Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Scandium is the “reclusive” critical mineral.

High-grade deposits suitable for commercial mining are extremely rare, and extracting it as a by-product from other ores is similarly challenging.

But, there’s a reason it’s listed as a critical mineral in the US, EU, Canada, Australia.

What is Scandium

Scandium is a soft, silvery metal classified as a rare earth element (RRE) group. However, as the 32nd most abundant element on earth (gold is the 75th), it is far from being rare.

The problem is that scandium is spread widely and thinly, most often combining with other metals. This means there are few high-grade deposits that can be commercially mined. Instead, it must be processed as a by-product from other mined metals (often through leeching), such as other rare earth elements or oftentimes uranium.

This means there is little reliable data on production, especially in what is a relatively small market, so it’s difficult to understand the size of the market, as well as supply and demand dynamics.

The argument runs that use of scandium in end-use products is limited precisely because of this difficulty in sourcing the metal — but new use cases and discoveries are starting to drive demand higher.

Demand for scandium

The two most important potential markets for scandium are:

- aluminium alloys

- the energy transition

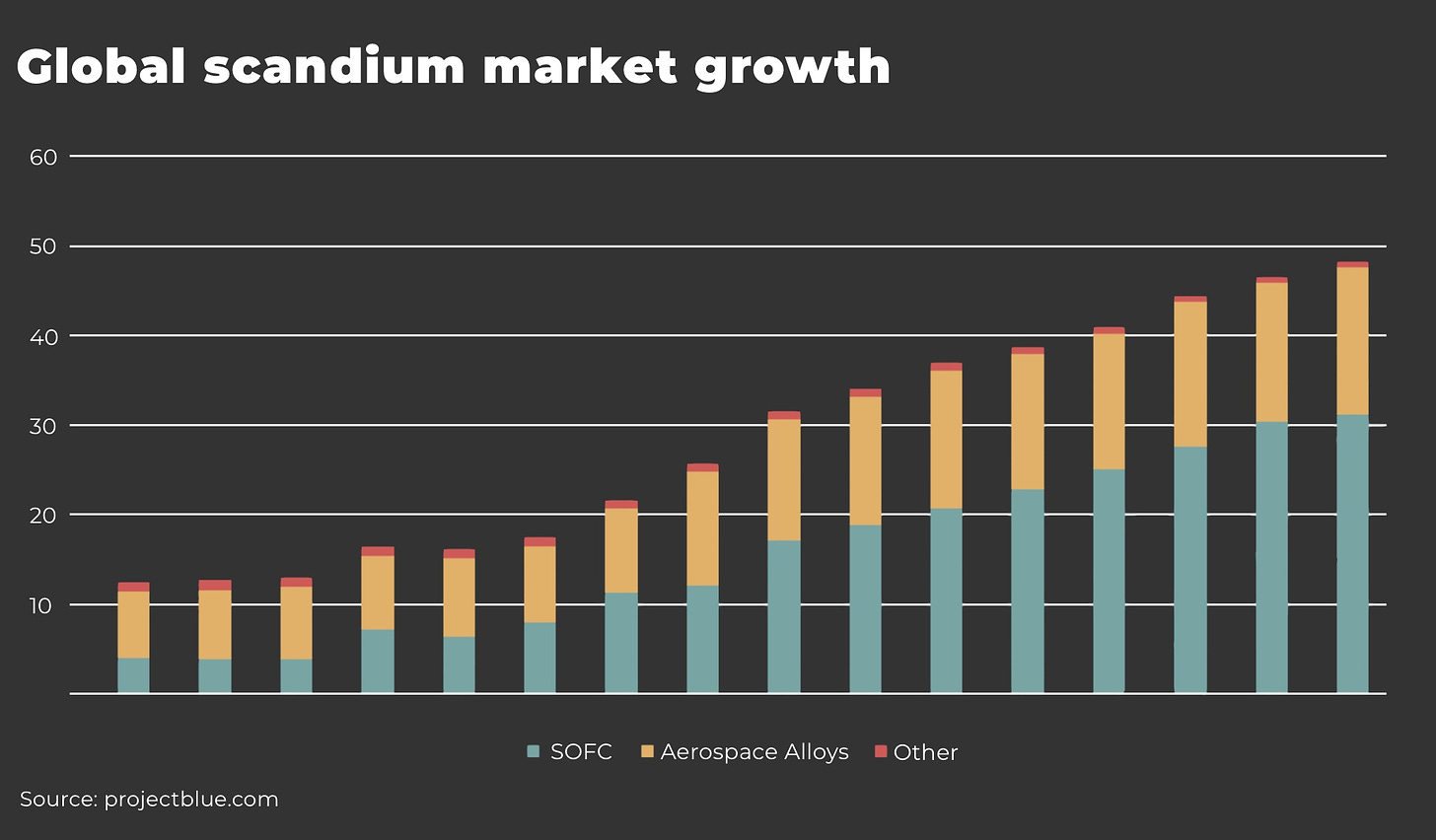

Global supply (and consumption) of scandium is, relatively speaking in comparison to other major critical minerals, very small — but growing at a significant rate.

The US Geological Survey estimates that supply and demand has doubled, from 15-25 metric tons in 2021, to 30-40 metric tons in 2023.

“Global consumption has increased considerably driven by its use in aluminum-scandium alloys and SOFCs”

— US Geological Survey, Scandium, 2024

Project Blue expects the scandium market to grow at a CAGR of 6.4% over the period to 2027, with the potential of more upside if scandium finds application in the electric vehicle and/or hydrogen economies.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Solid Oxide Fuel Cells (SOFCs)

