The US Treasury has announced that any electric battery manufactured in the US that includes components or critical minerals extracted or processed from China, or other foreign entity of concern (FEOC), will not be eligible for a US$7,500 credit from the Inflation Reduction Act.

The restrictions for battery components begin in 2024, and for critical minerals extracted, processed or recycled by a FEOC, start in 2025.

“To strengthen the security of America’s supply chains, beginning in 2024, an eligible clean vehicle may not contain any battery components that are manufactured or assembled by a FEOC, and, beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC”

— US Treasury, Treasury Releases Proposed Guidance to Continue U.S. Manufacturing Boom in Batteries and Clean Vehicles, Strengthen Energy Security

Compliance for the sourcing of critical minerals will be reviewed at all phases of extraction, processing and recycling. So, for example, a mineral extracted in Australia but processed in China would not be compliant.

“President Biden entered office determined to reverse the decades-long trend of letting jobs and factories go overseas to China”

— John Podesta, Senior Advisor to the President for Clean Energy Innovation and Implementation

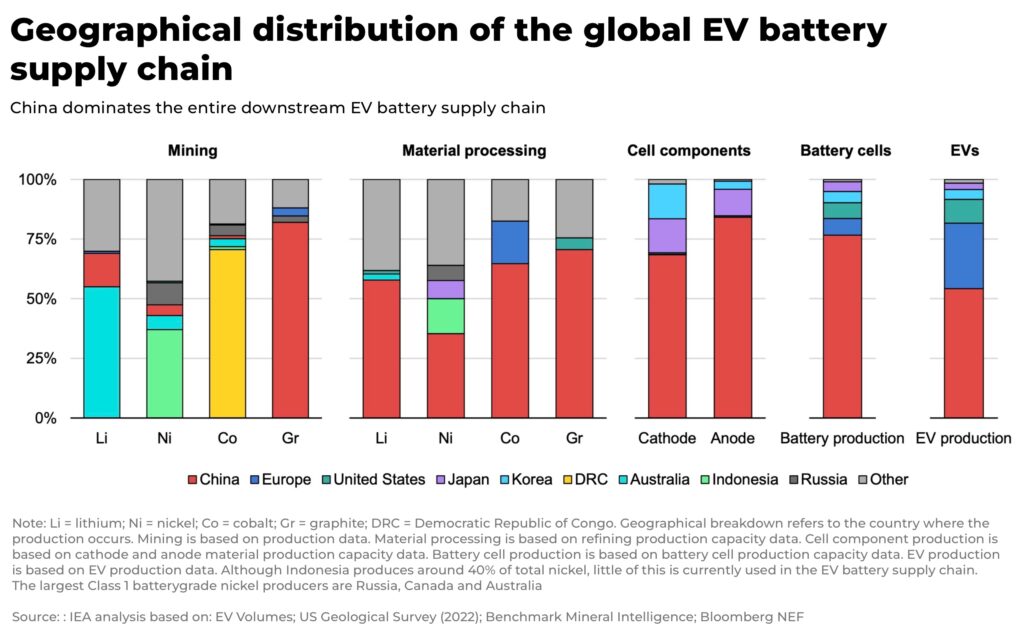

The challenge is China’s dominance over the critical mineral supply chain.

The US Treasury will exempt some trace critical minerals for two years, “given that there is commingling in the critical mineral supply chains and suppliers may not be able to physically track certain specific masses of minerals to specific battery cells or batteries.”

It’s a move mostly welcomed by the Alliance for Automotive Innovation, who warn:

“The EV transition requires nothing short of a complete transformation of the US industrial base. It’s a monumental task that won’t happen overnight”

— Alliance for Automotive Innovation, Foreign Entity of Concern: Finally… Some Clarity

And the timeframe for the restrictions is not immediate, but ratchets up each year.

To meet the battery component requirement and be eligible for a $3,750 credit, the applicable percentage of the value of the battery components must be manufactured or assembled in North America

- for 2023, the applicable percentage is 50%

- for 2024 and 2025, the applicable percentage is 60%

- for 2026, the applicable percentage is 70%

- for 2027, the applicable percentage is 80%

- for 2028, the applicable percentage is 90%

- beginning in 2029, the applicable percentage is 100%

To meet the critical mineral requirement and be eligible for a $3,750 credit, the applicable percentage of the value of the critical minerals contained in the battery must be extracted or processed in the United States or a country with which the United States has a free trade agreement or be recycled in North America—as mandated by the Inflation Reduction Act.

- for 2023, the applicable percentage is 40%

- for 2024, the applicable percentage is 50%

- for 2025, the applicable percentage is 60%

- for 2026, the applicable percentage is 70%

- beginning in 2027, the applicable percentage is 80%

However, there is also considerable criticism of the plan. In particular, West Virginia Democratic senator Joe Manchin, who was pivotal to the IRA’s confirmation, has warns the proposals will increase US reliance on China:

“The proposed Treasury rules on Foreign Entities of Concern are another example of the Biden administration clearly breaking the law to try to implement a bill that it could not pass. The Inflation Reduction Act clearly states that consumer vehicles are ineligible for tax credits if “any of the applicable critical minerals contained in the battery” come from China or other foreign adversaries after 2024. But this administration is, yet again, trying to find workarounds and delays that leave the door wide open for China to benefit off the backs of American taxpayers”

— Senator Joe Manchin (D-WV), Chairman of the U.S. Senate Energy and Natural Resources Committee

This will introduce significant pressure to questions over countries like Indonesia who produce 37% of global nickel supply, forecast to increase to two-fifths of global supply by 2030; as well as the second largest cobalt supplier in the world, forecast to increase more than x10 by 2030. Our latest analysis: