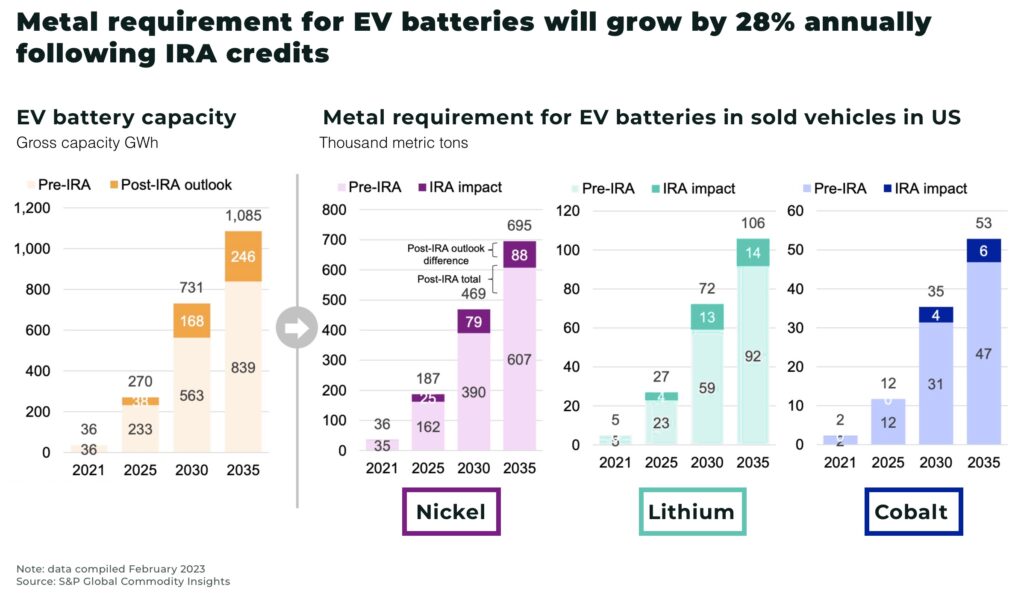

The US Inflation Reduction Act (IRA) will significantly increase demand for critical minerals — cobalt, lithium, nickel and copper — and it will be “very challenging” to meet this new demand, according to the latest S&P report.

- demand for cobalt, lithium, nickel, taken together, will be x23 higher in 2035 than 2021

- demand for copper will be x2 as high

This growth is equivalent to compound growth rates of 25% for cobalt, lithium, nickel, and 4% for copper.

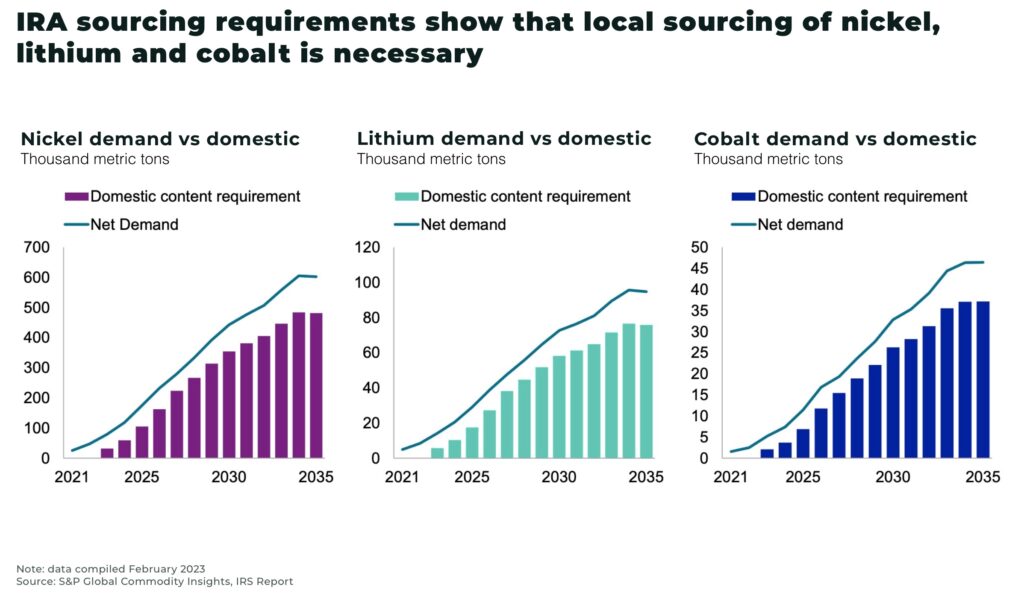

“The IRA impacts minerals in two ways. On the demand side, it does so by providing major stimulus and subsidies for a wide range of mineral-intensive decarbonization technologies, from electric cars to off-shore wind turbines. On the supply side, it seeks to promote mineral development by imposing percentage requirements for mineral content from the United States or countries with which it has a free trade agreement (“FTA countries”). These requirements rise quickly. To qualify for IRA tax credits, 50% of the critical minerals in a vehicle’s battery (by value) must meet these requirements in 2024 — rising to 80% by 2027. The IRA also seeks to reduce reliance on “foreign entities of concern””

— Inflation Reduction Act: Impact on North America metals and minerals market

Domestic demand for will also challenge the US mining sector as local or FTA-sourced (free trade agreement) supply will likely be a major challenge for EV manufacturers looking to maximize IRA incentives.

Our report on how America’s ambitious plans to invest almost US$1.6 trillion to counter climate change and update infrastructure will support demand worth almost $160 billion at today’s values for copper, cobalt, lithium, graphite and nickel by 2040, according to our estimates: