Gold is the new gold. Real assets will be king again and people will care about commodities. Everything else is just Sydney Sweeney bathwater soap.

Have you been on Tik-Tok lately? My video range includes skiing shots out of South America to the new Sydney Sweeney soap memes, with my algorithm probably making some guy in the bat cave in China laugh — but, I digress.

The world is a mess. Between a holy war in the Middle East, a war over two versions of history in Europe, and a potential war over an island off the coast of China, basically every commodity has the potential to be exciting. The US President is talking rare earths in his Truth Socials. Money is already being made in our space. It’s time to be long and strong!

But let’s start off with the obvious.

Gold is a store of value with thousands of years of history. The others? A speculative fantasy that smells nice for a moment, makes you feel special, and then goes down the drain.

I was talking to a friend at a Bay Area fund a few weeks ago. We covered deep sea mining, Tesla, crypto, and the observation that today’s market isn’t about fundamentals. It’s about faith. Many stocks and tokens now trade like religions, not businesses or real assets. The story is king… everything else is just a detail. This too shall pass.

Meme coins print millionaires overnight. Anything tied to a Trump or a tweet surges. Tesla remains less a car company than a secular religion. People are making money in non real assets, yes.

BUT, it’s not unlike buying that limited-edition soap infused with Sydney Sweeney’s bathwater — intoxicating, absurd, maybe even collectible. And eventually the bubbles pop, the water turns cold, and you’re left shivering, wondering where your money went.

All things come full circle…we are entering a “Golden Era”…gold is the new gold and real assets matter. Fortunes will be made.

A brief trip down memory lane on how we got here.

Gold is on a tear – $4,000 or even $5,000 per ounce gold no longer seems like a fever dream…to understand where the gold market is today and why it shows no sign of slowing you have to first understand that the foundation for the current market began twenty years ago.

