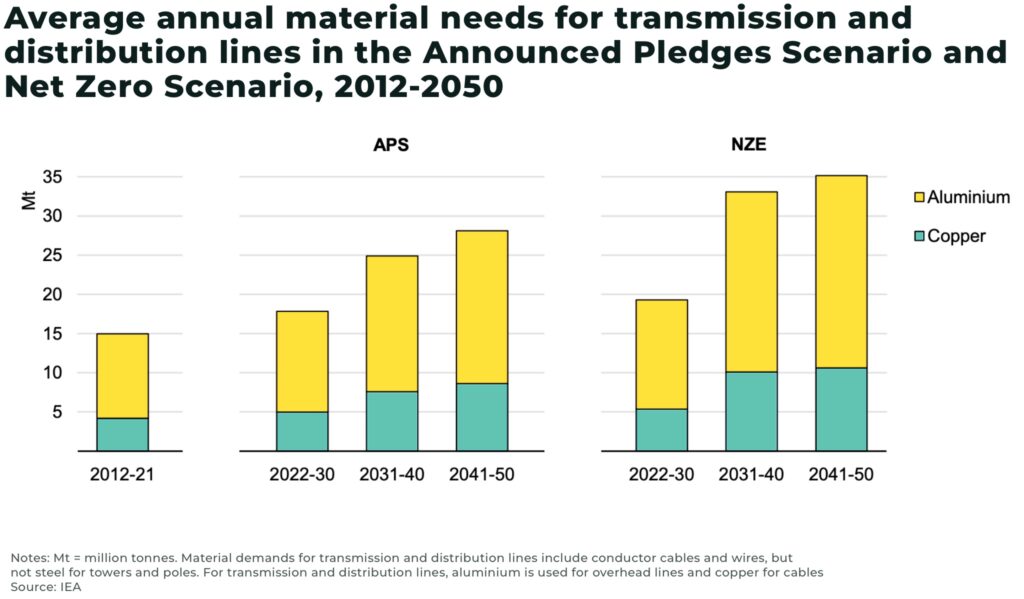

Demand for copper and aluminium for use to expand national electricity grids across the world will need to more than double to meet net-zero targets, according to a new report by the IEA.

- in the announced pledges scenario, from 2041-2050, the average annual copper demand increases to 9 Mt/year and aluminium to 21 Mt/year

- in the IEA’s net zero emissions scenario, from 2041-2050, demand reaches 12 Mt/year for copper and almost 27 Mt/year for aluminium in 2041-2050

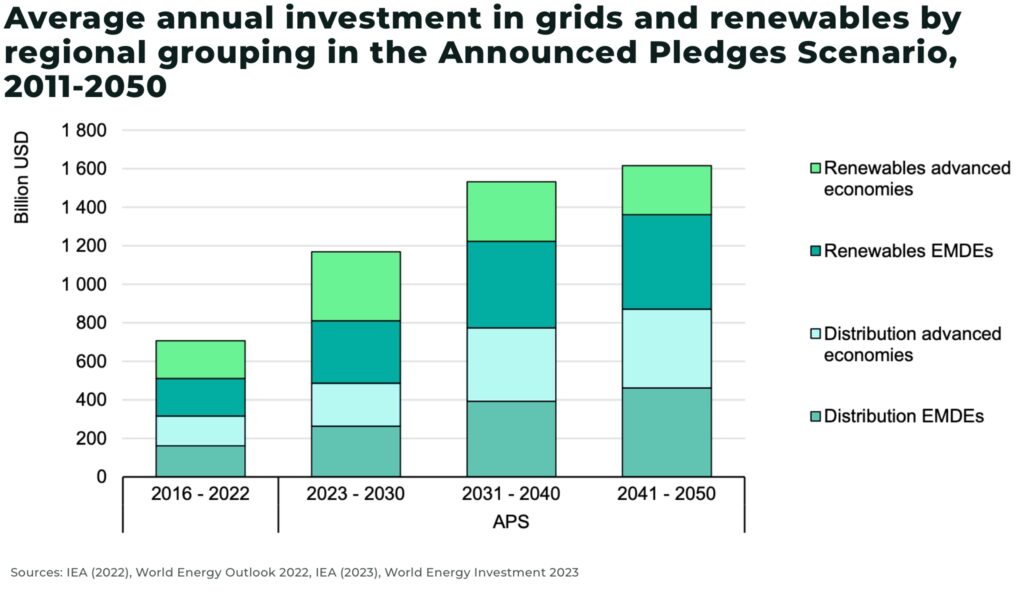

To meet global net zero targets will mean electricity use will need to grow 20% faster in the next 10 years than the previous decade, according to the IEA, to meet national energy and climate goals through electric vehicles, electrolysis for hydrogen production, heat pumps, and more. By 2040, it’s estimated more than 80 million km of electricity grid will need to be added or refurbished — the equivalent of the entire existing global grid.

The challenge is increasing supply to meet the expected demand, with significant investment is required for the opening of a new mine, which on average takes 17 years from discovery to production.

“The availability of materials, manufacturing capacity and technical constraints are already causing some tightness in today’s supply chains. In the future, given the growth in clean energy technologies and infrastructure, the availability of materials and manufacturing capacity is expected to become a significant challenge for supply chains.”

— IEA, Electricity Grids and Secure Energy Transitions

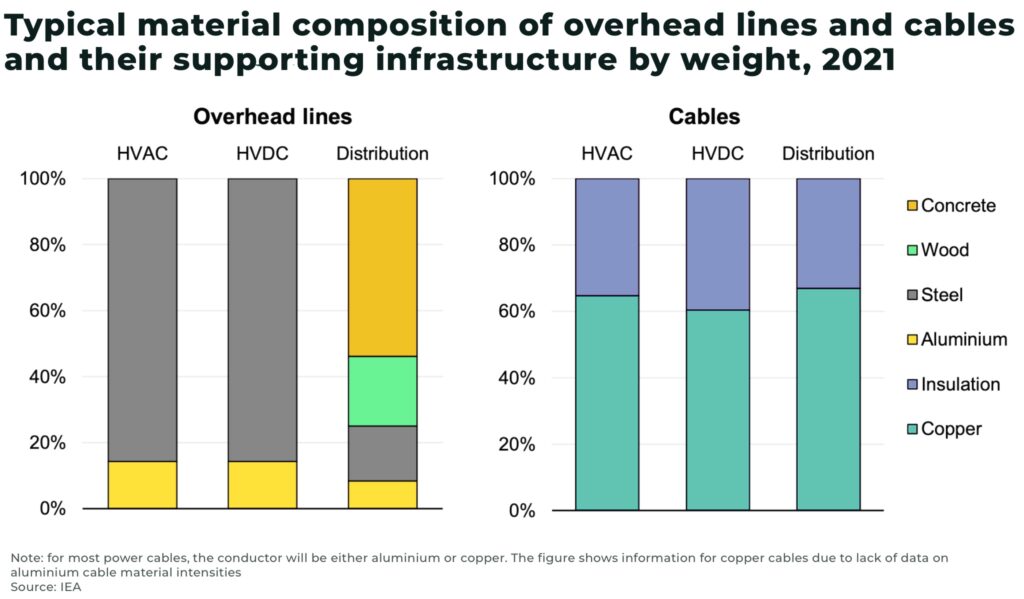

Copper and aluminium are essential for use and expansion in transmission lines, distribution grids and transformers.

Our analysis on what will be needed to expand the electricity grid to meet net-zero targets: