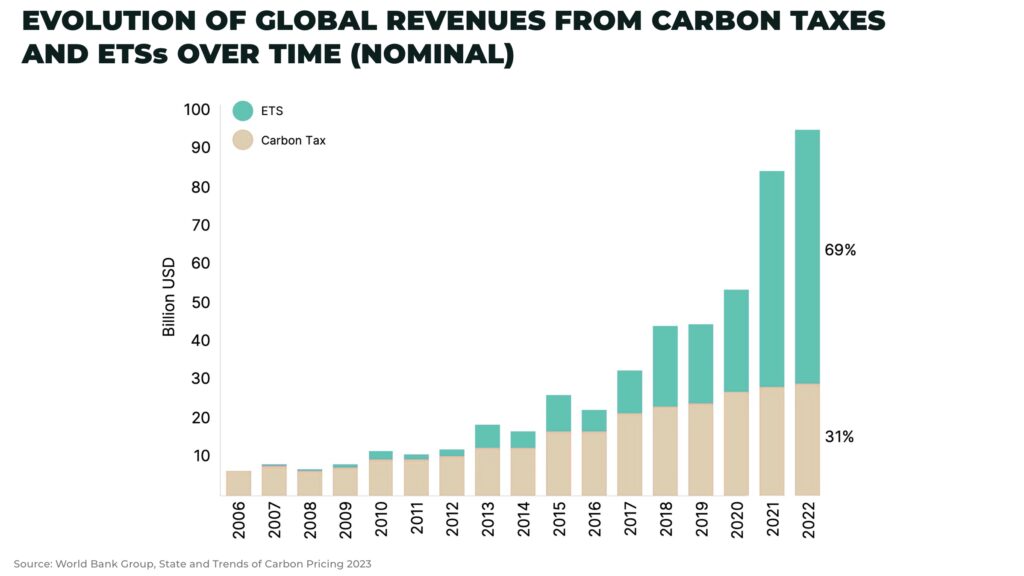

- global revenues from carbon taxes and emission trading systems worth over US$95 billion in 2022

- EU agreed their first cross border carbon tariff last year

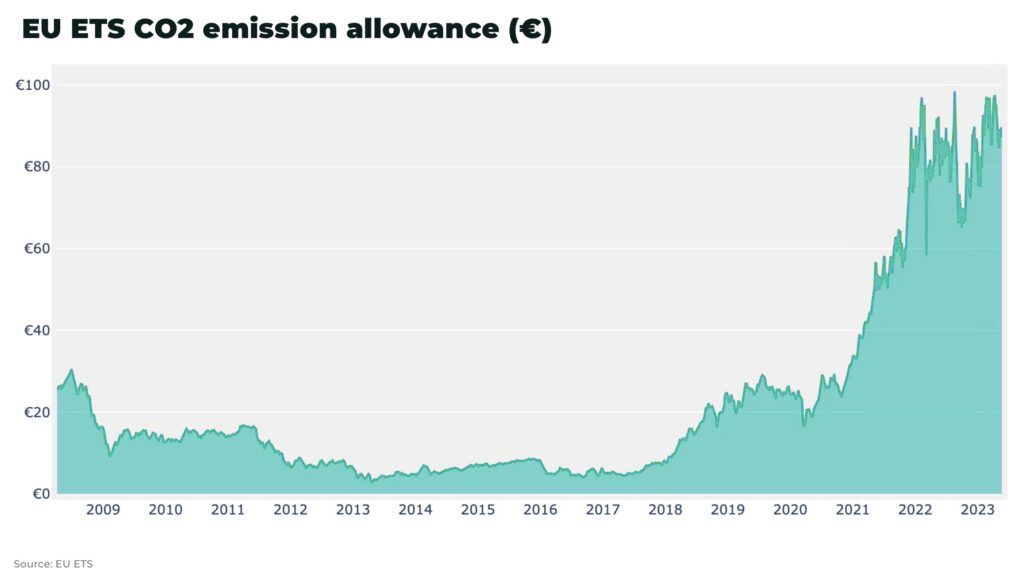

- the price of carbon permits hit €100 euros per tonne for the first time in 2023

- carbon tariffs may seem like they will take years to be enacted but, for mining and commodity investors, it is critical to begin positioning as soon as possible

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Global revenues from carbon taxes and emission trading systems were worth over US$95 billion, growing over 10%, in 2022.

