Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

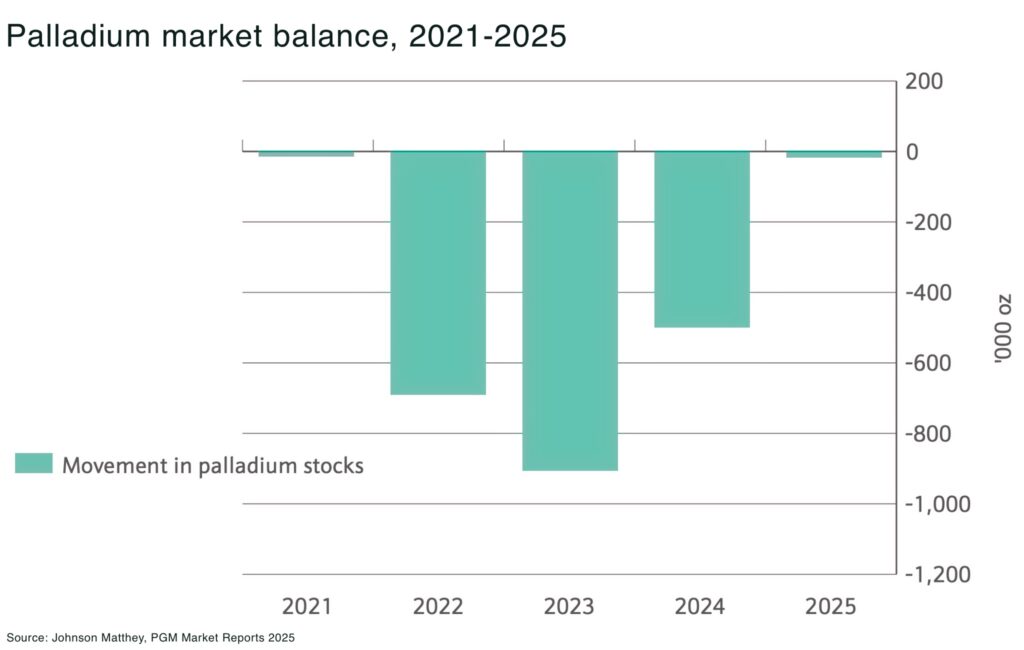

- persistent deficits: global palladium supply has been in deficit since 2012, with shortfalls reaching 0.9 Moz in 2023 and 0.5 Moz in 2024 (these combined deficits (~1.4 Moz) equal about 15% of annual demand)

