Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The price of gold hit a record US$3,000 per ounce in early 2025, a rise of 15% from January to March alone.

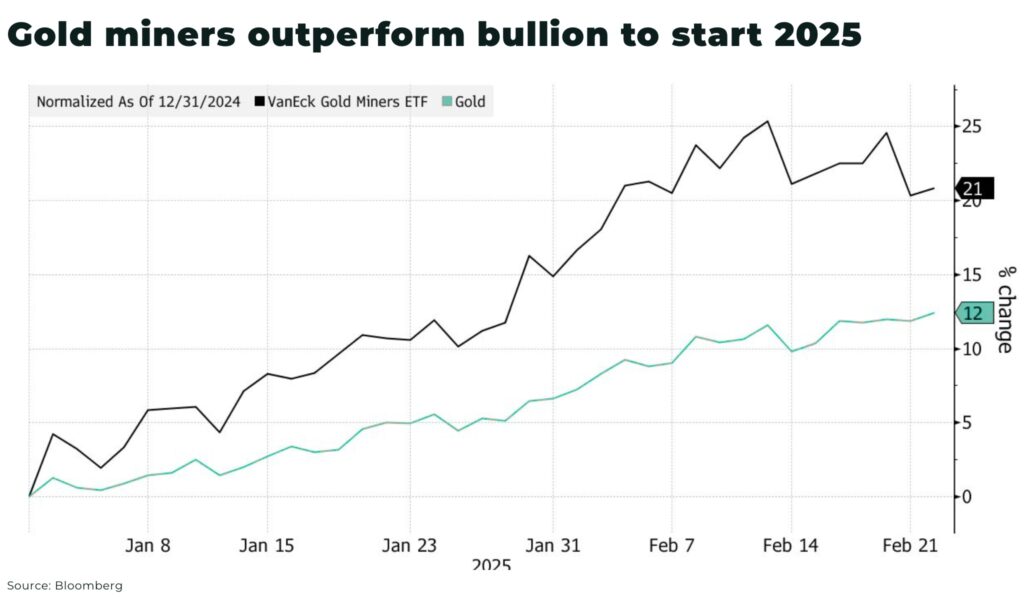

And — after what may seem a shockingly long time — gold miners are finally starting to benefit, including:

- shares of many gold majors have more than reversed 2024 falls, for example, with Newmont and Barrick Gold increasing 27% and 21.5% so far this year

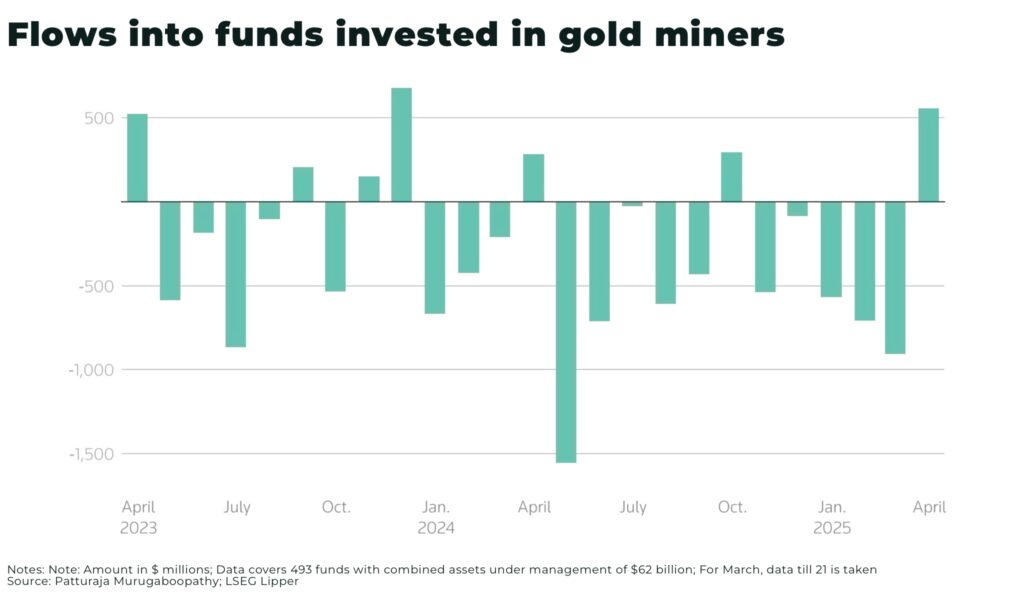

- funds that invest in gold miners are attracted their largest net monthly inflows — US$555.3 million — in more than a year in March 2025

