Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Sponsored Post: why junior gold company AMEX Exploration is positioned to be built or bought

The gold market is experiencing record high prices, with gold trading above US$3,400 an ounce as of June 2025 after hitting fresh highs in February. Yet gold mining equities continue to underperform by one of the widest margins in decades. For investors, this disconnect may present a generational buying opportunity — particularly in well-positioned juniors.

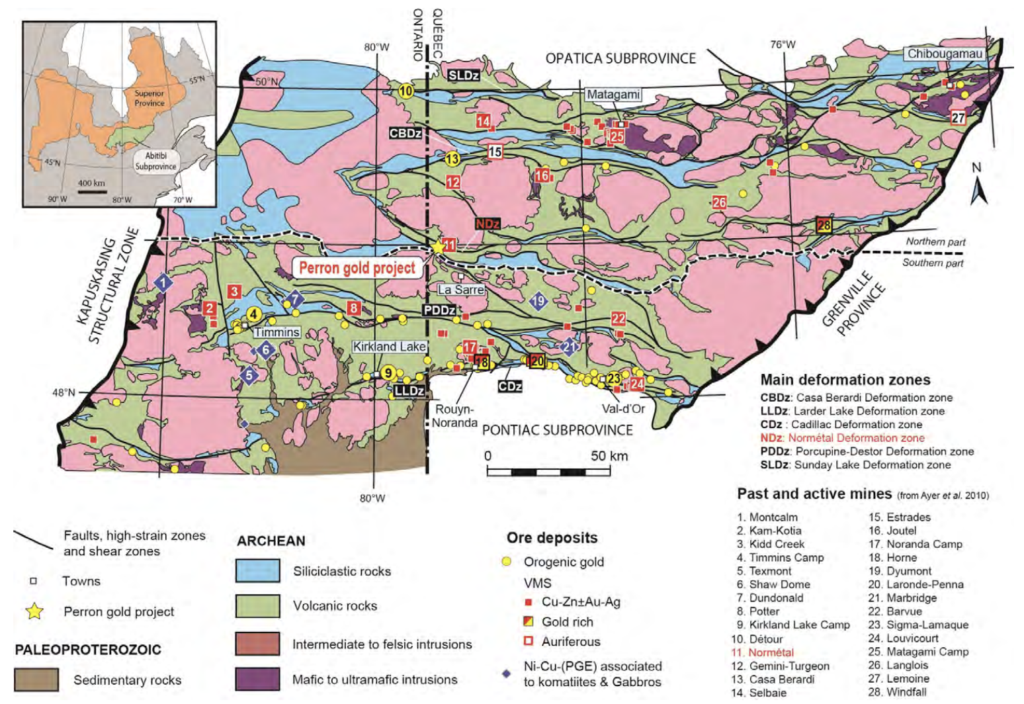

One of the most compelling candidates is AMEX Exploration Inc. (TSXV: AMX), a Canadian junior focused on high-grade gold exploration in Quebec’s Abitibi Greenstone Belt. AMEX’s flagship Perron project has delivered consistent high-grade drill results, advancing toward a potential maiden resource. With strong fundamentals, district-scale upside, and proximity to infrastructure and majors. AMEX is well placed for a build-or-buy outcome.

