- global electricity grid needs to double in size by 2050 to meet net-zero targets

- cost to upgrade grid to meet targets will be US$21 trillion

- 427MT of copper will be needed by 2050, more than 8x as much as wind turbines, solar panels and energy storage combined

A 152 million km global electricity grid is needed to meet net-zero targets by 2050 — double the size of grid today. To put in perspective, this is the distance from earth to the sun.

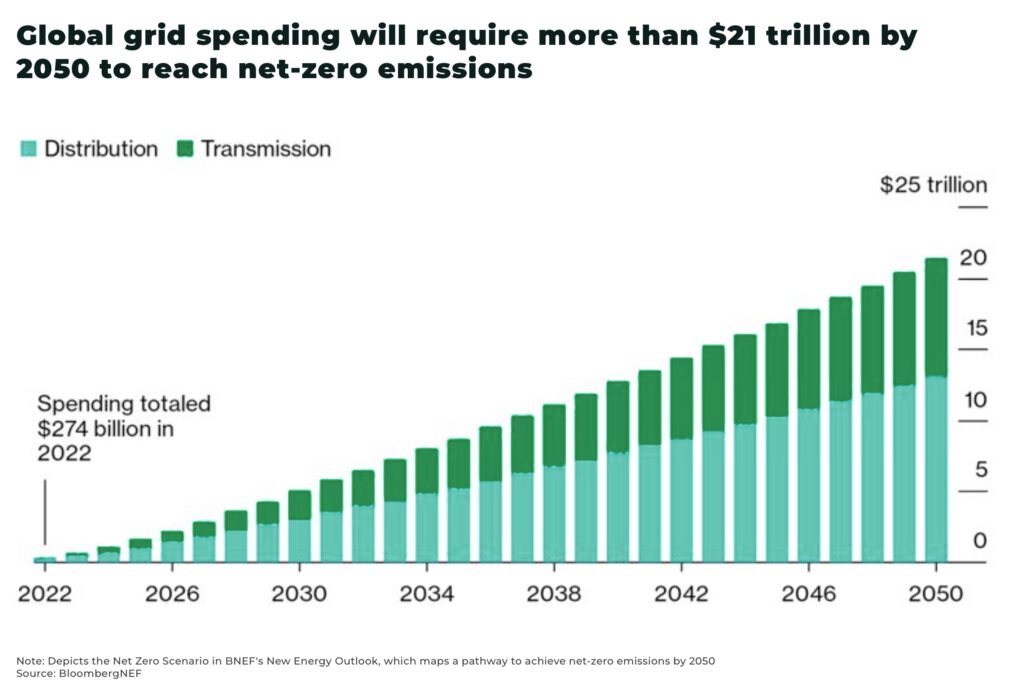

To meet this target, US$21 trillion will need to be spent, with annual investment increasing from US$274 billion in 2022 to US$1 trillion by 2050. This year, global annual spending is expected to increase to US$300 billion.

There are plenty of debates over what type of energy should be used to power the clean energy revolution — all of them will need an expanded grid.

For commodity investors this means an enormous amount of raw materials, especially copper and aluminium.

