- 300 SMRs generate enough electricity to power half the homes in US

- construction costs between US$300-500 million for first build, but potentially falling to US$150 million for subsequent builds

- US, UK, France, China, Canada, Russia and others all developing SMRs

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

A nuclear fission start-up specializing in “nuclear microreactors”, backed by OpenAI founder Sam Altman, has announced a plan to go public in a deal estimated to be worth US$850 million.

Start-ups, nuclear microreactors, US$850 million, even some AI — is it all too good to be true?

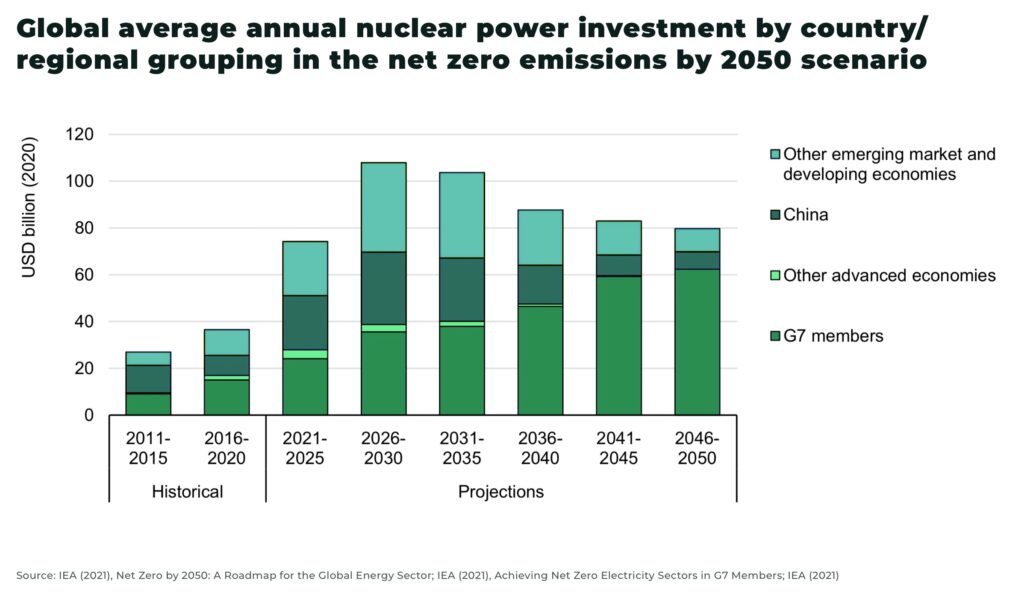

To meet net-zero targets, it’s estimated global nuclear power capacity will need to double, requiring an enormous investment of US$2.6 trillion from 2021-2050.

As we’ve highlighted in our recent report, The Uranium Bull Market and Coming of the Second Atomic Age, nuclear energy is undergoing a renaissance with new investments and projects from the US to China, India to Europe.

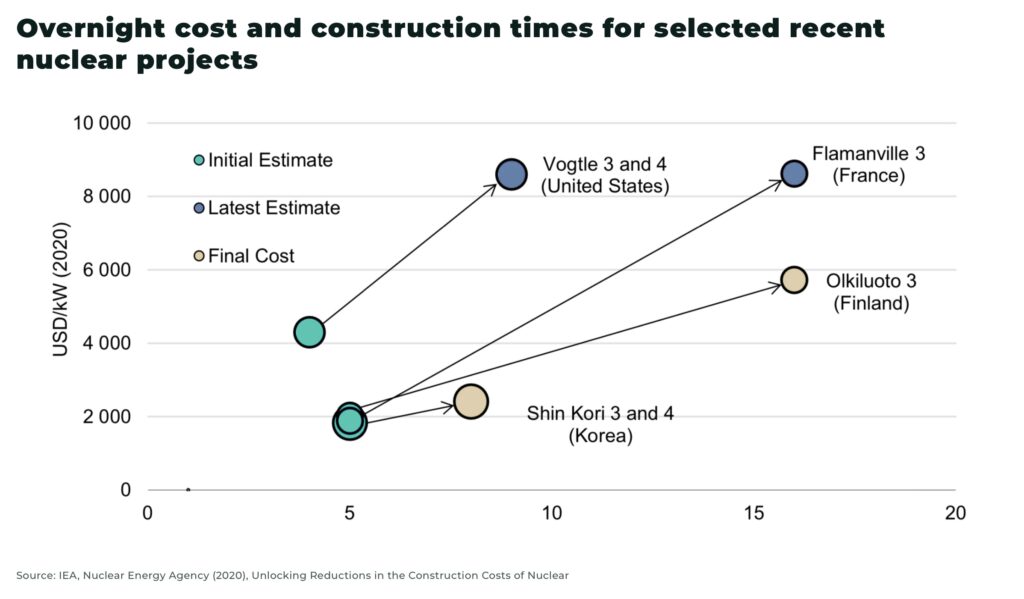

The challenge for expanding nuclear energy is managing risks over permitting, regulations, and cost over-runs. The average, existing nuclear reactor took 7 years to build, but more recent projects in the US and Europe have begun to experience significant delays and extra costs. For example, Vogtle nuclear power plant in Georgia is seven years behind schedule, with costs doubling to more than $31 billion.

If you reduce the size of the project, can you reduce the size of the problems?

Meet Small-Modular-Reactors (SMRs). Or, microreactors, as Sam Altman might describe them.

What is SMR?

As the name suggests, SMRs are advanced, small-scale nuclear reactors built from factory-assembled modules, with a power capacity up to 300MWe per unit.

The smaller size of the reactors means they generate about one-third of the energy of larger nuclear reactors for a shorter timespan, but avoid many of the permitting and construction delays, especially as they can be built in brownfield sites, such as disused coal power plants.

There are about 50 different designs and concepts; for example, they can be designed with a 60-year lifespans, with a construction time of approximately 3-5 years.

Construction costs are estimated to be between US$300-500 million for the first build, but potentially falling to US$150 million for subsequent, similar reactors off the assembly line.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

If you want to see what such an assembly line would look like, NuScale have officially entered the manufacturing phase in development of their small modular reactor technology:

Small reactors also use less fuel which means that, in the event of an accident, there is a significantly lower risk of extensive contamination.

The idea is not new, with all US submarines now powered by nuclear reactors, as well as 10 nuclear powered Nimitz Class aircraft carriers.

What is new is the commercial application of SMRs in electricity production.

Nuclear is clean energy

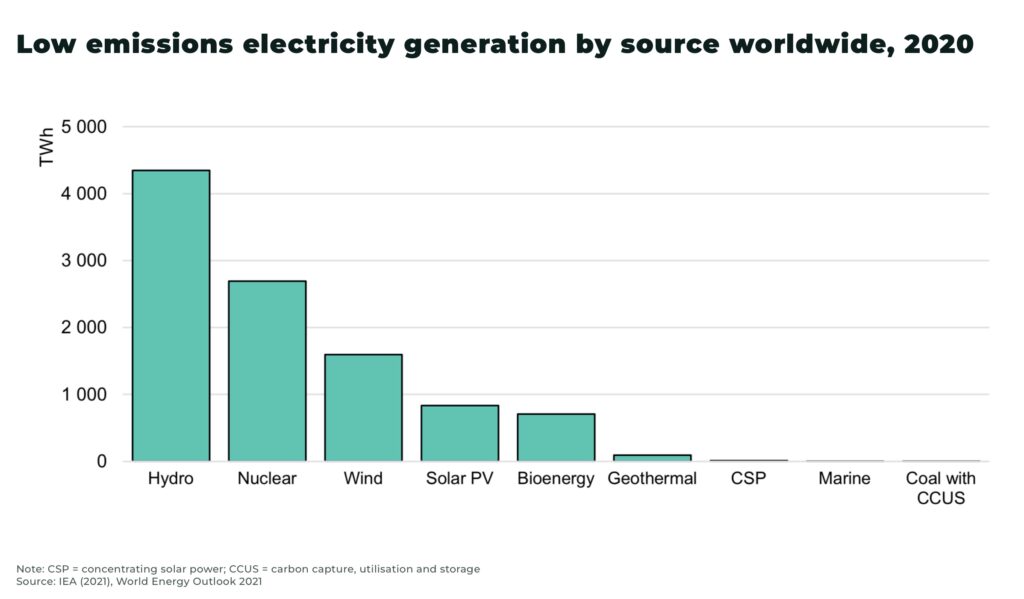

To meet their net-zero targets, many governments are investing heavily in solar and wind power. However, the problem is when the sun doesn’t shine or wind doesn’t blow.

