- one of fastest growing economies in world, projected to average 6.3% annually 2021–3

- robust domestic demand and strong investment activity, bolstered by government incentives

- large, young and well-educated population; world’s most populous country

- well-regulated exchanges and commodity trading growing fast

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

India is the fastest growing economy in the world. The World Bank expects it to outperform all other major economies in 2023, with 6.3% GDP growth versus 4.3% for China and just 0.5% for US.

India is booming, presenting a significant opportunity for investors positioned to take advantage of the opening up of one of the world’s largest economies.

A decade ago, India was the eleventh largest economy and it is now on track to become the third largest economy by 2030 (overtaking Japan and Germany), according to a Morgan Stanley report.

“India is gaining power in the world order, and in our opinion these idiosyncratic changes imply a once-in-a-generation shift and an opportunity for investors and companies”

— Ridham Desai, Morgan Stanley’s Chief Equity Strategist for India

Population

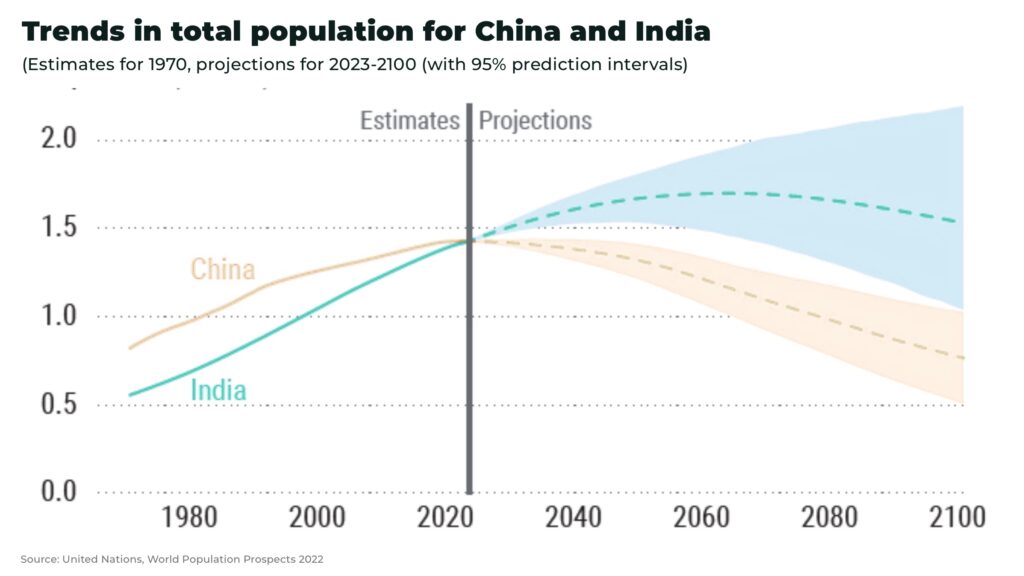

In April this year, India overtook China as the most populous country in the world, with a population of 1 billion.

Perhaps, more importantly, compared with many other countries with quickly aging demographics, India’s population is a young, well-educated population with rising disposable income.

This disposable income has led to strong domestic demand for consumer goods, making it a lucrative market for global businesses. And, while the workforce of China is shrinking because of its aging population, India’s workforce will grow until the late 2040s.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Business-friendly government

India’s liberal democracy has pushed through a series of reforms over the past thirty years to open up the economy, working to increase international competitiveness, reducing import tariffs, and deregulating markets.

India’s liberal economy, highly regulated markets and the strength of the rule of law makes it a stable environment to do business.

This year, India overtook the UK to become the fifth largest economy in the world, and the country’s stock market has moved into second place after China in the MSCI Emerging Markets Index.

Now, through a series of strategic partnerships, India is securing a regional leadership role and establishing itself as a leader of emerging economies. For example,

- ahead of Modi’s visit to the US this month, the US and India sealed the approval for the manufacture of F414 jet engines in India. This is the first time that the US will share what it called a “crown jewel” in its defence capabilities with a non-ally, and part of a closer defense alignment between the two countries

- India is a longstanding member of BRICS (Brazil, Russia, India and China) and a partner of the Association of Southeast Asian Nations (ASEAN)

The next China?

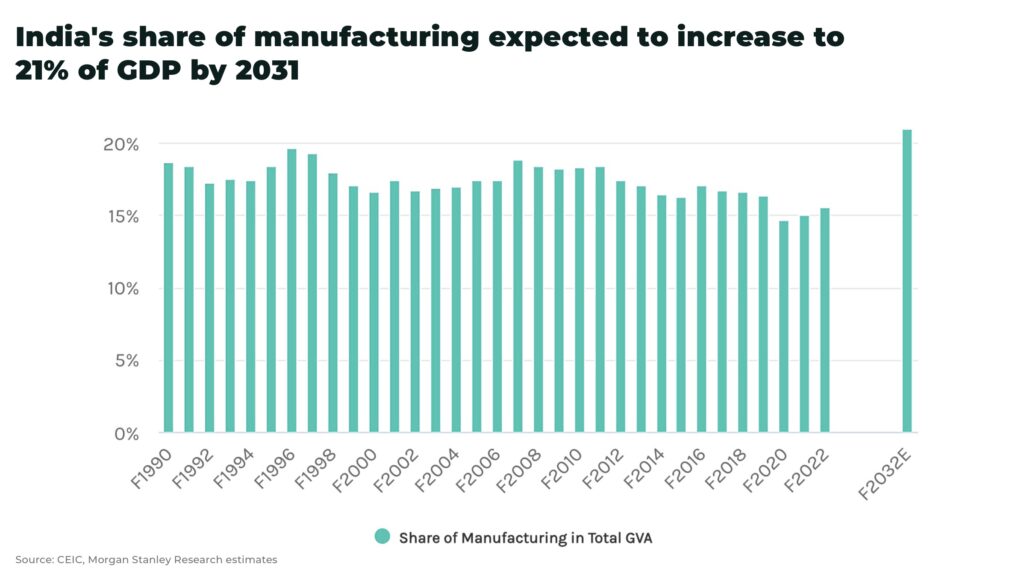

As Western governments and business look to secure their supply chains — after the disruption caused by Covid-19 and the war in Ukraine — India is positioning itself to become a hub for foreign investors, as well as a manufacturing powerhouse.

India’s exports have grown by 73% over the past decade and its share of global exports has risen from 1.9% in 2012 to 2.4% in 2022.

- Apple has just opened a new factory in India, as it tries to unwind its dependence on China

- India is also positioning itself to as an alternative to China in the electric vehicle supply chain

- India is to build its first semiconductor manufacturing facility, a joint venture between India’s Vedanta and Taiwan’s Foxconn

- Suzuki Motor Corp plans to invest 100 billion rupees in EV and battery manufacturing in India

The government is looking to boost manufacturing and exports through its incentives for foreign investors, such as the Production Linked Incentive Scheme (PLIS). Introduced in 2020, PLIS offers domestic and foreign investors tax rebates and license clearances, as well as other forms of stimulus.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The government’s ‘Make in India’ campaign aims to increase share of manufacturing in the country’s GDP and promote domestic industries. This includes cutting corporate income tax from 30% to 22% and establishing special economic zones with tax incentives and expanded infrastructure.

Expansion of renewable energy to meet domestic demand

With its population and business booming,India expects its energy needs to increase substantially in the coming decades. At present, 70% of its electricity comes from burning coal.

Yet, at COP26 in 2022, Indian Prime Minister Narendra Modi pledged to reach net zero by 2070, with the government looking to accelerate its energy transition.