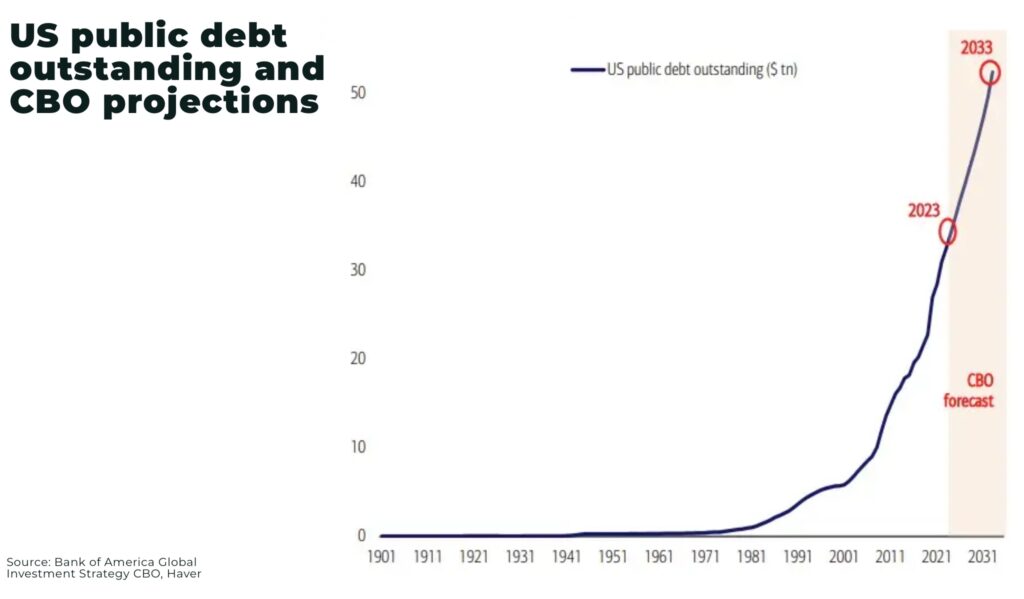

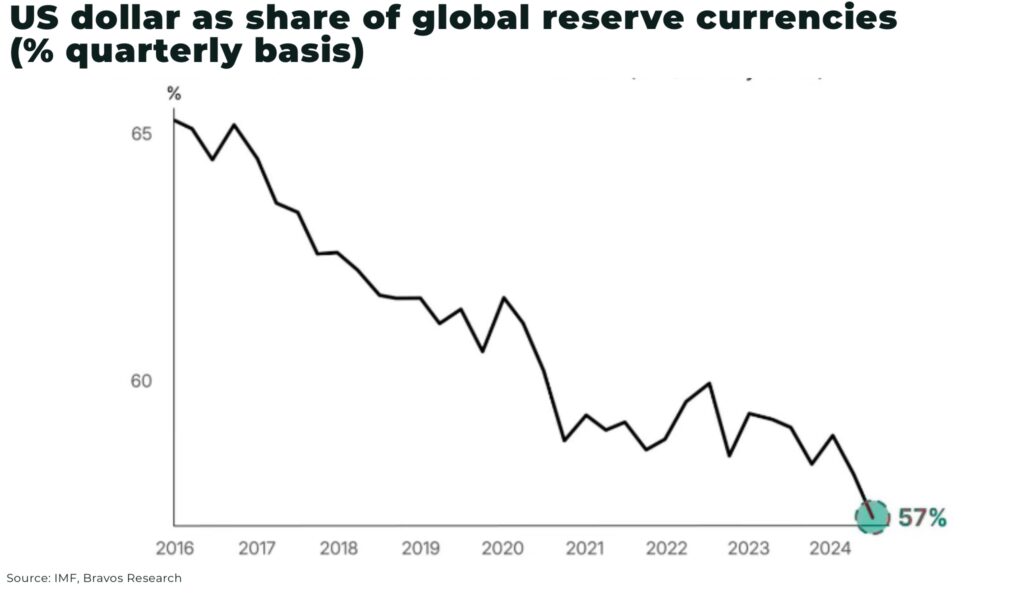

The U.S. dollar began to be “weaponized” — aka used as a tool in US foreign policy — in a significant and systematic way in the early 2000s:

Key Milestones in Dollar Weaponization

- 2005–2010: The U.S. began sanctioning foreign banks (like Banco Delta Asia in North Korea’s case), using access to the U.S. financial system as a coercive tool.

- 2012 – Iran Sanctions: The U.S. cut Iran off from the SWIFT network and threatened foreign banks with losing U.S. access if they dealt with Iran — a major inflection point in dollar weaponization.

- 2014 – Russia Sanctions: After the annexation of Crimea, the U.S. escalated financial warfare by restricting Russian banks and oligarchs from dollar funding and capital markets.

- 2022 – Russia & SWIFT: In response to the Ukraine invasion, the U.S. and allies removed major Russian banks from SWIFT and froze hundreds of billions of Russia’s central bank reserves — possibly the clearest and most extreme example of dollar weaponization to date.

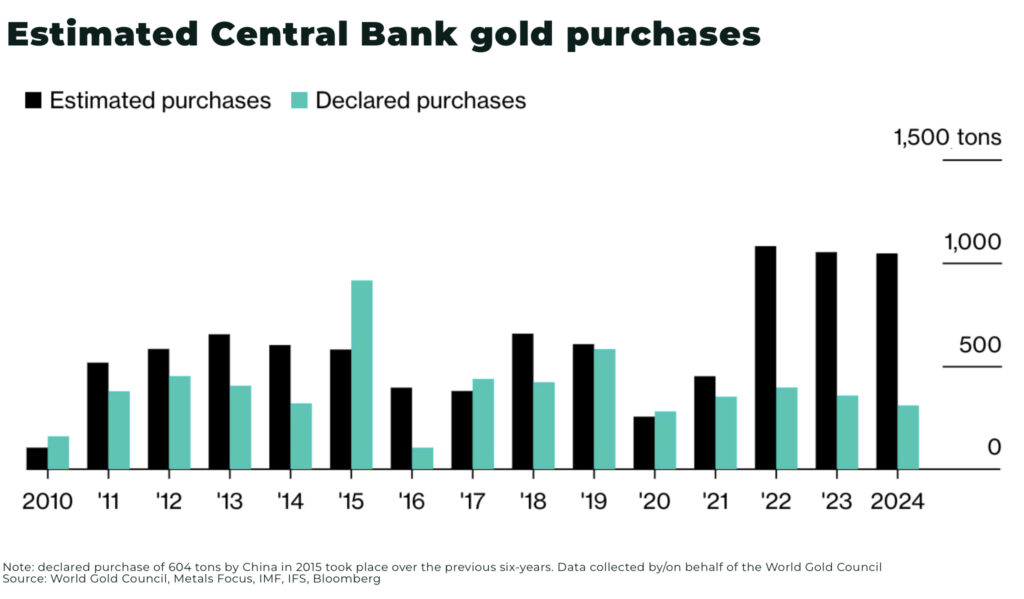

In addition to the weaponization of the dollar and in part in the wake of COVID spending you had an explosion of US debt. Central banks took notice and, in haste, started to buy gold in a way that we have not seen in generations.