Nuclear power has one of the lowest carbon footprints for electricity generation, and is available day and night, whatever the weather — allowing it to act as a necessary, stable baseload electricity provider of a clean energy system. It also requires 170x less acreage than a wind farm to generate the same amount of electricity.

For example, 300 SMRs generate enough electricity to power 68 million homes (half the homes in the US), with the equivalent carbon emissions avoided of 100 million cars off the road (97% of all passenger vehicles on the road annually in the US)

“I’m not sure, without nuclear, Europe can go to a net zero world. SMR [small modular reactors], frankly, relative to the traditional nuclear power plant, has lots of advantages, because it is much smaller. And therefore the risk profile is much smaller… SMRs are a massive opportunity that could be multiples of the size of our civil aerospace large engine business”

— Tufan Erginbilgic, chief executive of Rolls Royce

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

SMRs go global

Governments and private companies across the world are making progress in developing the new technology. For example:

US:

- in January, 2023 the US Nuclear Regulatory Commission (NRC) approved the first SMR design by NuScale for use

- in August, 2023 the NRC approved “alternative emergency preparedness requirements for small modular reactors and other new technologies”, part of a trend in simplifying regulation to bring reactors online

- NuScale plans to build it’s initial six-module plant near Idaho falls, generating 462MW of electricity, with more than US$1 billion awarded by the Department of Energy to help fund development

- NuScale is also in talks to support the building of SMRs in Poland and Romania, as well as possible deployment in the UK

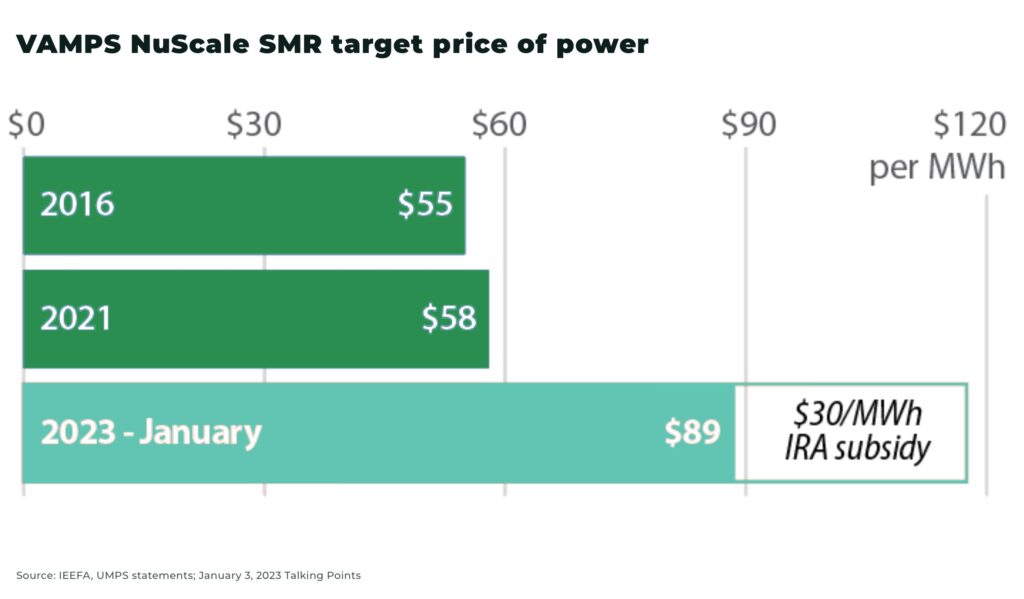

- the Inflation Reduction Act (IRA), 2022, includes tax incentives for advanced nuclear reactors, with tax credits for both taxpayers and production tax credits for up to ten years to generate clean hydrogen. The act also amends Internal Revenue Service (IRS) rules, allowing investments in advanced reactors to qualify for a 30% tax credit on cost of construction of a nuclear power plant after 2025

