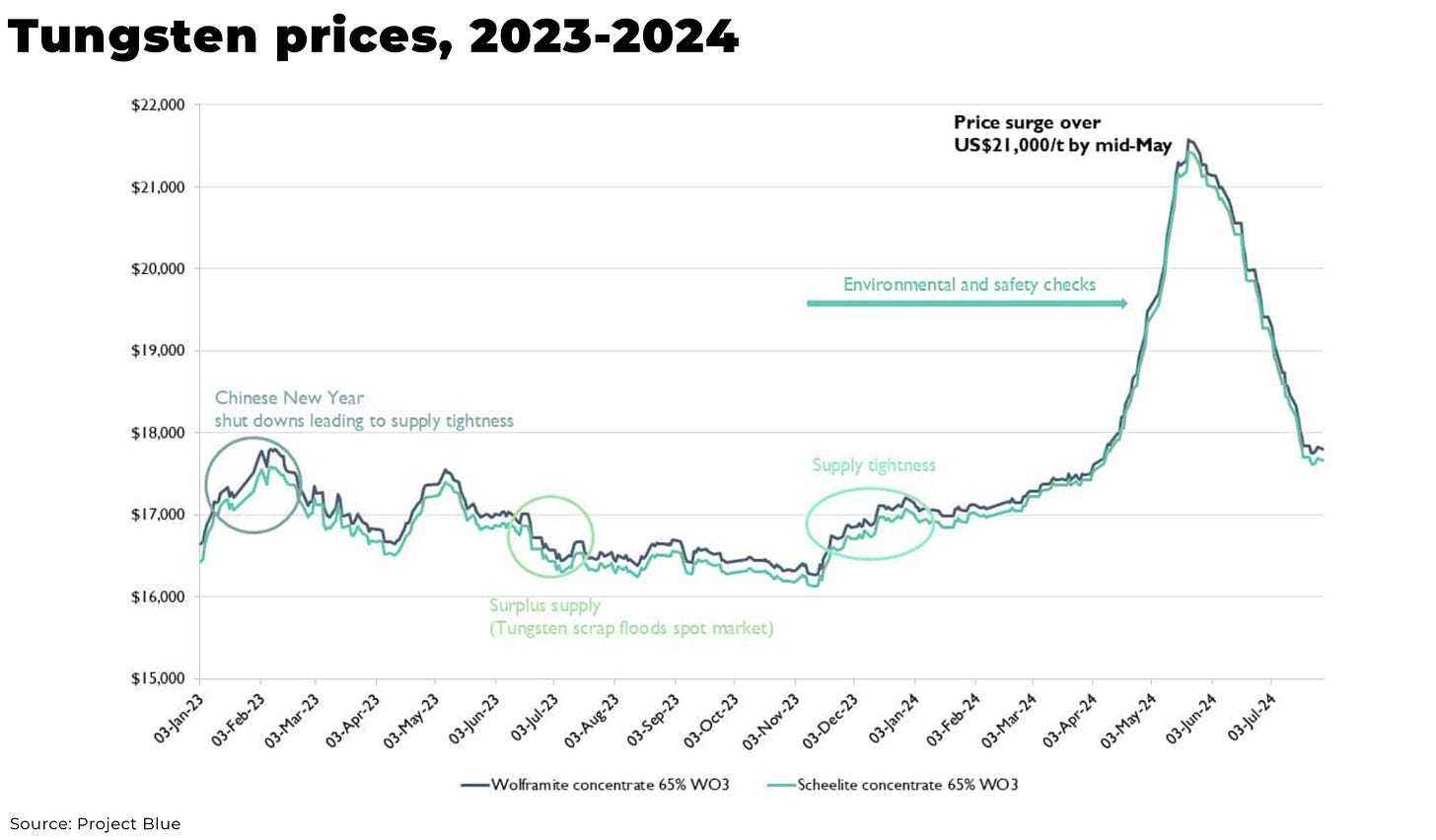

However, tungsten concentrate prices hit a 10-year high in China in May 2024, increasing 24% for 65% WO3 wolframite concentrate (US$21,600/t) and 65% WO3 scheelite concentrate (US$21,400/t) compared with prices in January, 2024.

