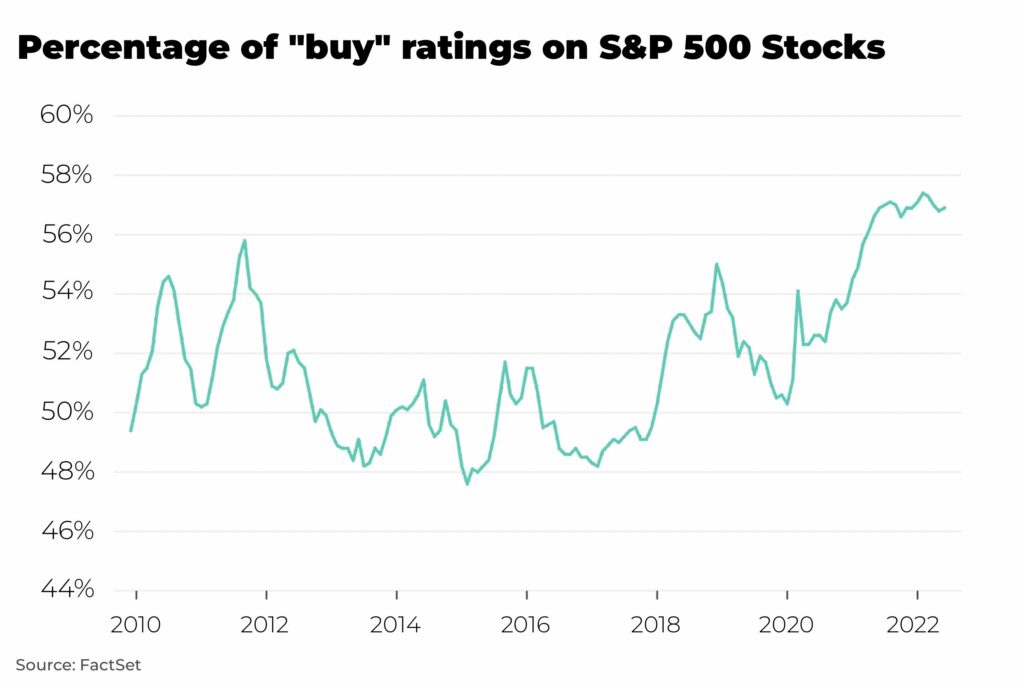

- number of US stocks rated “buy” is the highest for over 10 years

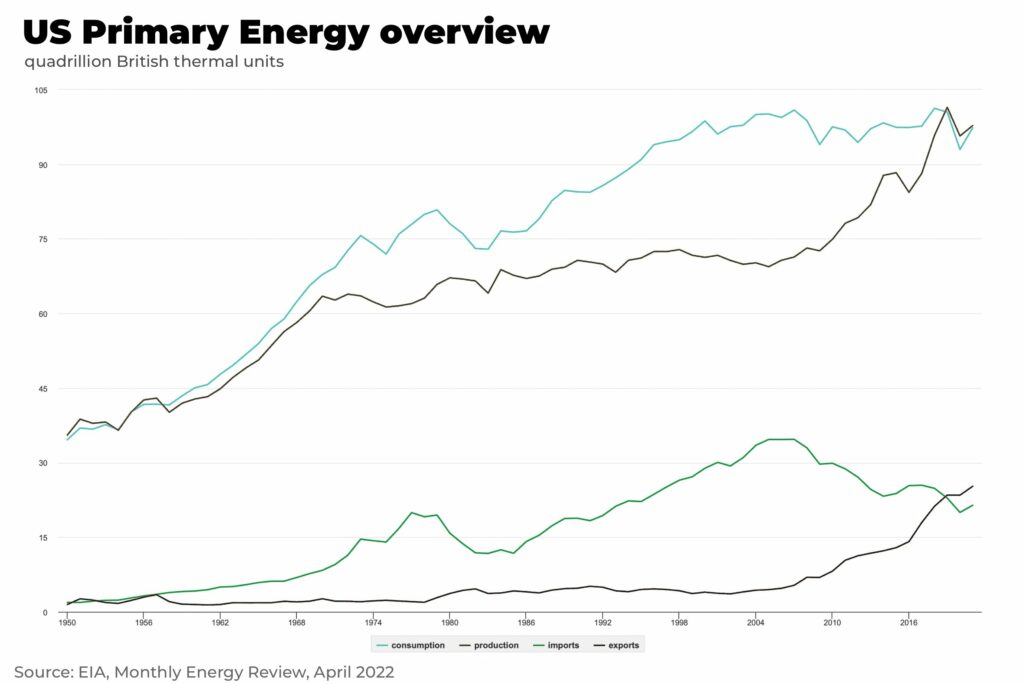

- the US has been a net total energy exporter since 2019 for the first time since 1957