- the roughly US$14 billion VanEck Gold Miners ETF is up around 20%, so far, in 2025, with all but four stocks in the 56-member fund rising

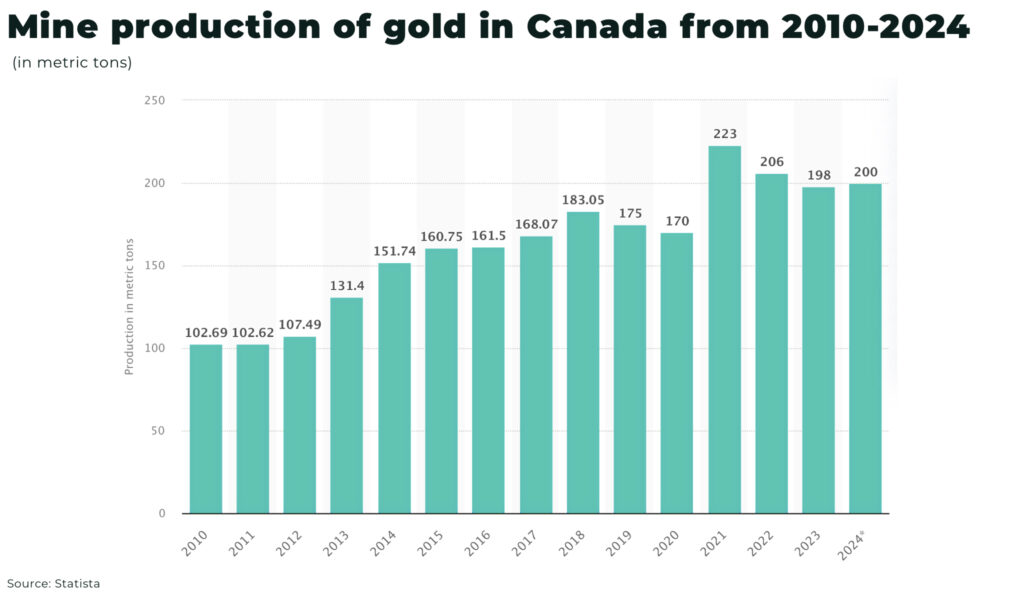

The recent historical underperformance of gold mining equities may be on the cusp of a dramatic resolution, and gold miners in Canada are uniquely positioned to capitalize on this opportunity as the country’s gold production rises 32% from 2014-2024.

The price of gold

The relentless rise in the price gold to record levels is no capricious spike, but instead is driven by sustained global uncertainty over geopolitical tensions, inflation, rising debt, tariffs, monetary easing, economic instability, as well as robust central bank demand — fueling demand for the metal’s safe-haven appeal.