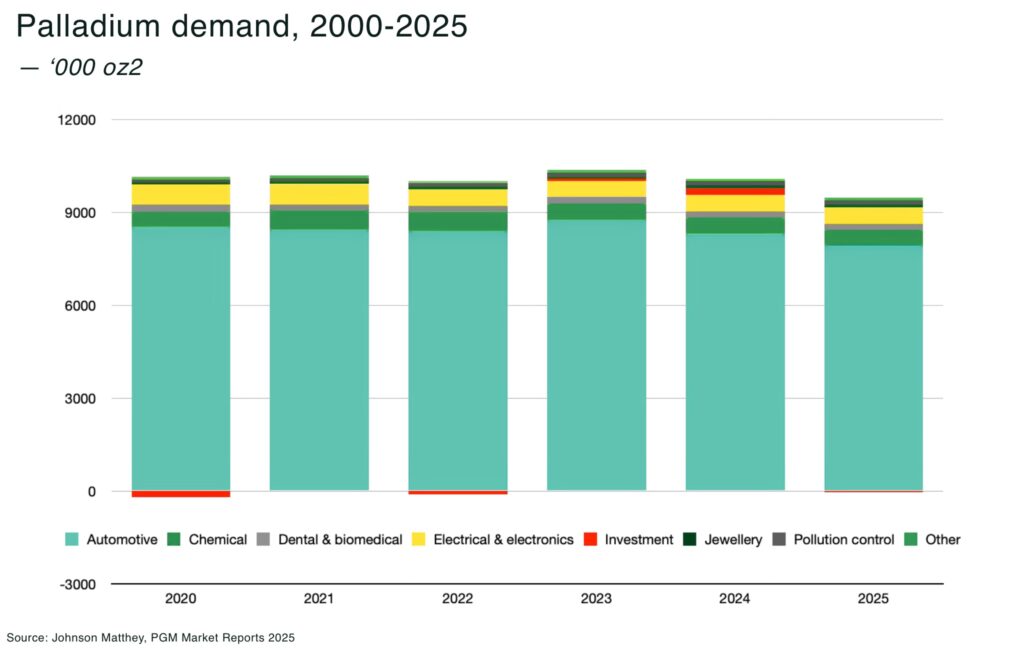

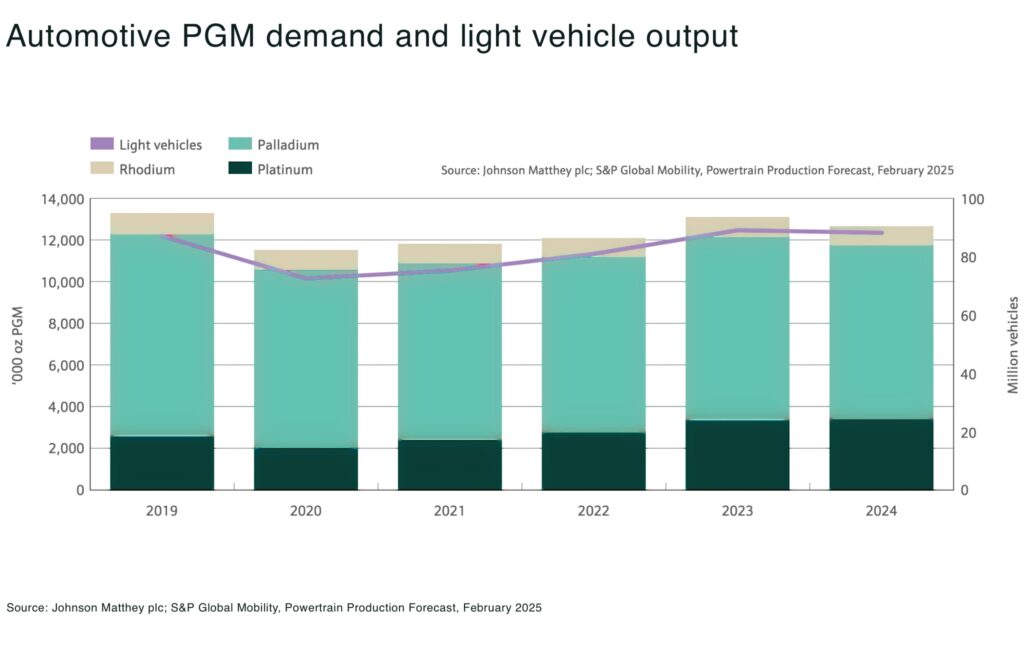

- robust demand: automotive uses account for ~80–85% of total palladium demand and, despite EV concerns, palladium demand topped 10 Moz in 2023 as the auto sector recovered

Palladium has recorded structural deficits from 2012 to 2024 — with the shortfall rising sharply over the last three years, hitting 0.91 Moz in 2023 and and 0.50 Moz in 2024 — now, market analysts warn an expected surplus in 2026 may be pushed further back.

What is palladium and why is it important

Palladium is a silvery, critical platinum group metal, or PGM, (including platinum, palladium, rhodium, ruthenium, iridium, and osmium) essential to many manufacturing processes, like electronics and industrial products.

More than 80-90% of palladium demand comes from the automotive industry, where palladium is used in catalytic converters due to its ability to absorb hydrogen and act as a highly efficient catalyst to reduce harmful emissions from gasoline engines.

Palladium is also used in electronics, medical devices, and chemical processes, with smaller roles in jewelry and investment.