- the IRA invests US$700 million to support development of a domestic supply chain for high-assay low-enriched uranium, commonly referred to as HALEU, used by SMRs

- the US Department of Energy identified 315 operational or retired coal plants that are suitable for SMRs, including long-term job impacts that could lead to additional annual economic activity of US$275 million (potentially a 92% increase in local country tax revenue)

UK:

- the government has announced a commitment of £20billion (US$25billion) to support the development of up to 8 SMRs — one of the largest ever direct UK investments in civil nuclear power. The development of SMRs has been opened up to competition by the government

- Rolls-Royce plans 16-30 SMRs for the UK, with the first to be online by 2029, with US$271 million support from the government. Their proposed design for a 470MWe reactors has moved to step 2 of the regulatory assessment, as well as shortlisting 3 sites in the UK for a factory to assemble the components of it’s proposed 470MWe reactor. Estimated cost of each reactor is US$2.5 billion

- US-based developer Last Energy has announced a deal to sell 24 SMRs to UK customers

China:

- China is already building one of the world’s first commercial SMRs, Linglong One, approved by the International Atomic Energy Agency (IAEA), with a potential capacity for 125MWe. The main internal structures of the reactor building have been completed and the core module installed in August

France:

- the government plans to invest EUR 1 billion in developing domestic SMR technology as part of its 2030 national investment plan

- Électricité de France (EDF), the French electricity utility company, is working on Nuward, a 340MWe SMR plant

Canada:

- the government released it’s SMR Action Plan in 2020, and significant national funding has been invested to support SMR initiatives; for example, CA$250 million for electricity development projects, including early phase SMR development activities; and, more recently, CA$29.6 billion for a newly announced SMR funding program

- Ontario government authorities have announced support for planning and licensing of 4 SMRs at a new site in Darlington; the Canada Infrastructure Bank recently agreed a CA$970 million deal to build the project

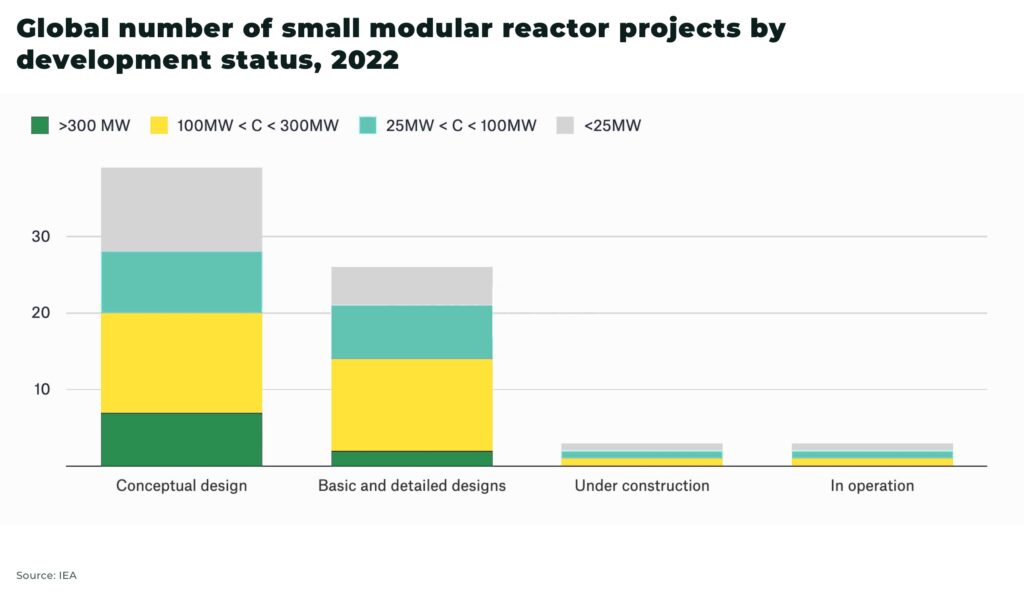

According to the IAEA, there are four SMRs currently under construction, in China, Russia and Argentina.