The importance of electricity grids

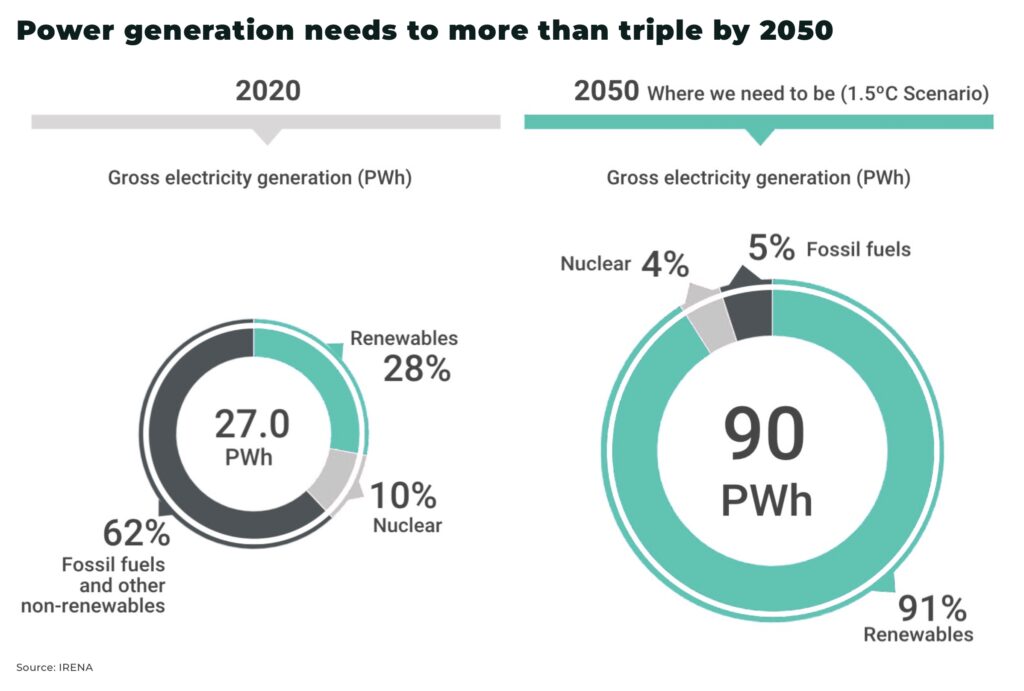

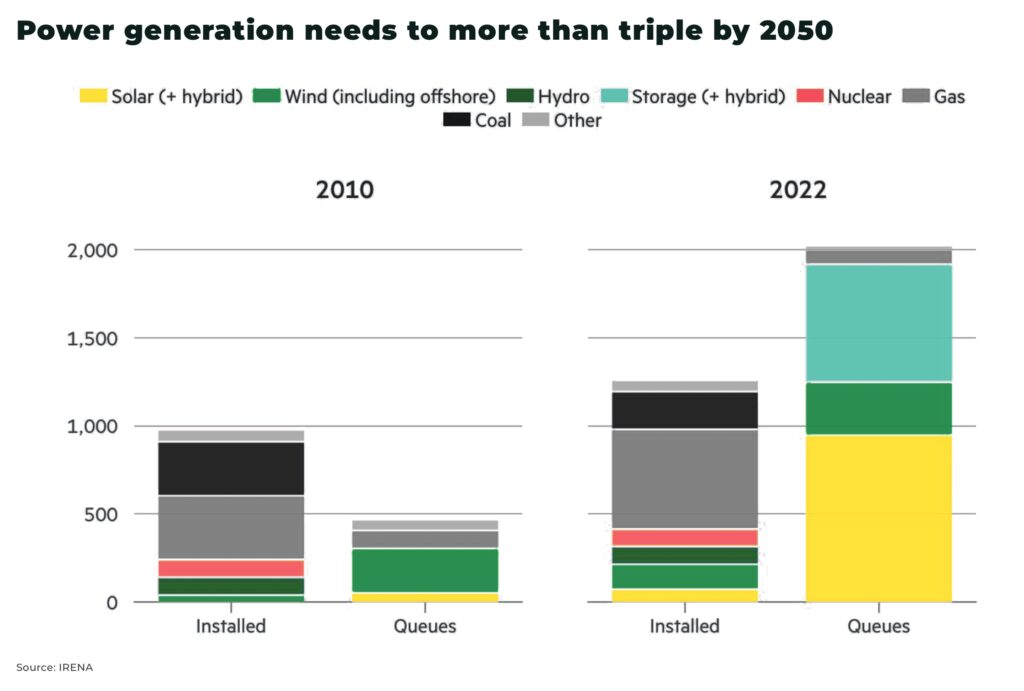

As the world focuses on electrifying their energy needs to reduce dependence on fossil fuels, such as oil and gas, power generation will need to triple by 2050.

