A new report by Wood Mackenzie, outlines how the European Union’s new Carbon Border Adjustment Mechanism (CBAM) will have far-reaching impact on global trade after it’s introduction in October 2023.

“The consequences will be vast. The CBAM’s initial effect — over the next five years or more, depending on the sector — will be to reconfigure international trade flows. In the longer term, it will put pressure on other economies to cut their emissions”

Wood Mackenzie, How the CBAM will change the world

The EU’s CBAM, agreed in 2022, aims to “combat climate change and prevent carbon leakage” by enforcing payment of a carbon tax that represents the difference between the carbon price in their country of production and the price of carbon allowances set in the EU’s Emission Trading System (ETS).

In three sectors researches — steel, hydrogen and oil — as representative of similar industries.

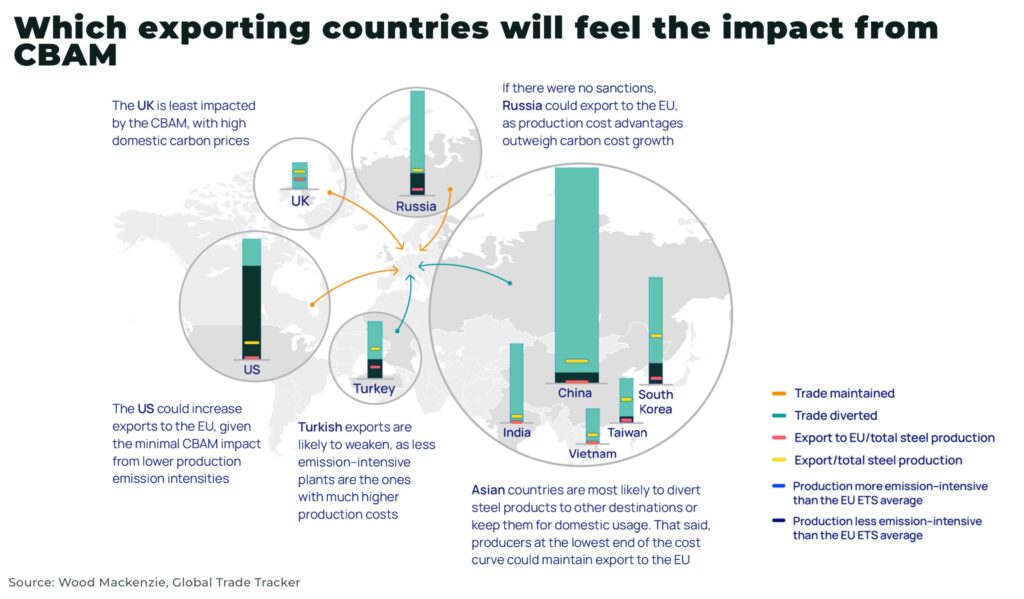

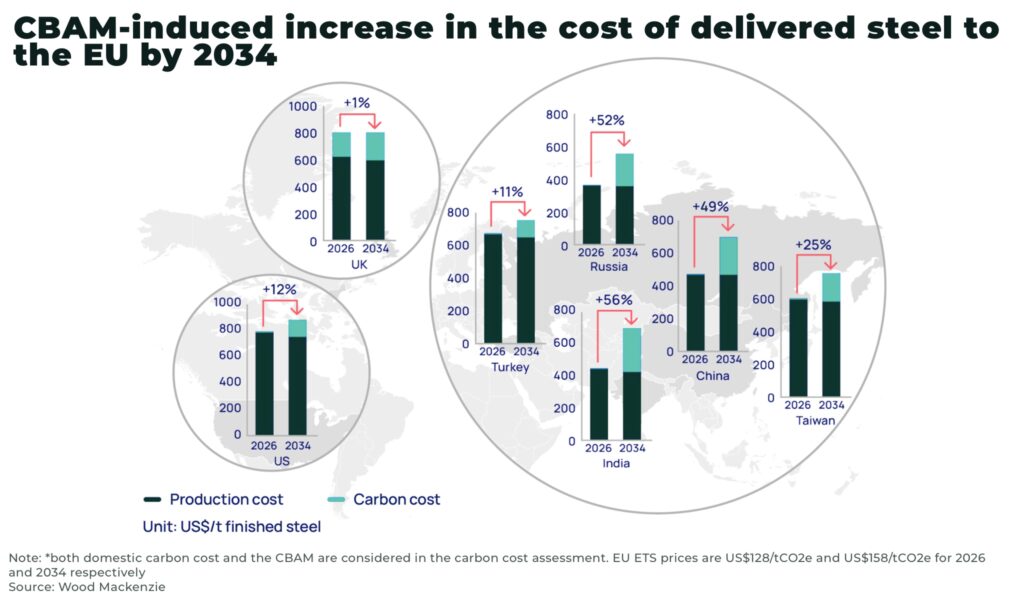

For example, estimates that by the end of the phase-in period, the cost of the CBAM for some of the key stell exporters to the EU could exceed US$275/tonne of finished steel. For reference, in 2022, the average import price of steel products covered by the CBAM was around US$1,450/tonne. The CBAM fees could increase the cost of delivered steel to the EU by about 56% for India and about 49% for China in 2034.

The EU is neither the only country with an emissions trading system, nor the only one considering a cross border carbon tariff.

Our analysis on the impact of CBAM on the mining industry: