Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

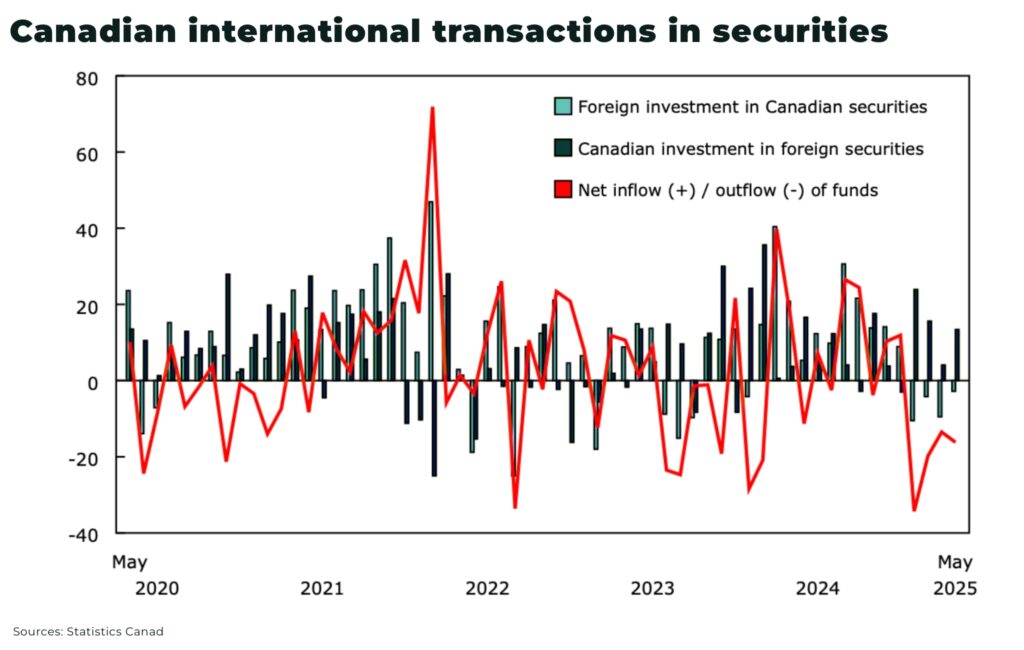

Domestic investors withdrew a net US$12.1 billion from Canadian securities in May, latest data from Statistics Canada reveal — the fourth consecutive month of outflows, bringing cumulative net capital flight to US$62.6 billion from February through May. The sustained withdrawal signals a broader trend beyond market noise.

Domestic investors funneled US$8.5 billion into US equities in May, the largest inflow since February.

The exodus wasn’t limited to local investors. Foreign investors sold off US$2.1 billion in Canadian securities, including US$8.5 billion worth of TSX-listed stocks. Meanwhile, Canadian investors ramped up buying of US equities, adding US$10.6 billion in May alone, the highest since February.

What this means for the mining sector

1. higher cost of capital

- with capital draining from Canadian markets, mining companies—especially junior explorers—will face higher borrowing costs and reduced access to equity markets

- many rely on TSX and TSXV listings to raise exploration and development funding. Less domestic investment means greater dependence on U.S. or international capital

2. investment shift toward US assets

- the flight to U.S. equities suggests investors view U.S. mining or energy firms as more stable or profitable—a competitive threat to Canadian miners

3. currency volatility and hedging pressure

- depreciation raises FX risk. Mining companies exposed to USD-denominated sales must ramp up hedging strategies, raising operational costs

4. foreign capital becoming scarce

- the withdrawal of foreign institutional money from Canadian stocks — including the TSX — means less capital for mining IPOs or project funding. Canadian miners, especially junior explorers reliant on overseas investment, may find the funding landscape more challenging

5. long-term implications for critical minerals

- as mining companies increasingly target critical minerals (for EVs, renewables), securing stable, low-cost financing becomes even more vital. Persistent capital flight could jeopardize Canada’s ambitions in this sector

- governments may respond with tax incentives or sovereign financing mechanisms to offset market tightening — shaping policy around critical minerals

Outlook: a sector under pressure

- Capital scarcity may force mining firms to raise prices on produce or curtail expansion

- Financing costs and FX volatility will require stronger risk management and may dampen profitability

- The shift to U.S. investment highlights a perception gap—Canadian miners need to demonstrate stronger governance and stability to attract capital

Conclusion

Capital flight isn’t just about dollars moving, it’s about confidence. Access to capital, crucial for the development of critical mineral projects, is tightening. The risk: Canada’s mining competitiveness could wane just as the global energy transition ramps up — unless government support and sector confidence can stabilize investor sentiment.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.