Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

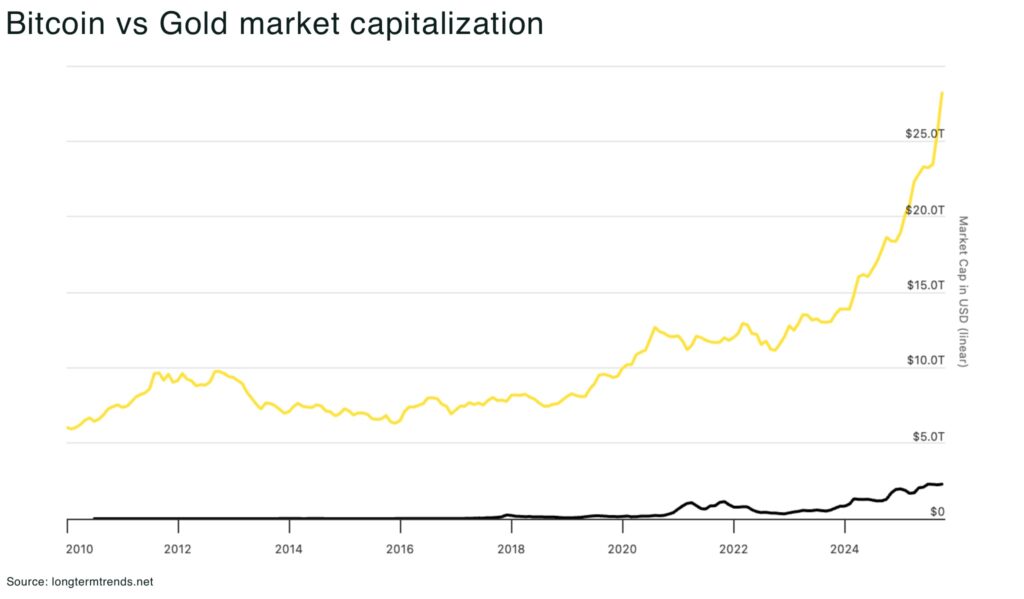

Metals and crypto are competing for capital in one of the great rotations of this decade

October, historically the most-volatile month, strikes again — and metals and crypto are competing for the role of the investor’s safe haven:

- Bitcoin plunged over 14% in early October 2025 – falling as low as US$104,800

- then gold dropped it steepest single-day fall since 2013, down 8% on October 21-22, erasing an estimated US$2.5 trillion

Those numbers hardly inspire confidence as a safe haven — but, step back a moment:

Gold prices are still more than 9% in October, and 40% year to date, beating an increase of 30% in Bitcoin and 15% in the S&P 500 y-o-y. And it’s not just gold, metals across the boards are up with capital pouring into a broader set of metals as investors seek diversification across the resource complex.

But, in crypto, on a single volatile week of October 2025, over US$19 billion in crypto positions were liquidated. Bitcoin, which had soared past US$126,000 to all-time highs earlier in the month, suddenly plunged to a low of about US$104,800. Some tokens like Solana and Sui fell 40%.

It was the largest crypto liquidation in history, sparked by US President Donald Trump’s announcement of a 100% tariff on Chinese imports, alongside threats of tech export bans. Within 24 hours, the wipeout was nine times larger than even the worst day of the 2020 crash, as leveraged crypto bets unwound en masse.

Meanwhile, metals are on a tear in 2026:

| Commodity | Latest Price (Oct 22, 2025) | YTD Performance |

| Gold | US$4,057/oz | +49.1% YTD |

| Silver | US$48.3/oz | +42.8% YTD |

| Platinum | US$1,534/oz | +50.1% YTD |

| Palladium | US$1,410/oz | +30.9% YTD |

| Copper | US$4.96/lb (US$10,612/tonne) | +13.6% YTD |

| Uranium (U₃O₈) | US$62.9/lb (Sep 2025) | +20–22% YTD |

| Lithium | CNY 74,350/tonne (~US$16,800/tonne) | +4% YTD |

| NdPr | CNY 532,500/tonne (~US$73,000/tonne) | ≈+29% YTD |

Despite the pullback, investors have snapped up the classic safe haven amid mounting economic and geopolitical uncertainty, from inflation worries to a still-raging war in Ukraine.

One of gold’s biggest cheerleaders, Peter Schiff, posted: “Gold is now down over $200. Quite a shakeout, but all of this volatility is occurring with gold still above $4,100, which was a record high last week. Bitcoin is catching a bid from this selloff, creating another window for Bitcoiners to sell fool’s gold and buy the real thing.”

