Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

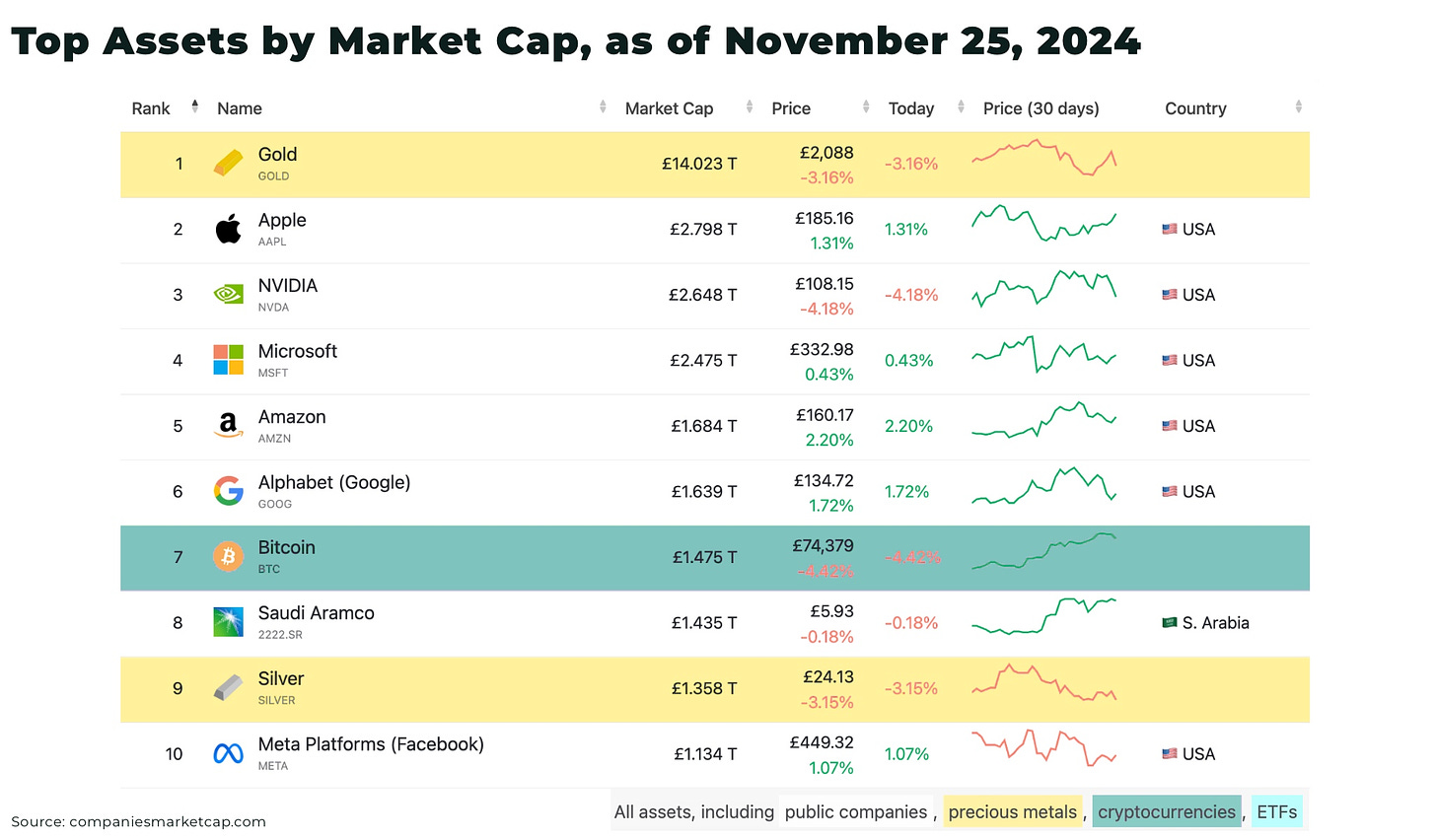

Bitcoin’s market capitalization hit a staggering US$1.776 trillion as of November 15, 2024, surpassing the value of oil giant Saudi Aramco and silver.

Many commodities would beg for such valuations — but, what if crypto was a commodity, a commodity from the future.

Crypto represents a potential digital revolution, turning bits and electrons into assets as significant as oil or gold. However, its status as a commodity remains controversial— is it a groundbreaking innovation or merely a speculative collectible dependent on technology with limited practical use?

Thanks for reading The Oregon Group. Subscribe for free to receive new posts and support our work.

Is crypto a commodity?

Firstly, we hear you say, commodities are either grown or mined. Well, crypto must be mined — except, this time, with complex algorithms rather than drill bits.

On March 26, 2024, the Commodity Futures Trading Commission (CFTC) declared Bitcoin, Ethereum, and Litecoin as commodities in a complaint against the cryptocurrency exchange KuCoin.

