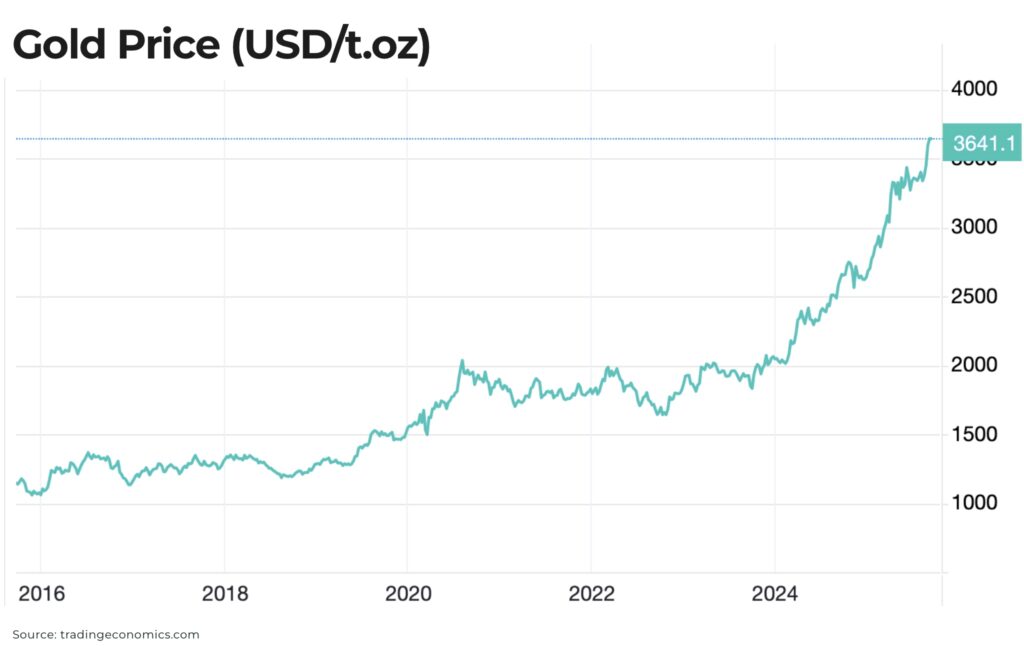

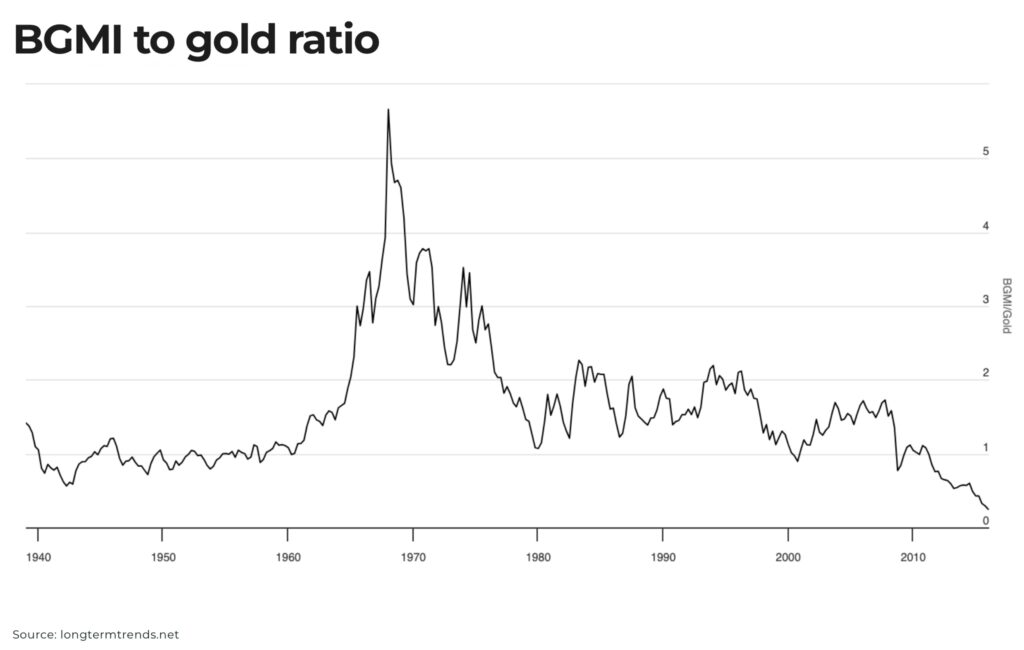

Gold prices have been testing $3,500 throughout 2025 and institutional analysts forecast $3,700 this year (Goldman Sachs) and $4,000 by 2026 (JP Morgan) — but the real upside opportunity lies with miners, underperforming gold price by historic levels.

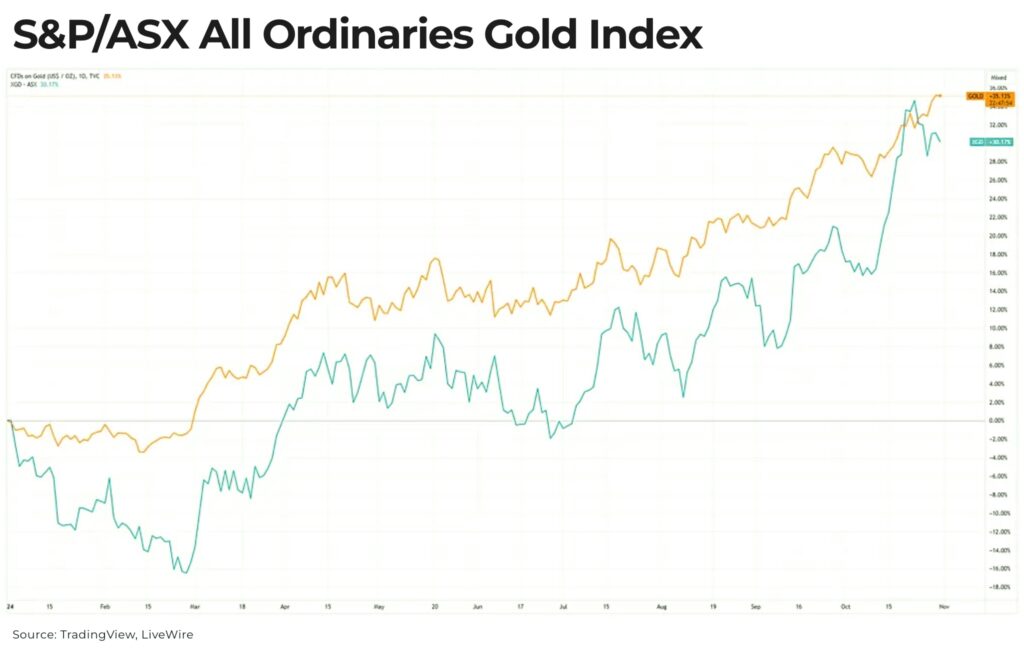

In Australia, the gap and opportunity is especially clear.

As we laid out in our recent analysis Australia’s golden opportunity, gold miners are reporting “outstanding” production results, yet the ASX/S&P All Ordinaries Gold Index has run 10-15% behind the gold price for most of 2025 — leaving producers trading at historic discounts to net asset value.

That raises the question: which Australian gold miners could be worth a closer look?

The geological advantage: a rich seam

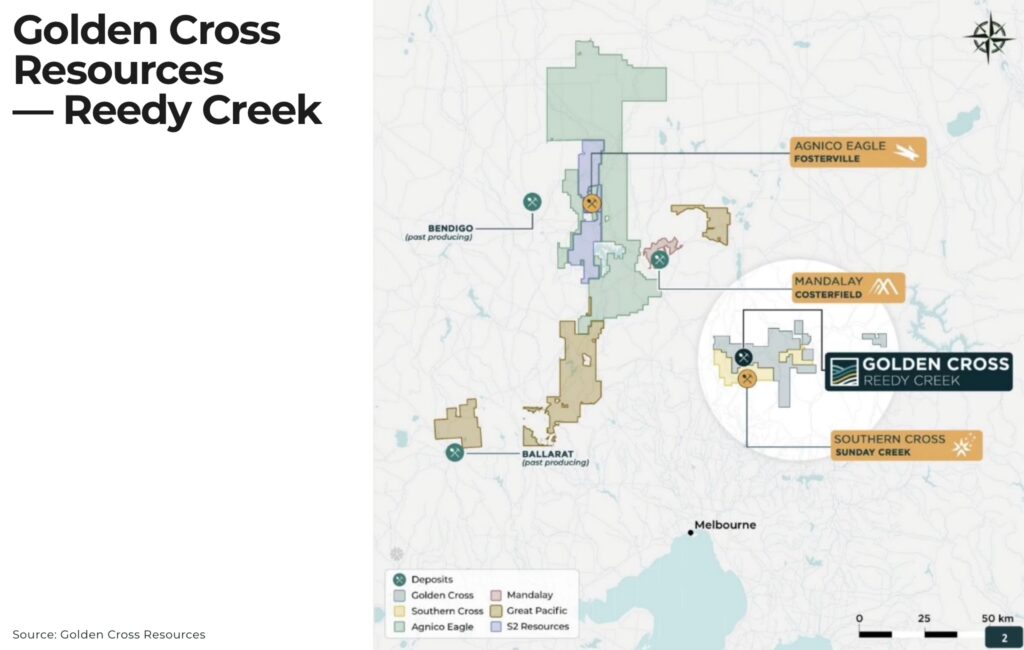

Golden Cross Resources (TSXV: AUX) is strategically positioned in Victoria’s underexplored Lachlan Fold Belt, a region renowned for high-grade epizonal gold systems that host some of Australia’s top operating mines:

