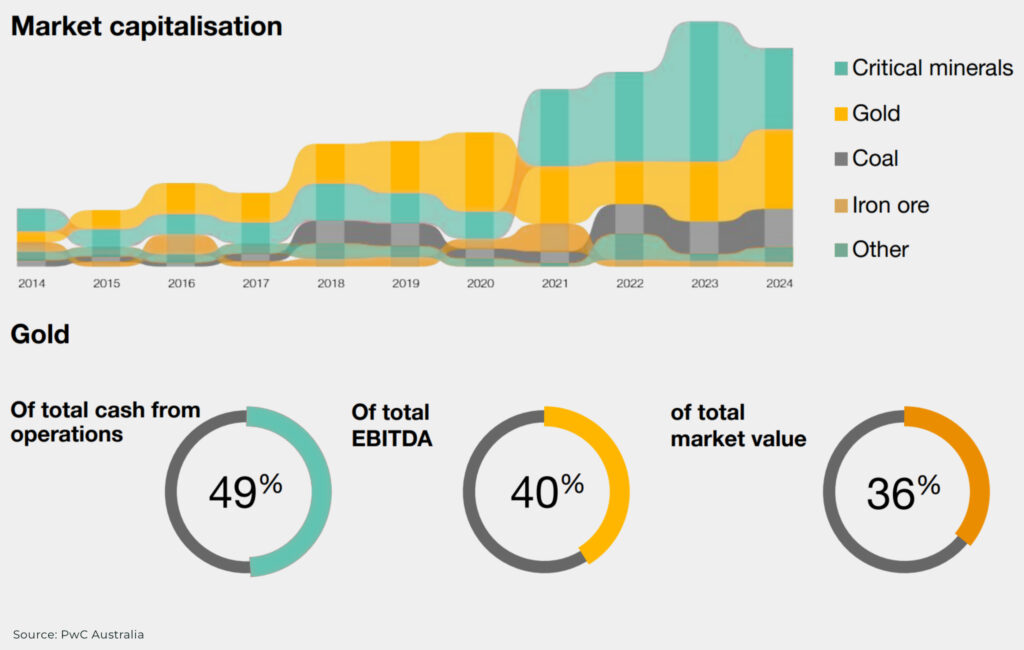

Gold miners in Australia are reporting “outstanding” production results into 2025 and, with surging gold prices, are leading the Australian Mid-Tier 50 (MT50) in operating cash flows and market capitalisation gains for FY24.

- 34% increase in total market capitalisation of MT50 gold companies to $51bn in 2024 compared

to 2023 - MT50 gold companies achieved a 47% increase in earnings from 2023

- EBITDA margin in FY24 was 42%, up from 36% the previous year

- Operating cash flows in FY24 were $6.7bn, an increase of 57%, and dividends are also increasing

Australia is already the world’s third largest gold producer, but this could be just the start of a new golden era for the country’s gold miners.

Australia’s unrivaled gold reserves

Australia has the world’s largest in-ground gold reserves, with an estimated 12,000 tonnes, or 22% of global share. It is just behind China and Russia in total global gold production with around 70 active mining operations.

Key gold operations and regions include:

- Cadia Valley (New South Wales): this mine, operated by Newmont, is one of Australia’s largest gold operations. Cadia contains approx 530 tonnes of gold reserves, with annual production expected to be 35 tonnes per year

- KCGM/Super Pit (Western Australia): the Kalgoorlie Consolidated Gold Mines (KCGM) operation has doubled the mineral resources since Northern Star Resources acquired the Super Pit five years ago, as well as increasing ore reserves by 50% since 2020

- Boddington (Western Australia): a top gold asset for Newmont, Boddington gold mine contains 12.4 million ounces of gold reserves as of late 2018, with substantial output and advanced processing technologies allowing for efficient extraction from low-grade ores

- other significant gold deposits include Fosterville in Victoria, Mount Carlton in Queensland, Olympic Dam in South Australia, and Tanami in the Northern Territory

The nation’s gold exports alone generated US$16.4 billion (A$24.4 billion) in revenue in 2022-23, nearly doubling in value over the past decade. Gold consistently ranks as Australia’s third-largest mineral export and fourth-largest merchandise export earner.

Strategic advantage: pro-mining jurisdiction and US alignment

Australia’s attractiveness for mining investment is underpinned by its world-class regulatory environment and robust infrastructure, including:

- Western Australia (WA) are globally recognised as top regions for mining investment by the Fraser Institute. WA alone hosts 98% of Australia’s iron ore and approx 60% of its gold reserves, alongside significant lithium and vanadium deposits

- South Australia (SA) holds 25% of Australia’s gold resources and the 4th largest global gold deposit, exports copper, uranium, and zircon, and is also highly attractive for mining investment

- Victoria (VIC) is historically significant for its 1851 gold rush, it still offers exciting mineral exploration potential

- New South Wales (NSW) is rich in gold, including the Cowal open pit gold mine which is the largest in NSW, as well as coal, copper, silver, lead, zinc, cobalt, and lithium

- Queensland (QLD), Tasmania (TAS), Northern Territory (NT) are also all significant mineral producers, from silver to tin, zinc to vanadium

The government is looking to set up a critical minerals reserve, a price floor to support critical mineral projects, as well as a long-term pivot from China to the USA through agreements like the Critical Mineral International Alliance.

Australia’s mining operations benefit from decades of accumulated infrastructure investment, from world-class rail networks to deepwater ports, a highly skilled workforce to a sophisticated mining services sector.

The mining sector in Australia is rapidly embracing innovation and technology: automation, digitisation, and Artificial Intelligence (AI) are becoming core elements of the country’s mining operations — with Australia’s national science agency, CSIRO, predicting that by 2030, 50% of the country’s mining operations will be fully automated.

Case Study: Golden Cross Resources and the “Ladder Methodology”

A prime example of Australia’s gold potential is Golden Cross Resources (TSXV:AUX, OTCQB:ZCRMF), which is actively advancing exploration at its Reedy Creek Gold Project in Victoria’s gold-rich Lachlan Fold Belt. The project is strategically located approximately 10 km northeast of Southern Cross Gold’s high-grade Sunday Creek discovery.

Southern Cross Gold’s Sunday Creek project has been hailed as “one of the Western world’s most significant gold discoveries in recent years” leading to a remarkable increase in its market capitalisation from approximately US$135 million (A$200 million) to US$1.1 billion (A$1.7 billion) within a 12-month period. This significant re-rating was based on a resource of 3.6 million ounces at 10.6 grams per tonne, derived from just six old gold workings over a 1400-meter trend.

The Reedy Creek project itself shows immense potential, with over 1,350 old gold workings identified across its land, and significant clusters like 20 “ladders” at the Reedy Creek Goldfield (Golden Cross is leveraging this regional success by applying a proven exploration strategy known as the “ladder methodology”). The company has also partnered with VRIFY for AI-assisted mineral discovery, a platform proven at the Sunday Creek Project.

Golden Cross Resources is led by a team with a strong track record of discoveries and corporate exits, including co-founders of successful gold companies.

The company recently closed a CAD$5 million (US$3.7 million) private placement, including a cornerstone investment from Jupiter Asset Management.

Efficiency is also a significant advantage. For example, in Victoria, drilling costs are remarkably low, at CAD$230 (US$168) per meter all-in, including assays. This is significantly cheaper than in other regions like the Yukon, where costs can exceed CAD$1,000 (US$584) per meter, allowing for more extensive and cost-effective exploration. Furthermore, drilling in Victoria is possible 12 months a year, providing operational consistency.

With its large land package and strategic application of a successful exploration playbook in a historically high-grade gold region, Golden Cross is well-positioned for potential significant gold discoveries.

Gold market dynamics and outlook

The gold price soared past US$3300 in April 2025, driven largely by central bank demand, as well as Exchange Traded Funds (ETFs), seeking safe haven assets amid global economic uncertainty and geopolitical tensions.

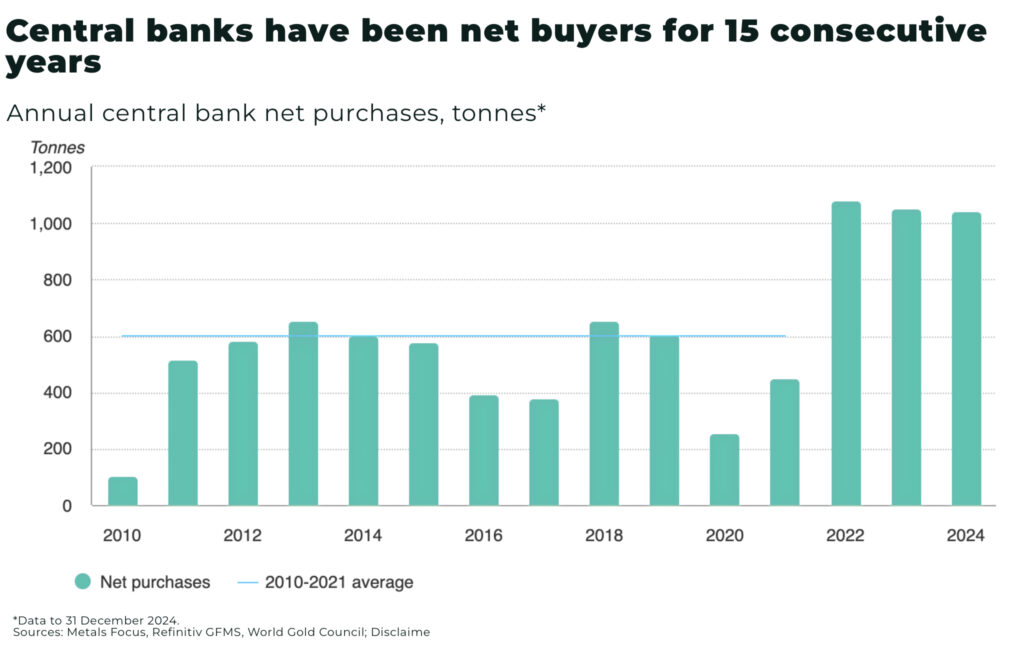

By Q4 2024, central banks had extended their buying streak to 15 consecutive years, with 2024 as the third consecutive year in which demand surpassed 1,000t, far exceeding the 473t annual average between 2010-2021 — “contributing to gold’s annual performance”, according to the World Gold Council.

Conclusion

The outlook for the global price of gold remains positive ahead of geopolitical tensions and economic uncertainty.

Australia’s gold output is projected to rise to 377 tonnes per year by 2029-30 due to increased output from multiple large-scale operations and new projects coming online.

For North American investors, Australia offers a sophisticated, resilient, and growing mining industry that is not only benefiting from the current gold market strength but is also strategically positioned.

This opportunity, backed by a strong operational framework and a proactive approach to international partnerships, underscores Australia’s compelling investment proposition for the decades ahead — a golden opportunity.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.