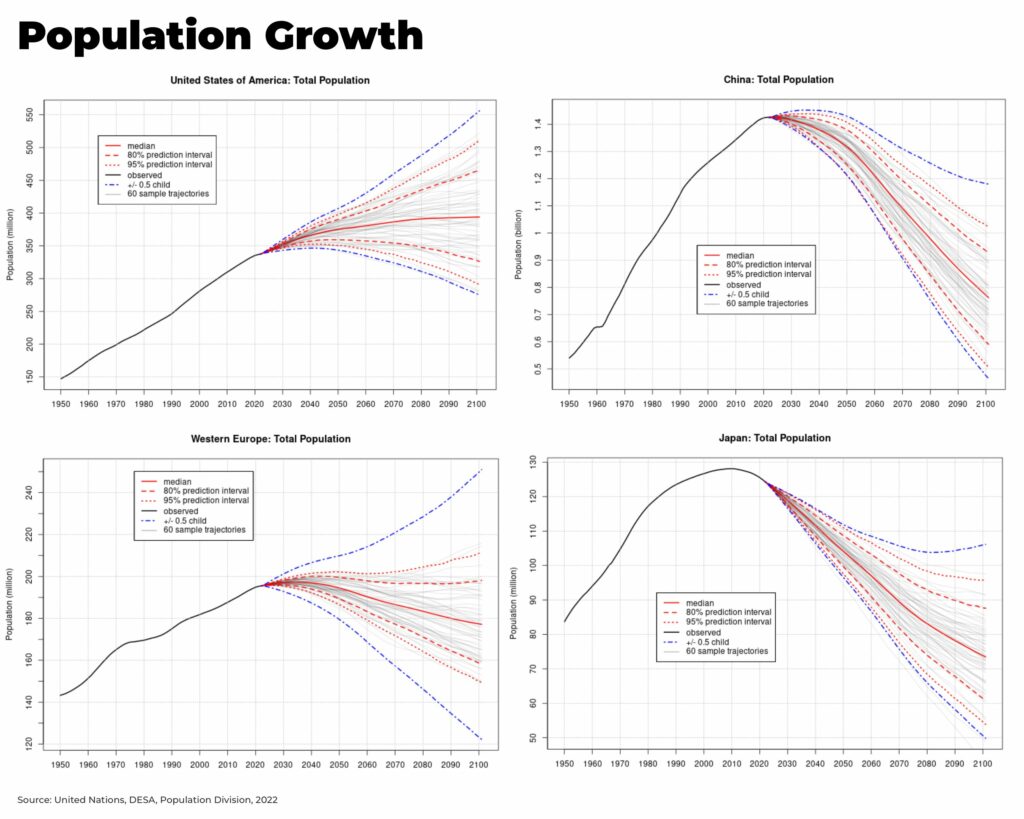

- one of few major economic regions to have relatively stable population growth

- long-term fundamentals in the US are flashing “buy”

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Flashing red lights are warning of a global recession, interest rates are rising, inflation is hitting record highs, there is war and energy crisis in Europe, while China manages an economic slowdown amid further Covid outbreaks.

These destablizing shocks present an historic economic opportunity for America. And, most importantly for investors, they appear to be seizing it.

This is perhaps best highlighted by the number of US stocks rated “buy” — the highest for over 10 years, despite over US$9 trillion wiped off the US stock market, the worst first half for 50 years, in the first half of this year.

The fundamentals underpinning America’s economy mean the country looks set to be the dominant economic player in the next decade, most likely establishing another new American century.

Secure and low cost energy.

The critical nature of energy for any economic growth has been thrown into sharp relief by the Russian invasion of Ukraine and the effective weaponization of gas and oil supplies, especially against Europe.

Natural gas prices in Europe spiked to record levels this year after Russia shut off most of its gas exports to the country (our analysis on how the global natural gas network is being overhauled).

Norwegian energy group Equinor estimates European energy companies could need at least US$1.5 trillion to cover the cost of their exposure to soaring gas prices. Business across the region is already being affected with one industry association warning high energy prices could lead to the permanent closure of metal producing plants.

The US, in contrast, has been a net total energy exporter since 2019 for the first time since 1957. Much of this growth has come from the shale revolution, using hydraulic fracturing and horizontal drilling to access new fields of oil and gas.

And demand for American energy is on the rise, with the US now the world’s largest LNG exporter (our analysis on how the US is supplying LNG demand from Europe and Asia).

And, the US is rapidly building out its renewable energy sector, which is the fastest growing electricity source in the country, generating 24% of utility-scale electricity in the first six months of 2022.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Demographics.

The US is one of the few major economic regions to have relatively stable population growth. Newly revised population figures by the UN’s Department for Economic and Social Affairs suggest America may well see a decline in its population, but nothing in comparison to its major economic rivals, Europe, China and Japan.

China’s head of population for the National health Commission confirmed the country should expect negative growth, with the population starting to decrease before 2025.

Population figures do not mean America’s economy is destined for growth — plenty of smaller countries have great wealth, and countries with much larger populations like India have struggled for growth — but, together with immigration, the US has a younger, more productive population to stay competitive.

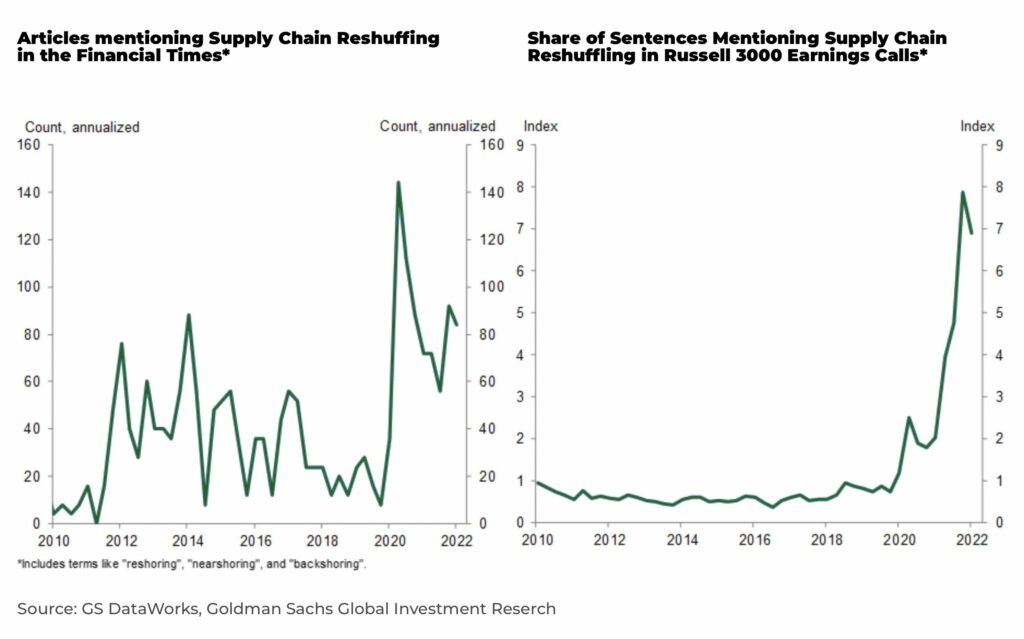

Supply chains and manufacturing.

The Covid pandemic, Russia’s invasion of Ukraine, as well as demands to meet climate change goals, have highlighted serious threats to global supply chains; including rising costs of raw materials and freight to export bans, tarrifs, labour shortages and rising wages.

According to a new survey, 70% of US businesses are planning to reshore or nearshore their operations to secure their supply chains, with increased investment in automation.

It’s a move supported by both Republicans and Democrats in the US, with President Biden boasting the economy added 367,000 manufacturing jobs — the most in nearly 30 years — in his first year in office. The bipartisan US$1.2 trillion Infrastructure Investment and Jobs Act, passed at the end of last year, promises to rebuild transport networks and the power grid. (for one example, we recommend our analysis on what deglobalization means for America’s superconductor industry)

We do not expect all manufacturing to return to the US, far from it, but the direction of travel is towards more diverse and resiliant supply chains and manufacturing base.