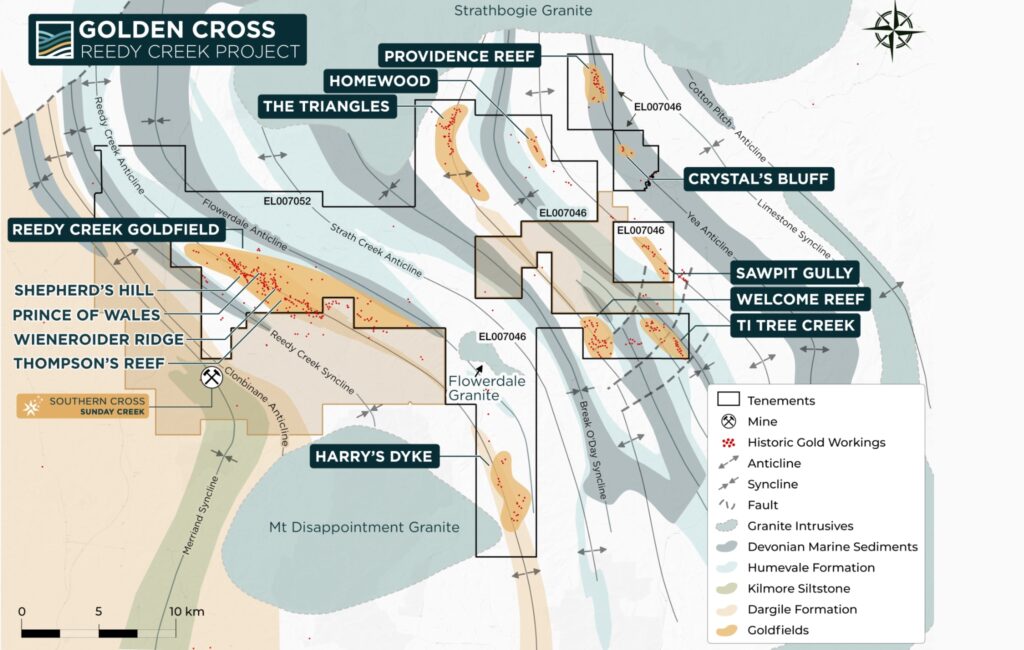

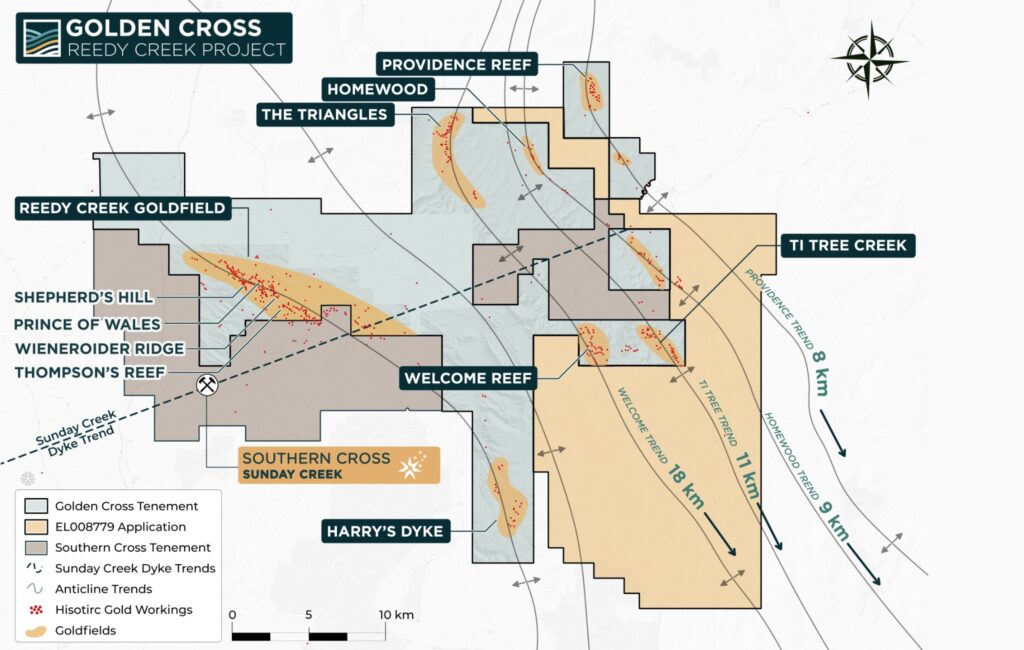

Golden Cross’s flagship Reedy Creek Gold Project spans 750 square kilometres and sits less than 10 kilometres northeast of Southern Cross Gold’s Sunday Creek discovery.

Southern Cross Gold’s Sunday Creek discovery is one of the most significant global gold discoveries, and one of biggest discoveries in Australia, in recent years. It has an updated exploration target (as of March 2025) of 8.1–9.6 million tonnes grading 8.3–10.6 grams per tonne gold equivalent (AuEq), which translates to approximately 2.2–3.2 million ounces of gold equivalent at exceptionally high grades (8.3–10.6 g/t AuEq) — doubled within a year and is based on only two-thirds of the drilled corridor.

Southern Cross Gold has since seen its market capitalisation grow from approximately CAD$200 million to over CAD$1.6 billion within two years.

Golden Cross’s Reedy Creek project is also situated within the same geological framework, the Lachlan Fold Belt, which also hosts Australia’s highest-grade operating gold mines, Fosterville and Costerfield.

Golden Cross, however, currently trades at a fraction of Southern Cross Gold’s valuation, despite its close proximity and similar geological characteristics. Should drilling confirm a high-grade discovery, the company could be positioned for substantial re-rating.