At the moment, there’s a simple way to avoid these taxes: operate in a country with no carbon tax and more flexible environmental legislation, then export your goods to the countries with the higher taxes.

Governments, especially in the West, are now working to stop this (carbon and tax) leakage through international, cross border carbon tariffs.

This matters for investors in mining and commodities.

Carbon Pricing and CBAMs

Carbon pricing puts a cost on the emission of greenhouse gases as governments work to put downward financial pressure on carbon dioxide emitting industries to go green by either lowering their emissions or transform their operations.

(Read our introduction to mandatory and voluntary carbon credits)

International carbon pricing was kickstarted in 1997 with the Kyoto Protocol, and has now been further developed with Article 6 of the Paris Agreement, providing the foundation for cooperation over international carbon pricing.

The largest mandatory carbon pricing system in the world is the European Union’s Emission Trading System (ETS), a “cap and trade” platform, worth over US$600 billion in 2021. The system forces manufacturers, airlines and power companies to pay for each tonne of carbon dioxide they emit.

The ETS is a cornerstone of the EU’s plan to cut CO2 emissions by 55% by 2030 and be climate neutral by 2050.

This year, the price of carbon permits hit €100 euros per tonne for the first time.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Obviously this tax puts companies operating in the EU at a distinct disadvantage when competing against anyone not operating in the EU and paying this tax, but who are still able to export to the economic bloc.

A CBAM hopes to end any such advantage, as well as applying the idea of downward financial pressure internationally to force other countries to improve their environmental standards.

Europe’s CBAM

In December 2022, the EU agreed their first Carbon Border Adjustment Mechanism (CBAM) to “combat climate change and prevent carbon leakage.”

Companies importing into the EU will need to pay the difference, by purchasing certificates, between the carbon price in their country of production and the price of carbon allowances set in the EU’s ETS.

For now, the EU’s CBAM will cover six major industries: iron and steel, cement, aluminium, fertilizers, electricity and hydrogen. If successful, this would expand to all imports.

From October 2023, the mechanism will start a transitional phase, so importers will only be obligated to report their transactions without any financial payments. But from 2026-2034, financial payments will be phased in.

“The [CBAM] law will incentivize non-EU countries to increase their climate ambition and ensure that EU and global climate efforts are not undermined by production being relocated from the EU to countries with less ambitious policies”

— European Parliament

The European Commission’s impact assessment report suggests it could bring in over an additional US$9.5billion per year by 2030.

Trade war or climate protectionism

China has asked the EU to justify the incoming border tax at the WTO and India has announced they plan to file a complaint with the WTO against the tariffs.

We believe, regardless of the challenges, the EU’s CBAM will be enforced — as long as they successfully argue it is an environmental measure, not a trade protectionist measure.

(China’s Ministry of Commerce appears to agree after they released a paper saying the government and companies should also plan how to respond to the incoming changes as early as possible)

The question for investors is: what happens next?

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

For developed countries, particularly in the West, and low-carbon industries, CBAMs offer an opportunity:

- to stop carbon and financial leakage through taxes

- to leverage clean technology and investments to corner soaring demand for sustainable mining and commodities (for example, nickel’s environmental challenge offers an opportunity for the West)

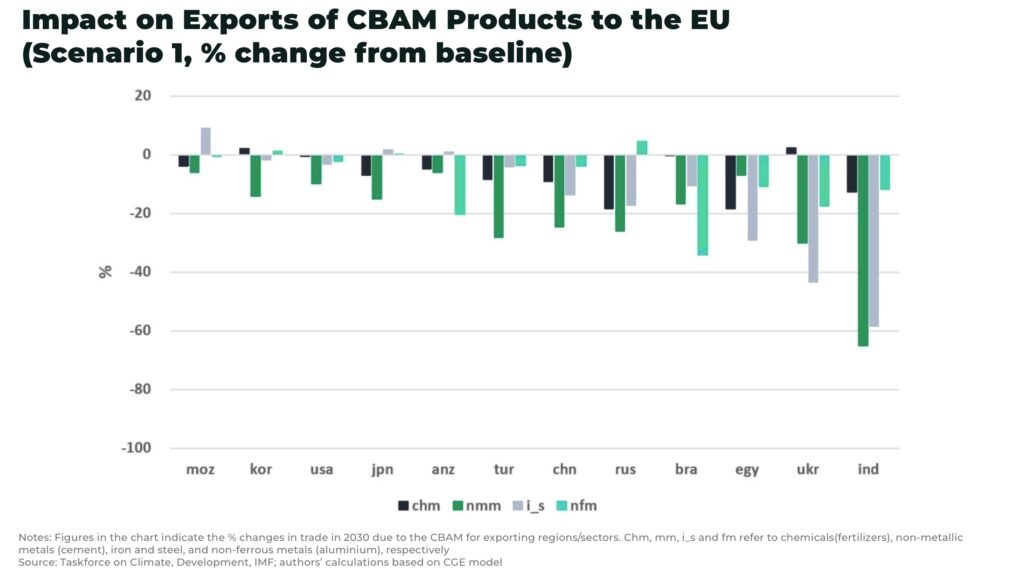

It is likely that developing countries will be impacted disproportionately, especially as the decarbonization of supply chains could take years.

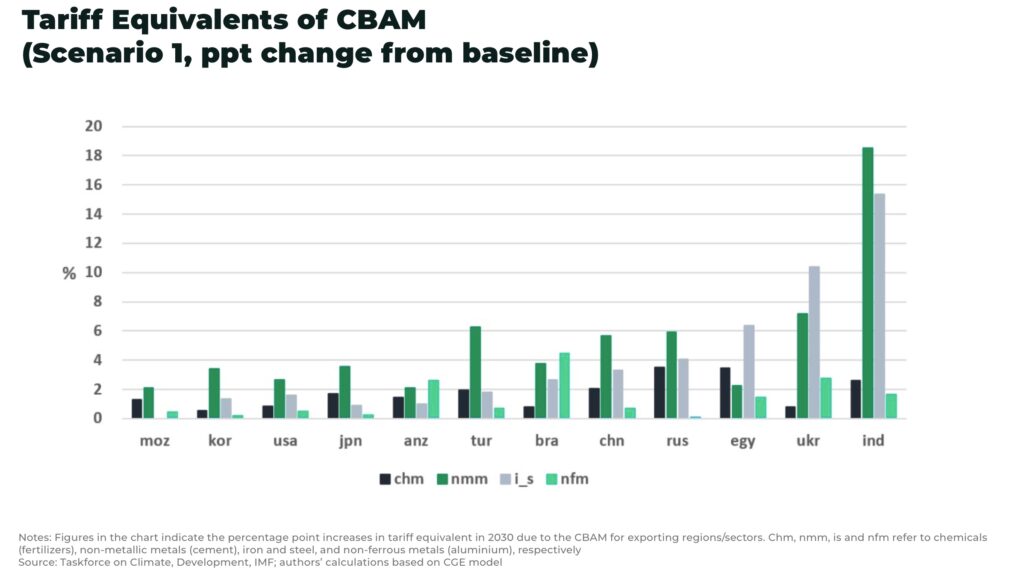

A Boston University study suggests countries that rely on carbon-intensive exports to the EU will be disproportionately impacted by the CBAM.

- tariff equivalents of CBAM on iron and steel exports from China, Russia and Brazil are between 3-4%, leading to falls of exports of up to 10%. Iron and steel exports from India are approx 15% leading to a fall in exports from India by as much as 58%

- costs in Ukraine, Egypt, Mozambique and Turkey could be as high as $5 billion. This is significant relative to their GDP

“At its broadest implementation, the CBAM could result in an annual welfare gain in developed countries of $141 billion, while developing countries see an annual welfare loss of $106 billion, compared to a baseline scenario”

— Boston University Global Development Policy Centre, The Global Impact of a Carbon Border Adjustment Mechanism: A Quantitative Assessment

