Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The Quad — comprising the US, Australia, India, and Japan — has formally launched a new Critical Minerals Partnership, aimed at securing supply chains for rare earths, lithium, graphite, and other strategic inputs vital to clean energy and defense sectors.

The deal was announced following a foreign ministers’ meeting in Washington on July 1. While the statement avoided naming China, the context was unmistakable: the initiative is a direct response to China’s growing weaponization of its mineral dominance.

“Reliance on any one country for processing and refining critical minerals and derivative goods production exposes our industries to economic coercion, price manipulation, and supply chain disruptions, which further harms our economic and national security” — Joint Statement from the Quad Foreign Ministers’ Meeting in Washington

In brief remarks alongside the other ministers, Rubio said he has “personally been very focused” on diversifying supply chains and wanted “real progress”.

Marco Rubio said the plans would allow “not just access to the raw material but also access to the ability to process and refine it to usable material.”

“It’s critical for all technologies and for all industries across the board… So having a diverse and reliable global supply chain of these is just one example of many that we can focus on and build upon and achieve some real progress on.”

The initiative will focus on joint investment, shared processing capacity, data sharing, and coordination on export controls — an echo of the EU-US Minerals Security Partnership, but with stronger security overtones.

Earlier this year China announced export restrictions on a number of critical minerals, in particular, rare earths, to the US.

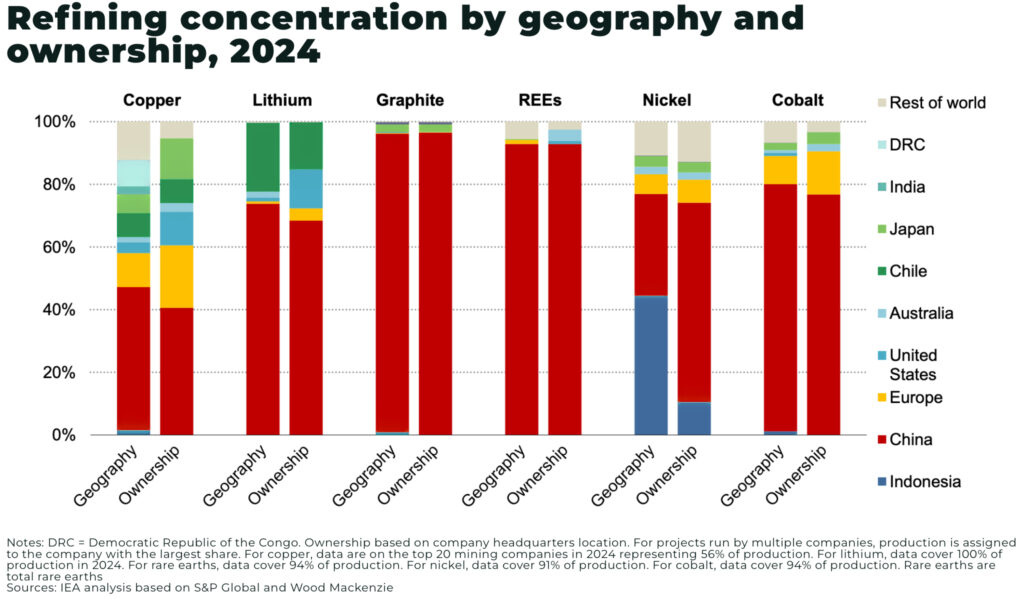

According to the IEA, China controls over 80% of global rare earth refining and 70–80% of key battery inputs, including graphite and manganese sulphate. That dominance is set to increase by 2035 unless rival supply chains are scaled quickly.

The new Quad initiative mirrors this urgency. It will target co-investment in “high-integrity” projects and environmental standards across Indo-Pacific producers, particularly in Australia and India. Japan is expected to provide financing; the U.S. will support with political and commercial backing via DFC and EXIM Bank.

But tensions flared on the sidelines. As reported by Reuters, Indian and Japanese officials raised concerns over recent U.S. protectionist moves, including potential tariffs on key imports. Frictions are building around how “friendshoring” is defined—and whether Washington sees partners as equals or subcontractors.

Still, the Quad’s critical minerals announcement marks a shift from declarations to implementation. It’s an acknowledgment that industrial policy and geopolitical alignment are now inseparable in the race for energy transition materials.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.