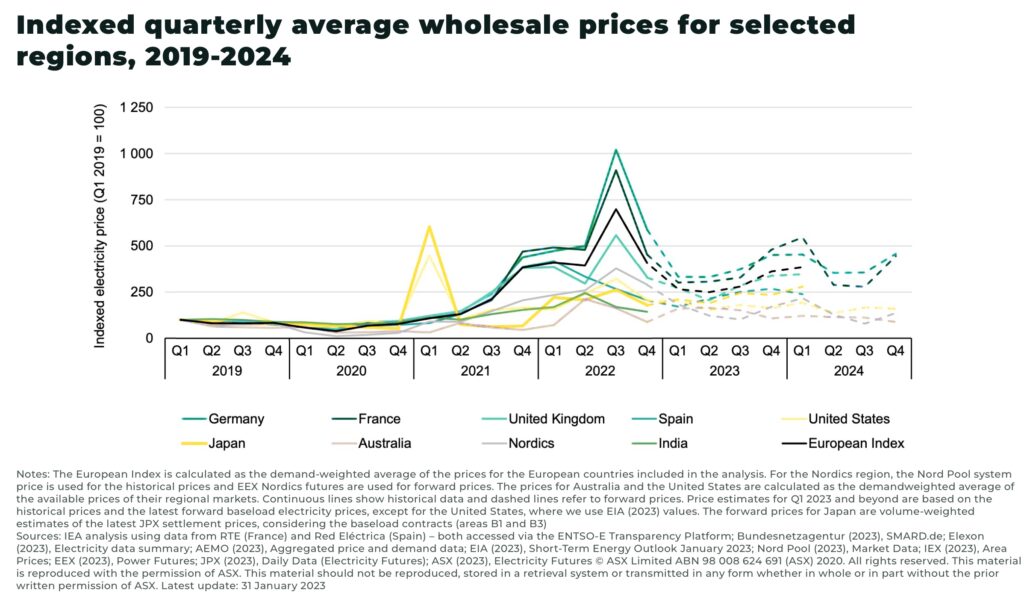

For example, after Russia’s invasion of Ukraine increased global natural gas prices, in the US, average wholesale price in H2 2022 cost approximately US$91/MWh, more than double the H2 2019-2021 average, and 65% higher than the price in H2 2021.

In the EU, high prices have led to significant industrial demand destruction, with electricity consumption recording a “sharp” 3.5% decline year-on-year.

Much of the focus has been on generating this electricity with renewable energy. For example, as we’ve highlighted, trillion-dollar legislative plans across the US and Europe are supercharging the energy transition.

“Power grids are among the unsung heroes of the energy transition, but they need massive investment. While much attention goes to solar panels and electric vehicles, it is grids that connect everything together. By digitalising our grids, our power systems become more reliable and secure, and our utilities can better manage the balance of electricity supply and demand. The longer we wait to upgrade and digitalise our grids, the more expensive it will get”

— Faith Birol, Executive Director, IEA

However, it’s essential to connect this massive new electricity generation to industry, consumers, electric vehicles, battery storage, etc

The overhauled grid will also need to shift from the centralized, one-way model of large power plants, to a decentralized model of intermittent, smaller-scale renewable energy projects, as well as the resiliency from extreme weather events.

And it’s already an urgent problem.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

In the US, an estimated 2,000GW of solar, wind and energy storage projects are in a queue to connect to transmission grids — more than the installed capacity of the US power plant fleet. Connection requests increased 40% in 2022.

In the UK, Spain and Italy more than 150GW of wind and solar projects are stuck in a bottleneck of projects queuing to connect to the electricity grid.