Gold’s Price Surge: Fundamentals vs Sentiment

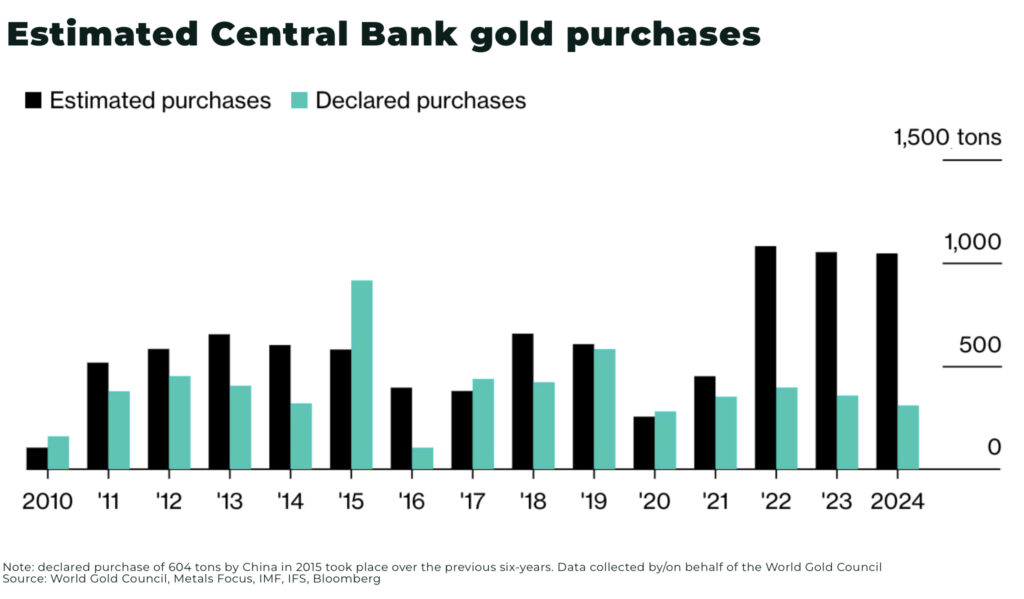

Gold has been one of the standout assets in 2024–2025, up 21% year-on-year, driven by persistent inflation, geopolitical uncertainty, and a renewed wave of central bank buying. The World Gold Council reported central bank net purchases of 1,045 tonnes in 2024. And, in an HSBC survey of 72 central banks, more than a third planned to buy more in 2025.

Junior gold miners have even outpaced the gold price.

The VanEck Junior Gold Miners ETF (GDXJ) has returned more than 66% year-to-date as of June 5, 2025, significantly surpassing gold’s performance, which is up over 16% in the same period.

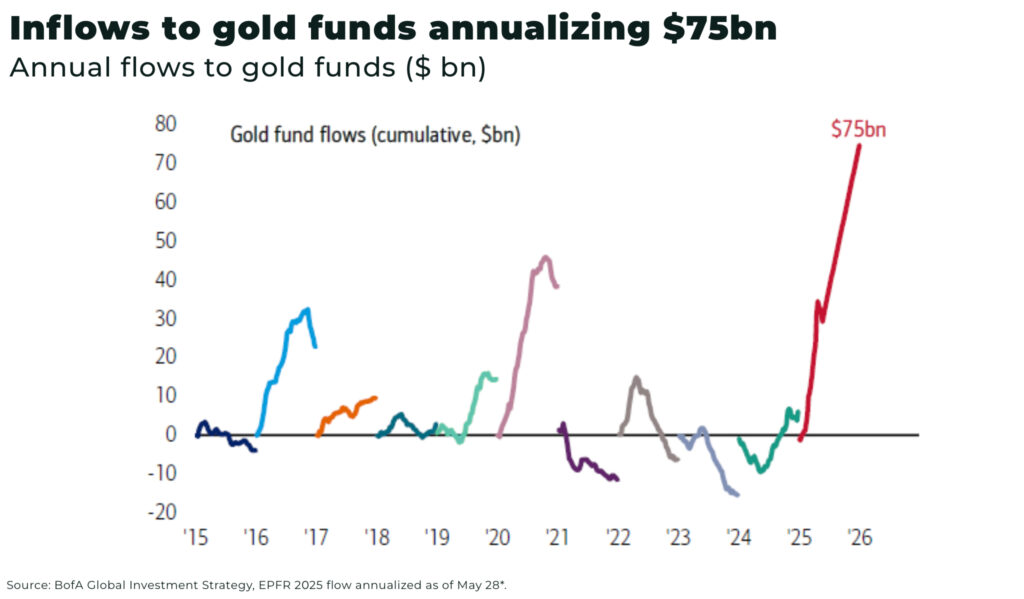

Inflows to gold funds are now on track to hit US$7.5 billion in 2025, an all-time high.

And this could be just the beginning.

Why AMEX? Strategic jurisdiction, tight structure, high-grade focus

Founded in 1996 and headquartered in Montreal, AMEX Exploration is focused on its wholly owned Perron gold project in the prolific Abitibi region of Quebec, Canada. Perron is located in one of the world’s most mining-friendly jurisdictions (ranked 5th in the Fraser Institute world rankings) — with key infrastructure, skilled labour, and permitting advantages.

Importantly, AMEX has taken a systematic, geologically driven approach to discovery. The company has drilled close to 430,000 metres, leading to the delineation of multiple high-grade gold zones.

- Eastern Gold Zone (EGZ): Includes the Champagne Zone (formerly the High Grade Zone)and Denise Zone

- Gratien Gold Zone (GGZ)

- Grey Cat Zone (GCZ)

- Team Zone

In particular, the Eastern Gold Zone has delivered some of the region’s highest-grade intercepts in recent exploration.

As of May 2025, the company reported a significant increase in its mineral resource estimate at the Perron project, with Measured and Indicated Resources totalling 1.615 million ounces at 6.14 g/t Au and Inferred Resources of 698,000 ounces at 4.31 g/t Au. Notably, the Champagne Zone, contains 831,000 ounces of Measured and Indicated Resources at 16.20 g/t Au and 128,000 ounces of Inferred Resources at 9.83 g/t Au.

Though the Champagne Zone has dominated headlines, AMEX’s exploration upside remains underappreciated. The Perron project hosts multiple parallel zones across a 4 km trend, many still open at depth and along strike. The recently discovered Team Zone continues to return strong assays, with mineralization similar to Champagne Zone.

Importantly, AMEX controls a contiguous land package in a region hosting deposits like Normetal (historical) and proximal to major players including Agnico Eagle and Hecla. This opens the door not just to a standalone development—but potentially a hub-and-spoke model if other juniors or past-producing assets are consolidated in the region.

AMEX Exploration’s leadership team combines deep technical expertise with seasoned capital markets experience, positioning the company for strategic growth and operational excellence.

President, CEO and director, Victor Cantore, is a seasoned capital markets professional specializing in the resource and high-tech sectors. He brings extensive experience in corporate development and strategic planning.

The team has applied rigorous geophysical and structural analysis, including AI-enhanced data targeting. The result: higher hit rates, lower cost per discovery ounce, and growing confidence in the deposit’s geometry and scale.

Unlike many juniors that dilute aggressively, AMEX has maintained capital discipline, with the company retaining a robust treasury and no debt, ensuring it can continue to drill aggressively into 2026 without returning to market.

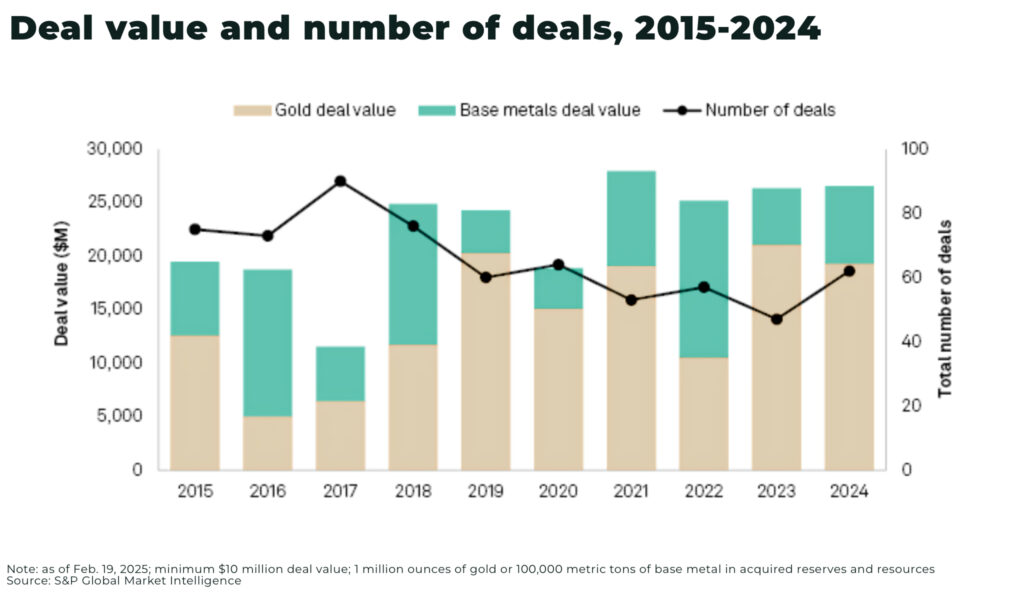

With major producers facing declining reserves and few new discoveries, the M&A cycle is turning, and companies like AMEX are increasingly prime targets.

In 2024, there were 43 gold deals with a total deal value of US$19.31 billion, and in 2023, there were 30 gold-focused deals contributing to a total M&A deal value of US$26.36 billion, which includes other metals but was heavily influenced by gold transactions.

AMEX offers leveraged exposure to a structural gold bull market—and a shot at a takeover premium before the market fully wakes up.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.