The race to develop and build the SMR technology has most definitely started — but significant challenges are still to be overcome.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The challenges for SMR

Despite the promise of SMR technology to overcome challenges that hinder the development of larger nuclear reactors, the potential, as yet, remains untested.

Cost

Despite the promise of smaller scale meaning smaller costs and less cost over-run, America’s NuScale has recently announced the target price for electricity from their first proposed SMR has increased from US$55MWh in 2020 to US$89MWh in 2023. The rise is due to the estimated costs for the project rising from US$5.3 billion to US$9.3 billion.

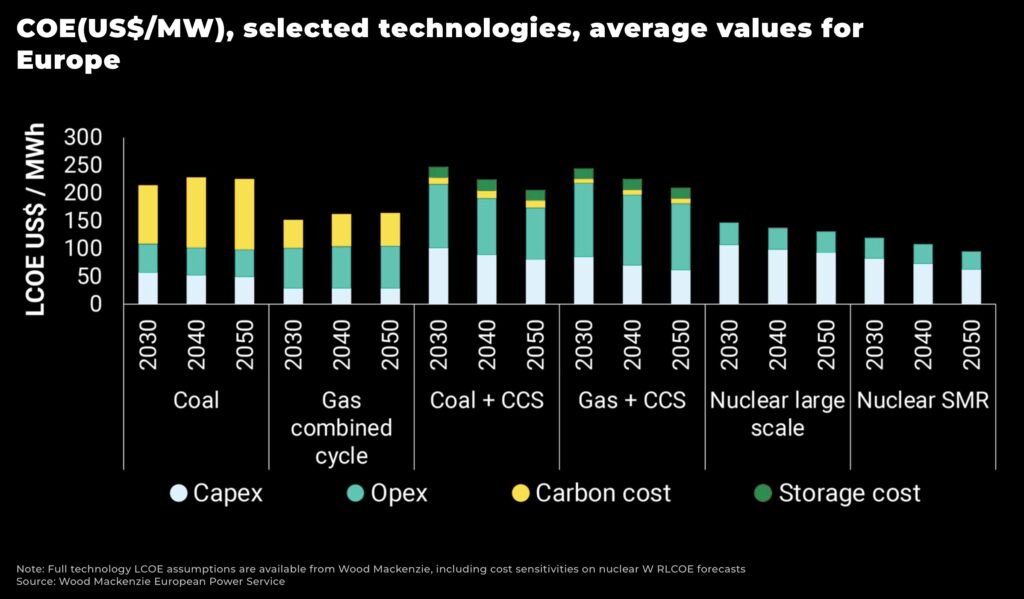

Wood Mackenzie estimates conventional nuclear power has a Levelized Cost of Electricity (LCOE) of, at least, 4x that of wind and solar.

With it’s 24/7 clean power generation, nuclear power provides added stability for these extra costs.

However, as NuScale’s figures hint, the economic competitiveness of SMRs is still yet to be proven once they have been built out at scale, especially in comparison to larger reactors.

It’s estimated at least 10-15 SMR projects will need to be under development by 2030-2040 for economies of scale to be realized.