Why are there supply-demand imbalances in the palladium market

Palladium’s supply-demand balance has been in deficit for more than a decade. According to Johnson Matthey’s latest PGM report (May 2025), annual demand consistently exceeded supply by roughly 5–9% of total consumption in 2023-2024.

Yet a recent report by Goehring & Rozencwajg notes that roughly 40% of global PGM production is uneconomic at current price levels, after the price fell from around $3,000/oz in early 2022 to around $900 by late 2024, squeezing the margins.

Table 1 summarizes the recent trend:

| Year | Total Supply (Moz) | Total Demand (Moz) | Deficit (Moz) |

| 2023 | 9.46 | 10.37 | 0.91 |

| 2024 | 9.59 | 10.10 | 0.50 |

| 2025* | 9.43 | 9.45 | 0.02 |

Table 1: Global palladium supply and demand. 2025 is a forecast.

Source: Johnson Matthey PGM Market Report May 2025.*

In 2024, total palladium supply was about 9.59 Moz against 10.10 Moz in demand. The market had to draw down stockpiles to bridge the approx 500 koz gap.

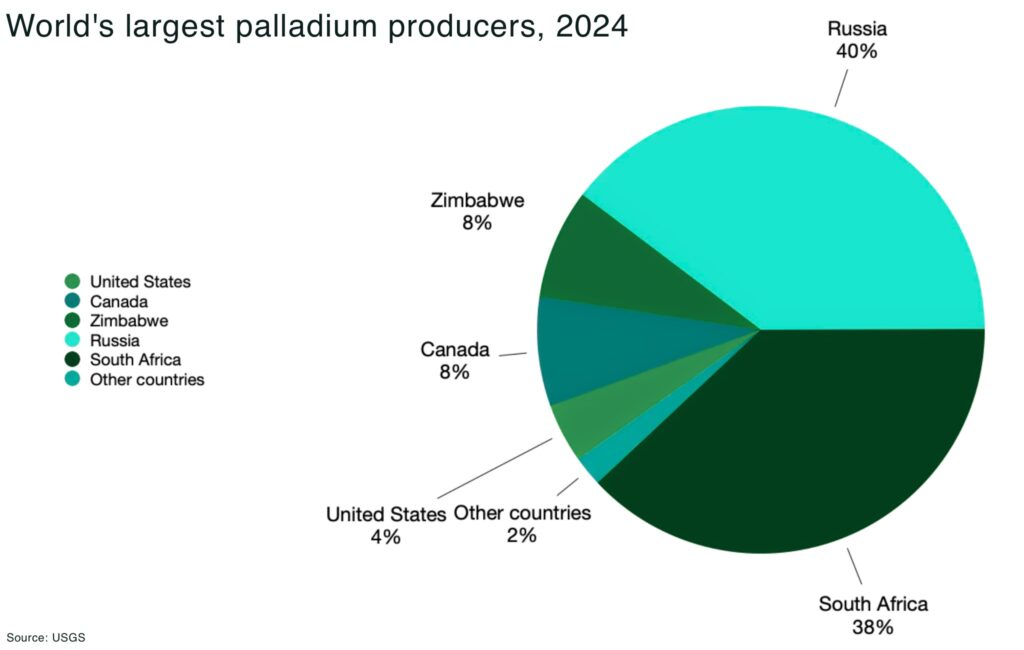

Supply of palladium is heavily concentrated in Russia and South Africa, with Russia’s Norilsk Nickel and South African PGM miners (like Valterra Platinum (formerly Anglo American Platinum), Impala, and Sibanye-Stillwater) being critical suppliers.

South Africa supply slipping

Production of palladium from South Africa has been falling steadily as, over the past two years, low prices of platinium group metals (PGM) have pushed many South African mines into the red, leading to cutbacks and mines being put on care-and-maintenance.

For example, Impala Platinum (Implats) — which produces approx 20% of global primary PGM supply annually and saw it half-year profit in 2024 fall by 43% — announced its Two Rivers operation would be put on care and maintenance.

