Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

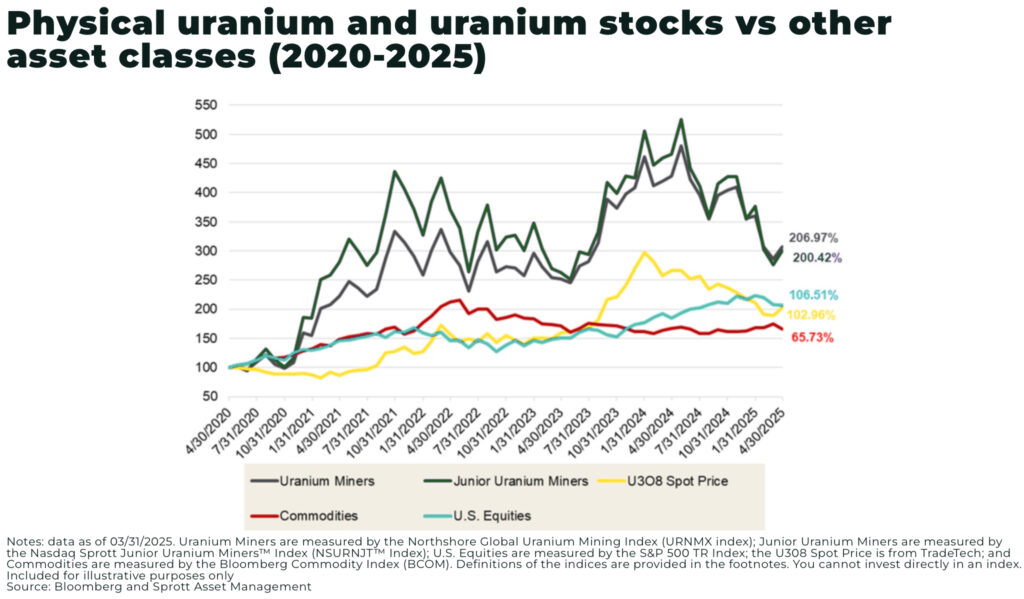

Uranium miners rose 7.1% in April 2025, while junior miners increased 8.6% — with momentum continuing in May. The rally was fueled by a 5.4% rise in uranium spot prices to to US$67.70 per pound during April.

Now, this has obviously been a volatile year for uranium prices, but, this recent strength builds on uranium’s remarkable longer-term trend, especially since 2020, with physical uranium and uranium equities outperforming other commodities and equities.

As uranium demand is forecast to grow, the mining majors are increasingly maxed out on their high grade deposits — more than 55% of global uranium production comes from just 10 mines with the majority of those outside Canada operating at average ore grades of approx 0.10% — which means attention is turning to the junior miners.

Uranium demand rising

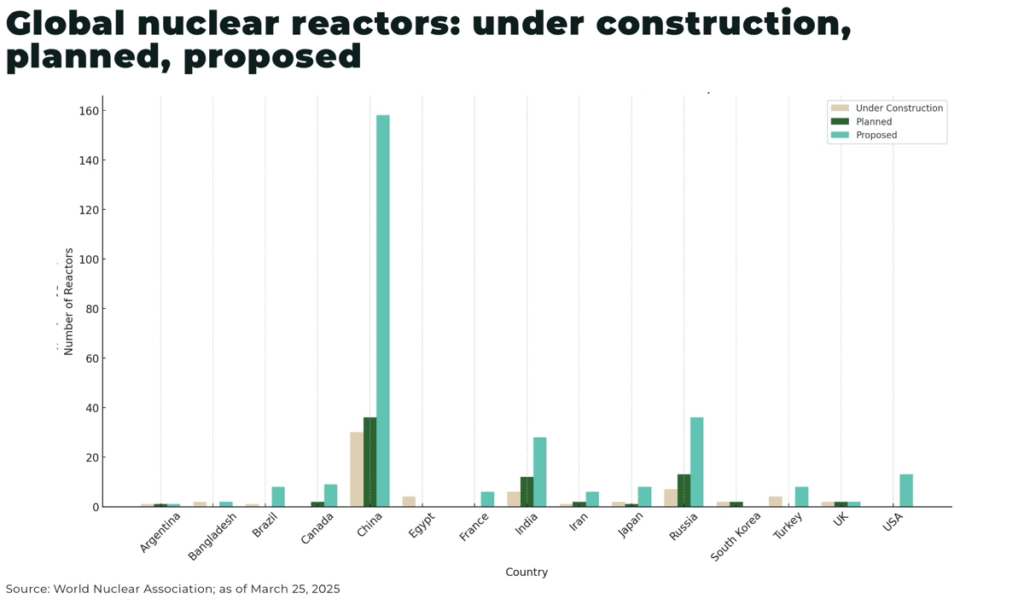

New nuclear reactor builds across China and reactor life extensions (and fleet expansions) across the West mean robust demand growth is expected for the fuel to power this new nuclear renaissance — uranium.

