A new report from BloombergNEF states the total value of carbon credits produced and sold to help companies and individuals meet their de-carbonization goals could approach $1 trillion as soon as 2037.

“Doubts over credit quality and climate impact gave investors pause in 2022, but long-term demand could still drive massive growth”

— BloombergNEF

This is similar to an argument (listen to our latest podcast, The road ahead for Carbon Credits) we have made on The Oregon Group to investors: stay focused on high quality carbon credits.

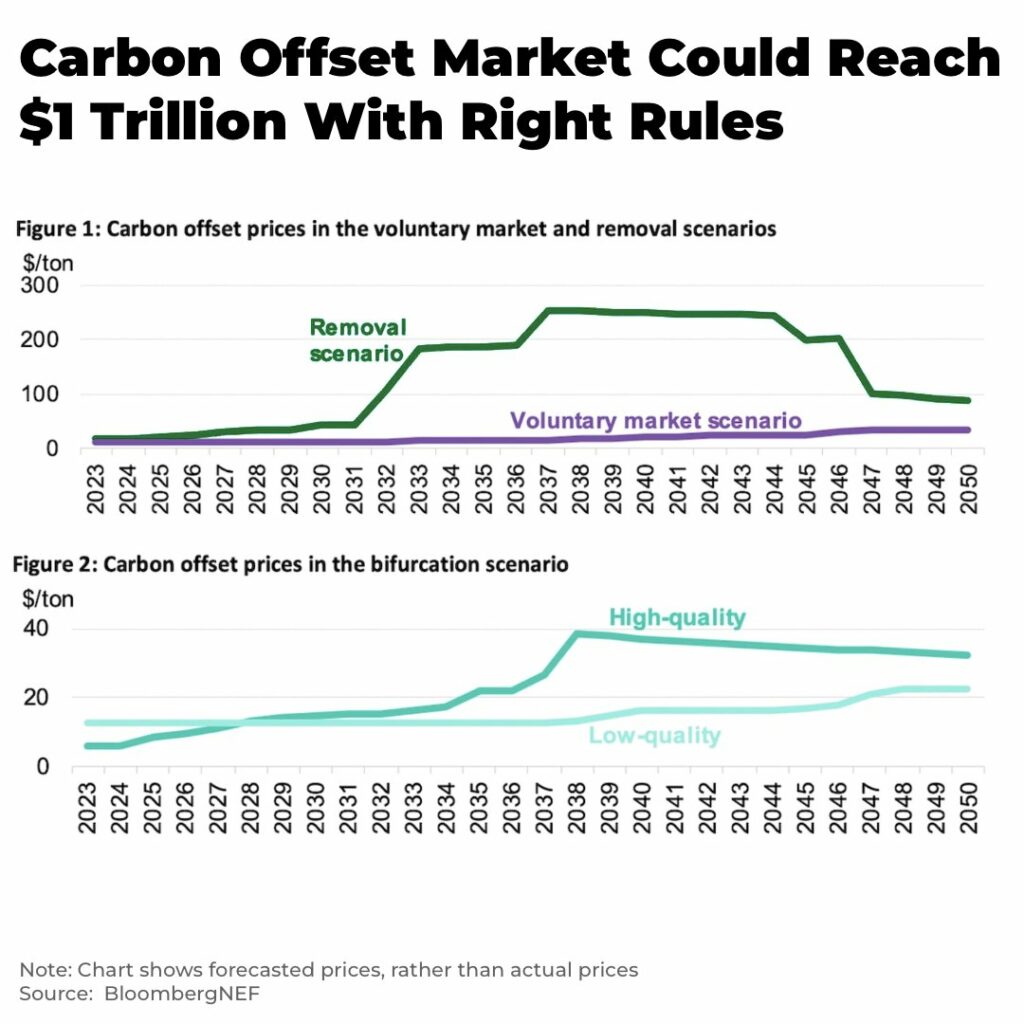

Looking to 2050, BNEF modeled supply, demand and prices for carbon offsets under three potential scenarios.

- in the voluntary market scenario, companies could purchase any type of carbon offset to achieve their net-zero goals and would need 5.4 billion offsets annually in 2050. The market would be valued at $15 billion annually in 2030 in this scenario – up from estimates of $2 billion today

- under the removal scenario, the supply-demand balance would be much tighter as only offsets from projects that actually removed carbon from the atmosphere would be allowed to count. Carbon offset prices would soar above $250/ton with the annual market reaching nearly $1 trillion

- the third bifurcation scenario assumes the debate effectively splits the market into two pieces. One is a smaller, less liquid market for high-quality offsets, including technology-based removal and nature-based solutions in Africa, North America and Oceania. Prices peak at $38/ton in 2039 before dropping to $32/ton in 2050

For interested investors, read our introduction to the Voluntary Carbon Credit Markets.