Historical drilling at Reedy Creek has already confirmed the presence of this high-grade system, returning impressive intercepts such as 2.0 meters at 174.4 g/t gold and 11.0 meters at 31.4 g/t gold.

A key aspect of the project’s potential lies in its 3km-long gold-in-soil anomaly, which runs parallel to the regional anticline structure – the same geological setting that controls mineralization at Fosterville, Costerfield, and Sunday Creek. This structural continuity suggests the potential for a district-scale gold system. Golden Cross is applying the “Testing the Ladder” exploration model, which proved successful at Southern Cross Gold, targeting steeply dipping, stacked high-grade quartz veins that allow for multiple intercepts from single drill setups. The company has identified over 55 such “ladders” (drill targets) on its project through LiDAR imagery and mapping of historical gold workings, significantly more than the six old workings that formed the basis of Southern Cross’s multi-million ounce resource. In this geological setting, the grade of gold often improves at depth.

The leadership team: a proven discovery track record

Golden Cross Resources is led by a team with extensive experience in capital markets and mineral discovery:

- Matthew Roma (CEO & Director): a seasoned resource finance executive with over 13 years of experience. He was the founding CFO of Snowline Gold Corp., which grew from a C$30 million market cap to approximately C$1.5 billion, a story similar to Southern Cross’s rapid re-rating

- Alan Till (VP of Exploration): an exploration geologist with over 17 years of experience in base metals, gold, and mineral discovery. He served as the lead geologist for the Mahenge Graphite Deposits discovery in Tanzania for Black Rock Mining and lives near the Reedy Creek project

- Darryl Cardey (Director): a co-founder of K92 Mining (a successful gold production company) and Northern Empire Resources (acquired by Coeur Mining in 2018), bringing crucial strategic guidance

- Nicholas Rowley (Director): an Australian resident with over 16 years of experience in financing and commodity trading, including a key leadership role at Galaxy Resources/Allkem, which was acquired by Rio Tinto for US$6.7 billion

The team’s goal is to make a discovery of scale and transact to a larger company.

The strategic plan: accelerated discovery program

Golden Cross has launched a comprehensive 6,000-meter diamond drilling program, structured in two phases: 2,000 meters of shallow drilling followed by 4,000 meters of deeper drilling to test vein extensions. To accelerate this, the company has deployed two drill rigs as of July 2025. The program is fully funded through 2026, thanks to a CAD$5 million private placement in July 2025, which included a CAD$2 million cornerstone investment from Jupiter Asset Management, a significant institutional validation.

The drilling cost in Victoria is highly efficient, with drilling possible for 12 months of the year, at approximately CAD$230 per meter, including assays.

Why now?

The current timing for Golden Cross’s exploration program is highly opportune due to several factors:

- gold prices have surged more than 26% in 2025, reaching record highs. This is driven by global uncertainty, trade conflicts, and robust central bank buying. Gold priced in Australian Dollars (AUD) saw a stunning 38% surge in 2024

- Australia is the world’s second-largest gold producer and ranked a premier global mining investment destination with a highly skilled workforce, streamlined regulatory environment is becoming more streamlined

- mining investment reached AUS$53 billion in FY2024, a 60% increase from 2019 levels. A weaker Australian dollar also adds further leverage, boosting margins on USD-denominated sales.

- Australia’s pivot to a “critical minerals superpower” with initiatives like the US Defense Production Act granting Australia “domestic source” status for critical minerals procurement, reinforces its strategic importance for global supply chain diversification away from concentrated sources (especially China) — a broader interest that supports a positive halo effect for all mining investments in the country

Conclusion

Australia is entering a new phase of its gold mining cycle, with the Lachlan Fold Belt, in particular, delivering discoveries that rival the best globally.

Against this backdrop, Golden Cross Resources represents a convergence of geological potential, experienced leadership, and exceptional market timing, making it a compelling opportunity in Australia’s gold sector. Initial drill results are expected by late summer 2025, providing near-term catalysts for value creation.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.