Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Simon Catt is a director of Arlington Group Asset Management Limited. He has over three decades of investment banking and capital markets experience between Canada, the UK and Australia.

The Margin Call of a lifetime

In March 2009 I was walking with my young children in the Surrey countryside, an hour south of London, when my broker called to tell me I had a margin call approximately equal to my net worth. After a year of crisis, I was used to margin calls – but not to wondering how I would pay for dinner.

I put the phone back in my pocket, feeling dazed and strangely liberated.

Less than an hour later, the phone rang again. This time it was the local optometrist, asking if I wanted to buy his house. I was recently divorced and needed somewhere to live.

Wall Street’s year of pain—triggered by the Bear Stearns and then Lehman Brothers bankruptcies in 2008—had by March 2009 infected the psyche of Main Street. High street banks, the ones that held our savings, were exploding daily like fireworks on Guy Fawkes Night.

With nothing to lose, I agreed to buy the optometrist’s house, wondering where I might find the deposit or a mortgage—especially if I didn’t have a job.

While I was still gainfully employed by GMP Securities, in 2009 stockbrokers had the job security of a window washer at a traffic light

Belt-tightening

Four months into Trump’s forty-eight-month tenure, the President has made it clear he believes Americans need to wean themselves off foreign goods—and the loans to pay for them.

Will they be prepared to tighten their belts?

Tariffs and uncertainty are pushing the U.S. economy into recession. A shrinking economy and potential tax cuts imply greater—not smaller—deficits.

Dollar debasement is good for all commodities and currencies

Debasement of the U.S. dollar has sparked significant rallies in 2025: gold +25%, euro +11%, copper +15%, and silver +10%.

Other commodities and currencies are about to join the party. It’s simple math.

Commodities and currencies are priced in U.S. dollars—e.g., 1 euro = $1.14, 1 barrel of oil = $58, or 1 ounce of gold = $3,250. If the denominator (the dollar) weakens, the numerator (everything priced in dollars) strengthens.

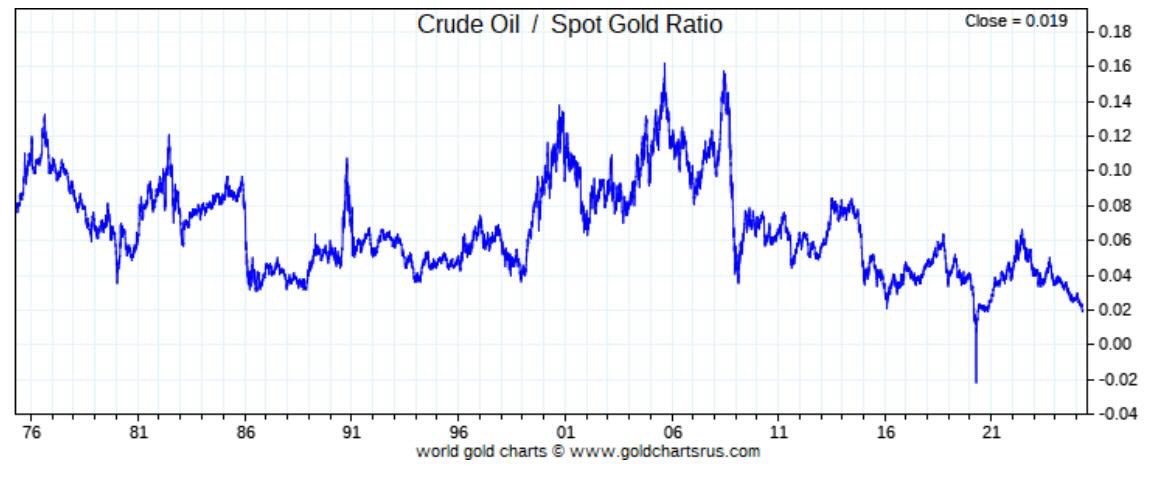

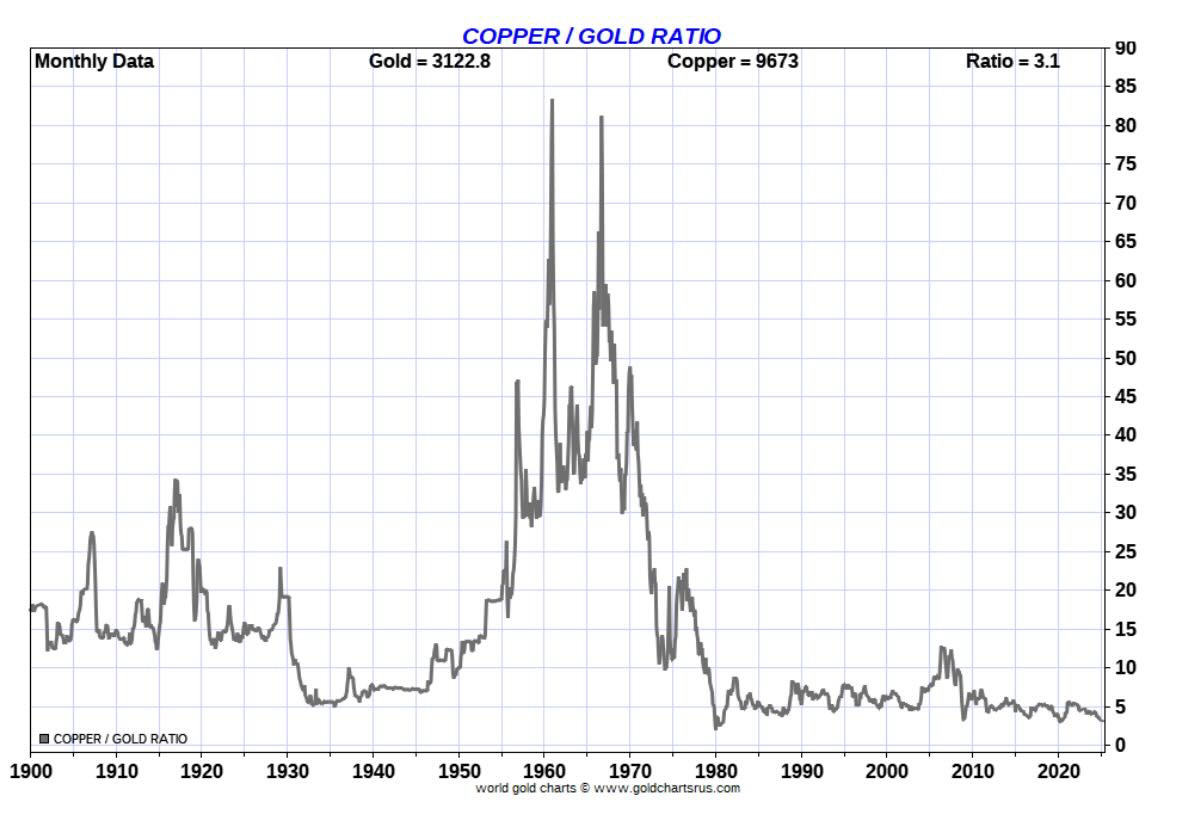

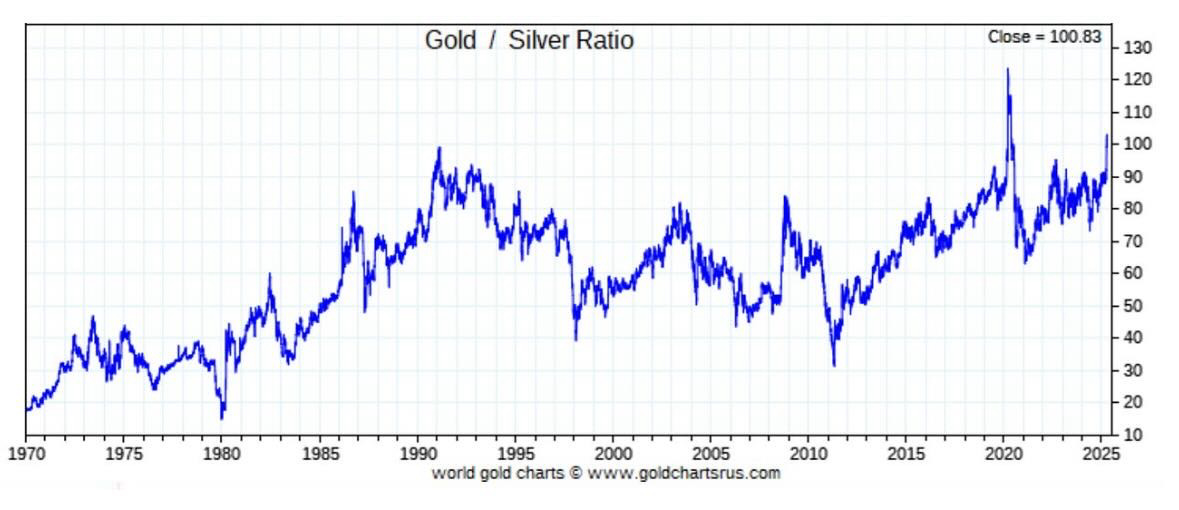

Gold, the strongest currency and commodity, has led this rally and is now at record highs against oil, copper, and silver.

Gold vs oil

Gold vs copper

Gold vs silver

As the dollar bear market accelerates in 2025, weaker currencies and commodities will follow gold, the euro, silver, and others—rallying against the dollar.

Slower growth and growing deficits = a weaker dollar and a stronger commodity complex.

TACO Trump

Trump’s “America First Investment Policy,” which alienates foreign owners of U.S. assets, is on a 2025 collision course with record deficits and the U.S. Treasury’s funding needs.

The fact that markets have recovered to their “Liberation Day” highs on April 2nd suggests investors believe “Trump Always Chickens Out” (TACO). Equities and bonds are pricing in a tariff U-turn.

But if Trump miscalculates and plunges the U.S. into recession, he’ll face voters at the midterms in November 2026. What could go wrong when the leader of the free world is posting fake images of himself as The Pope online!!??

Xi the Lifer

President Xi Jinping doesn’t worry about elections—he’s leader for life. China has a much higher tolerance for financial pain and no external net debt.

U.S. voters own stocks and bonds.

Chinese citizens own gold and cash.

High-stakes poker

Trump is bluffing with a pair of twos in this poker game against China. America’s economy IS its stock market. Where stocks go, so goes the economy.

Trump has given the world 90 days from April 5th to cut a trade deal—or else. Walmart, Amazon, and McDonald’s have all warned that Americans are reacting to higher prices and uncertainty by buying less.

Investors and businesses are currently assuming Trump will back down. The U.S. can’t afford these tariffs. But what if he doesn’t? Or worse, what if China won’t let him? Xi holds all the cards.

As I previously discussed, on the blog, silver is gold on steroids.

Our favourite silver eggs, Discovery Silver, Mithril Silver & Gold and Polymetals Resources have begun to rerate.

It’s not too late to buy these silver eggs. The real fireworks for the silver price are just beginning. I’m long the September 2025 $40 and $45 SLV ETF call options, Discovery, Mithril and Polymetals shares.

The Trump 2025 financial crisis

History will show that Trump’s 2025 tariffs like the Smoot-Hawley tariffs of 1930 accelerated but did not cause their respective crisis. The root cause of the Trump 2025, the Global Financial Crisis in 2009 and the Great Depression in 1930 is the same: too much debt.

Ballooning U.S. deficits and a lack of foreign buyers for U.S. Treasuries will force the Federal Reserve back into quantitative easing in 2025.

The US dollar will then do a Wile E. Coyote off a cliff and all commodities and currencies priced in dollars will benefit.

The Trump 2025 crisis is not some abstract future event but occurring now in real time on your smart phone.

To answer the question – “Is silver David to gold’s Goliath?” – we’ve assembled three superheroes of the Silververse: Eric Sprott, Phil Baker, and Michael Oliver for our Silver Slingshot live Zoom webinar on May 8th at 16:00 UK / 11:00 ET.

Reserve your spot and submit your silver questions here:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.