- US is creating a $12 billion strategic minerals stockpile to reduce dependence on China

- the program targets rare earths, lithium, nickel, cobalt, graphite and other critical minerals

- funding will be routed through EXIM Bank and federal procurement mechanisms

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US will establish a US$12 billion strategic minerals stockpile, marking its most direct intervention yet in critical mineral markets as competition with China intensifies. The initiative, announced by the White House on Monday, is designed to secure long-term supplies of minerals vital to defense, energy transition and advanced manufacturing.

- government buying sets a price floor for select minerals

- long-term offtakes reduce financing risk for miners and processors

- supply outside China gains strategic premium

The program authorizes federal agencies to purchase, store and rotate strategic minerals, shifting US policy beyond subsidies and tax credits toward direct ownership of physical supply.

“Project Vault will secure the raw critical minerals essential to our defense, energy and technology sectors so we are no longer reliant on our adversaries!” — Secretary Doug Burgum, Secretary of the Interior and Chairman of the National Energy Dominance Council

Why now?

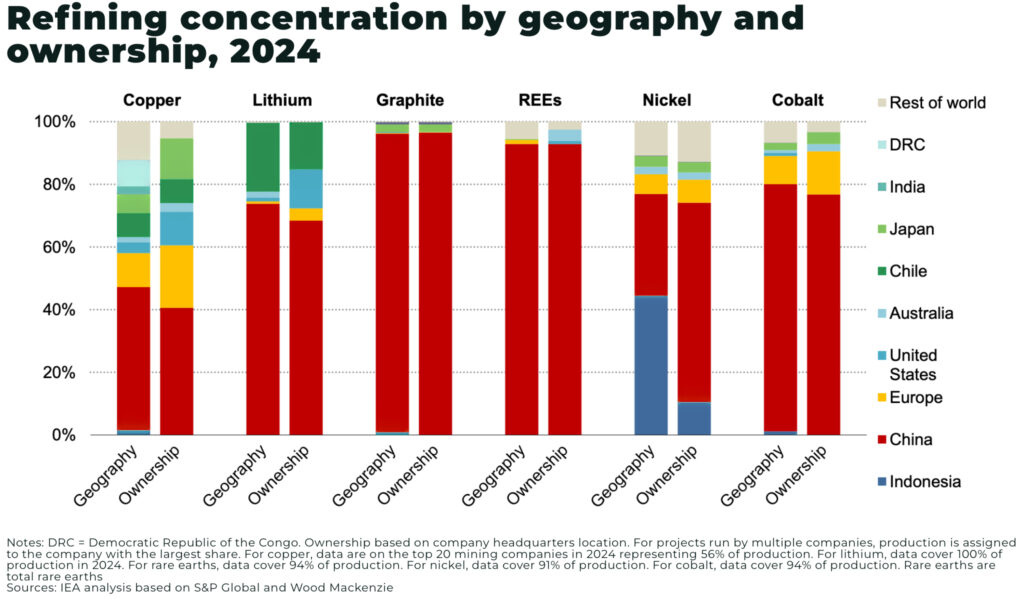

China controls or dominates processing across much of the critical minerals supply chain, refining roughly 60–90% of global rare earths and battery materials depending on the mineral

Beijing has increasingly used export controls as leverage, tightening restrictions on gallium, germanium, graphite and rare earth-related technologies.

How the stockpile will work

The Export-Import Bank of the United States will play a central role, financing purchases and long-term offtake agreements with domestic and allied producers

Unlike the Strategic Petroleum Reserve, the minerals stockpile will focus on diversification and rotation, buying material during periods of surplus and releasing supply to stabilize markets during disruptions, according to administration officials cited by Bloomberg.

What minerals are included?

While the full list has not been disclosed, officials have confirmed priority materials include:

- rare earth elements used in magnets and defense systems

- lithium, nickel and cobalt for batteries

- graphite for anodes and energy storage

- Other minerals designated as critical by federal agencies

A shift in US industrial policy

The stockpile represents a clear escalation in US industrial strategy. Previous efforts focused on permitting reform, tax credits and loans. This move places the federal government directly into mineral markets as a buyer and holder of supply.

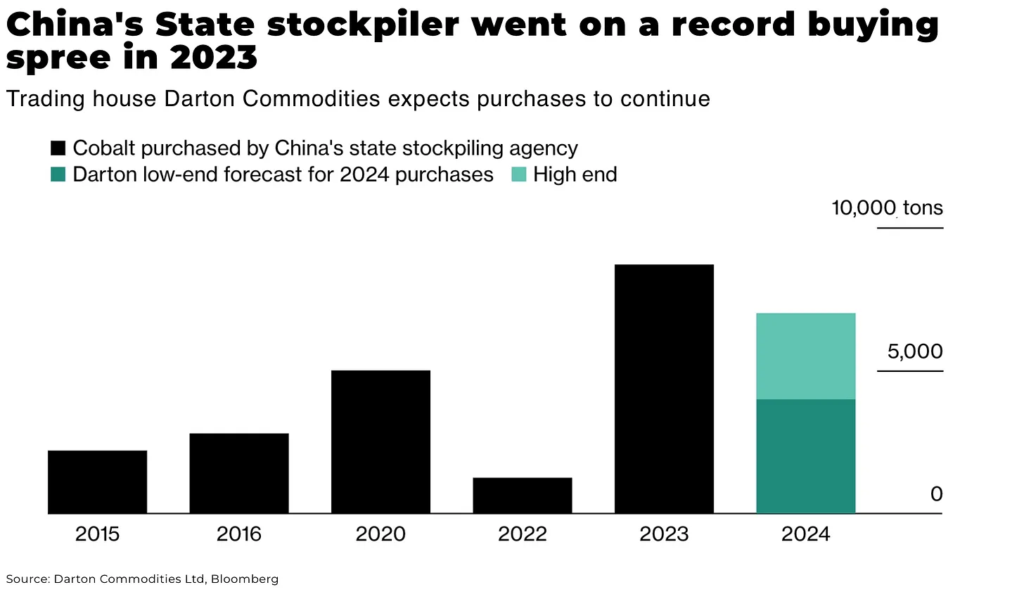

Bloomberg notes the policy mirrors China’s own state-backed stockpiling playbook, which has historically supported domestic producers and insulated supply chains during market downturns

For investors, the announcement tightens the link between national security and mineral pricing. Strategic materials are no longer just cyclical commodities; they are becoming state-backed assets with asymmetric upside during supply shocks.

As geopolitical risk rises and supply chains fragment, the US minerals stockpile signals that critical minerals are moving closer to the status once reserved for oil.

Find out more:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.