”It’s highly improbable that you’re going to see material investment in new PGMs (platinum group metals) production in South Africa” — Nico Muller, Chief Executive of Impala Platinum said on a media call

Russia disruption

In 2024, Russian palladium shipments actually increased approx 2% to 2.75 Moz, as Norilsk Nickel managed to beat its production guidance despite logistical hurdles. However, Russian exports had to be rerouted as direct shipments have been disrupted by sanctions after the invasion of Ukraine, forcing flows through intermediaries like Armenia and Swiss bonded warehouses.

This underscores the geopolitical risk around Russian palladium: further sanctions or export restrictions could quickly remove a large chunk of supply. Indeed, simply the US discussing the idea of tighter restrictions on Russian palladium in late 2024 sent the price spiking above $1,200/oz in October 2024.

North America supply in care-and-maintenance

Similarly, in North America, Sibanye-Stillwater announced a major production cut at its Stillwater mine in Montana – the only primary palladium mine in the US — that could cut output of palladium and platinum by as much as 45%. The Stillwater mine produced 426,000 oz of PGMs in 2024 , so a one-third cut implies approx 140,000 oz less supply in 2025 from the US. A delegation of Montana lawmakers recently visited the White House, imploring the government to implement harsher sanctions of Russian palladium.

And, in Canada, the Lac des Iles mine in Ontario, is expected to cease commercial production at Lac des Iles by mid-2026.

Recycling palladium depressed

Auto catalyst recycling, normally is a growing secondary source of PGMs as old cars are scrapped, has also remained depressed.

Owners are keeping older cars on the road longer, delaying scrappage – US vehicles now average a record 12.6 years old — with palladium recylcing supply falling from 3,117 in 2022 oz to 2,789 oz in 2024.

All of this has meant less palladium being recovered from end-of-life vehicles, further tightening the market.

Demand remains robust

As supply tightens, robust industrial and autocatalyst demand for palladium has meant the market remains in deficit.

Global light vehicle sales totalled 89 million units in 2024, a 2% increase from 2023. And, despite concerns over electric vehicles sales (which don’t need palladium for catalytic convertors).

The Johnson Matthey PGM Market Report, May 2025 warns that tariffs by the Trump administration and a global economy slowdown means a move by the market into significant surplus “cannot be ruled out.” But, for now, projects a stalemate between demand and shrinking supply.