The reasons why crypto can be classified as a commodity include:

- fungibility: cryptocurrencies are interchangeable, each unit is identical to every other unit, similar to “traditional” commodities like gold or wheat, where one ounce or bushel is interchangeable with another

- scarcity: limited supply is programmatically enforced in crypto, mimicking the natural scarcity of physical commodities, as well as the cost of production (energy) and store of value

- decentralization: many cryptocurrencies operate on networks without a central issuing authority, much like commodities which are not produced by a centralized entity but instead are mined or grown by independent actors

- lack of legal obligations: the value of crypto comes from utility or speculation, unlike securities, which often represent an investment in a company with expectations of dividends or capital gains

- global trade and liquidity: crypto can be traded globally with high liquidity and futures contracts, similar to how commodities operate in global markets, as well as being able to serve as a medium of exchange or store of value

- use cases: some crypto tokens are designed for specific uses, similar to commodities used in industry or commerce; for example, tokens might be tied to real-world assets or utilities, functioning much like commodities in trade

The three main uses cases of crypto are as token using blockchain technology, crypto currencies as payment methods, or as tokens representing physical commodities.

George Selgin, a prominent economist, argues Bitcoin represents a synthetic commodity money.

“What I argued was that what we have here in principle is the possibility of designing a synthetic commodity that combines the advantages of fiat money, or some of them, with the advantages of commodity money”

— George Selgin, director emeritus of the Cato Institute’s Center for Monetary and Financial Alternatives

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US

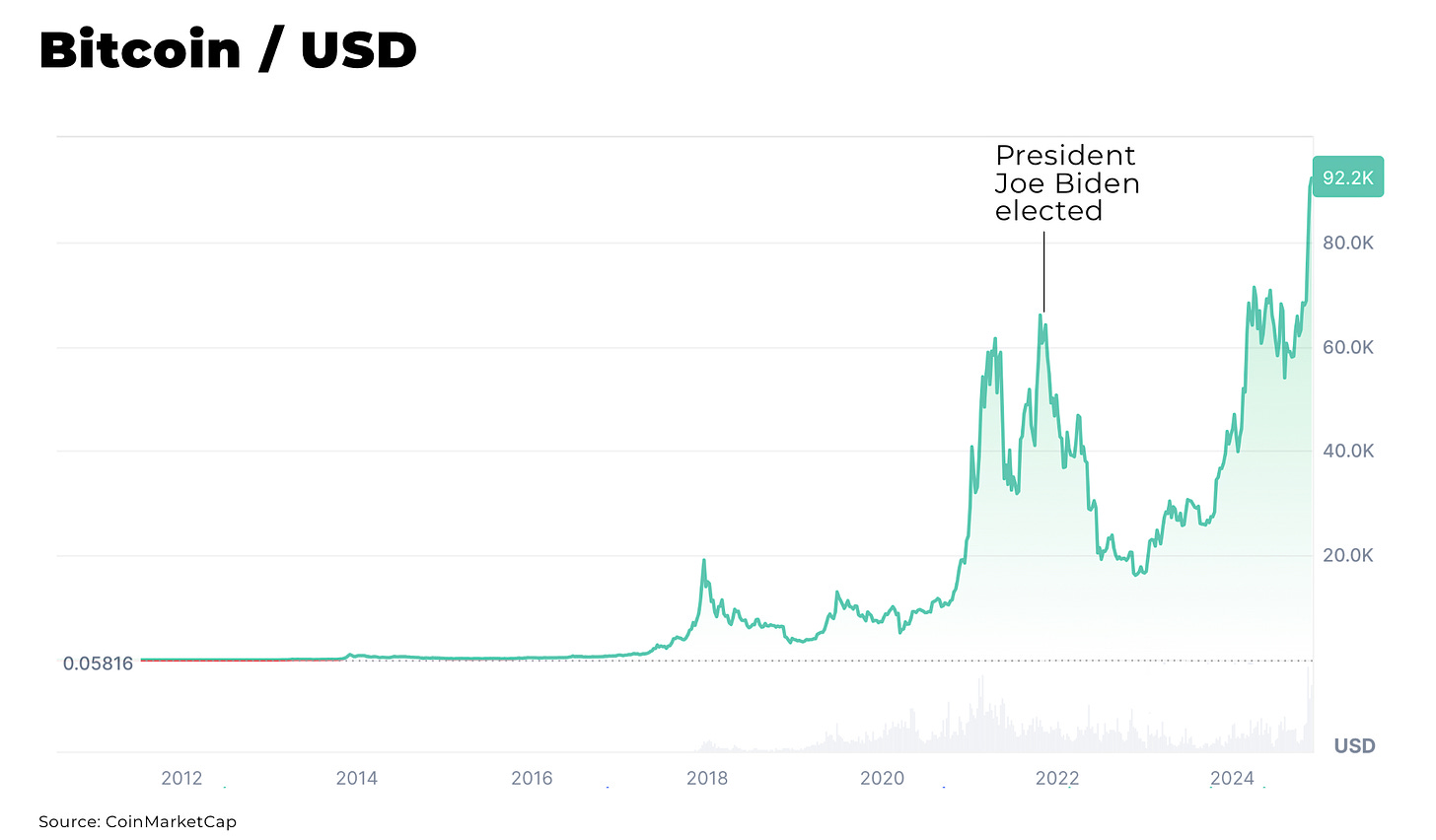

Bitcoin was created in 2009 but from 2021 to early 2024, Bitcoin saw a significant dip and volatility in price. It’s a similar story across the industry.

Governments across the world have been reluctant to embrace the technology, in particular because they are decentralized, cannot be controlled, and threatens to undermine government monetary policy and national currencies — in particular, the dollar.

The US, under Biden, vetoed legislation that passed Congress and the Senate that would allow banks and other financial entities to securely hold digital assets, integrating Bitcoin into the official financial system.

So, what’s changed?

With the re-election of Donald Trump in 2024, the landscape for crypto has undergone a seismic shift with the pledge to establish a national strategic crypto stockpile and proposed creating a Bitcoin and Crypto Presidential Advisory Council.

“If I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future”

— President Donald Trump said at the Nashville Bitcoin Conference in July, 2024

Trump’s supporters also include crypto supporters such as Elon Musk, Robert F. Kennedy Jr, as well as supporters such as Marc Andreessen.

Howard Lutnick, CEO of Cantor Fitzgerald and an outspoken crypto advocate, has been appointed head of the US Department of Commerce. There are even reports that Trump’s team is considering creating a post dedicated to cryptocurrency policy.

All of this after Gary Gensler, chair of the US Securities and Exchange Commission and critic of alleged non-compliance and risky practices in the digital-asset sector most often regarded as securities, has announced he will now step down.

And it’s not just the US.

Thanks for reading The Oregon Group. Subscribe for free to receive new posts and support our work.

Global adoption

Several countries have already begun treating crypto as currencies and commodities:

El Salvador, made Bitcoin legal tender in 2021

United Arab Emirates, established a comprehensive regulatory framework for crypto assets in 2024

Switzerland, recognized cryptocurrencies as assets and implemented clear regulations in 2021

The EU, working to regulate cryptocurrencies through the Markets in Crypto-assets Regulation (MiCA), which aims to create a comprehensive framework for crypto-assets across EU member states, in a manner similar to how traditional financial instruments and commodities are regulated

Potential uses of crypto as a commodity

Crypto is still in its infancy across technology, regulatory frameworks and market acceptance, but there are already many ways tokens can be used as commodities, including:

- store of value: similar to gold, cryptocurrencies can be used as a store of value

- stablecoins: cryptocurrencies pegged to commodities (eg gold-backed stablecoins) can provide a digital representation of physical assets

- medium of exchange: cryptocurrencies can be traded on commodity exchanges, similar to traditional commodities like gold or oil

- hedging instrument: crypto is used as risk management and hedge against currency fluctuations or market volatility

- energy trading: some cryptocurrencies are being explored for use in energy markets; for example, allowing for peer-to-peer trading of carbon credits

- supply chain tracking: crypto tokens can represent physical commodities in supply chains, to help provide traceability and transparency

- tokenized traditional assets: crypto tokens can represent ownership of real-world commodities; for example, precious metals, real estate, or agricultural products.

- cross-border payments: as a digital commodity, crypto can potentially facilitate faster and potentially cheaper international transactions

- derivatives market: crypto-based futures, options, and other derivatives can be traded, similar to traditional commodity derivatives

- contract execution: to automate and execute commodity-related contracts and agreements

- commodity-backed tokens: creating tokens that represent ownership of physical commodities on the blockchain

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Crypto challenges

We warn, however, this technology is still in its infancy, and the path to establishing crypto as a globally recognized commodity faces significant challenges, in particular:

- energy consumption, with global energy demand for mining already accounting for 1% of the world’s electricity demand, equivalent to Australia

(although note, this energy-value relationship further supports the idea of crypto as a commodity, where production costs directly influence market value) - environmental concerns, with its huge energy demands, US cryptocurrency operations are estimated to emit up to 50 million tons of CO2 annually, comparable to emissions from the US railroad industry

- regulatory restrictions, due to the strain on national electricity grids and net zero targets, as well as its potential to compete with national currencies (and criminal use), means some countries have banned mining and transactions — including China

Crypto and critical minerals

And, as our recent report on AI and crypto highlights — Artificial Intelligence and the next Critical Mineral SuperCycle — increased energy demand is set to spark a 10-year critical mineral supercycle as the massive energy needs of new AI data centers will increase pressure on global supply chains already under strain to meet global net-zero targets.

This would impact a range of minerals from uranium to tin, copper to rare earths.

Conclusion

Crypto has not yet made the jump to replace the use cases supplied by fiat currencies and “traditional” commodities — and still remains a highly speculative asset — however, that speculation also includes the potential to drive innovation and reshape commodity markets.

As we have written about previously, we do not think the dollar is about to lose its place as the global reserve currency anytime in the near future. But, with the election of Donald Trump, we expect the US to start to take the global lead in developing regulatory environment, market confidence, and innovation around crypto.

The great experiment in a new commodity is underway.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.