This demand is driven by a need for:

- clean energy to meet net-zero goals

- the US, France, and others have moved to extend the lifespans of existing reactors beyond 60–80 years of operation, reversing prior phase-out plans in order to maintain reliable baseload power

- energy demands from data centers running Artificial Intelligence by the major tech giants

- potentially secure energy source, not reliant on vulnerable supply chains (similar to fossil fuels)

For example, Amazon Web Services (AWS) bought a 960MW data centre powered by a a nuclear power plant in Pennsylvania for US$650 million in March 2024; Apple (finally) included nuclear power in their definition of clean energy this year; Google’s CEO, Sundar Pichai, has said the company is looking at additional investments in nuclear to generate the electricity needed for AI; etc.

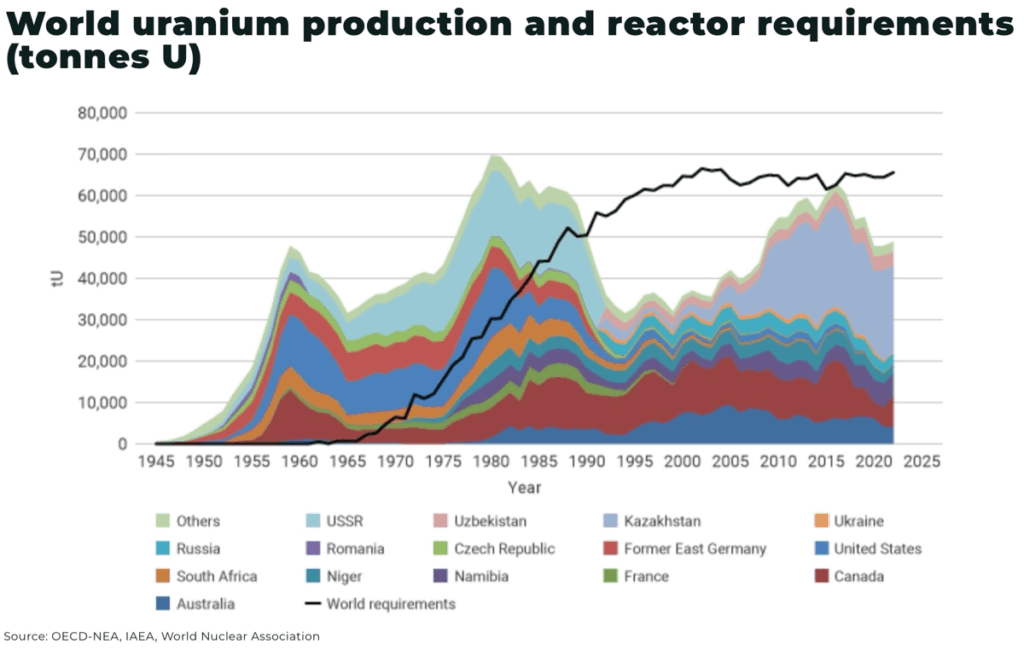

Reordering global uranium supply

The war in Ukraine and the disruption of the Covid pandemic on supply chains has accelerated Western efforts to secure sources of uranium.

In particular, Kazatomprom – the world’s largest producer of uranium – will likely send the majority of its production to China going forward.

But geopolitical challenges are reordering supply:

- US sanctions on Russia have banned the import of certain uranium products

- French nuclear fuel firm Orano announced it is halting its uranium production in Niger, citing a “highly deteriorated” situation and its inability to operate

- attempts to revive uranium mining in Australia continue to hit obstacles with state-level bans and protests

- and, in Namibia, a rising player in the uranium space, the government is making overtures to Chinese investment

However, bringing new production online is a slow process, and current mine output is insufficient to meet reactor requirements, resulting in an ongoing structural deficit.

This has brought put the spotlight on North America, as we highlighted in our analysis: “Fortress North America, a uranium alliance” — in particular, Canada’s Athabasca Basin, which holds the highest grade uranium deposits in the world not entangled in the geopolitical crossfire.