Uranium

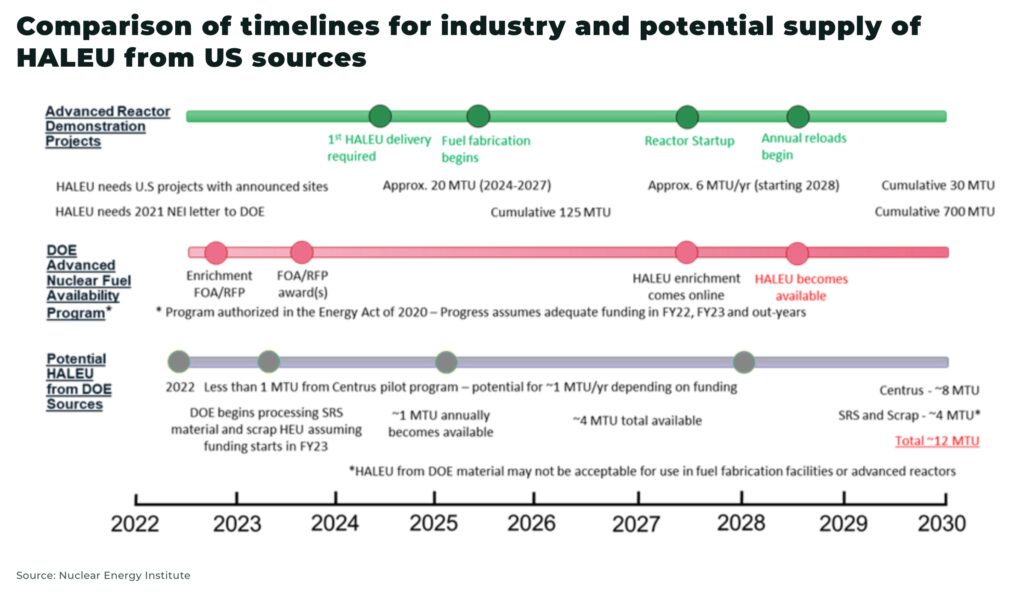

The majority of existing large nuclear reactors use fuel that is 3-5% uranium-235, but almost all (eg 9 out of 10 of the advanced reactors funded by US government) of the SMR reactors under development require a fuel that is 5-20% uranium-235, or high-assay low-enriched uranium (HALEU).

The US alone will need more than 40 metric tons of HALEU by 2030, with additional amounts required each year, for the new generation of reactors, including SMRs.

The problem: only one company currently commercially sells HALEU, Techsnabexport, a subsidiary of Rosatom, Russia’s state-owned nuclear energy company.

There are no Western sanctions on Rosatom, but political and logistical challenges over buying HALEU from Russia since the invasion of Ukraine has already cause delays: Terrapower now expects it’s Natrium demonstration reactor to be delayed by 2 years to 2030 due to a lack of HALEU.

“Production of HALEU is a critical mission and all efforts to increase its production are being evaluated”

— a spokesperson for the US Department of Energy (DOE) told Reuters

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US is moving fast to resolve the problem.

In June 2023, the NRC approved a request by Centrus Energy to make HALEU at it’s facility in Pinkerton, Ohio — now the only licensed HALEU production facility in the US. And Terrapower and Centrus are collaborating to ensure Terrapower’s Natrium demonstration plant has enough HALEU to start operations by 2030.

In July 2023, the US Senate approved an amendment to the National Defense Authorization Act to establish a Nuclear Fuel Program, and reduce independence on uranium from Russia.

The IRA has allocated US$700 million to develop a domestic supply chain of HALEU, with contracts finalized with a variety of companies, such as Centrus, to begin development of HALEU production.

But, the Nuclear Energy Institute (NEI) warns, enough HALEU still might not be ready until 2028-30.

Can SMRs work?

Political and financial investment in developing SMRs has gained a momentum that would now be difficult to stop, especially as governments increasingly come to understand the critical need for baseload power to compensate for when wind and solar are not working.

The two major challenges for SMRs are:

- proving the cost-efficiencies

- and, once proven, to gain enough momentum and investment to reach economies of scale

The widespread rollout of commercial-scale SMRs is not expected before 2030. Projections on this timescale are difficult but, barring some new energy technological breakthrough (such as fusion), the dynamics and options in the clean energy transition are unlikely to shift significantly from today. Therefore, we would go so far as to venture that, come 2030, there will likely be increased pressure to fast-track nuclear energy as legally-binding net-zero deadlines draw closer. SMRs will be a critical part of that nuclear energy rollout.

Exposure to SMRs

To gain exposure on your portfolio to the potential of Small Modular Reactors, there are two main options:

- investment in public companies and utilities involved in SMR development

- investment in uranium, which will be in higher demand due to increased capacity of nuclear energy. For SMRs, this exposure will be with companies developing a secure supply chain of HALEU in Western markets

Sam Altman is making a long-term bet on SMRs. We suspect the odds are in his favor.

Stay Subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.