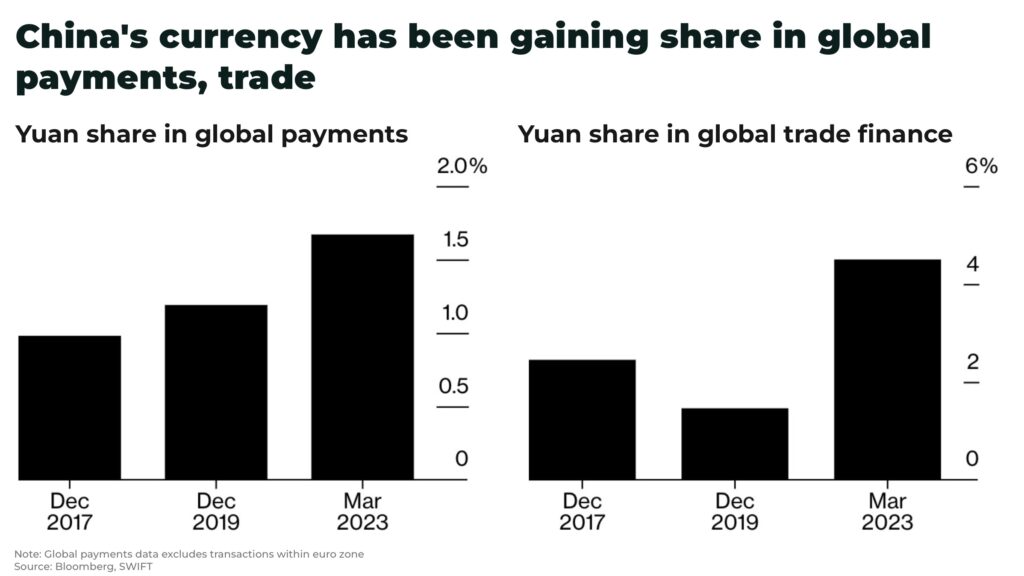

- the yuan’s share by value of global trade finance increased from less than 2% in February 2022 to 4.5% in February 2023

- while still small, “de-dollarization” could have an increasingly outsized impact on commodities

- or, is the global economy about to go enter a stage of re-dollarization?

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Is the dollar about to lose it’s place as the global reserve currency?

No.

But that does not mean some countries are working to set up an alternative — and that can have some real world consequences which commodity investors need to be aware of.

But, let’s back up a moment, why do some analysts suggest we could be entering a new financial era, why we disagree, and why the argument still matters.

What is de-dollarization

So-called “de-dollarization” is the reduction of reliance by economies on the US dollar as a global currency. It’s an argument that has come and gone in cycles over the past 40 years, but recently gained new traction after the invasion of Russia and subsequent sanctions by the West.

The argument went mainstream (again) after economic strategist Zoltan Pozsar suggested we are entering a new economic global order based, not on fiat, but on commodity-backed money.

(We suggest listening to Zoltan Pozsar’s argument directly: This Is Zoltan Pozsar’s Vision For Bretton Woods III )

“It’s not just one currency that’s dominant, but there is going to be, you know, as a reflection of a multipolar world, a multitude of currencies. You know, rubles if you want to get Russian oil. RMB, if you want to get stuff out of China. You have the dollar if you trade the U.S., and so it’s a fragmented system where commodities play a much bigger role and where price stability is a big issue in certain parts of the growth. So this is a very complex mosaic that we need to navigate here”

— Zoltan Pozsar

A brief history

Bretton Woods: a system for fixed exchange rates, named after the 1944 Bretton Woods agreement, was the first example of a fully negotiated monetary order with the US dollar pegged to gold, while all other countries’ currencies would be pegged to the dollar.

Bretton Woods II: in 1971, as inflation was rising and the US trade balance falling, President Nixon unpegged the US dollar from the gold standard and other currencies quickly followed.

One of the lynchpins to the success of Bretton Woods II was the creation of the petrodollar, an agreement where Saudi Arabia agreed to exclusively sell their oil in dollars and invest in US Treasury Bills and, in return, the US guaranteed Saudi’s national security. This system had a signifiant impact across almost all commodities trades.

Bretton Woods III

Many economies — both emerging and developed — around the world are not happy with the US dollar’s dominance. As far back as 1965, Charles de Gaulle’s finance minister Valery Giscard d’Estaing described it as an “exorbitant privilege.”