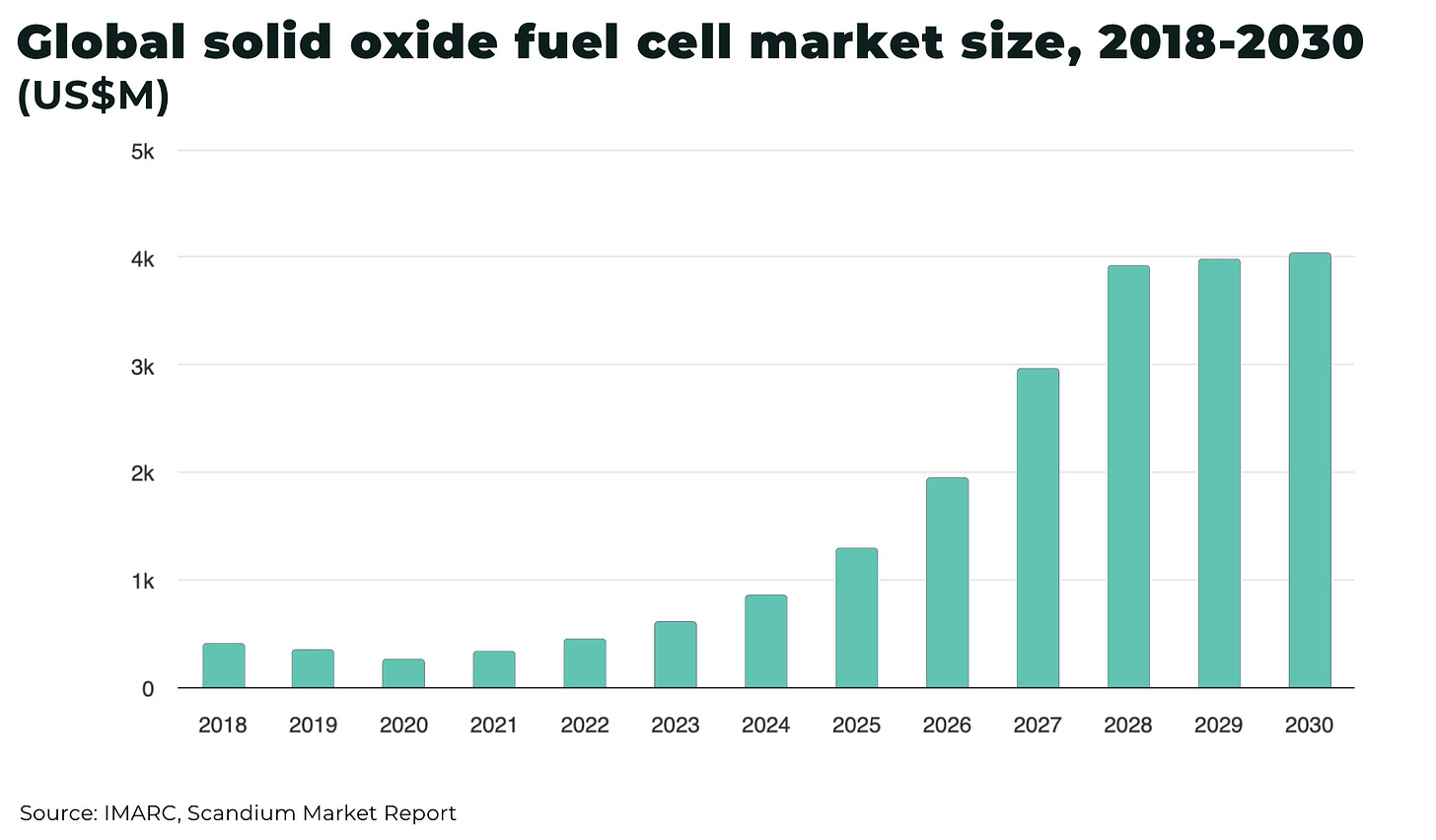

Scandium is a key element in a type of fuel cells known as Solid Oxide Fuel Cells (SOFCs) – the largest commercial market for scandium. It allows the electrolytes in the fuel cells to cool, helping reduce costs — as well as offering a replacement for fossil fuel vehicles.

In 2022, the SOFC market accounted for an estimated 55% of global scandium consumption.

There are a variety of estimates on the size of the market and scale of its growth — Grand View Research, for example, estimates the solid oxide fuel cell market worldwide generated a revenue of US$458.5 million in 2022, set to grow at a CAGR (2022 – 2030) of 31.3% to more than US$4 billion by 2030 — but we are wary of committing to any specific figures.

However, there is movement with companies like Nissan recently announcing it is testing a new SOFC to power its electric vehicle production, as well as Elocgen’s expansion of SOFC facilities in Estonia.

“There is a considerable rise in the demand for solid oxide fuel cells (SOFCs) for producing electricity. This represents one of the key factors strengthening the growth of the market”

— IMARC, Scandium Market Report

Aluminium Alloys

Scandium-aluminium alloys (AISc alloys) are advanced materials that combine the light-weight properties of aluminium with the unique alloy characteristics of scandium, including:

- increased strength, especially over many other alloys

- corrosion resistance

- heat tolerance

- increased weldability

Aluminium alloys represents one of the most forward-looking commercial opportunity for the mineral. The major applications for scandium-aluminium alloys include:

- aerospace and defence; initially started with in the Russian military, with the Mikoyan-Gurevich MiG-21 and MiG-29, with potential across a wide variety of aircraft components and drones

- sports equipment, such as bicycle frames

- as well as potential to be used in the frames of solar panels, due to its light-weight, high-strength properties

Only 1-2% of vs 98-99% aluminium is needed for the alloy, which means aircraft and jet fighters can be assembled faster and at 15-20% reduction in weight.

Total world aluminium production was 70.581 million metric tons in 2023. If only 0.1% of this total was alloyed with a scandium concentration of 1%, it would mean an annual global scandium demand of more than 700 tons — x17.5 current demand.

Other demand

Other demand for scandium comes from:

- high-intensity metal halide lamps

- 3D-printing

- magnets

- lasers (for example, unlocking scandium’s “resonance” to create an atomic clock that gives an accuracy of 1 second in 300 billion years)

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Supply

There are very few primary scandium mines, with most of supply recovered as a by-product from processing other metal ores.

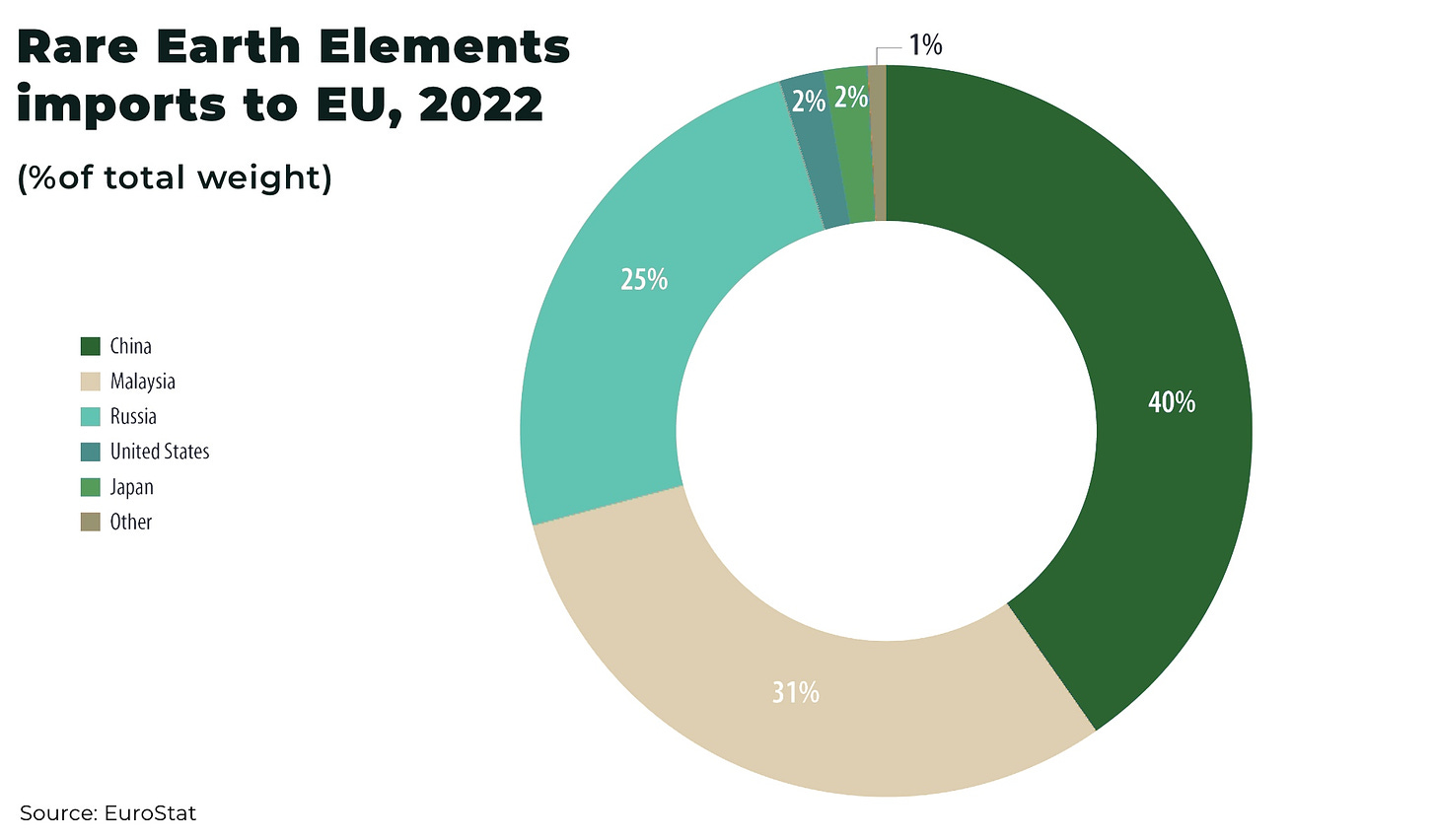

With scarce mine production figures and sales settled privately, prices and production are difficult to discern but estimates suggest the largest producers of scandium are:

- 80% from China (as by-product from iron ore, rare earths, titanium, and zirconium

- 10% from Russia (as by-product from apatite and uranium)

- 10% from Kazakhstan (uranium), Philippines (nickel), Ukraine (uranium), and Japan