Why junior miners

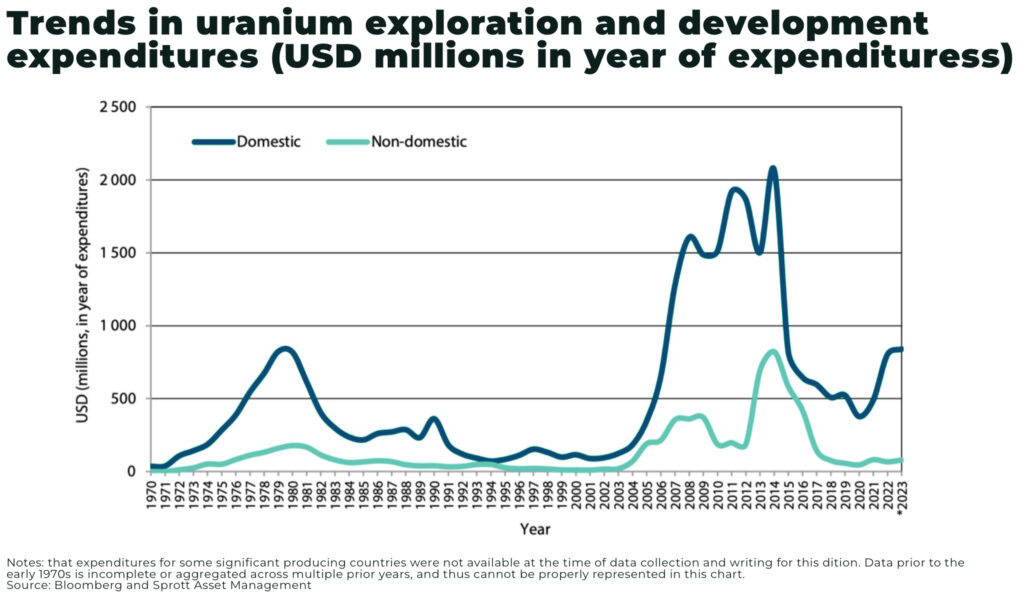

The Sprott Junior Uranium Miners ETF (URNJ) had a total net asset value of US$243 million (as of May 14, 2025) — and, while volatility remains, some high-grade discoveries attracting attention and capital reminiscent of the mid-2000s uranium bull market.

Total exploration and mine development expenditures for 2021-2023 totalled more than US$2.1 billion, with expenditures across Canada, China, Russia, India, Namibia and Uzbekistan accounting for 90% of the total — and Canada accounting for 34%.

Juniors typically offer greater sensitivity to positive sector sentiment, rising uranium prices and demand growth — with juniors standing to benefit disproportionately from any price rally.

And, for majors, they offer a ready-made, already-discovered choice of assets. And Mergers and Acqusitions (M&A) in the sector is back in focus with some significant recent activity, including:

- Paladin Energy’s US$789 acquisition of Fission Uranium in December 2024

- merger of 92 Energy, ATHA Energy, and Latitude Uranium, resulting in the combined entity with signifcant Athabasca Basin exposure, having a pro-forma cash balance of approx US$73 million

- Cosa Resources Corp agreed to purchase the Titan Uranium Project in the Athabasca Basin from CanAlaska Uranium in 2024

And it’s not just M&A, but also new discoveries and financing, including: the latest, new discovery made by F3 Uranium Corp (TSXV: FUU, OTCQB: FUUFF) with drillhole PLN25-205 which intersected radioactivity over a total of 33.0m including 0.56m of high radioactivity (>10,000 cps) with a peak of 37,700 cps at 398.34m.

The company has also just closed a private placement worth more than US$5 million (CA$7 million).

“We are extremely excited to have successfully intersected high-grade pitchblende mineralization hosted within competent but strongly chloritic and clay altered orthogneisses, in the hanging wall of an unmineralized fault with mineralization starting at a vertical depth of 325 meters from surface. This discovery is particularly exciting as it is within the Clearwater Domain – a geological package predominantly thought to consist of intrusive rocks and historically considered less prospective for uranium mineralization.

The F3 technical team, with 4 uranium discoveries, is confident that this new discovery will result in other mineralizations in this area”

— Sam Hartmann, Vice President Exploration, on the new discovery

“This financing is not just a reflection of the confidence investors have in our high-grade JR Zone discovery; it’s a testament to the growing recognition of the Athabasca Basin’s critical role in the uranium supply chain for the West. With geopolitical tensions escalating and the world’s need for clean nuclear energy, the demand for secure, high-quality uranium assets is more important than ever.

The funds raised will allow us to advance our exploration efforts and strengthen our position in a region that has long been recognized for its rich uranium deposits, positioning us to help meet the rising demand from utilities and address the looming supply gap in the global market”

— Dev Randhawa, CEO of F3 Uranium Corp, on the company’s recent $7 million bought deal private placement

Conclusion

Junior uranium miners are back in the spotlight for good reason. They offer:

- exposure to a commodity facing long-term structural undersupply

- leverage to exploration and development success

- strategic value in a bifurcated geopolitical environment

Investors are taking notice. So are utilities, funds, and majors.

The uranium bull market is no longer theoretical — and juniors are once again the sector’s most compelling story.