The US dollar.

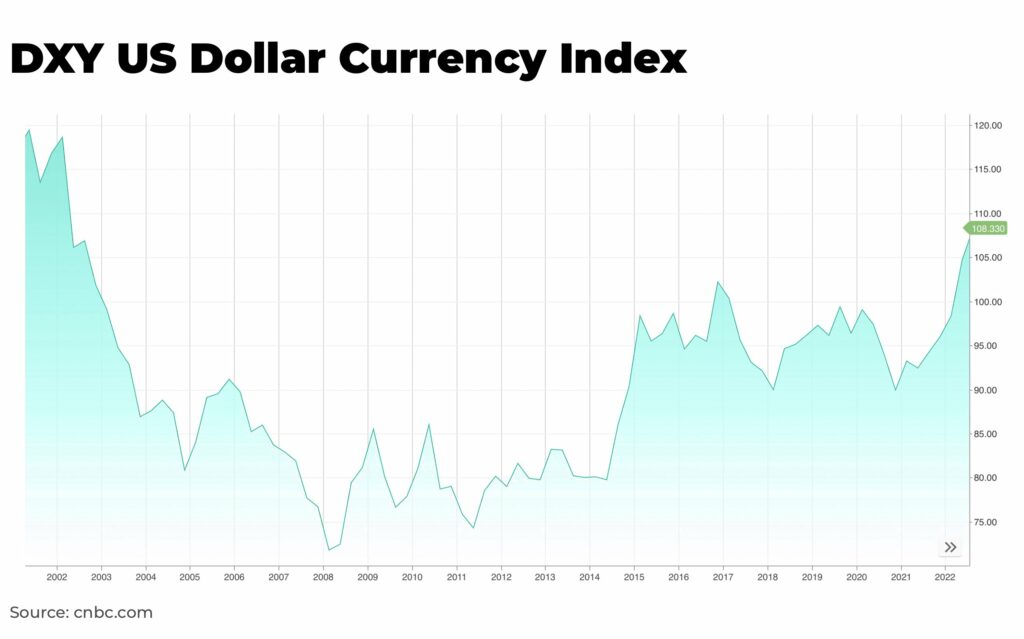

There have been many warnings of the demise of US dollar as the global reserve currency, but the DXY, an index of of the US dollar against other major world currencies, is at a 20-year high. Nearly 60% of global foreign exchange reserves are still held in dollars.

After Russia invaded Ukraine and the Fed raised interest rates to tackle record inflation, capital has poured in, pushing up the dollar. The effects of a strong dollar will have a significant impact across the world, but it’s the sentiment that’s critical: confidence that, in times of trouble, the world still views the dollar as the most secure currency because of America’s economic and military might.

For example, the Euro is the second most widely held currency in reserves after the dollar and they are also raising interest rates. But, after the eurozone crisis in 2009 and now the regional energy crisis, many investors are wary — with the Euro reaching parity with the dollar for the first time in 20 years.

The Chinese Renminbi currently remains too limted by liquidity and capital controls to act as a global currency.

And this is important because it means the US can continue to borrow money at a lower cost, extending the influence of US financial institutions, as well as increasing American financial leverage through access to the US financial system or sanctions, such as it has just done with Russia.

Rule of law.

Enterprise thrives in a stable, secure environment where businesses have legal means to protect their interest. It’s not perfect, but the US still upholds this value. And we do not see this changing in the foreseeable future.

It’s the same in Europe, but business in many other countries operate under “rule by law”, with the government having final say over property and capital.

“For investors unsure where to put their money to secure growth, the long-term fundamentals in the US are flashing “buy.””

— Anthony Milewski, The Oregon Group

There are, of course, challenges.

The next decade will be extremely volatile with the economic fallout from the pandemic, Russia’s invasion of Ukraine and a slowing economy in China. Global growth is forecast to slow to 3.2% in 2022, from 6.1% last year — and there may well be more black swan events on the horizon.

So, there will be a need to manage risk significantly in the short-term.

The US is far from the only player with a bright future in the market, but for investors unsure where to put their money to secure growth, the long-term fundamentals in the US are flashing “buy”.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.