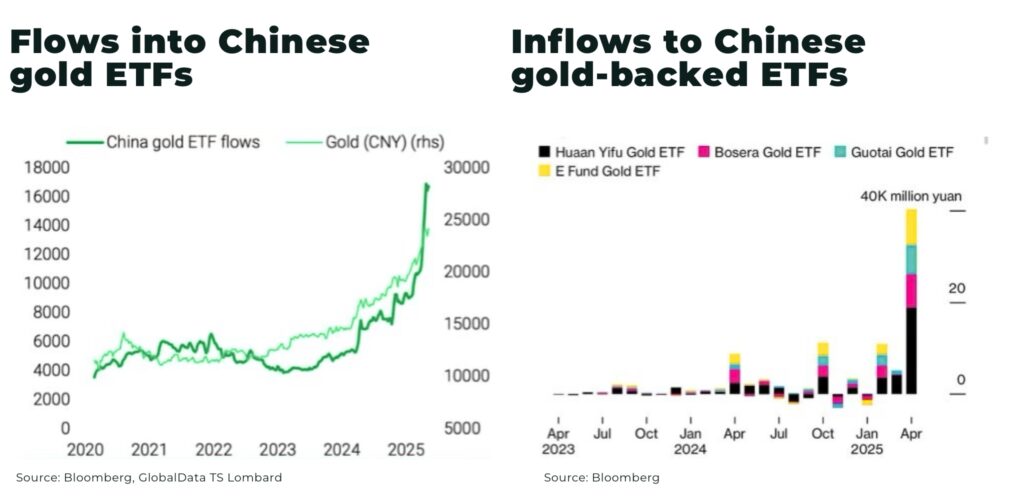

The move in gold price up to this point was largely driven by central bank buying, the decline of the US dollar and even some Chinese retail. It’s the reason investors took so long to join in. In a more typical gold cycle you have retail investors buying physical gold, who then, in turn, buy equities creating huge moves in the market. In this cycle, we had central banks kick off the physical gold buying and now investors are playing catch up.

We are a long way from the top of the gold equities market.

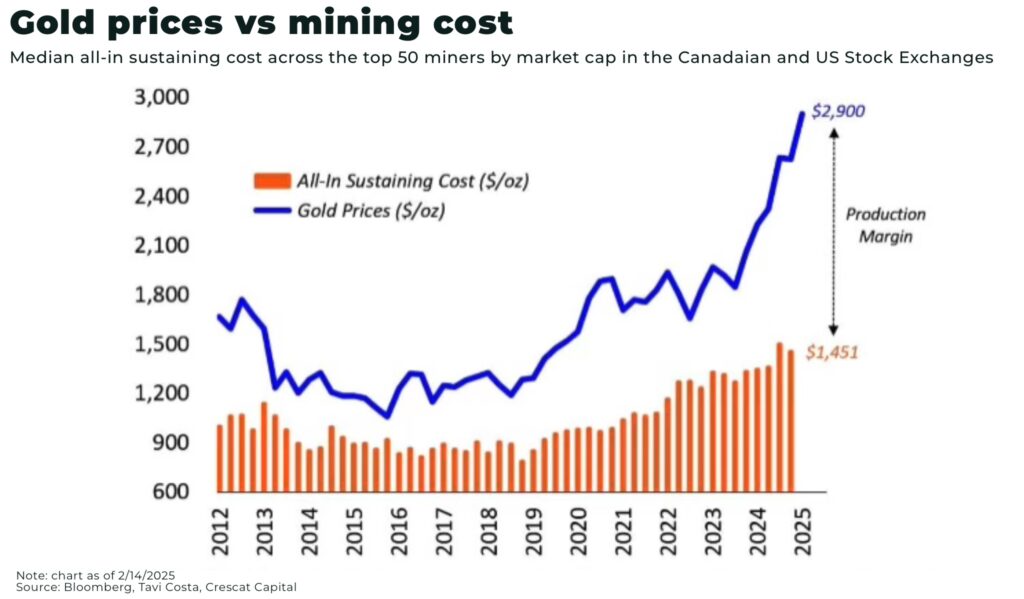

Producers that maintain some semblance of cost control will generate huge amounts of cash and go higher. Mid-tier developers will be acquired. Multi million ounce camps have already started raising huge sums of money and will advance their projects.