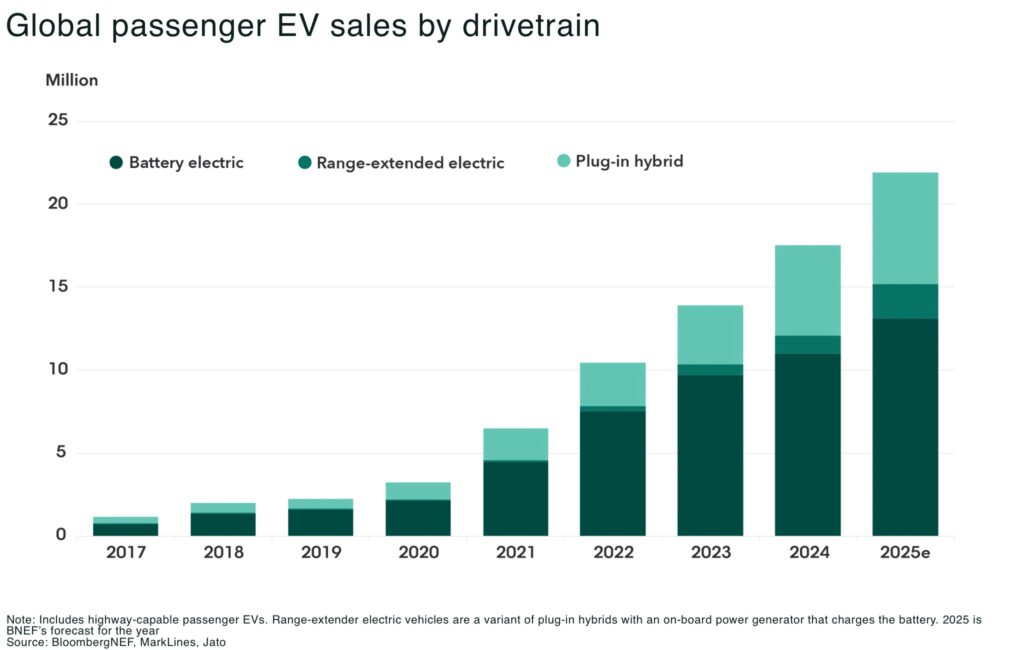

We argue that, US tariffs on electric vehicles from China and removal of subsidies for electric vehicles in the US may, in fact, boost sales of internal combustion engine vehicles: according to consulting firm EY, electric vehicle adoption in the US is forecast to fall from 7.3% in 2024, to under 2% annually each year through 2030.

How hybrids reshape palladium demand

Then there’s the expected incoming demand from hybrid vehicles,

Hybrids keep internal-combustion engines but use 10–20% more palladium per car than standard ICE models, as cold-start emissions are tougher to “clean” when engines cycle on/off.

And PHEV (Plug-In Hybrid Electric Vehicles) sales are accelerating.

BloombergNEF expects 22 million BEV+PHEV sales in 2025 — with more than 30% of that figure made up of PHEVs.

Hybrids are seeing particularly strong growth in China, but also gaining traction in the US with hybrid sales rising 36.7% in 2024 year-on-year.

Policy and tech are pushing PHEVs forward. The IEA notes consumers in China are increasingly opting for PHEVs for range flexibility, with PHEV electric range up >20% since 2020 (≈100 km), which improves real-world fuel/emissions performance but retains the need for full exhaust after-treatment (and PGMs).

Goldman Sachs expects hybrid vehicles to “fill the gap as battery EV sales slow”, raising its forecasts for hybrid sales weightings to 12% of the global market in 2030 (up from 10% previously) and 9% in 2040 (from 5%). In addition, they see plug-in hybrid electric vehicles (PHEVs) getting 14% of the market in 2030 and 17% in 2040 (up from a previous forecast of 9% in 2040).

Emissions standards push up palladium demand

Another factor pushing up automotive palladium demand is increasing emissions standards.

As regulators across the world tightening vehicle emissions rules (both pollutants and CO₂), so too they generally force higher catalyst loadings. For example:

- Europe’s Euro 7 regulations and China’s upcoming China 7 standards will push automakers to further reduce tailpipe pollutants

- and, in the US, stricter standards for heavy-duty trucks, including EPA Tier 4 in the US from 2027

Thus, each new generation of emission rules tends to boost palladium use per vehicle, offsetting the reduction in total ICE vehicle volumes

North American palladium producers and security of supply

The strategic importance of North American palladium sources for security of supply has increased sharply since Covid and Russia’s invasion of Ukraine — as the geographic concentration poses both economic and geopolitical risks.

In this context, North America’s palladium projects have taken on new significance.

As America’s only active primary palladium mine in the US (Sibanye-Stillwater’s operation in Montana) is now scaling back output due to cost pressures and Canada’s one primary palladium mine (Lac des Iles in Ontario, operated by Impala) is expected to close in 2026 — the focus has shifted to development-stage projects that could bolster North America’s palladium output in coming years.