And, on November 13, 2024, Argus’ European tungsten concentrate price was $260-270/kg, an 8% increase year-on-year.

The reasons for the recent volatility in price includes:

- conflict and political instability

- declining ore grades

- environmental restrictions

- limited production investment outside of China

In total, countries classified as “politically unstable” and “extremely unstable” account for 96% of supply.

China

China, in particular, has seen increased volatility in supply:

- new export controls on tungsten (and 24 other rare metals) were introduced no February 4, 2025. The extent of the restrictions is yet unknown and exports will be permitted if they comply with the relevant regulations

- on December 1, 2024, China announced export restrictions on “dual use” goods, that can be used for military or civilian purposes, suggesting tungsten exports may need licences

- output fell by 4.6% in 2023, after the Ministry of Natural Resources set a tungsten ore mining quota at 63,000 metric tons, and this output fell again with a quota of 62,000 metric tons in 2024

- “The announced mining quota for 2024’s first batch of tungsten ore has declined since 2020… Many market participants anticipated that tungsten production in 2024 will continue to be tight since the overseas tungsten production will be quite hard to fill the gap”

- — China-based tungsten producer source told FastMarkets

- environmental inspections across China’s mining regions, including the two major tungsten regions, Jiangxi and Hunan provinces, also disrupted production with many mines and smelters forced to close for maintenance checks

- in 2022, China’s export tax on tungsten concentrates was increased from 15% to 20%

The reasons for the reduction in exports includes geopolitical tensions with the US over semiconductor sanctions and trade tariffs, declining ore grades, as well as local demand for solar and manufacturing industries and stricter environmental supervision.

US

Tungsten has not been mined commercially in the US since 2015, instead the US imported 6,550 metric tons of tungsten from January-October 2024, making it one of the world’s largest importers of tungsten. The leading sources of imports are:

- Republic of Korea, 20%

- Bolivia, 18%

- China, 20%

- Vietnam, 10%

Official statistics suggest stockpiles have remained below 50 metric tons for the past decade.

Now, the officially stated aim of the US is to reduce dependency completely on China, with some of the most significant steps taken incluing:

- the REEShore Act of 2022 encourages the extraction of rare earths, including tungsten, to secure US supply chain by 2025 — and prohibits the use of tungsten from China in military equipment by 2026

- in 2024, the Biden administration raised tariffs on tungsten concentrate, tungsten oxide and tungstate from China by 25%, taking effect on January 1, 2025.

- in December, 2024, the US Department of Defense announced a US$15.8million award to Canadian company Fireweed Metals Corp to accelerate the development of a tungsten mine at the Mactung site in the Yukon, Canada, which is one of the world’s largest undeveloped high-grade deposits of tungsten

(and, it’s not just the US, with the EU’s renewed anti-dumping duties on imports of tungsten carbide from China for another five years in 2023)

Global supply

As concerns about tungsten supply security escalate, numerous countries are increasing their investments in the sector.

Vietnam: Vietnam is the second-largest tungsten producer outside China, with the Nui Phao mine operated by Masan Resources contributing significantly to global supply. However, the mine has reportedly seen production decline by 15% year-on-year in 2024, due to lower grades and throughput.

South Korea, with the Sangdong Tungsten Project, estimates to be one of the largest tungsten resources in the world with the potential to produce 50% of the world’s tungsten supply (ex China). Production is expected to start in 2025.

Australia, has world’s second-largest tungsten resources, but only one active tungsten mine at Mt Carbine mine, currently exploring US government funding opportunities.

Portugal: Almonty Industries operates the Panasqueira mine in Portugal, which produced approximately 500 tons of tungsten in 2022. Almonty is expanding the mine’s life by another 20 years, securing a long-term supply source for European markets.

Russia: Russia holds substantial tungsten reserves and is a significant producer. However, sanctions by the UK and EU, imposed in response to the invasion of Ukraine, are complicating trade and investment.

Conclusion

Despite the toughness of the metal itself, the global supply of tungsten is cracking. The world’s largest supplier, China, is threatening export restrictions and the West wants to secure supply from elsewhere.

As the global supply network is rewired, there are opportunities ahead, but the sharp price spike of 2024 is a warning of more volatility ahead.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.