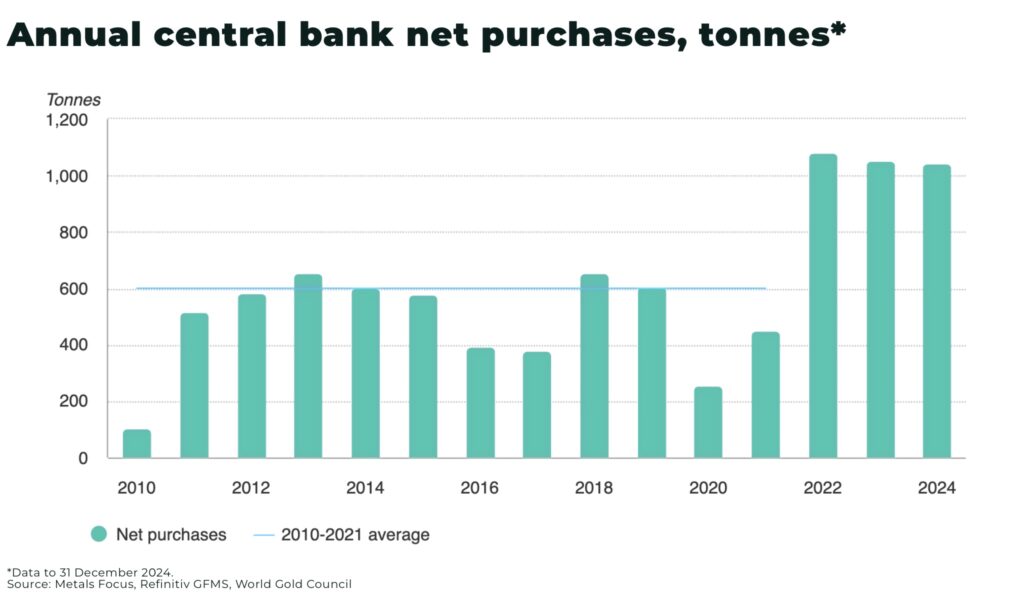

The biggest driver has been the aggressive demand from central banks across the world to increase their gold reserves, reaching 1,000 metric tonnes in 2024, nearly double the average annual acquisition of the last decade.

This trend has persisted into 2025, with significant purchases reported from nations like Kazakhstan, Poland, and India.

Struggling gold mining equities

As we highlighted in our analysis last year:

“Something has to break: either the price of gold drops or the price of the miners will dramatically rise” — Anthony Milewski, In gold miners we (don’t yet) trust

Challenges for the gold mining sector included:

- rising operational costs, including equipment, labour, and energy

- production challenges, including declining ore grades, resource depletion, and geopolitical risks (eg in Mali)

- investor trust over allocation of capital, with the memory of past boom-and-bust cycles, where miners aggressively pursued production growth at the expense of shareholder returns and often overpaid for acquisitions.

eg after the gold price spiked in 2011, the gold mining sector went on a buying spree, which meant low returns and high debt when the price dropped from 2012-19

This time, gold miners have worked hard to earn back trust, reducing debt levels and introducing share buyback programs and increasing dividends with substantial cash-flow.

For example, Barrick Gold (NYSE:GOLD) announced a US$1 billion share buyback after doubling free cash flow; AngloGold Ashanti (NYSE:AU) is boosting payouts to investors, hiking its dividend nearly x5, after profits surged to US$954 million in 2024; Gold Fields (JSE:GFI) announced they are considering a share buyback programme to boost shareholder returns if the gold price stays high, as the company reported a 42% jump in annual profit.

Gold mining equities are currently still trading at depressed levels, suggesting the valuation gap has the potential to close dramatically.

Canada calling

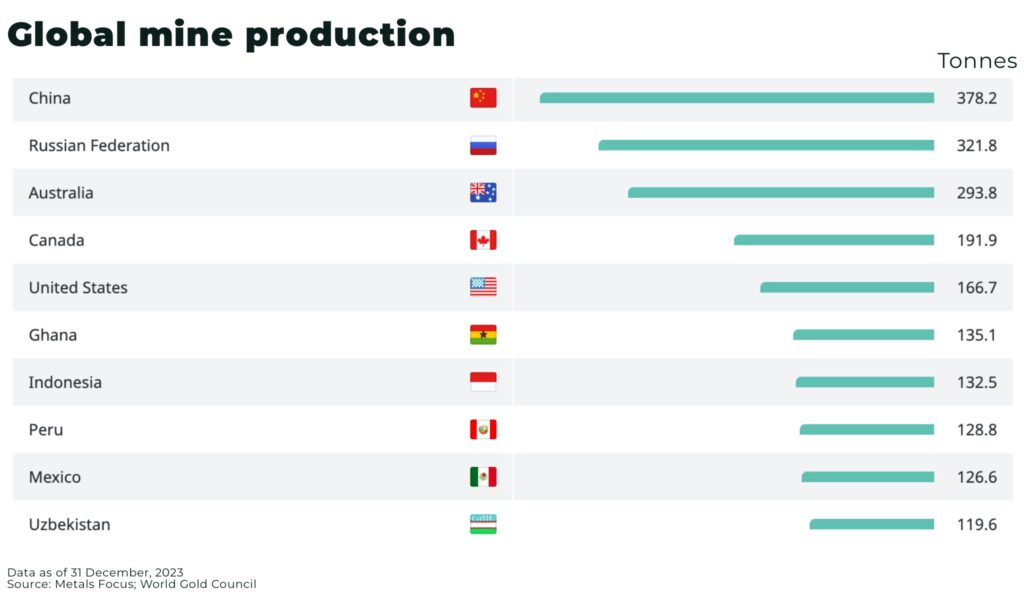

Canada is the fourth largest producer of gold in the world, after China, Russia, and Australia.