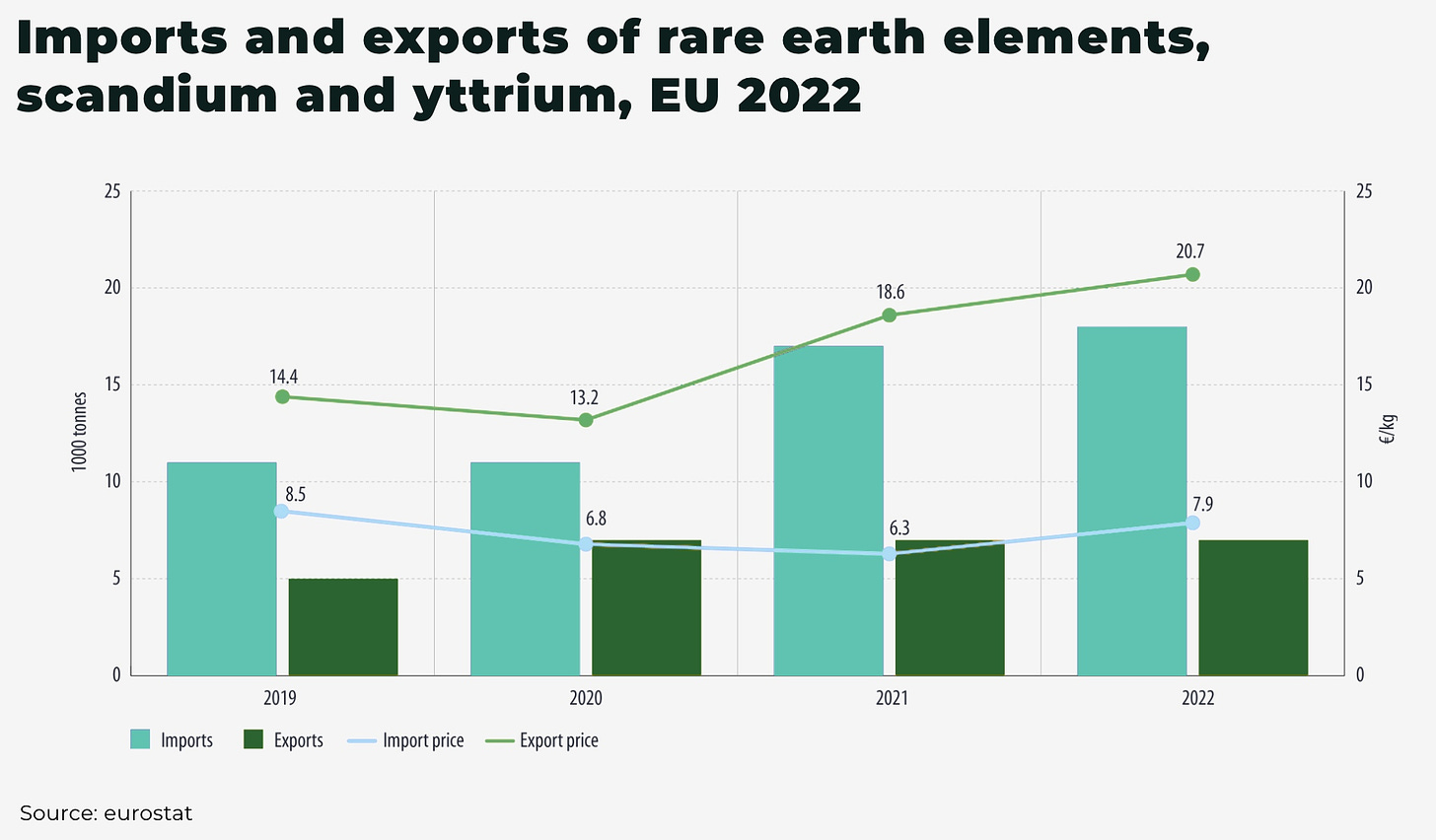

Europe’s rare earth imports give an indication of the global import/export state-of-play:

For the US, imported scandium from 2017-2020 was largely from:

- China

- Japan

- Russia

- Germany

- Philippines

The difficulty in sourcing large, easily mined deposits, as well as the scarcity of reliable figures on long-term production, many argue, has limited the commercial uptake of scandium.

“There’s an enormous latent demand for scandium if it ever became available on a primary, scalable basis”

— John Kaiser, of Kaiser Research, told Investing News Network

There have been many false dawns for scandium. But could this be about to change?

Australia

In 2023, Rio Tinto announced they were acquiring the Platina Scandium Project, a high-grade scandium resource in New South Wales, Australia for $14 million. The primary scandium mine development could produce up to 40 tonnes of scandium oxide per year, for 30 years.

The acquisition comes just a few years after Rio Tinto opened its new scandium oxide plant in Quebec; a US$6 million project developed through the Quebec Plan for the Development of Critical and Strategic Minerals, with production projected to reach a capacity of 3 tons of scandium oxide per year — suggesting their development of scandium is paying off.

“We’ve seen significant interest from the market in the alloy, which we can produce ourselves”

— Sinead Kaufman, Rio Tinto’s chief executive for minerals, said at an industry conference in Perth, Australia last year

“Certainly the Rio deal is positive for the market as a whole as it creates new supply in a market dominated by Chinese and Russian output at a time when supply from these countries is becoming increasingly problematic for certain consumers”

— Jack Bedder, founder and director of London research firm Project Blue, told S&P Global

“It’s quite clear that Rio has fallen in love with scandium. If you can get into all the alloy mixes for every airplane that’s being made going forward, that’s no small market. Longer-term it is going to switch over to aerospace”

— Christopher Ecclestone, principal and mining strategist at equity research house Hallgarten & Co, told S&P Global

Rio Tinto is betting on growth across aluminium alloys, 3D printing, energy transmission applications, solid oxide fuel cells in buildings, medical facilities and data processing centres, as well as in niche products such as lasers and lighting.

Rio Tinto is also betting on Australia — and it’s not the only one.

Australia hosts:

- 50% of the world’s largest scandium projects (by reserves and resources)

- 38 of the world’s 62 active scandium properties (including 11 in New South Wales), with some of the world’s most high-grade deposits in the eastern states that can be developed as primary mines, unlike most of the rest of the world