The international response

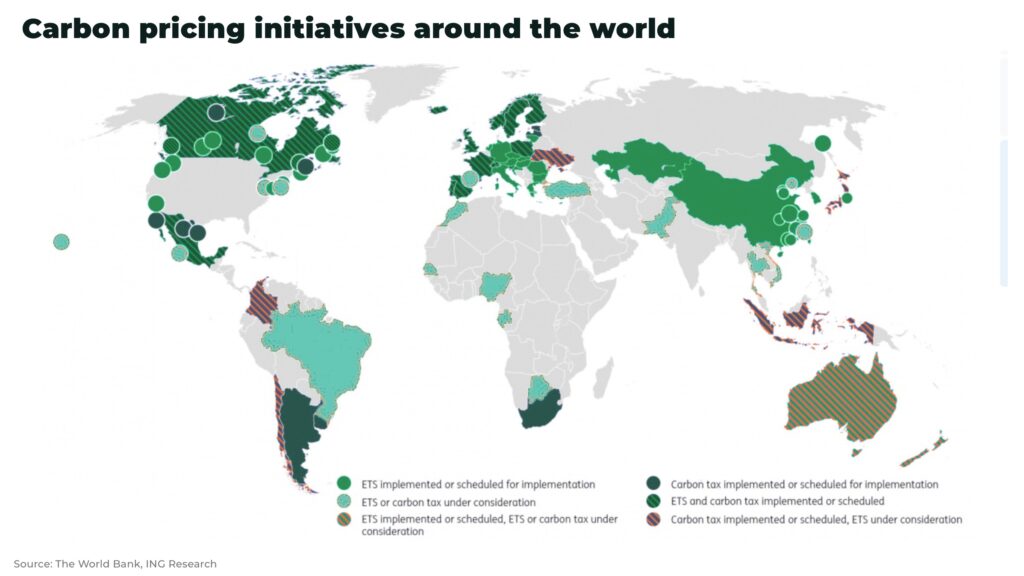

The EU is neither the only country with an emissions trading system, nor the only one considering a cross border carbon tariff:

- in America, there is increasing cross-party support for a “polluter import fee” (although both Republicans and Democrats have different reasons for the tax)

- Canada already has a cap and trade system with a legally binding schedule to increase carbon prices to CA$170/tonne by 2030. The government is already exploring how to set up it’s own border carbon adjustment (BCA) scheme

- the UK set up a consultation in March 2023 to explore potential policies, including a CBAM, mandatory product standards (MPS), or other policy measures

- Japan is also considering a carbon border tax

- China is likely to accelerate the expansion of its national compliance emission trading scheme (ETS) in the next 2-3 years to cover sectors eligible under the EU’s cross-border adjustment mechanism or CBAM, mainly cement, aluminum and iron and steel, according to exchange officials and market participants

- Japan, South Korea and South Africa are also implementing their own internal carbon pricing mechanisms, paving the way for cross border tariffs

We suspect this is only the beginning.

After the EU’s CBAM is enforced and, if even only moderately successful (the CBAM could bring in additional revenue of more than $9 billion per year by 2030), others will quickly gain momentum.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Indirect cross border carbon taxes

Each cross border carbon tariff will vary according to how each country implements it, from legislation to enforcement, eg whether countries focus on environmental protection or domestic industries.

We expect international agreements to temper the more economic protectionist measures that may be introduced.

We also expect cross border carbon tariffs to develop, not necessarily as direct taxes, but indirect instruments. For example, individual agreements between countries that provide tax breaks, or “friend-shoring”. eg the latest agreement between the US and Australia over critical minerals trade, or the US-EU bi-lateral agreement over steel and aluminium with a focus on low carbon production.

Cooperation or competition

One big question mark remains over the future of cross border carbon tariffs: will the future of international carbon tariffs be one of international cooperation or competition?

We hope the future is one that supports international trade, but suggest investors prepare — not necessarily for a worst case scenario of ever-increasing trade barriers, but — for a more complex system.

How should investors prepare?

The introduction of carbon tariffs may seem like they will take years to be enacted — the EU’s CBAM comes into force in 2026 — but, especially for mining and commodity investors, it is critical to begin positioning as soon as possible.

The reason: mines and processing industries can take between 10-20 years to develop, by which time, cross border carbon tariffs may have a very significant impact on returns.

Mining and commodity investors can prepare for and respond to carbon tariffs in a number of ways. These include:

- Investing in companies that are reducing their carbon emissions: Investors can invest in companies that are making efforts to reduce their carbon emissions, such as by investing in renewable energy, clean tech and energy efficiency. It may seem more costly in the short-term, but will be critical in the long-term

- Investing in companies that are located in countries with trade facilitative cross carbon border agreements: both America and China will likely be at the centre of any competing tariff agreements

- Investing in companies that are located in countries with low carbon emissions: Investors can invest in companies that are located in countries with low carbon emissions

- Diversifying investments: Investors can spread their investments across a variety of industries and regions to mitigate the impact of any cross border carbon tariffs that may be implemented in the future

Carbon tariffs are a complex issue with a number of potential impacts on mining and commodity investors. Investors who are considering investing in commodities should carefully consider the impact of the tariffs on their portfolios, and should be prepared for the possibility of significant changes in the prices of commodities in the future.

Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.