For investors looking for exposure to mining opportunities, outside of the majors, there are a series of obvious challenges with China and Russia:

- geopolitical and trade risks

- lack of environmental scrutiny

- governance and transparency risks

Instead, Australia and Canada offer stricter ESG compliance, stable political jurisdictions, clearer regulatory frameworks, and well established mining infrastructure.

And Canada is moving to position itself as a leader in new mine development, including:

- The “Canadian Shield”, a massive area of Precambrian igneous and metamorphic rocks covering much of eastern and central Canada, hosts most of the gold reserves in the country. Recent discoveries and ongoing exploration activities suggest that Canada’s gold endowment is far from exhausted, for example, the Ring of Fire in Northern Ontario holds significant potential for various minerals, including gold

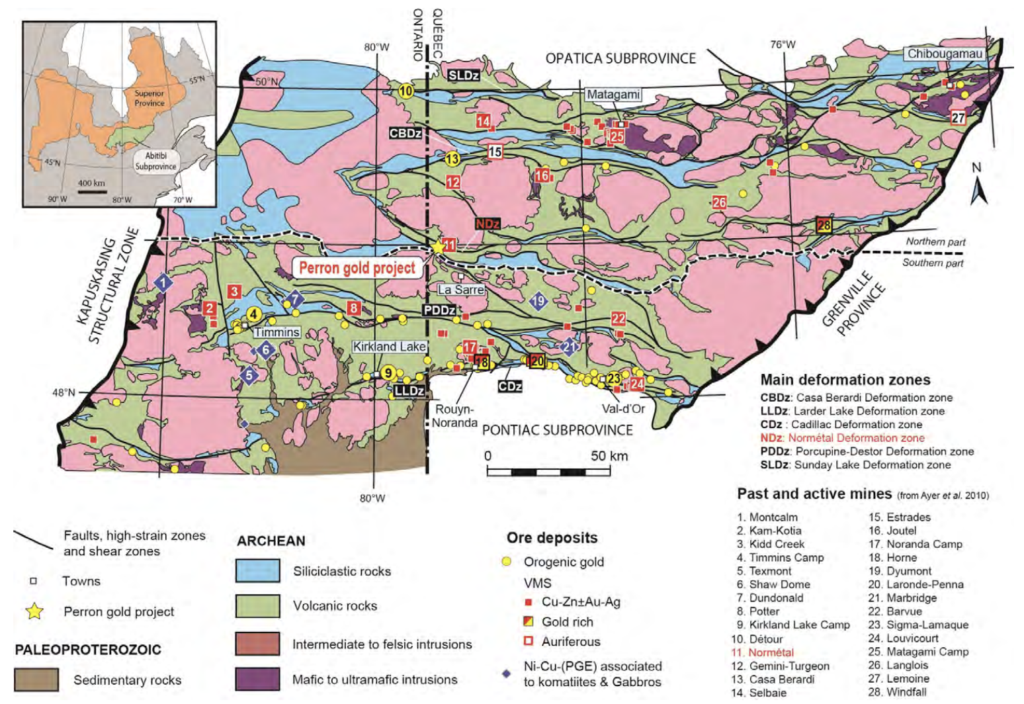

- gold is mined in ten Canadian provinces and territories, mostly in Ontario and Quebec, which together accounted for 70% of Canada’s total gold output in 2023

- gold is Canada’s most valuable mined commodity, with a production value of CA$15.1 billion in 2023 — the country’s mines yielded nearly 200 tonnes of gold

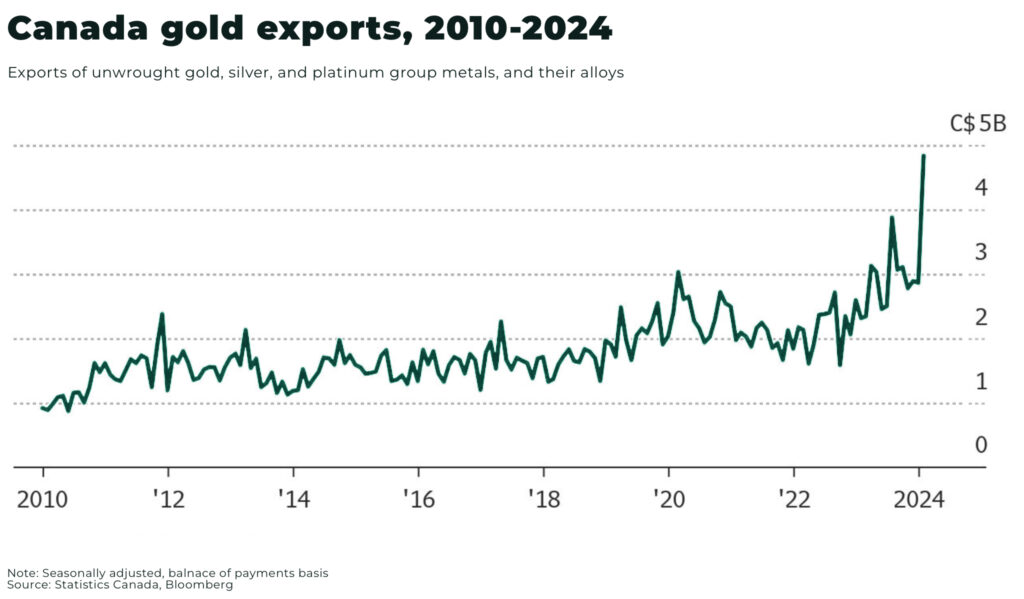

- gold production from Canadian mines reached 200 tonnes in 2024, a 3% increase from 2022 and 32% higher than in 2014. In February 2024 gold exports increased 69%

- Recent discoveries and ongoing exploration activities suggest that Canada’s gold endowment is far from exhausted. For instance, the Ring of Fire in Northern Ontario holds significant potential for various minerals, including gold.

- provinces and territories in Canada will no longer require separate federal government approval for new mines, while in Australia, new mines typically need to be signed off by both state and federal (with each state having its own mining laws)

- energy costs have risen significantly in recent years in Australia, with Glencore claiming they’re at least double those in countries like Canada, US, and China; and, in November 2024 Newmont shares had their biggest decline in more than two years after earnings suggested the gold producer is struggling to control mining and energy costs

In comparison, in Canada — and Quebec in particular — investment in hydroelectric power can mean both sustainably sourced power and lower energy costs

And the junior mining sector is taking advantage of record gold prices and the opportunities within the Canadian gold mining sector with new discoveries and rehabilitating old projects, for example, companies like:

West Red Lake Gold Mines (TSXV:WRLG) are positioned to restart historic mines in well-established districts like Red Lake, Ontario, leveraging significant sunk capital costs. These projects offer a potentially faster route to production and cash flow.

NOVAGOLD Resources (TSX:NG) with its flagship Donlin Gold project in Alaska (a strong mining jurisdiction), are advancing large-scale, high-grade resources towards potential construction decisions. While Alaska is not strictly Canada, many Canadian companies have significant operations and expertise in similar northern environments.

Amex Exploration (TSXV: AMX), a Canadian developer in Quebec’s low-risk mining belt, is focused on its 100% owned Perron Gold Project within the prolific Abitibi Greenstone Belt. Amex has made multiple high-grade gold discoveries over a 4 km strike. Situated near existing infrastructure and a skilled workforce, the project has potential for both open pit and underground mining.

The company has been undertaking extensive drilling, exceeding 500,000 meters and aiming for an additional 100,000 meters in 2024 and 2025. Recent drilling results, such as 18.66 g/t Au over 3.00 m in the Gratien Gold Zone, and the discovery of new zones like the Team Zone, highlight the ongoing potential to define substantial resources.

The company completed aPreliminary Economic Assessment (PEA)in Q4 2024, highlighting the significant impact of high-grade gold mineralization, near-by infrastructure and access to a skilled local workforce resulting in a compelling low-capex, high-margin operation with a rapid payback. The PEA demonstrates the robustness of the project even at lower gold prices, but shines a spotlight on the excellent leverage to the rapidly rising price of gold.

With hundreds of thousands of meters of drilling completed, Amex continues to make new discoveries and expand known mineralization, including the recently discovered Team and JT Zones.

Backed by a strong management team and significant institutional investment, including a 9.9% ownership by Eldorado Gold , Amex offers substantial exploration upside and is poised to deliver significant value through further resource definition and project advancement.

Conclusion

Gold miners have had to work hard to earn back the trust of investors — now they are starting to reap the rewards.

Gold is sustaining prices above US$3,000 per ounce and capital is flowing back into the industry, marking a potential, significant inflection point for the sector — and Canadian miners are exceptionally well-positioned to capitalize on this trend.

And it will be the juniors who write the next chapter.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.