Plans to electrify the grids

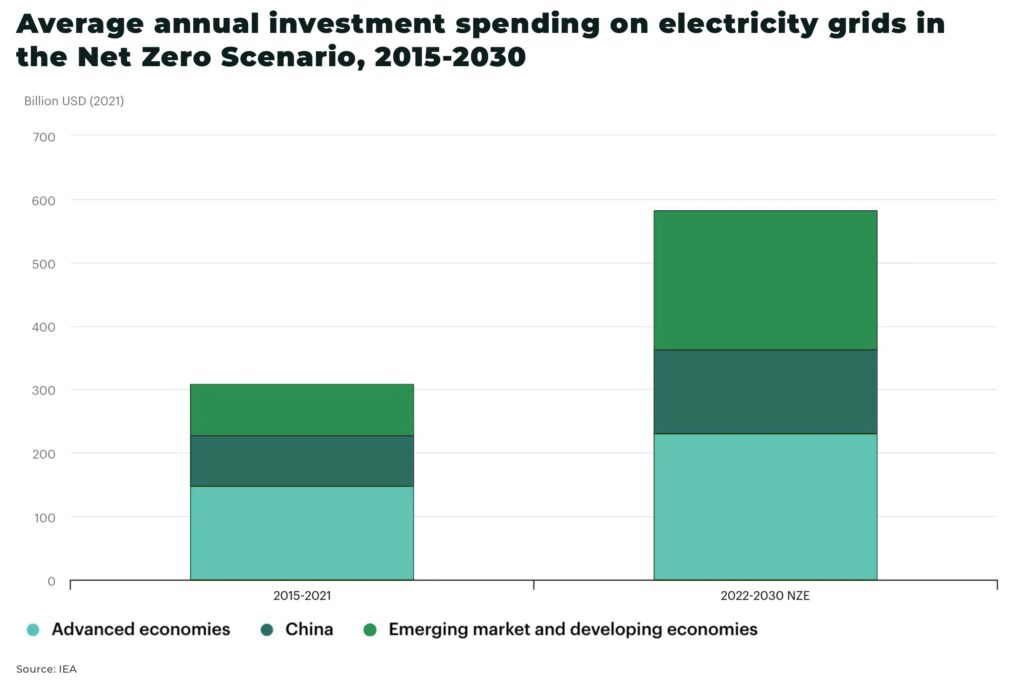

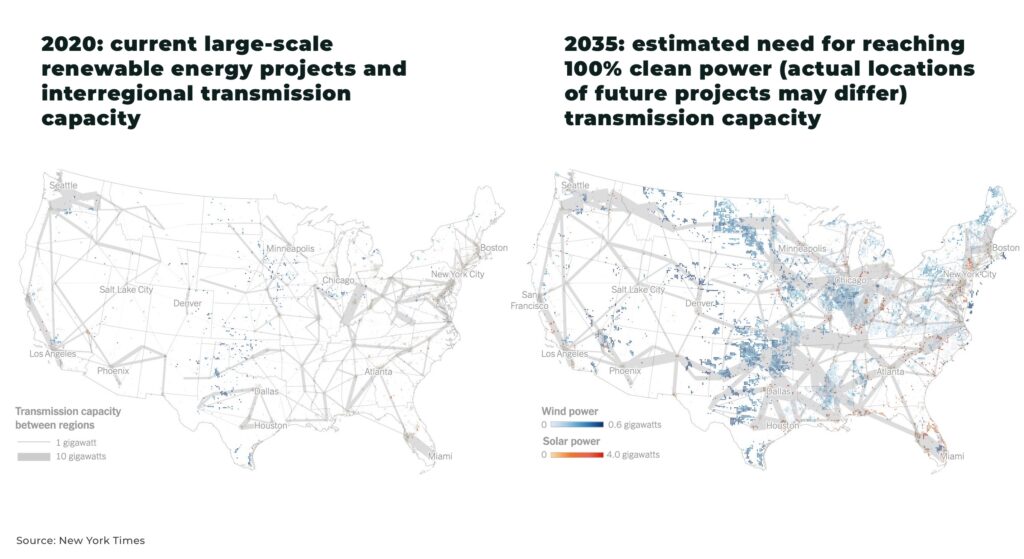

Prioritized build out of new grids will be uneven, initially it will be concentrated in North America, Europe, China and India. BloombergNEF estimates the US and China will account for more than 33% of the total investment.

But, planning, permitting and construction of new projects can take years.

For example, in the US, approximately 70% of lines are over 25 years old, and 30% over 50 years, while, according to one Princeton study, the country’s electricity transmission lines will need to expand 60% by 2030.

“Achieving this objective would require a mind-boggling acceleration of the typical ten-year capital project timeline. It is, arguably, a century of work to do in less than a decade”

— McKinsey & Company, Upgrade the grid: Speed is of the essence in the energy transition

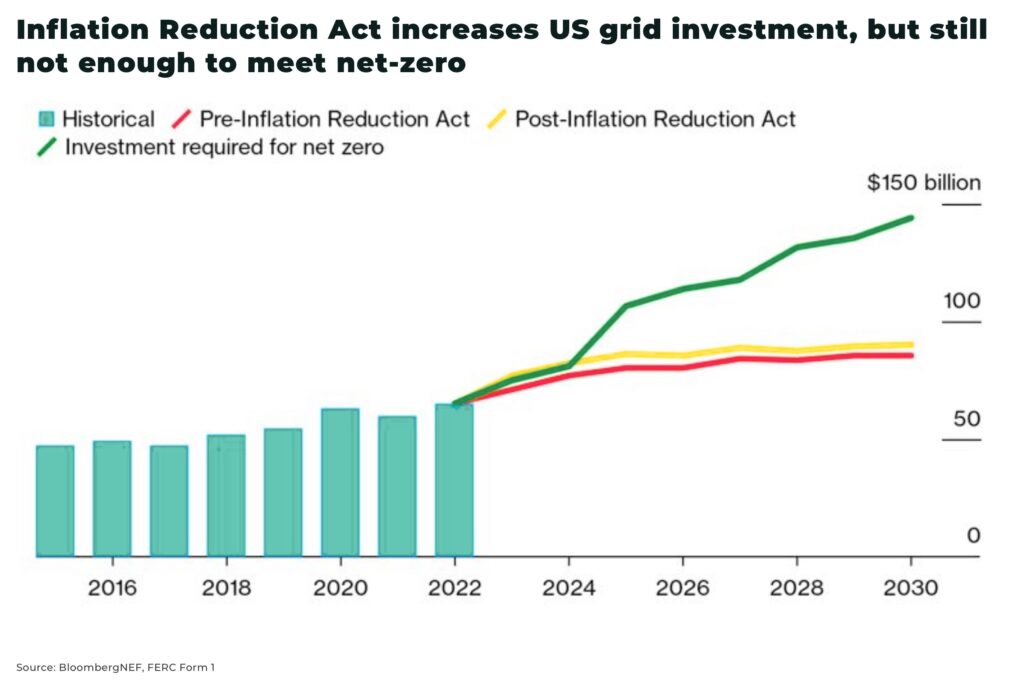

Over 80% of the potential emissions reductions delivered by President Biden’s Inflation Reduction Act are lost if transmission expansion is constrained to 1% per year, and roughly 25% are lost if growth is limited to 1.5% per year.

Government investment

But momentum and investment is quickly building.

In the US, the recent Infrastructure Investment and Jobs Act and Inflation Reduction Act allocate US$29 billion towards initiatives related to the grid. BloombergNEF estimates this to stimulate US$89 billion of extra grid investment by 2030.

Other countries are rolling out similar plans.

For example, in the UK, the National Grid has launched its first overhaul of the grid in decades, with more than US$20 billion to be invested by April 2026, as well as reform of the planning system.

The EU estimates more than US$635 billion will be required between 2020-2030 to ensure a resilient energy system.

Metals

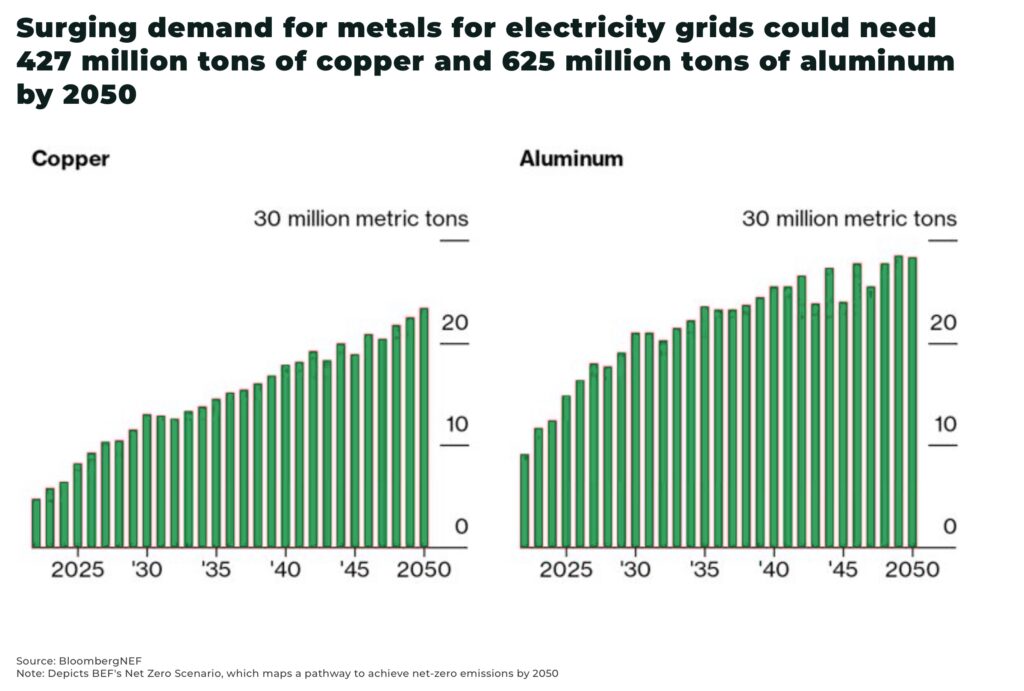

The scale of this historical expansion of national electricity grids will require an enormous amount of minerals and metals.

Two metals, in particular: copper and aluminium, for the wires and cables.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Copper

Copper has the highest electrical conductivity rating of all non-precious metals.

To provide a range on current estimates of copper supply needed to reach net-zero targets:

- BloombergNEF estimates approximately 427MT of copper will be needed by 2050, accounting for more than a third of global copper demand by mid-century — more than 8x as much as wind turbines, solar panels and energy storage combined

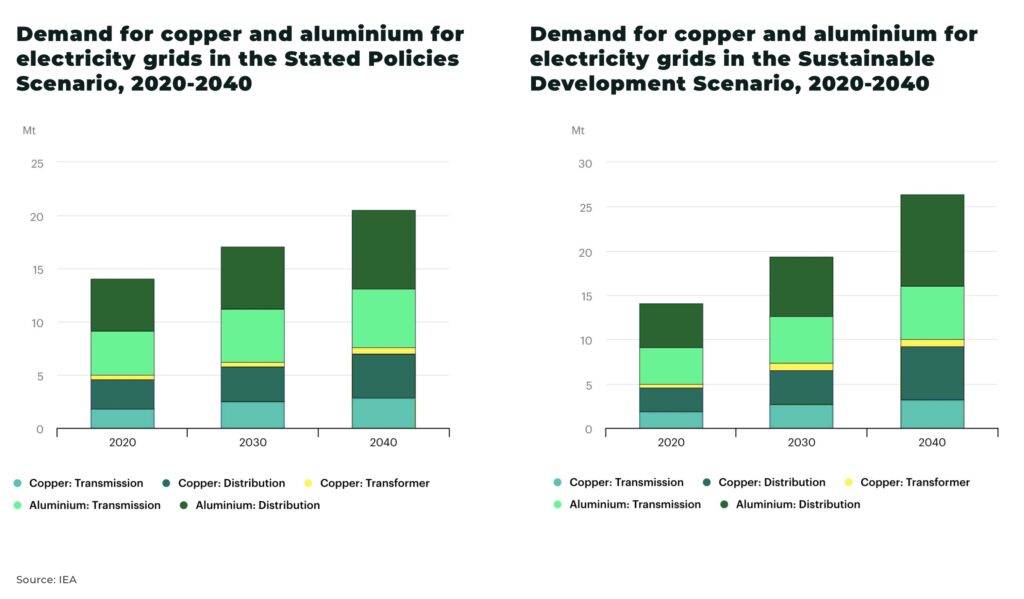

- the IEA’s Sustainable Development Scenario estimates annual copper demand for electricity grids is forecast to double from 5MT in 2020 to 10MT by 2040

However, copper is over 3x heavier by weight than aluminium and more expensive (after adjusting for connectivity).

Aluminium

Lighter and cheaper than copper, aluminium is often used for overhead cables.

- the IEA estimates demand for aluminium could also increase from 9MT in 2020 to 16MT by 2040, in a Sustainable Development Scenario

Concerns over NIMBY’ism (Not-In-My-Backyard) and extreme weather will likely mean much of the grid expansion will be placed underground. Currently this means more copper, but one option to reduce development costs would be to switch to aluminium. Such a switch could reduce copper demand by 3.6MT in 2040, and raise aluminium demand by 5.8MT.

New technology

There are a variety of technological developments that will impact the scale demand.

For example, advanced conductors (eg carbon or ceramic fibres covered in a aluminium wrapper) are more expensive but more efficient; China is using direct current (DC) transmission lines, which used less metals, to connect remote regions; and smart grids will help support a more efficient national grid by monitoring supply and demand, and adjusting energy sources appropriately.

However, these efficiency gains will only be marginal. Ultimately, a significant amount of copper and aluminium will be needed.

Supply

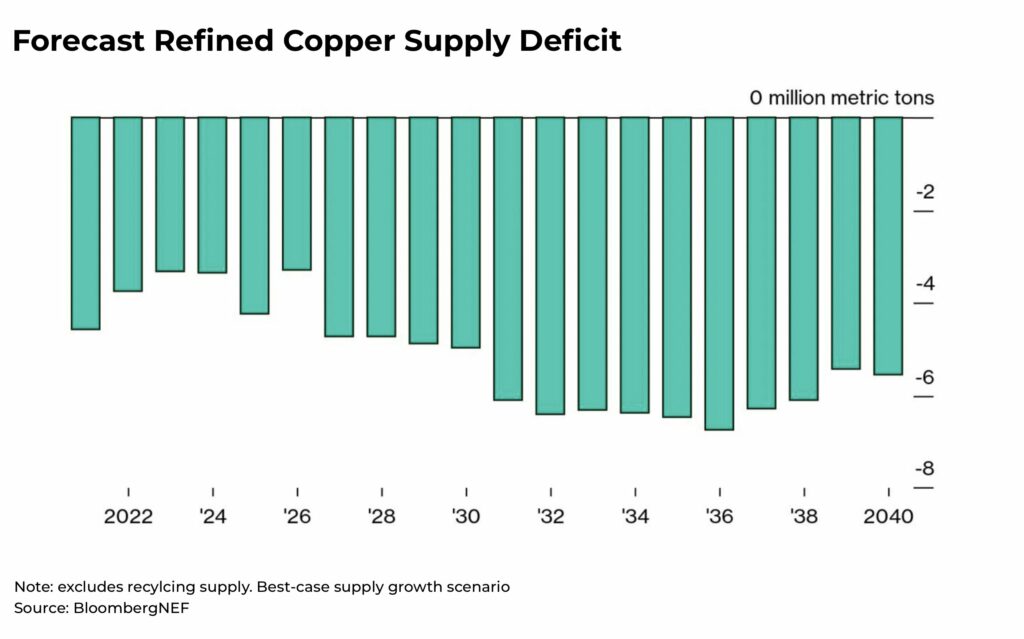

The challenge, as we outlined in our analysis: copper demand set to electrify prices and aluminium supply shutting down as demand set to rise — supply is tightening, not expanding.

By 2035, the copper supply shortfall could be as much as 9.9MMt, 20% less than what is needed to meet global 2050 net-zero goals. To put this figure in context, the biggest shortfall between 1994-2020 was 2.5%.

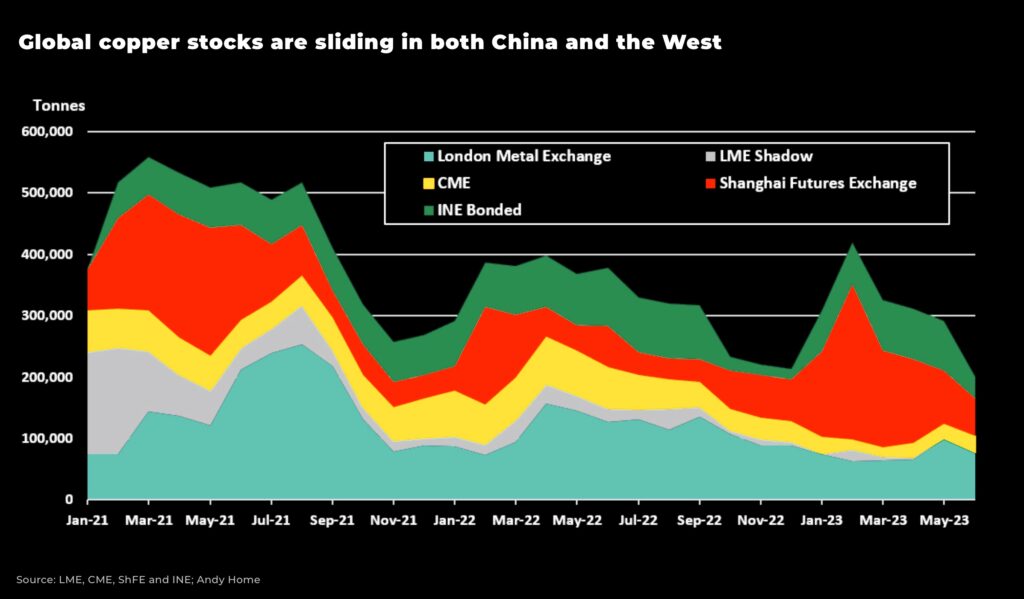

And the problems are already acute, with LME copper stocks falling from 100,100 tonnes to 77,050 over the last three weeks despite almost 30,000 tonnes of arrivals. Available tonnage stands at just 31,900 tonnes, enough to supply the global market for around 11 hours.

European Aluminium expects a “staggering loss” of 50% of the region’s primary aluminium production capacity as energy costs rise on the continent. Production in Europe is already at it’s lowest levels since the 1970s and may well get worse as energy costs rise over winter.

Conclusion

Global efforts to reach net-zero present an historic opportunity for commodity investors.

To find exposure, options for investing include:

- copper or aluminium ETFs

- directly in copper and aluminium mining companies

- companies that support the development of transmission lines and grid expansion

- invest in utility companies which, although they will need to invest in sufficient and secure commodity supply, they will also be the beneficiaries of government support and increased energy usage

Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.