- investment plans are on the scale of the New Deal of the 1930’s

- will support demand for metals worth $160 billion at today’s prices

- create powerful incentives to buy North American minerals

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

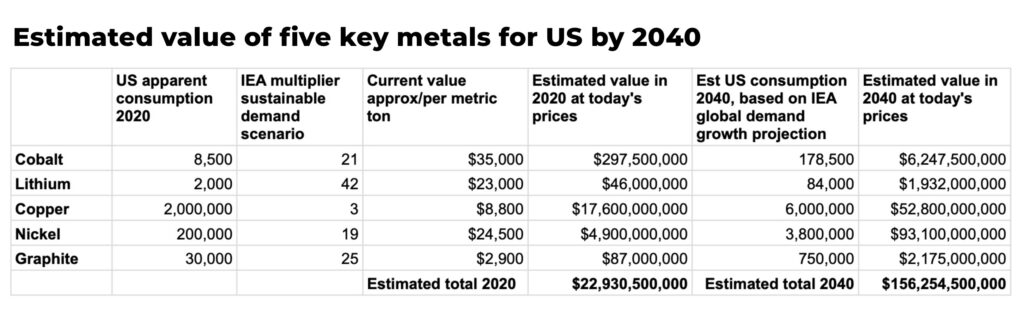

America’s ambitious plans to invest almost $1.6 trillion to counter climate change and update infrastructure will support demand worth almost $160 billion at today’s values for copper, cobalt, lithium, graphite and nickel by 2040, according to our estimates.*

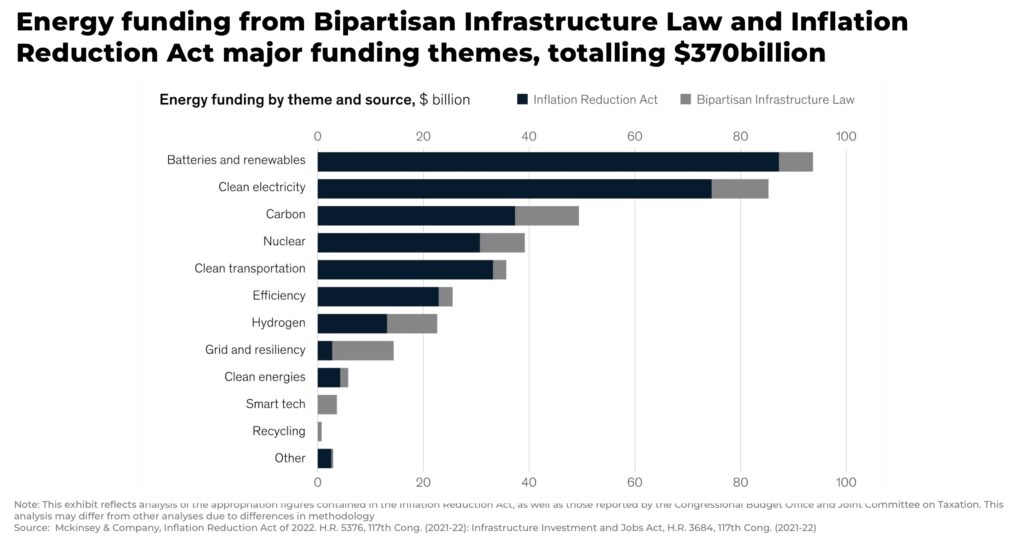

The Bipartisan Infrastructure Law (BIL), passed in November 2021, promises new spending of $550 million by 2026 to rebuild roads, bridges and airports, while the Inflation Reduction Act (IRA), passed last August, will make new investments of $370 billion to cut carbon emissions by 40% by 2030. Total spending, including money already committed to other programmes, is much higher.

The legislation is vast and impacts a wide variety of investments, but we’re focusing on the impact on mining critical minerals, which is likely evident in GM’s recent investment in Lithium America’s Thacker Pass mine in Nevada.

The IRA’s advanced manufacturing production credit focuses on incentivizing the production of critical minerals used in renewable energy, storage and related production. It will give mining companies that produce those metals in the US a tax credit that equals 10% of the cost of production so long as their output meets specific purity levels.

Producers welcome IRA support

Lithium producer Albemarle, which is developing the Kings Mountain lithium project in North Carolina, welcomed the proposal though it noted the long time it will take to begin production.

“Albemarle sees the Inflation Reduction Act as a positive step forward in support of attracting EV supply chain investment domestically to support the transition to clean energy in the US… The Inflation Reduction Act’s conditions and timeline for the credit on electric vehicles is challenging given the battery industry largely operates in Asia and the domestic supply chain is in early development”

— Albermarle, “Inflation Reduction Act creates new tax break for US critical minerals”

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

While the scale of investment should spark the interest of investors in commodity producers and refiners, the projections of tight supply and soaring demand for those key metals will sharpen the sense of opportunity further.

The International Energy Agency estimates that sustainable development globally such as that outlined in Biden’s plans will require over 40 times more lithium, around 20 times more cobalt, nickel and graphite, and three times more copper by 2040.

*Applying those multiples to the US’s current consumption suggests cobalt usage will rise there to 179,000 tonnes from 8,500 tonnes in 2020 (worth $6.3 billion at today’s prices); lithium to 84,000 tonnes worth $1.9 billion at today’s prices) (2,000 tonnes in 2020); copper to 6 million metric tons, worth $53 billion at today’s prices (from 2 million); nickel to 3.8 million metric tons, worth $93 billion at today’s prices (from 210,000 tonnes) and graphite to 750,000 tonnes (from 30,000 tonnes).

To source these minerals, powerful levers for the development and expansion of mines across North America have also been legislated for in the IRA. From 2024, to access the $7,500 tax credit for new EVs available under the IRA, the vehicle must not only be built in North America, but at least 50% of its battery mineral content must be sourced in North America or by a US trading partner. This percentage increases by 10 points annually until it hits 80% in 2027.

Private investment could boost spending

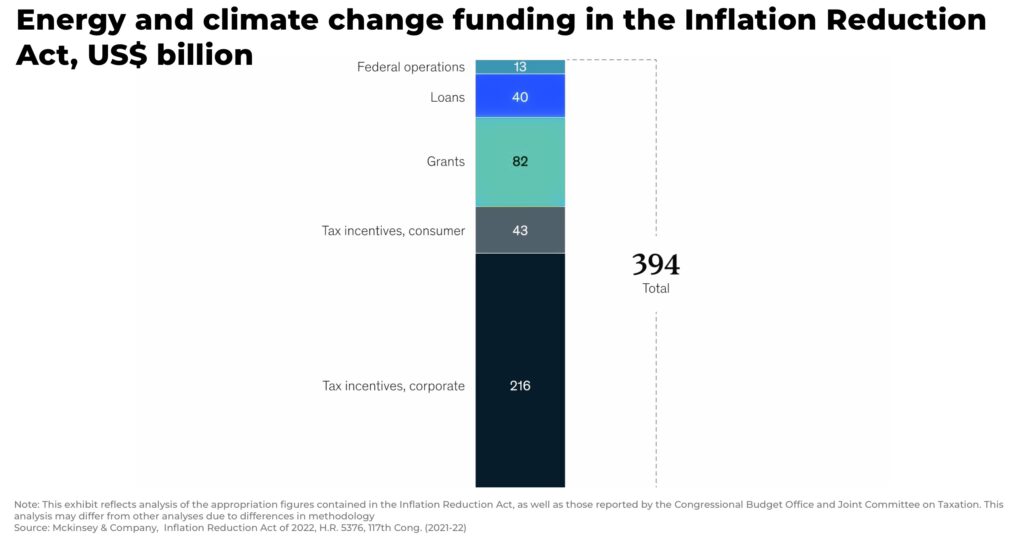

The laws are structured in such a way as to incentivize private investment, and in some cases do not cap the amount that the US government will spend based on volumes of production or capital spent.

Arguably, more important than the total sums, is the demonstration and commitment by the US government that it is serious about clean energy and the energy transition.

Credit Suisse reckons there will be a powerful multiplier of investment as a result. In the case of the IRA it forecasts that federal spending will be double the projected amount at over $800 billion, and that total spending could reach $1.7 billion on the IRA alone over the next ten years.

The laws are expected to accelerate demand

Of course, even this size of investment will not eliminate market volatility for the critical materials that are essential for achieving a low-carbon economy, including copper, nickel, cobalt, lithium, silver, nickel and graphite.

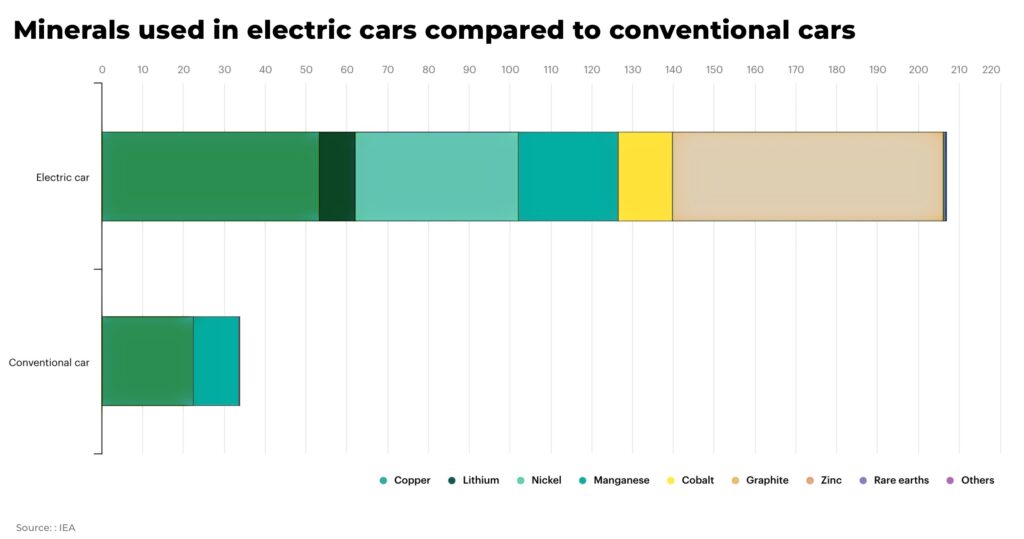

But the laws have already helped accelerate investment in America’s metals sector, as well as low-carbon technologies and services. The BIL looks as though it could support the development of 500,000 charging stations, suggesting the creation of demand of around 1.75 million metric tons of copper by 2030.

Bloomberg New Energy Finance calculates that more than half of the cars sold in the US will be electric by 2030, an increase of 9% from estimations prior to the IRA.

Total US car sales in 2023 will be 14.8 million units, according to estimates from information business S&P Global. On the basis of a growth rate of 2% every year, this suggests that 1.6 million more EVs will be sold as a result of the IRA in 2030 than the prior baseline in the US. On average a car EV battery contains 83kg of copper compared with 23kg in the average combustion engine, which implies almost 100,000 metric tonnes of copper demand will result from the new law.

Still, as Albemarle’s caution about the development of the domestic US supply chain makes clear, even with the best resources, it can take years to develop mines that match such demand, as Piedmont Lithium is finding as it too looks to develop a lithium mine in North Carolina.

The growth in demand is likely to increase competition for material produced in US allies such as Canada, Australia, Japan, the EU and South Korea, even as those countries seek to decarbonise their own economies. This challenge, along with questions about the degree to which the US’s subsidies to buyers of domestically-made and -powered EVs will impede fair competition, will be a key question for the US and its partners, and one that investors should watch closely.

The length of time it takes to build new mines anywhere globally will mean that supply of critical minerals will remain tight. For investors, the new legislation means investing in America in the short-term can bring long term rewards.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.