Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

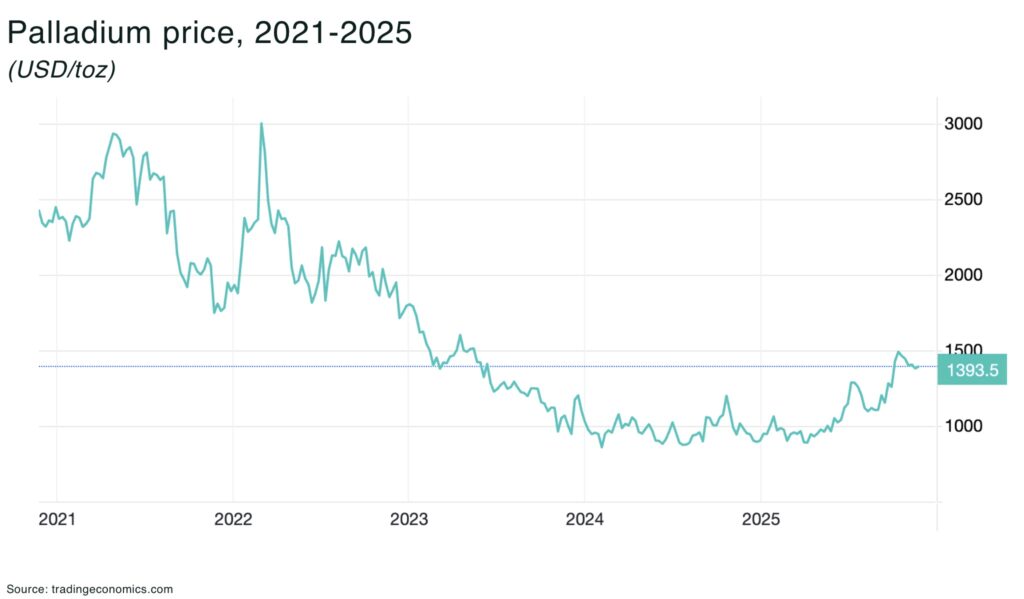

The price of palladium hit near US$1,500 in October 2025, up more than 50% in 2025, the highest since April 2023 — almost mirroring the soaring rise in price of gold — but, this is not just a debasement trade: the global electric vehicle boom is hitting serious speed bumps, and the palladium market, already in deficit since 2012, is responding.

Quite simply: palladium is essential to internal-combustion engines because it sits at the core of modern catalytic converters so stalling electric vehicle (EV) momentum is extending the lifespan of internal combustion engines (ICE) and hybrid vehicles.

This dynamic is sustaining robust demand for palladium in catalytic converters. And, as emissions rules have tightened — for example, from Euro 6 to Euro 7, China 6 to China 7, and, in the US, stricter standards for heavy-duty trucks, including EPA Tier 4 in the US from 2027 — so the required catalyst performance has risen, pushing up palladium loadings per vehicle.

In 2024, an estimated 85-90% of palladium demand comes from the automotive industry.

(the remaining demand is from electronics, medical devices, and chemical processes, with smaller roles in jewelry and investment).

Hybrids reinforce this dynamic: because their engines cycle on and off, catalysts spend more time in “cold start” conditions, forcing manufacturers to use 10–20% more palladium per car than standard ICE models. And hybrid demand is rising.

Electric vehicle growth is slowing

EV sales are still rising globally, but the breakneck growth is cooling and, importantly, has slowed in key regions – especially Europe and the US, but also in China, which is the world’s biggest car market and accounts for more than half of global EV sales):

- in the US, growth in EV sales slowed significantly in 2024, increasing by just 10% compared to 40% in 2023

- in Europe, EV sales fell or flatlined in 13 of 27 EU countries in 2024, notably in Germany and France, due to subsidy cuts and phase‑outs; in Germany

The latest report from Rho Motion on EV sales highlights how global EV sales may be up 23% in 2025 year-on-year so far, but are slowing in all major markets as EV subsidies and support programmes are rolled back:

- in Europe, month-on-month EV sales are down 13% in October

- in the US, EV sales have dropped significantly in October, for example, Ford sales have fallen 60% (Mach-e, F-150, E-Transit), Hyundai down 77% (Ioniq models), Kia down 77% (EV6, EV9)

- in China, EV sales were also slightly down month-on-month by -2% in October 2025, with 1.3 million units sold