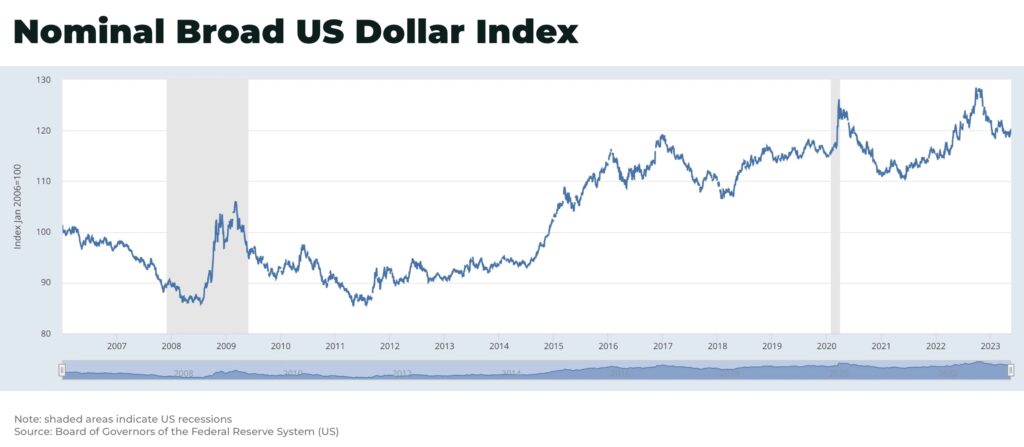

For example, as the dollar strengthens so global trade is restricted, which forces emerging economies to build up significant dollar reserves to cushion their finances from shocks to the value of the dollar.

However, this dependency and build up of reserves means countries are exposed to US sanctions and financial manipulation, as well as geopolitical risk.

When Russia invaded Ukraine, the West not only imposed sanctions on Russia but froze their US dollar reserves (worth an estimated US$600 billion) and blocked them from the SWIFT dollar transfer system.

Many countries have since announced their intention to increase their trade in another currency — in particular, China’s yuan (or renminbi).

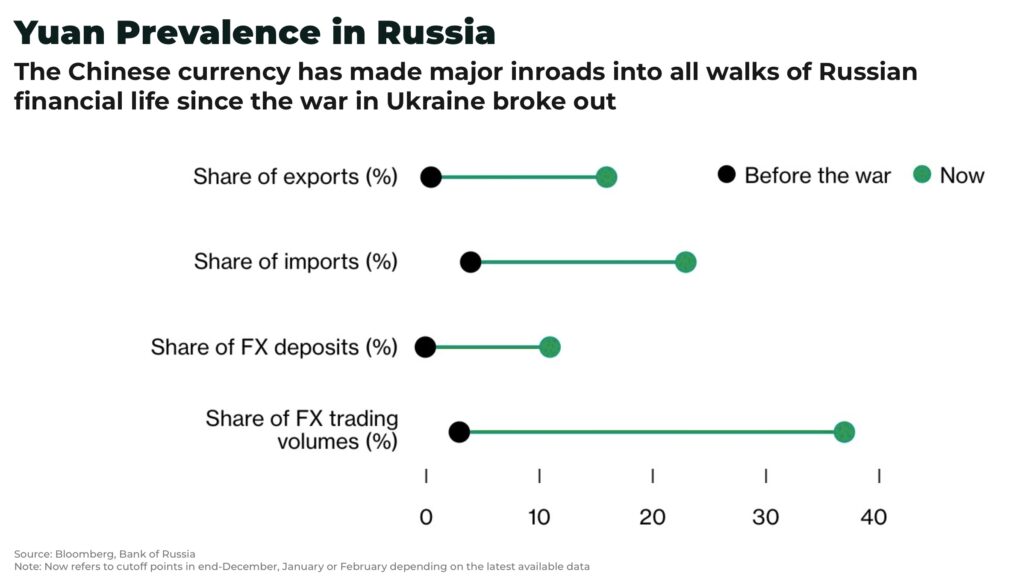

- this year the yuan replaced the dollar to become the most traded foreign currency on the Russian exchange

- Saudi Arabia has announced it is in active talks with China to price some of it’s oil sales in yuan

- in Brazil, the yuan has beaten out the Euro to become the country’s second most important foreign reserve currency. The move comes as Banco BOCOM BBM, which provides banking services in Brazil, has become the first bank in Latin America to sign up to China’s cross-border payment system, CIPS

- Argentina announced in April that it will start to pay for Chinese imports in yuan instead of dollars

- other examples include Bangladesh and Russia agreeing to use the yuan to settle payment for a nuclear plant that Russia is building in the South Asian country; Pakistan has placed an order for a single cargo of Russian oil in yuan, but is keen for a long-term deal to buy the crude in Chinese currency, according to the country’s power minister

These are relatively small steps, but are beginning to add up: the yuan’s share by value of global trade finance increased from less than 2% in February 2022 to 4.5% in February 2023, close to the Euro at 6%.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

And it’s not just the yuan.

India has increased moves to internationalize the rupee, with a new agreement with Malaysia to settle trade in the rupee; ASEAN members, including Indonesia and it’s nickel reserves, have agreed to increase the use of local currency transactions.

While this rise of “de-dollarization” is nowhere near the share of the US dollar — 84.3% in February 2023 — it could have an increasingly outsized impact on commodities.

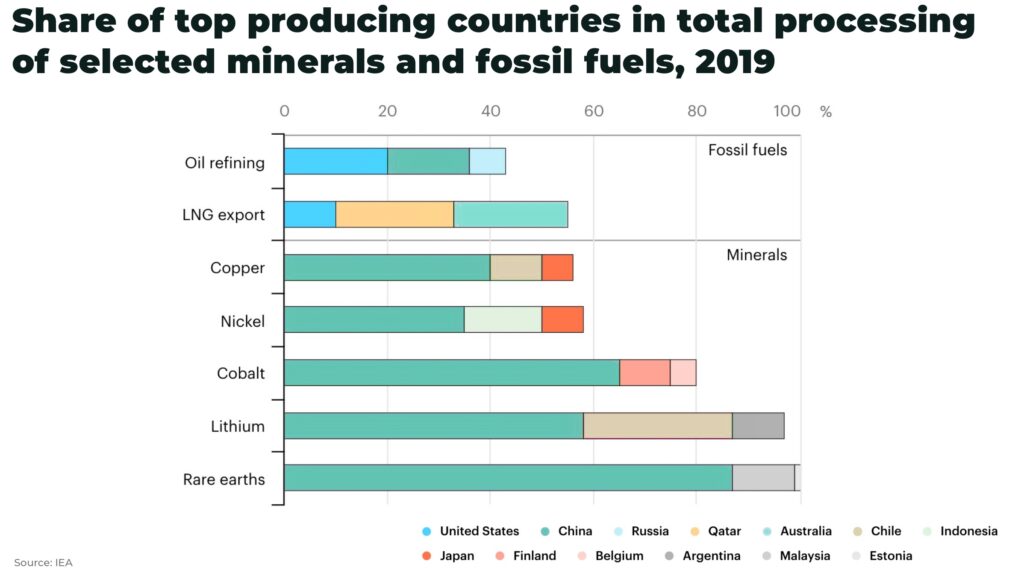

The reason: many of the countries announcing or making moves to move away from the dollar are significant commodity exporters and importers.

So, similar to the importance of gold under the first Bretton Woods, so now almost all major commodities play a bigger role.

China is the world’s largest producer of many key metals used in the energy transition, including lithium, nickel and rare earths. If China pushes for the use of the yuan in global trade, then so too will demand for these metals priced in yuan.

The same goes for Russia, which was the world’s largest exporter of oil to global markets and the second largest crude oil exporter behind Saudi Arabia, before the invasion of Ukraine; as well as a major producer of natural gas, coal, aluminium, cereals, fertilizers, and more.

De-dollarization would result in a more fragmented, complicated global financial system.

For example, the use of currencies other than the dollar could impact supply patterns as producers shift exports to countries using the currencies as payment.

Leverage of exporters in commodity and financial markets would increase accordingly.

For example, in March 2022, the London Metal Exchange suspended trading in nickel for the first time since 1988, when prices surged 250%, to over US$100,000/tonne.

Xiang Guangda, founder of Tsingshan Holding Group (the largest producer of nickel and stainless steel in the world), had made a bet against rising nickel prices which collided with Russia’s invasion of Ukraine and concerns over Western sanctions against Russia, the world’s fourth largest nickel producer.

The Hong Kong Exchanges and Clearing Limited-owned LME decided to controversially void all trades from midnight until 8.15am on March 8, 2022 when trading was stopped, totalling over US$4billion.

One of the reasons was because the influence of China and Tsingshan in the market trumped the LME’s capacity to force the bills to be paid.

(You can read more on our analysis: Can the London Metal Exchange nickel contract survive?)

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Re-dollarization

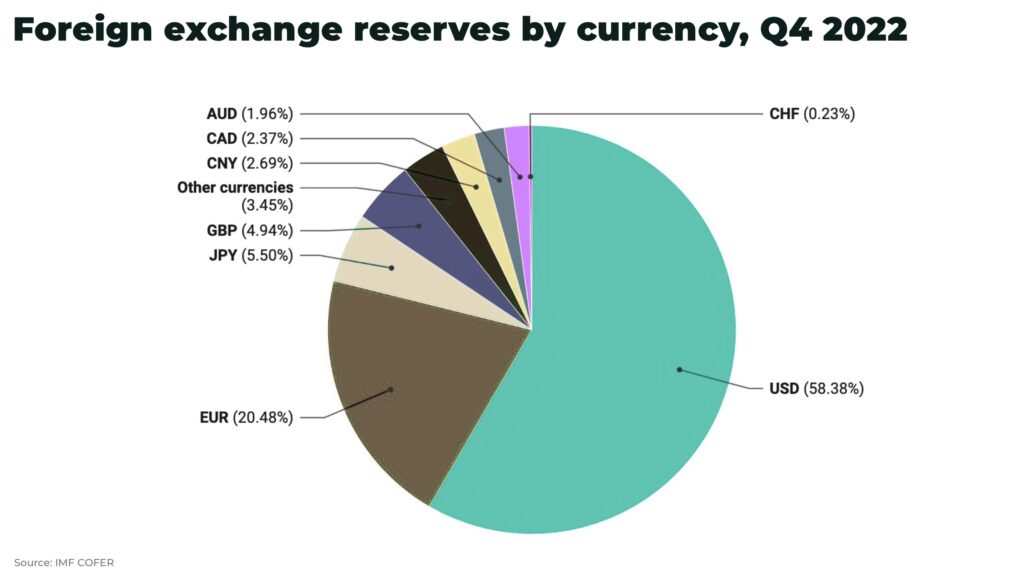

However, despite these grievances against the dollar, no one else has yet been able to displace it as the global currency.

“At some point, when you only have dirty shirts in your closet, it’s about your cleanest dirty shirt. The US is your cleanest dirty shirt”

— Mohamed A. El-Erian of Pacific Investment Management Co. (PIMCO) in 2010

The challenge to any currency competing to replace the dollar, as outlined above, is trust.

Ultimately, that is why we do not believe the end of the dollar as the global reserve currency will happen anytime soon.

China’s yuan is a closed currency, and the currency is not yet fully convertible. China is unlikely to liberalize it’s financial system anytime soon, and doing so would pose major financial challenges for it’s economy.

Russia’s recent embrace of the yuan is determined by necessity, not trust. There may be a marriage of convenience between the two countries over the yuan at the moment, but are these traditional geopolitical rivals going to trust each other over the long term?

Even without many of the above concerns, the Euro and Japanese Yen have failed to find a dominant position over the dollar.

The dollar’s share of in central banks’ foreign exchange reserves has dropped from more than 70% in 1999, IMF data shows, but is still 58.36% in the fourth quarter last year.

And there are other reasons:

No other country, except the US, has the military projection capabilities to protect the global sea lanes and maritime trade.

And America’s economy still seems unstoppable. According to the IMF, America will remain the world’s largest economy worth US$32.3 trillion, with China the second largest with US$27.4 trillion.

With increased global geopolitical and economic risk — a weakening European economy, Japan’s bond experiment, challenges to economic growth in China, as well as rising interest rates and the potential for a much stronger dollar — there is an argument that, in fact, we are about to witness a period of “re-dollarization”.

(You can read more on our analysis: The new American century)

Exposure

Regardless, the financial systems behind commodity markets are under pressure.

This volatility means both significant turmoil but also opportunities for investors.

Trust will be essential, but also leverage. If you are trading commodities in a currency other than US dollars, it will be important for any investor to know that the “rules” can be broken at any time — and something more than trust will be needed.

For example, a focus on commodities that are essential to critical industries, such as oil and gas for energy, or nickel and copper for the global energy transition.

Diversification across commodities and currencies will also provide some security from localized geopolitical risks.

In conclusion, while attempts at de-dollarization may not lead to the end of the US dollar as a global reserve currency in the short-term, it could result in a more fragmented and complicated financial system with significant impact on commodity investors. The rise of alternative currencies, particularly the Chinese yuan, could have outsized impacts on commodity prices and supply patterns.

Stay subscribed to stay ahead of the latest developments.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.