In embracing what is being termed the ‘debasement trade,’ investors have turned to (precious) metals and other real assets as a safer store of value as market sentiment shifts toward tangible stores of wealth.

The fundamental question being asked: Which is the true store of value – crypto or gold?

So, is this the start of a great rotation back into mining stocks, after crypto has pulled much of the liquidity from the mining industry over the last few decades.

Are investors rotating from crypto to mining stocks?

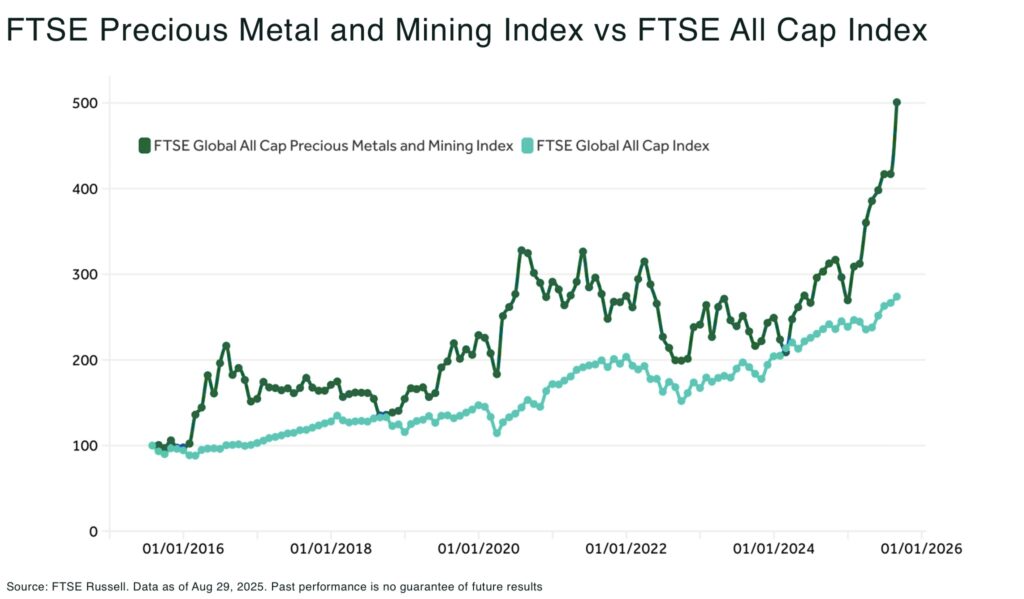

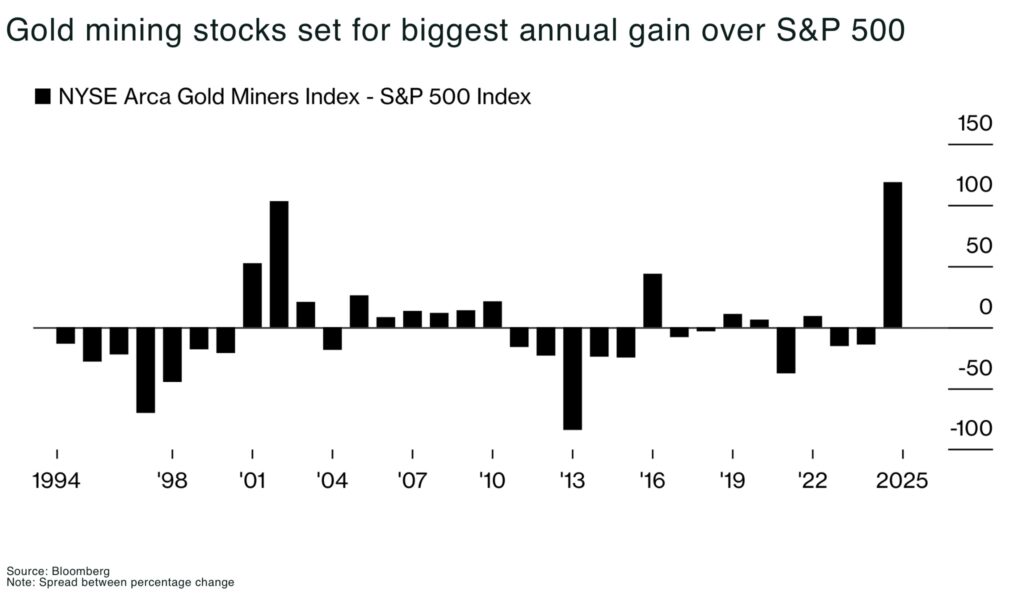

The capital pivot out of speculative tech and crypto and into real assets is showing up in fund flows and equity performance. Mutual funds focused on gold mining firms are now 2025’s standout winners, overtaking even this year’s high-flying AI and tech funds.

The VanEck Gold Miners ETF (GDX) fell 9.4% on October 21, its steepest drop since 2020, erasing roughly a week’s worth of gains.. Gold producers such as Newmont, Barrick, and Agnico Eagle each slid between 4–8%.

But, even after this correction, the mining ETF remains up nearly 115–130% for 2025.

Gold miner funds have soared 114% in early October, far outpacing technology sector funds (+27%) or broader natural resources funds (+24%). Newmont, the biggest US gold miner, has soared 131% this year.

In other words, mining equities – long shunned during the crypto frenzy – are suddenly crushing the returns of Silicon Valley darlings and bitcoin itself.

As at the end of August 2025, the FTSE Global All Cap Precious Metals and Mining Index was up 86% in the year to date, outperforming LSEG’s flagship global equity benchmark, the FTSE Global All Cap Index, by over 70%.

Crucially, this isn’t just price appreciation but new money pouring in. In the third quarter alone, investors plowed US$5.4 billion of net inflows into gold miner funds, the largest quarterly move into the sector since 2009. That was the era after the Global Financial Crisis when gold last had a major bull run. Now history appears to rhyme: as bullion prints fresh highs, mining companies are enjoying record margins and cashflows, sparking dividends, buybacks, and even new stock offerings in the sector.

Miners have become cash gushers thanks to US$4,000 gold, for example, Newmont’s latest quarter blew past profit forecasts and Barrick Gold hiked its dividend 50%.

“Despite the rally, the sector remains widely under-owned, leaving room for new investors,” explains Global X analyst Trevor Yates, told Reuters.

Under-ownership means any rotation of capital into mining stocks could have a lot further to run. In short, many generalist investors are only now waking up to miners, adding fuel to an ongoing rotation.

Broader materials and mining indexes are climbing as well. In Toronto, the TSX Metals & Mining group jumped 1.8% in a single day when gold pierced $4K , helping push Canada’s stock market near record highs.

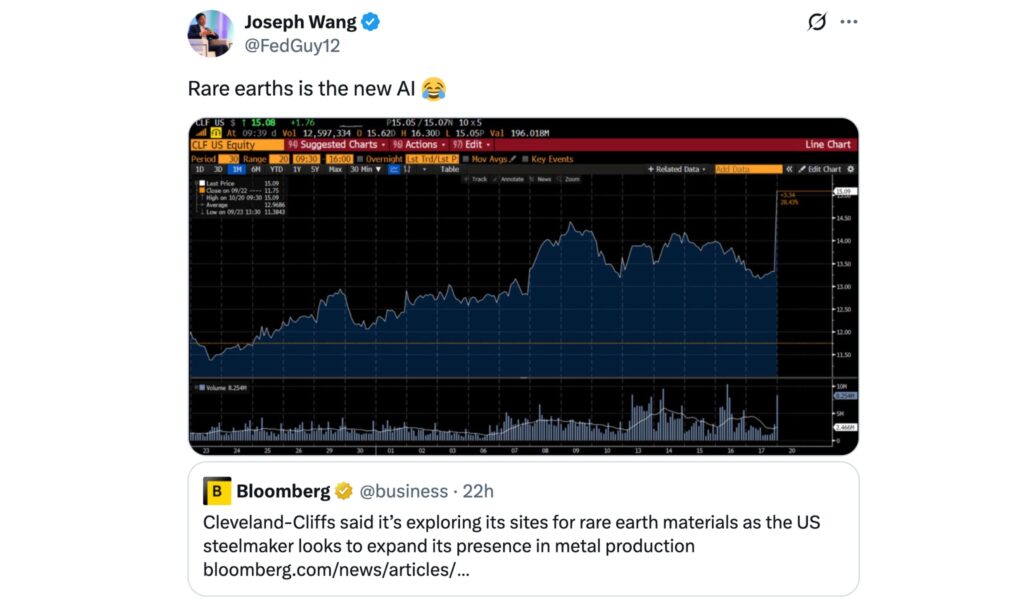

In May 2025, US rare earth magnet imports from China plunged by 93.3% year-on-year after Beijing imposed sweeping export licenses. This chokehold on magnets, vital for EV motors, wind turbines, and missiles, has turned obscure mining companies into strategic assets overnight. Western governments and investors are now scrambling to back non-Chinese producers, bolstering mining stocks beyond just gold.

This kind of supply shock is incentivizing a wave of investment into rare earth projects in the US, Canada, and Australia. For example, the latest US$8.5billion rare earths deal signed between US President Donald Trump and Australia Prime Minister, Anthony Albanese.

It’s a stark reminder that “hard assets” now include not just gold bars, but lithium mines, copper deposits, and rare earth magnet factories. In effect, geopolitical conflict is accelerating a rotation out of intangible assets and into the companies that produce society’s physical building blocks.

Even within the crypto ecosystem, a form of rotation is evident: capital is consolidating into “safer” coins. After the October crash, on-chain data showed investors shifting from altcoins into Bitcoin itself, treating BTC as the blue-chip of crypto while abandoning riskier tokens.

On purely anecdotal evidence, our hairdresser has shifted his barbershop floor chat from Bitcon to gold for the first time.

Why ride out a 70% drawdown in Dogecoin when you can buy shares of a gold miner digging up record profits or a rare earth miner with the weight of the US government investment supporting it.

What’s driving the crypto-to-hard assets move?

Several converging forces are behind this great rotation. First is the macro policy whiplash. President Trump rode into office as a self-proclaimed friend of crypto and Bitcoin jumped 50% after his 2024 election on hopes of a “crypto president” easing regulations. Indeed, in January he signed an order calling digital assets “crucial” to innovation and even floated a US strategic crypto reserve. But today, it’s Trump’s trade and fiscal policies that have dominated market psychology rather than the long awaited Strategic Bitcoin Reserve, and this has been decidedly bullish for old-school havens like gold.

Trump’s aggressive tariffs, economic policies, and geopolitical brinkmanship have injected new, “real” risk into markets. His late-night tariff decrees, such as the 100% tariff threat on all Chinese goods in October, caught investors off-guard and directly triggered flight-from-risk events like the crypto crash.

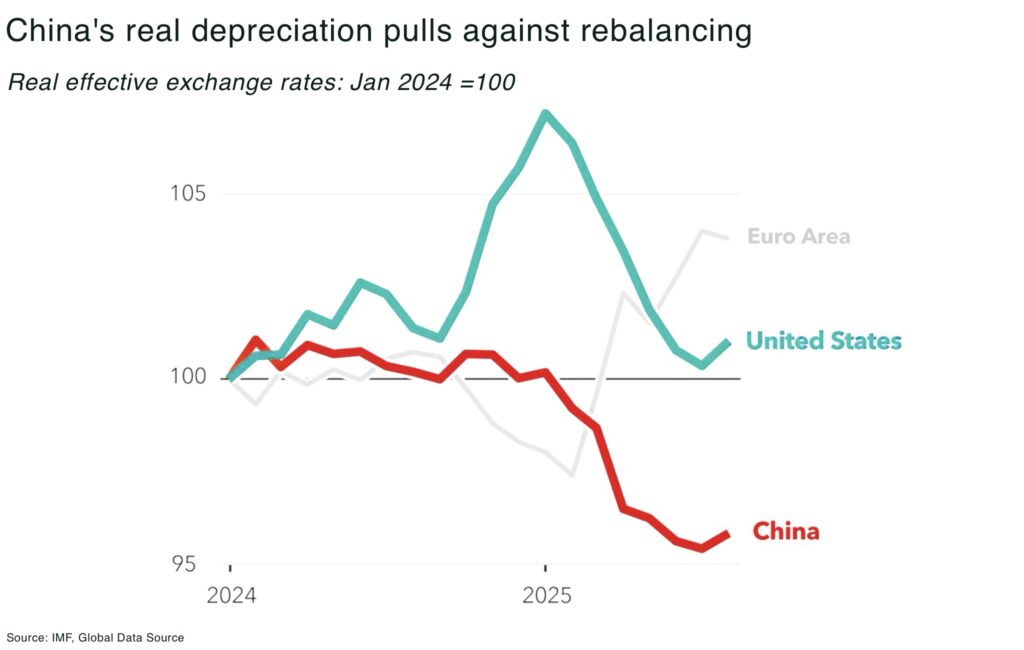

At the same time, the global interest rate cuts and currency devaluations are pushing the value of money down and risk of inflation up. In particular, China’s currency depreciation, with the renminbi’s real effective exchange rate falling by nearly 20% since early 2022, increasing the appeal of gold as a store of value and contributing to upward pressure on prices.

Central banks are also still buying up record amounts of gold — rather than introduce new national crypto currencies — with China leading, hitting an estimated 2,235 tonnes of gold as of September 2025.

The US Federal reserve cut rates by 25 basis points in September, with more cuts expected. And in Fed Chair Jerome Powell has even announced an end to Quantative Tightening. Looser monetary policy threatens to fuel inflation, a clear bullish signal for metals.

By the end of 2024, gold overtook the Euro as the world’s second most important reserve asset for central banks — accounting for +20% of total reserve assets.

The risk is stagflation, a textbook scenario where gold thrives and speculative assets struggle.

Then there’s national security and industrial policy.

The Trump administration is explicitly championing domestic mining and metals production in response to China. Treasury Secretary Scott Bessent blasted Beijing’s rare earth export curbs as a “global supply-chain power grab” and vowed that Washington “would neither be commanded nor controlled” by Chinese resource dominance. To counter Beijing, the US is now taking direct stakes in critical mineral companies, a notable shift from free-market norms, including:

- MP Materials

- Lithium Americas

- Trilogy Metals

The message is clear: securing supply of real commodities is a priority. Policies include setting price floors and building strategic stockpiles of rare minerals. This government backing further boosts the investment case for mining stocks, which now carry an implicit policy support.

A deliberate or incidental rotation

So — is this rotation deliberate? In many ways, it aligns with Trump’s America-first, hard-asset instincts and policy direction of investment and support into mining and critical minerals.

While not an explicit policy to sink crypto, the side effect of Trump’s administration’s stance has been to direct capital toward the tangible economy: factories, mines, and “stuff” – and away from what Trump himself once called an asset “based on thin air.“

Trump recognises the power of dollar — with no obvious reason to want to undermine it. At minimum, the administration has shown it will not protect crypto markets from collateral damage.

The priorities are telling.

For crypto enthusiasts, Bitcoin was supposed to be the new reserve asset, but so far, central banks are clearly choosing 8,000-year-old gold over 15-year-old crypto when the stakes are highest.

Hard assets backed by policy: “We’re not going to let a group of bureaucrats in Beijing manage global supply chains,” declared Treasure Secretary, Scott Bessent — so imagine what he really thinks of crypto currencies

Risks, rewards, and the road ahead

For investors, the implications of this great rotation are profound: opportunity knocks in mining and metals (again), but so do new risks.

Mining equities, after a decade in the wilderness, now offer leverage to rising commodity prices. They are delivering windfall profits and returns to shareholders unseen in years. If gold and critical mineral prices stay elevated / climb higher, then mining stocks could continue to vastly outperform more growth-oriented sectors. The upside scenario is a prolonged commodities super-cycle, fueled by geopolitical tensions, artifical intelligence, economic and inflation concerns, and the energy transition’s demand for raw materials.

We are not, however, calling the classic canard that “crypto is dead” — Bitcoin is still up roughly 30% this year and has a fervent following who view it as “digital gold” and to replace fiat (or, just avoid sanctions). Even if it falls dramatically, it won’t die.

If financial conditions ease (a China deal) or a major peace deal (Ukraine-Russia) that restores global confidence, we could see speculative appetite return, lifting crypto higher. Rate cuts expected in 2026 could also produce a rising tide that floats both boats – gold and Bitcoin – as happened earlier in the year. The current tandem rally of stocks, gold, and bitcoin before the latest pullback was unusual and hints that macro liquidity remains a swing factor.

On the other hand, an escalation – like China outright banning rare earth magnet exports, or the US enforcing the 100% tariffs – would almost certainly send shockwaves through markets again. That would likely turbocharge the rotation. If Trump’s 100% tariffs actually hit, gold will quickly hit $5,000 and Bitcoin fall much lower.

Conclusion

The 2025 rally across metals may have paused, but it hasn’t broken. The underlying story — inflation persistence, supply insecurity, and policy support — remains intact.

From a macro, strategic vantage, the big picture is taking shape. The world is entering a period of resource nationalism and higher inflation uncertainty, conditions under which “real stuff” outshines digital dreams. Investors and policymakers alike are recalibrating what constitutes a secure investment.

For investors, the message is to look beyond short-term volatility. Mining equities, industrial metals ETFs, and select physical asset plays still offer leverage to the macro environment now being priced into markets.

Gold’s resurgence to record highs, and the fact that some gold mining stocks have doubled in price within months, signal a reordering of priorities. Risk and reward are being repriced across the board.

We believe, yes (finally), a great rotation from crypto back to mining and hard assets is underway, though its longevity will hinge on how the economic and geopolitical drama unfolds.

Deliberate or not, the Trump administration’s actions have created an environment where bullion outshines bitcoin and “pickaxe” investments are — dare we say it — sexy again. For a generation of investors raised on digital disruption, 2025 is a wake-up call that physical commodities and geopolitics can disrupt back.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.