McKinsey & Co. has released a new report, McKinsey stating that without a major ramp-up in mining and refining, the world is going to hit a supply wall by 2030. They specifically reference nickel, copper, lithium, and cobalt and are predicting that nickel alone could see a 10–20% supply gap by the end of the decade. McKinsey also estimates that shortages of these critical metals could lead to an extra 400 to 600 million tons of greenhouse gas emissions in 2030.

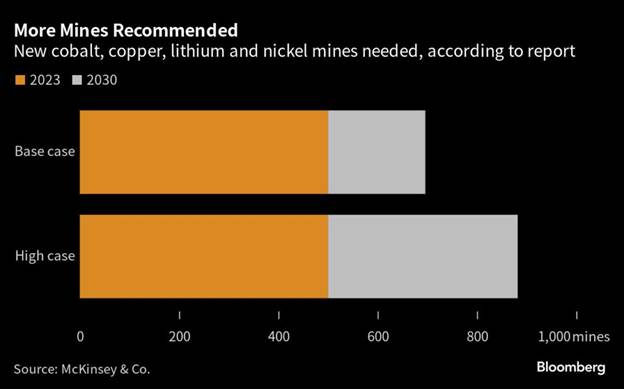

According to McKinsey, the world needs to nearly double the number of current cobalt, copper, lithium, and nickel mines—jumping from around 500 today to almost 900. And that’s just to meet expected demand. They’re also calling for a massive cash injection into the sector—between $3 trillion and $4 trillion in investments by 2030. That’s a 50% increase in annual spending compared to the last decade.

As we know, this year has seen some significant price pullbacks in the nickel space due to the scale of supply increases. I am therefore very pleased to see reminders that, while we may currently be in a state of imbalance that favors supply, over the longer term, that pendulum is set to swing hard the other way in favor of demand, with corresponding price swings. Music to a nickel bull’s ears.

Anthony Milewski

Chairman, Nickel 28 Capital