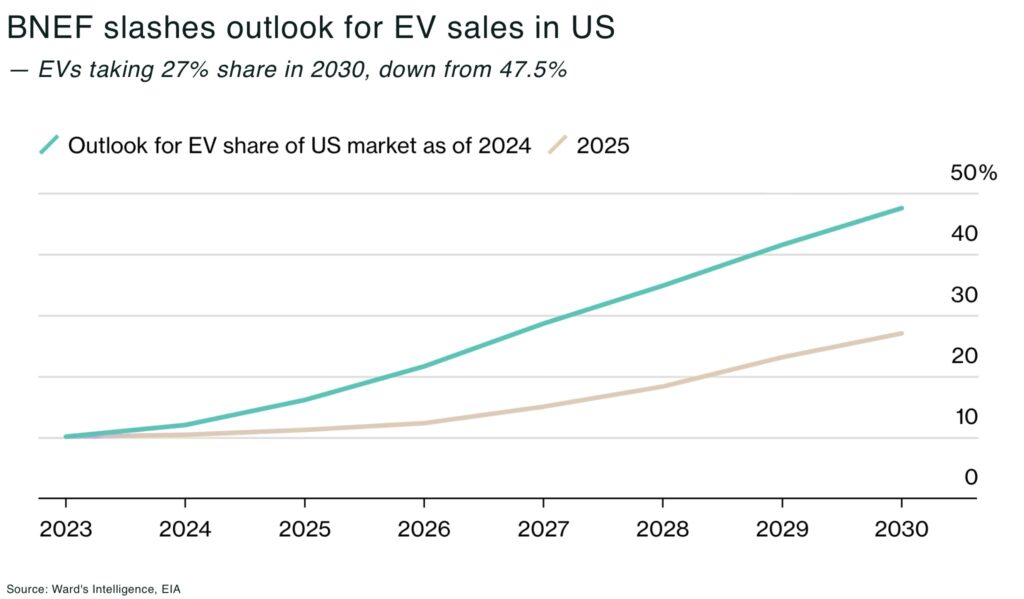

“Passenger electric-car sales in the US rise from 1.6 million in 2025 to 4.1 million in 2030 in this year’s outlook, representing 27% of sales. This is significantly less than in BNEF’s previous outlook — cumulative EV sales between now and 2030 are 14 million units lower” — BloombergNEF, Electric Vehicle Outlook 2025

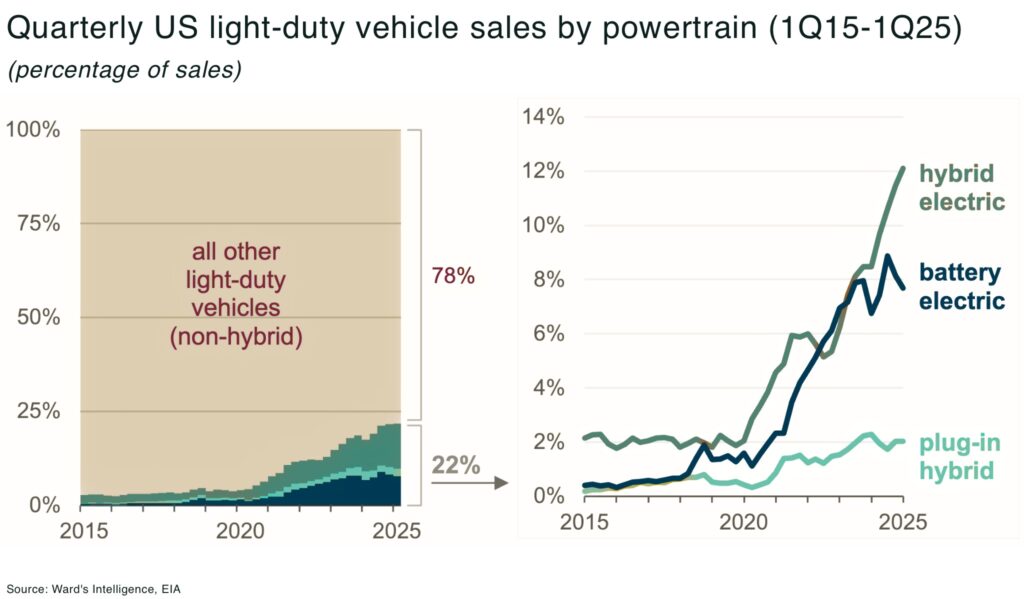

Hybrids accelerating

Sales of plug-in hybrid vehicles (PHEVs) and Range-extender EVs (EREVs) — all of which still require a catalytic converter — are now outpacing sales of battery electric vehicles in many large markets with sales rising 83% in 2024 to 1.2 million:

- about 22% of light-duty vehicles sold in Q1 2025 in the US were hybrid, battery electric, or plug-in hybrid vehicles, up from about 18% in the first quarter of 2024

- plug-in hybrid sales surged 62% across greater Europe in September 2025, according to the ACEA, the industry’s main lobbying group

- in 2024, EREV models accounted for nearly 25% of electric SUV sales in China, and they dominated the larger end of the electric SUV segment, making up 60% of large electric SUV sales

In other words, relative to forecasts even a year ago, EVs are stalling while hybrids and ICE vehicles are holding ground — and in many markets accelerating — keeping palladium-rich autocatalysts firmly at the centre of the auto supply chain.

And, for supply, this is a challenge.

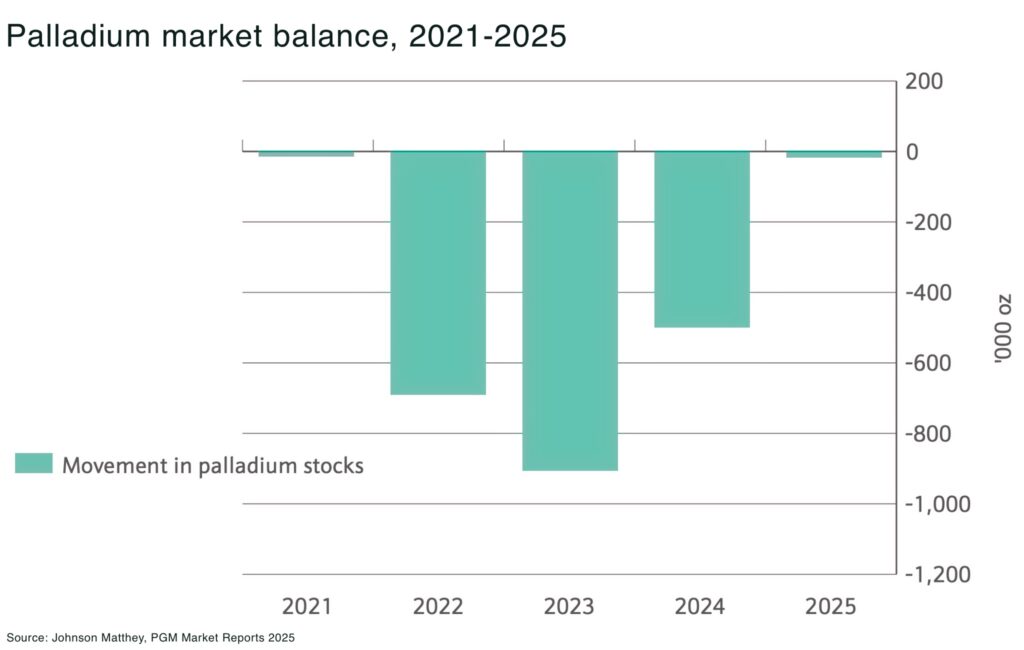

Palladium supply deficit

Global palladium supply has been in deficit since 2012, with shortfalls reaching 0.9 Moz in 2023 and 0.5 Moz in 2024 (these combined deficits of equal about 15% of annual demand). And market analysts now warn an expected surplus in 2026 may be pushed further back.

The issue is not just that demand remains robust, but supply is tightening — as we highlighted in our recent analysis: Palladium market confronts deficits amid North America’s push for supply security