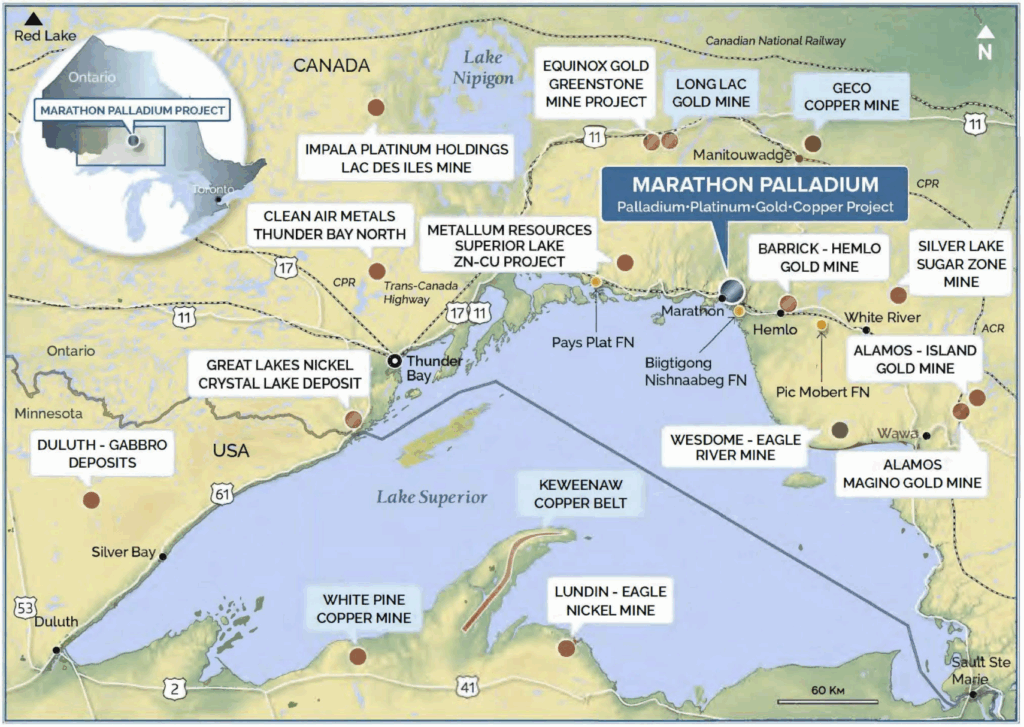

Generation Mining’s Marathon Palladium-Copper Project (TSX:GENM OTCQB: GENMF) in northern Ontario, Canada is advancing Marathon as a new source of critical minerals, with palladium being the flagship product.

In May 2025, the company achieved a major milestone by receiving the final key permit needed to begin construction of the mine. According to Generation Mining’s updated feasibility study, Marathon would produce an average of approx 166,000 oz of palladium per year over a 13-year mine life. In total, the project is expected to yield about 2.16 Moz of palladium, along with significant copper (532 million lbs), platinum (488k oz), gold (160k oz), and silver. As a true critical mineral mine, at today’s metal prices the revenue from palladium and copper will be about equal. Both metals have been on fire, with palladium up 35% year-to-date while copper has risen 27% over the same period of time.

This multi-metal output highlights why the project is strategically important: not only would it be Canada’s next major palladium mine, it also provides copper, another critical mineral. The Marathon project’s economics appear robust: an NPV (6% discount) of C$1.07 billion and an IRR of 28% were estimated, using trailing 3-year average metal prices.

With all key permits now in hand, the main hurdle is securing construction financing. The company has a “shovel-ready” plan and strong community and Indigenous support, positioning Marathon to move forward as financing is arranged.

Once built, mines like Marathon would significantly enhance North America’s palladium supply.

Beyond Marathon, there are other North American palladium initiatives worth noting:

- Sibanye-Stillwater’s US operations (Stillwater and East Boulder in Montana) remain important, even after the announced cuts, producing hundreds of thousands of ounces per year. Sibanye has indicated it will reevaluate and potentially expand these operations when/if market conditions improve

- in Canada, aside from Lac des Iles and Marathon, there are palladium-rich deposits in the Sudbury basin (by-product of nickel mining) and projects like Clean Air Metals’ Thunder Bay North (another Ontario PGM development)

Conclusion

The palladium market of 2025 is at a crossroads. Years of deficit have tightened the market’s slack, yet prices have yet to reflect the true scarcity. Security of supply is now a top-of-mind issue, elevating the importance of new North American palladium sources and highlighting the fragility of relying on a few overseas producers.

At the same time, demand for palladium remains firmly entrenched in the auto industry that will serve a fleet of tens of millions of combustion engines for decades to come. Hybrid vehicles are also giving the metal a new lease on life.