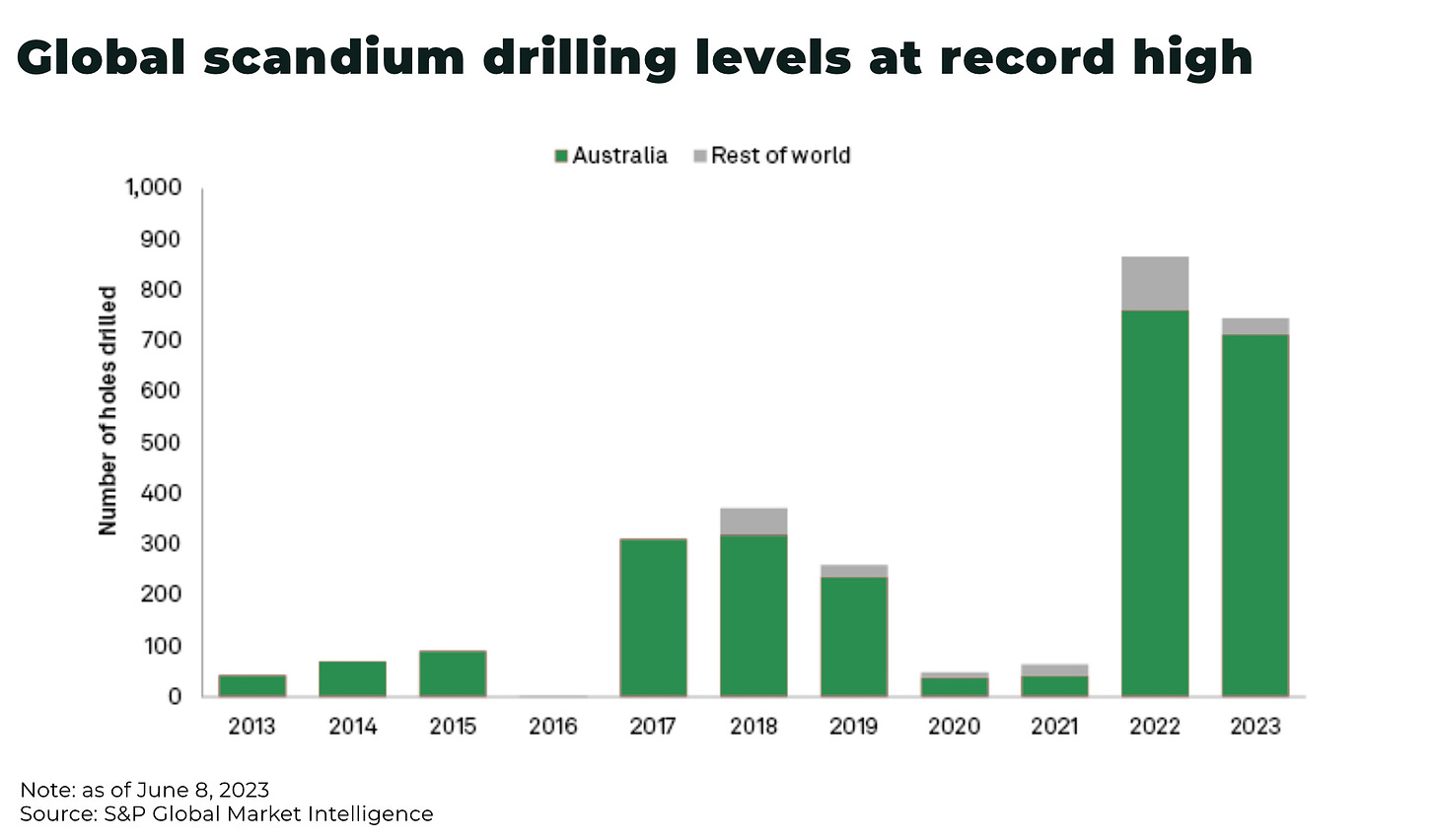

Scandium drilling hit a record high in 2022, with S&P Global data showing levels surging again in 2023. Other junior mining companies working to develop scandium deposits include Scandium International Mining and Sunrise Energy Metals.

New South Wales’ scandium geology is “better than anywhere else — at surface, good grades. And that area will be developed before any other tertiary areas” — Christopher Ecclestone, principal and mining strategist at equity research house Hallgarten & Co, told S&P Global

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Australia has the potential to diversity global supply from China’s dominance, but it’s not the only Western country trying to secure supply.

USA

The US currently produces no scandium domestically (either mined or recovered), nor has a stockpile.

This may all change with the Export-Import Bank of the United States (EXIM) recent proposal to finance up to US$800 million in NioCorp Developments Elk Creek critical minerals project in Nebraska. The deposit is one of the largest scandium deposits in the world, and would create North America’s only advanced materials manufacturing facility for producing scandium, niobium and titanium. And, in 2023, the company successfully demonstrated pilot-scale production of 1 kilogram of aluminum-scandium ingot.

The investment comes after the US Department of Defense allocated US$4.7 million to the funding of SAE Government Technologies-led Supply Chain of Recovered Elements Consortium (SCORE) in 2022.

“The first focus of SCORE will be the extraction of scandium and integration into the aluminum alloys supply chain, supporting domestic manufacturing through castings, welding, and additive (3D printing) pathways”

And, there are others too, including Canada, Kazakhstan

Conclusion

The promise of a scandium “boom” is nothing new, with much debate over whether supply drives demand (or demand drives supply).

But now momentum finally appears to be shifting.

The energy transition and net-zero targets mean demand is fast-growing for light-weight, enhanced strength aluminium alloys across aerospace and electric vehicles, as well as alternative energy sources such as solid oxide fuel cells.

And the West’s search for secure supply chains is exacerbating the issue.

And supply is responding, with major investments in both scandium exploration and development.

Get ready for “reclusive” scandium’s coming out party.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.