Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US Energy Secretary Chris Wright this week pushed to expand the country’s strategic uranium reserve. His goal: reduce exposure to Russian imports, shore up nuclear fuel security.

“We’re moving to a place — and we’re not there yet — to no longer use Russian enriched uranium,” Secretary Chris Wright told Bloomberg News, where he attended the IAEA’s annual general conference.

Russia currently supplies about 25% of enriched uranium for America’s 94 nuclear reactors which supply roughly 20% of US electricity.

Why the urgency?

- US nuclear fleet depends heavily on foreign supply. If Russian deliveries were abruptly cut, about 5% of US electricity generation would be at risk

- with electrification rising, consistent baseload power becomes a priority. Nuclear offers that

- proposed phase-out of all Russian uranium by 2028, under current legislation

What are the market reactions?

- uranium stocks surged after Wright’s announcement:

- Energy Fuels Inc. up ~9%

- Uranium Energy Corp. up ~6%

- Cameco ~7% gain

- investors are pricing in demand increase for domestic production, enrichment capacity

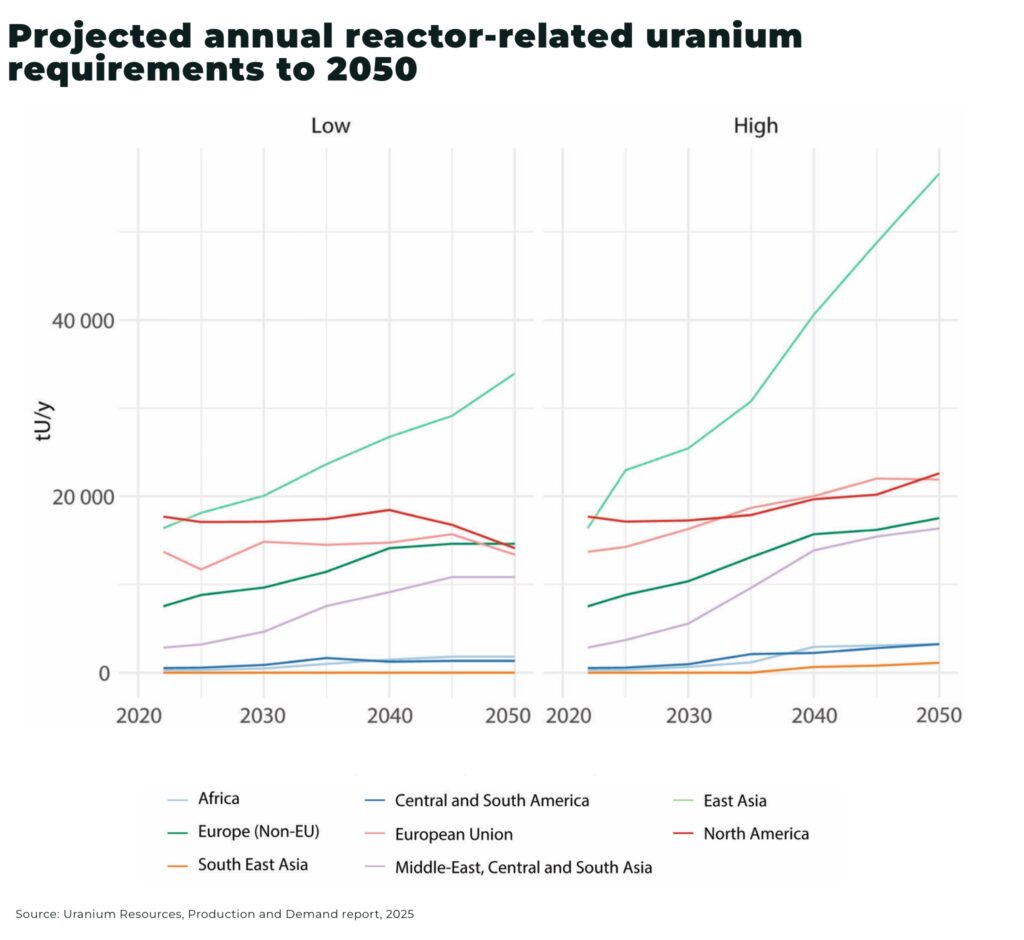

The challenge is that supply is struggling to keep up with demand.

What are the strategic implications for the nuclear industry?

| Element | What’s changing / needed |

|---|---|

| Domestic production and supply chain | Growth in US uranium mining, processing, enrichment will be required. Private sector contracts likely to expand |

| Contracts and reserves | Increased government procurement may create long-term contracts, boosting certainty for miners and enrichment firms |

| Price pressure | Higher demand, supply risks could lift spot and term prices for uranium, enrichment services |

| Policy and regulation | Tightening import bans, faster licensing, more subsidies and regulatory support likely |

Risks, gaps, and watchpoints

- domestic enrichment capacity is limited now. Scaling up will take capex, time.

- regulatory hurdles: environmental, licensing, permitting still significant.

- supply chain fragility remains: mining, transport, enrichment require secure, diversified inputs.

- geopolitics: Russia/foreign supply disruption is a risk driver; global uranium market remains volatile.

What to monitor next

- specific size targets for the reserve: how many pounds/tonnes of U₃O₈ (uranium oxide) or enriched uranium will the US aim to hold?

- funding and budgeting: how much will Congress allocate for purchases / capacity building?

- contracts awarded to domestic producers & enrichment firms

- price movements in spot vs term uranium markets

- progress on advanced reactor fuel (like HALEU) supply chain & reserve planning

Conclusion

The US is taking concrete steps to build a strategic uranium reserve, cutting reliance on Russian supply, supporting nuclear power growth. For mining and enrichment firms, this signals opportunity: long‐term contracts, rising demand, potential for higher margins. But execution risks are real — capacity, regulation, funding all must move fast. Investors should vet which players are positioned to scale in mining, conversion, enrichment.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.