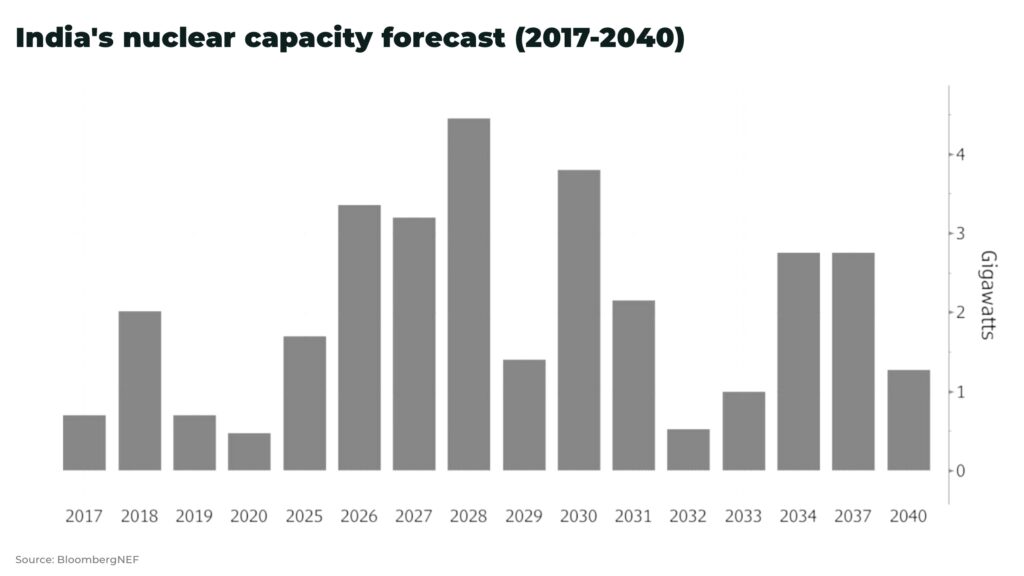

India plans to build out its nuclear energy capacity in the next decade. India currently has 22 nuclear reactors, with an installed capacity of 6780 MegaWatt electric (MWe) and has given approval for the construction of at least 10 new reactors by the early 2030s.

“India is looking to reduce its fossil fuels by half by 2032; building nuclear plants is seen as a central part of that strategy”

— Irina Tsukerman, a geopolitical analyst and president of Scarab Rising, a Connecticut-based business advisory group

Currently, nuclear power is India’s fifth-largest source of electricity after thermal, hydroelectric and renewable sources of electricity. And, according to a recent Reuters report, India may overturn a ban on foreign investment in its nuclear power.

India’s most recent National Electricity Plan (2022) outlines a 24% increase in solar production targets for 2027. To achieve this target India is incentivizing the manufacture of photovoltaic panels domestically by Indian companies.

While solar capacity averaged 8.3 gigawatts (GW) in the five fiscals through 2022, wind power grew just 1.6 GW per annum. However, in January this year the government set a target to annually auction 8 GW of wind power projects to the end of 2030. Although costlier than solar, wind power is crucial as it can provide electricity even at night and so forms an important part of round-the-clock power supply.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Mineral commodities in high demand

As India grows, so too does its demand for commodities and critical minerals.

Estimates suggest metals used in next-generation batteries increased 50% in 2022 alone and will quadruple by the end of the decade. In order to just meet its domestic demand of 200 gigawatt hours of lithium-ion batteries, India will need about 35,000 tons of nickel sulphate and 11,000 tons of both manganese sulphate and cobalt sulphate.

India has only a fraction of the raw materials it needs to manufacture lithium-ion batteries. It announced a small lithium discovery near Karnatka in 2021 but is still carrying out exploration of the area. India is, therefore, almost entirely reliant on imports of many critical minerals required for the energy transition, for example:

- 100% lithium and cobalt, required to manufacture batteries for electric vehicles

- magnesite, manganese ore, copper ore, lead ore, and rock phosphate to meet its own needs (India has large manganese and graphite resources but production has yet to achieve scale

- Copper is in short supply domestically since the closure of Vedanta Ltd’s 400,000 tons a year plant in 2018

To meet this demand, the Securities and Exchange Board of India (SEBI) has recently granted foreign businesses better access to Indian commodities. This allows stock exchanges in India to extend direct market access to registered foreign portfolio investors.

Commodity trading in India is also growing fast as manufacturers discover the benefits of hedging risk through commodity futures and investors seek to diversify their portfolios.

Infrastructure

This missing piece in India’s growth, is its poor infrastructure. The need is broad, from roads and bridges to power, telecom, sanitation and education. For example, only 5% of its roads are highways and 40% are dirt roads and there are delays in railway freight movement, all of which lead to significant capacity constraints.

However, Modi’s government is investing heavily in its infrastructure. The length of electrified railway lines has more than doubled since 2014 and the proportion of electrified lines in India reached 65.8% in 2021, higher than France (60.3%) and the UK (38%). India is also making improvements to its road infrastructure, with almost 50,000 kilometers of national highways added in the last nine years. This includes the Delhi-Mumbai Expressway, expected to be completed by the end of 2024 and which will halve journey times between the two cities. The number of airports has doubled and, as of last year, India has 832m broadband connections.

Conclusion

Over the past five years, the profits of all multinationals in India rose by 80% to $45billion, according to The Economist. India’s growth predictions depend on the continuation of trade and financial liberalization, labor market reform and investment in infrastructure.

But the fundamentals, both domestically and internationally, present India with an historic opportunity for the country and investors.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.