Recall that much of the industry still has PEAs and other studies done at $1800 per ounce gold. What is the IRR at $3000, $4000, or even $5000 gold?!??

The gold price opens up my favorite type of gold play: the large high grade deposits in difficult places. Some of these assets still have tiny market cap and weak management teams. These are the gems that can go from a 10 m market cap to 150 m in months after lift off.

We remain a longways from the top of the equities market. I have yet to see company presentations searching for lost ships full of gold or, my personal favorite, the companies looking for lost Inca treasure.

For now I continue to own the GDXJ and names like Skeena Resources. But I am getting really excited about my bread and butter – out of the money option plays!

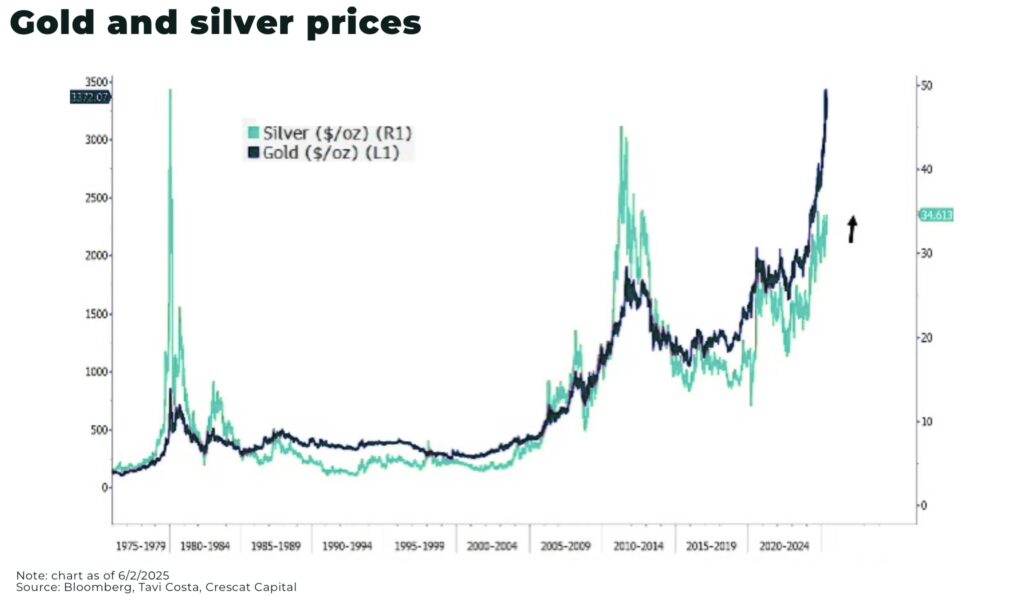

The silver and gold ratio has yet to converge – leaving open an exciting opportunity for silver equites to rerate

Tariffs, war, and the threat of war take critical minerals to all time highs

In recent days the world has been captivated by surreal images of party goers having dinner while watching missiles fly towards Israel.

No matter what side of global conflict you are on, the munitions, computers, and power that make modern warfare possible use critical materials. Yet, I have watched, with some surprise, as the war in Ukraine has continues on, tariffs have ebbed and flowed, and now a war in the Middle East — and equities with exposure to commodities such as antimony, tungsten, and others have not out performed the market.

I am not sure what to make of this.

We’ve previously examined flaws in the current capital markets, but I’m still surprised how little equities have responded, despite a strong rally in the physical market for these minor metals. Many of the minor metals are at or near all time highs and have a highly restricted supply side.

I have to think that these “war metal” names get a bid soon.

The EV story is so last cycle – long live energy (basically the same same – but different)

Politics being what it is has killed the EV market narrative. I am not seeing a bunch of bouncy lithium stories, nickel is on life support, and all presentations don’t end in getting a Tesla off take.

But…like all these things…the EV story was really only part of the story. The really story is the energy transition that is well underway. Pressure continues to build in the copper supply chain as we have gone a generation without investment. Nuclear now has the support of the left and the right. Data center energy demand is expected to increase 15% a year. Coal hasn’t gone away.

We are looking at one of the most exciting times to be investing in commodities since the Chinese investment driven super cycle. We have a variety of different demand side factors driving different commodities and we have more than a decade of underinvestment.

Historically a gold bull market has made investors money and helped to spark interest in other commodities. That looks to be the case again.