Simon Marcotte has more than 25 years of experience in the mining and finance sectors, with key roles at companies such as CIBC World Markets, Sprott and Cormark Securities. He has been instrumental in founding and leading multiple successful mining ventures. He is currently the President and Chief Executive Officer of Northern Superior Resources.

https://www.linkedin.com/in/simon-marcotte-macro-mining

Northern Superior also Acquires Further Strategic Assets in the Chibougamau Gold Camp: Hazeur (Philibert’s Western Extension), Monster Lake East, and Monster Lake West

The Chibougamau Gold Camp in Quebec is well on its way to join the ranks of the world’s most sought-after gold districts — Yukon, Guyana, and Finland.

Northern Superior Resources has made the consolidation of the Chibougamau Gold Camp central to its strategy and continues to deliver the right actions at the right time — advancing consolidation efforts just as IAMGOLD is expected to become the driving force in the camp, and delivering meaningful results through expansion drilling and the recent discovery of a high-grade underground zone at Philibert, Northern Superior’s main project in the Camp.

Philibert is making headlines once more.

Located just 9 kilometres from IAMGOLD’s Nelligan project, Philibert is ideally positioned to feed a centralized mill. In fact, the entire camp exhibits clear hub-and-spoke potential, with multiple gold resources situated in close proximity — a rare and valuable setup, and the fundamental reason behind Northern Superior’s strategy to consolidate the key assets of the camp: Philibert, Lac Surprise, Chevrier, Croteau, and now – as discussed below – Hazeur, Monster Lake East and Monster Lake West.

Northern Superior just announced additional results from its 20,000-metre expansion drilling campaign at the Philibert gold property, located just 9 km from IAMGOLD’s Nelligan project.

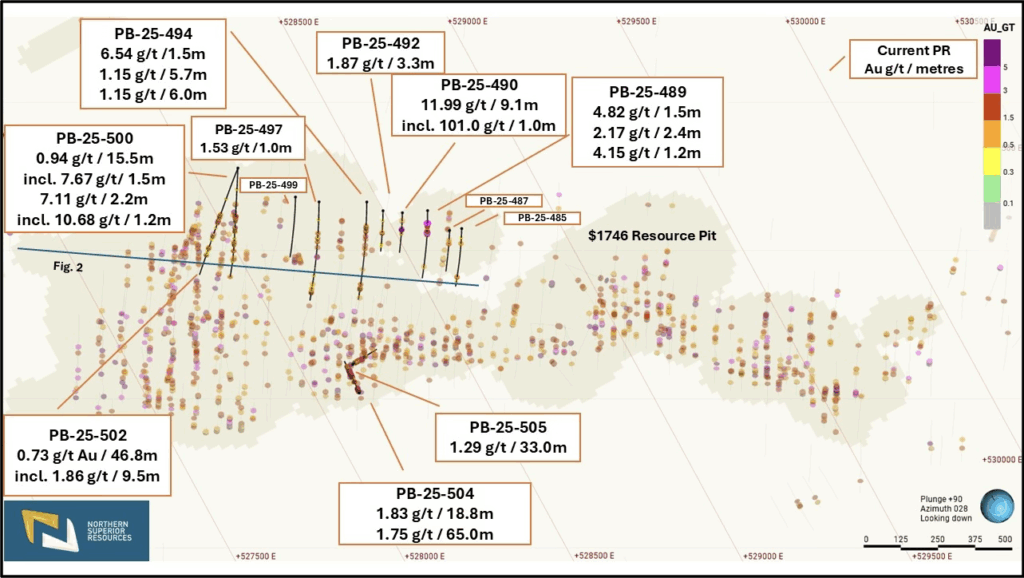

Today’s Highlights Include: (Grades uncut; lengths are measured along the drill hole.)

- PB-25-490: 11.99 g/t Au over 9.1 metres, including 101.0 g/t Au over 1.0 metre, starting at 104.5 metres — Corsac Fox Hanging Wall Zone;

- PB-25-502: 0.73 g/t Au over 46.8 metres, including 1.86 g/t Au over 9.5 metres, starting at 232.7 metres — Corsac Fox Hanging Wall Zone;

- PB-25-504: 1.83 g/t Au over 18.8 metres, including 3.02 g/t Au over 10.6 metres, starting at 6.7 metres, and 1.75 g/t Au over 65.0 metres, including 3.92 g/t Au over 17.4 metres, starting at 94.5 metres — Arctic Fox Footwall Zone drilled parallel and down dip of mineralization; and

- PB-25-505: 1.29 g/t Au over 33.0 metres, including 5.71 g/t Au over 1.7 metres, starting at 9.0 metres — Arctic Fox Footwall Zone drilled parallel and down dip of mineralization.

Those new results, combined with the continued success at the southeast pit, the recent deep high-grade hits, and now this new hanging wall mineralization, all underscore the potential to grow Philibert well beyond the current resource. Moreover, drilling has filled in areas previously interpreted as non-mineralized due to sparse historical drilling.

Only a few weeks ago, Northern Superior announced another set of impressive results: 21.6 metres at 4.82 g/t Au, including 7.0 metres at 11.86 g/t, and 22.2 metres at 2.09 g/t, including 10.0 metres at 3.54 g/t. These results provided further confirmation of a meaningful high-grade underground mineralization developing beneath the current resource. Such potential is not unheard of in the area — IAMGOLD’s Monster Lake deposit, located within the same camp, hosts approximately 500,000 ounces at an average grade of 14 g/t Au. As discussed below, Northern Superior recently acquired Monster Lake East and Monster Lake West.

Figure 1

Please see details and disclosure in the Company’s press release dated July 30, 2025.

Acquisition of Further Strategic Assets in the Chibougamau Gold Camp: Hazeur, Monster Lake East, and Monster Lake West

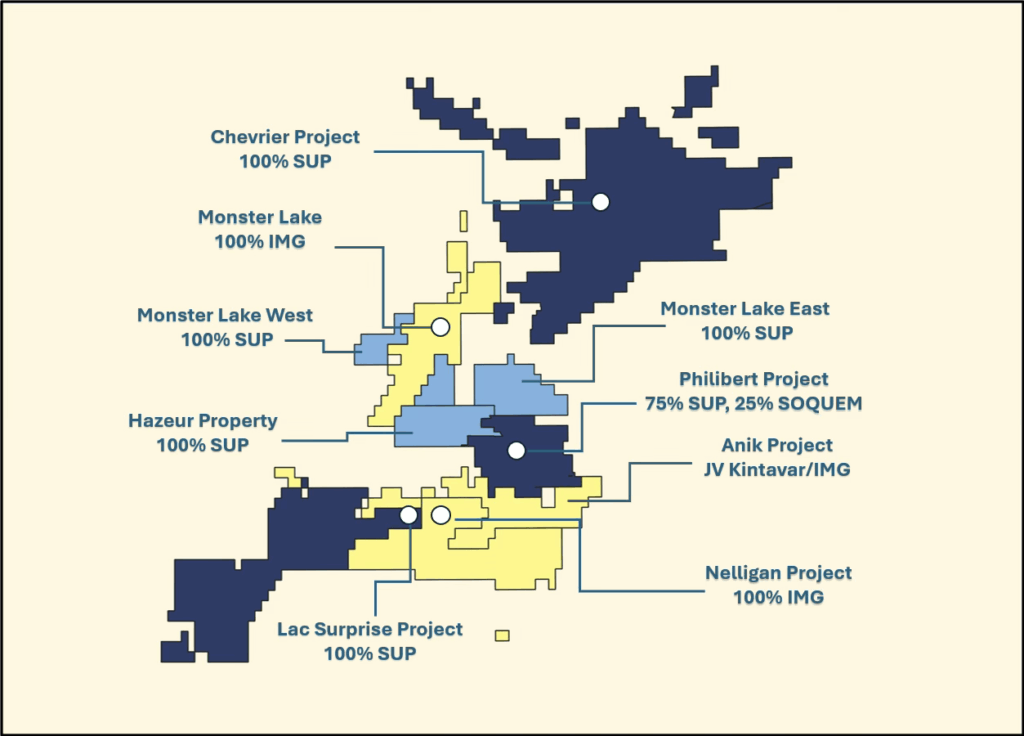

Concurrently with the announcement of a fully-subscribed and now closed Cormark-underwritten equity financing, the Company announced the acquisition of further strategic assets in the Camp: Hazeur, which the Company believes could be the northwest extension of its Philibert deposit, and the Monster Lake East and Monster Lake West properties, located on either side of IAMGOLD’s Monster Lake property (see Figures 2, 3, and 4).

Figure 2: Yellow: IAMGOLD Corporation; Blue: Northern Superior Resources.

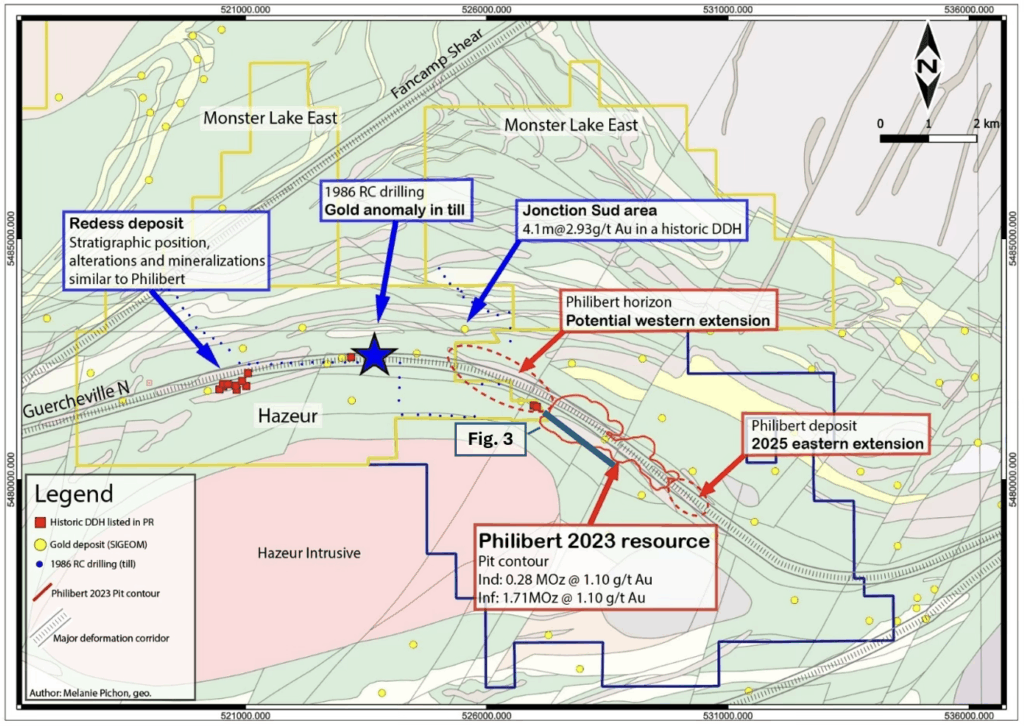

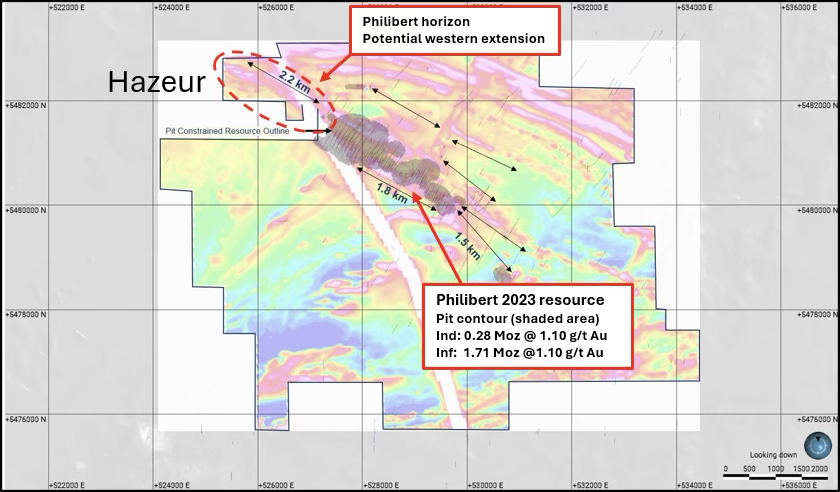

The western limit of the Philibert deposit remains open and results suggest the presence of a high-grade plunge within the gold system, which the Company is actively investigating (see figures 3 and 4).

The acquisition of those properties is a major step forward in unlocking the broader potential of the Chibougamau Gold Camp. Not only do these new properties host known gold mineralization and compelling exploration upside, but they also extend key geological structures directly linked to the Philibert deposit.

In addition to the Hazeur property, the acquisition of the Monster Lake East and West properties gives the Company control over highly prospective ground along the Fancamp trend, adjacent to the Company’s Chevrier Project and IAMGOLD’s Monster Lake Project. This acquisition extends our control to over 15 kilometres along the Guercheville Fault Zone (see Figure 3), where the Philibert deposit remains open in both directions. The Hazeur property shows strong evidence for the continuation of Philibert-style mineralization. Additionally, we now cover more than 30 kilometres along the highly prospective Fancamp Fault Zone and Monster Lake trends.

Western Extension of the Philibert Deposit

Northern Superior sees strong potential to expand the Philibert deposit along strike to the west. Drilling has confirmed that mineralization remains open in this direction. The recent acquisition of the Hazeur property, directly adjoining the northwest boundary of the Philibert Project, strengthens this expansion opportunity. Historical drilling on Hazeur indicates the potential continuation of the Philibert mineralized system which is also supported by airborne geophysics and regional mapping (see Figure 4).

Figure 3

Figure 4

Please see details in the Company’s press release dated July 18, 2025.

The Chibougamau Gold Camp

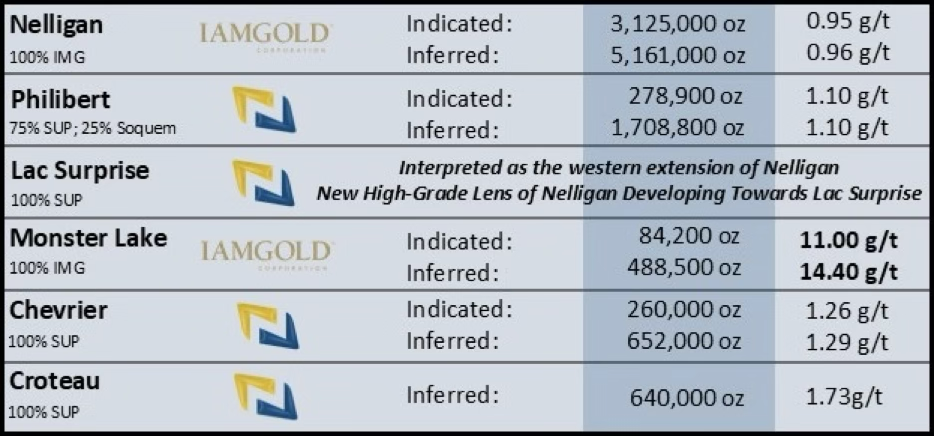

The Chibougamau Gold Camp is rapidly emerging as one of the world’s most sought-after gold destinations with several complementary gold resources reaching viable scale. In recent years, these critical assets were divided amongst five different companies. Today, largely due to Northern Superior’s acquisitions and corporate transactions, ownership has been streamlined, with only IAMGOLD and Northern Superior holding these assets. The proximity of these deposits to each other makes them ideally suited to feed a single mill, and their consolidation enhances their viability, thereby increasing their value.

Below is a table showing the resources of the camp having been formalized to date.

Figure 5: Note: see NI-43-101 information in notes 1, 2, 3, and 4

What’s Next for the Chibougamau Gold Camp?

I firmly believe that the Chibougamau Gold Camp is poised to be the next major gold district to break out on the global stage. In recent years, we’ve seen similar trajectories in the Yukon (both West and Central Yukon), Guyana, and Finland — regions that have captured investor attention and delivered substantial returns in the process, even in the recent dark years of the sector.

When China’s Zijin Mining acquired Guyana Goldfields in 2020, it became the driving force behind the development of the Guyana gold camp. This momentum catalyzed significant value creation for companies like Reunion Gold, which rose from $0.08 in 2020 to $0.72 in 2024 before being acquired by G Mining, and G2 Goldfields, which climbed from $0.40 to over $3.00 in the same period. Similarly, in Finland, Agnico Eagle played a pivotal role in the camp, only to see Rupert Resources surging from $0.80 in 2020 to over $5.00 today, benefiting from the region’s growing recognition and investment.

IAMGOLD is poised to become the driving force behind the Chibougamau Gold Camp. Once its Côté Gold Mine in Ontario is fully de-risked and operating smoothly, the company is expected to redirect its capital, focus, and narrative toward Chibougamau. In that context, what’s good for IAMGOLD is good for Northern Superior — as the strategic alignment and regional synergy between our assets only continue to strengthen.

The Question is: How is IAMGOLD Doing?

IAMGOLD is a company with unbelievable momentum, which is clearly reflected in its share price performance. Investor confidence appears well-founded — CEO Renaud Adams recently purchased $250,000 worth of stock on the open market, a notable vote of confidence. Further reinforcing the value of IAMGOLD’s flagship asset, Franco-Nevada recently paid more than $1 billion for a royalty on the Côté Gold Mine, which followed extensive due diligence. Remarkably, this transaction implies a valuation for the Côté Gold Mine that is well above the valuation implied by IAMGOLD’s share price — not only a powerful indicator of latent value, but also a testament of Franco’s confidence in continued flawless execution. It is only a matter of time before IAMGOLD’s success and transition to its next phase of growth put the spotlights on the Chibougamau Gold Camp.

In preparation for its next phase of growth, IAMGOLD has recently been acquiring private assets in the area. In 2024, IAMGOLD also acquired Vanstar Resources, its joint venture partner on Nelligan.

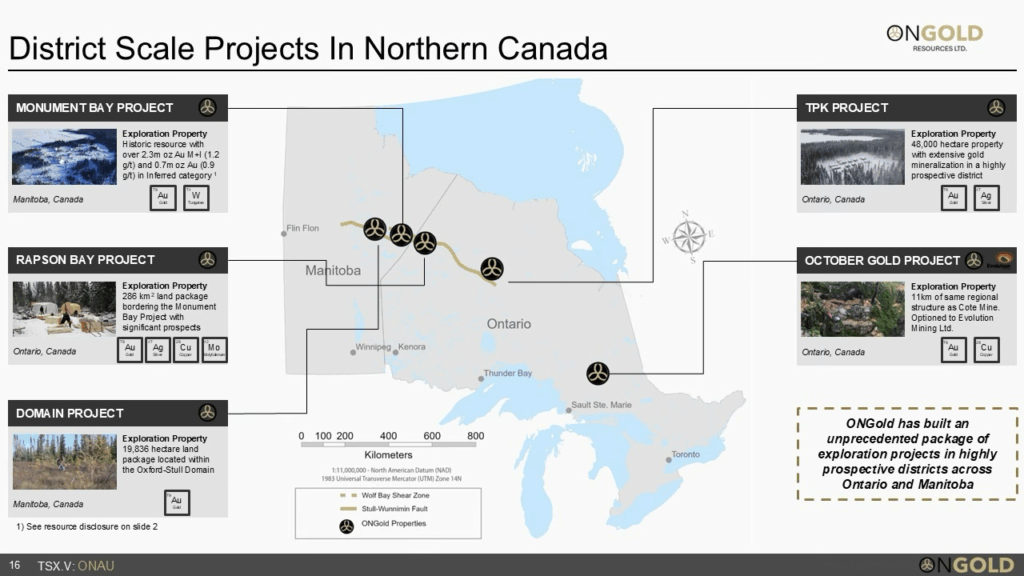

Northern Superior Also Owns 56% of ONGold Resources

Northern Superior wanted to be entirely focused on the Chibougamau Gold Camp. To that effect, the company spun out its Ontario assets to create ONGold Resources, of which it still owns 56%. Agnico Eagle also owns 15% of ONGold Resources. ONGold’s key assets include Monument Bay and the famous TPK Project.

Monument Bay: Yamana Gold initially acquired Mega Precious Metals for Monument Bay, its flagship asset. When Agnico Eagle later acquired Yamana’s Canadian portfolio, Monument Bay appeared to be relegated to the back burner. However, that was short-lived — Agnico subsequently partnered with ONGold Resources, recognizing ONGold’s team as the ideal steward for the asset. Monument Bay has a historic resource estimate of 2,321,840 oz at 1.24 g/t Au in the Measured + Indicated category, as well as 719,584 oz at 0.92 g/t Au in the Inferred category.

The famous TPK Project: TPK is widely considered to be North America’s largest gold-in-till anomaly, and a standout intercept of 25.87 g/t Au over 13.45 metres undeniably drew attention when it was first announced. With its exceptional geological potential, TPK remains a major discovery in the making — one that stands to benefit significantly from the long-awaited push to develop Northern Ontario’s vast mineral wealth. When the Company was granted its drilling permits last year, Barrick Gold secured claims all around TPK.

What’s Next?

Northern Superior has plenty of catalysts to come and plenty of resources to grow. After focusing on Philibert this year, the Company believes it can grow the resources across Lac Surprise (believed to be the western extension of Nelligan), and at Chevrier and Croteau, two very large systems that provide for a lot of potential.

This is the year.

Qualified Person (“QP”)

The technical content and drilling results contained in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101“) and have been reviewed and approved by Ms. Adree DeLazzer, P.Geo., Vice-President Exploration for Northern Superior. Ms. DeLazzer is a QP under the NI 43-101 and is not considered independent.

Northern Superior adheres to strict protocols following the NI 43-101 best practices when conducting exploration works. Sampling and assay results are monitored with strict QAQC protocols. Drilled core is processed and assayed in Northern Superior’s facilities in Chapais, Quebec. Core samples (half core) are transported to Agat Laboratory in Val d’Or. Samples are analyzed by fire assay with a 50-gram charge with an Atomic Absorption (AA) finish. Samples returning assay values over 10.0 grams are re-assayed with a gravimetric finish. QAQC consists of 4% of blank material, certified standards and duplicates inserted in the assay sequences by Northern Superior.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of the management of Northern Superior, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither party nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Neither party undertakes, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this article.