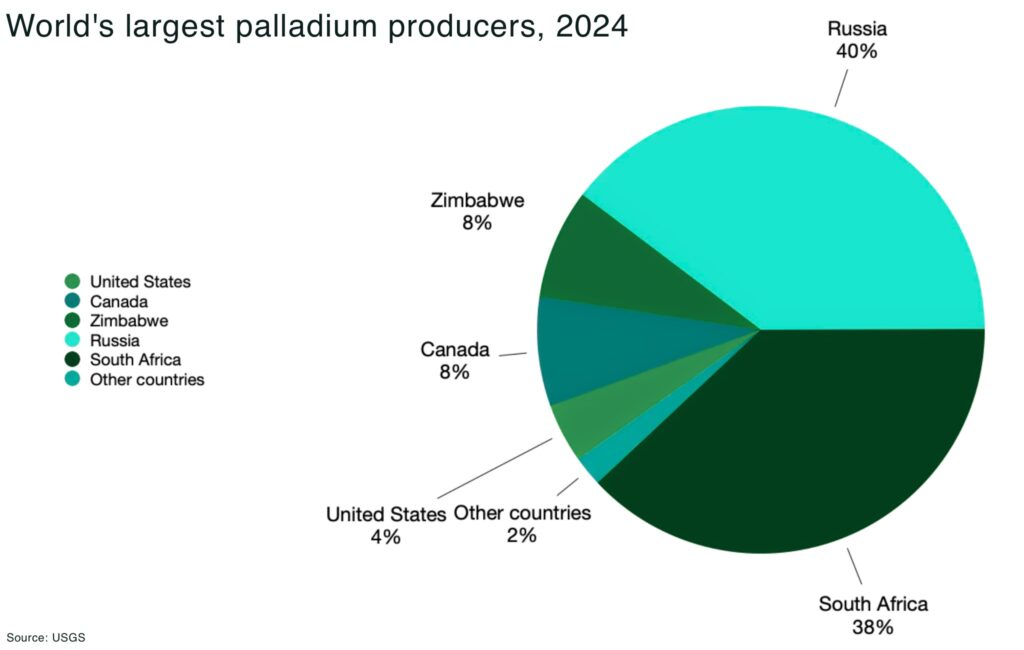

Supply of palladium is heavily concentrated in Russia and South Africa, with Russia’s Norilsk Nickel and South African PGM miners (like Valterra Platinum (formerly Anglo American Platinum), Impala, and Sibanye-Stillwater) being critical suppliers.

South Africa: supply slipping

The latest news for palladium from South Africa is the opening of Ivanhoe Mines long-awaited Platreef mine, a 25 years after exploration began. The project will ramp up annual output to 100,000 ounces of platinum, palladium, rhodium and gold.

However, South Africa, which provides ~35–40% of the world’s palladium, has recently seen production decline steadily.

Chronic power outages (load-shedding) and rising costs have hit mining operations, and two years of depressed PGM prices pushed a large share of the country’s mines into loss-making territory, triggering shaft closures, deferred capital spending, and multiple operations moving to care-and-maintenance

Output has been slipping as a result. Impala Platinum — responsible for roughly 20% of global primary PGM supply — reported a 43% drop in half-year profit in 2024 and subsequently placed its Two Rivers mine on care-and-maintenance.

The message from the industry is blunt: “It’s highly improbable that you’re going to see material investment in new PGM production in South Africa,” Implats CEO Nico Muller told reporters.

With power shortages, rising costs, and tighter margins, the country’s contribution to global palladium supply is shrinking rather than expanding.

Russia: disrupted flows, rising risk

Russia (Norilsk) is the single biggest source of the world’s palladium (approx 40% of mine supply), and production even increased approx 2% in 2024 to 2.75 Moz as Norilsk Nickel beat its guidance. But the headline masks deep instability.

Direct exports to Western markets have been heavily disrupted by sanctions following the invasion of Ukraine, forcing Russian metal to move through rerouted channels such as Armenia and Swiss bonded warehouses.

The fragility of these workarounds highlights the geopolitical risk: any tightening of US or European sanctions could remove a significant volume of palladium from global trade almost overnight. Markets have already tested this scenario when the US merely floated the idea of tougher restrictions in late 2024, palladium spiked above US$1,200/oz, underscoring how sensitive the market is to any threat to Russian supply.

North America: production cuts and looming closures

North American supply is also tightening. Sibanye-Stillwater — the only primary palladium mine in the US — has announced significnat cuts at its Stillwater operation in Montana, with output of palladium and platinum expected to fall by up to 45%.

The Lac des Iles mine in Ontario, one of the country’s few significant palladium producers, has been given a temporary reprieve from closure next year but is still scheduled to cease commercial production by mid-2027, further tightening North American supply as global deficits deepen.

The strategic importance of North American palladium sources for security of supply has increased sharply since Covid and Russia’s invasion of Ukraine as geographic concentration poses both economic and geopolitical risks. In this context, North America’s palladium projects have gained new significance.

Generation Mining’s Marathon Palladium-Copper Project (TSX:GENM OTCQB: GENMF)in northern Ontario, Canada, is advancing its Marathon Project, a fully permitted and construction-ready critical mineral development — with palladium as the flagship product.

Generation Mining’s feasibility study projects Marathon will yield an estimated average of 166,000 ounces of payable palladium (and 41 million pounds of payable copper) per year over a 13-year mine life — 2,122,000 ounces of palladium in total over those 13 years.

In May 2025, a major milestone was reached with the final key permit for mine construction.

At today’s metal prices, Marathon’s revenue from palladium and copper will be roughly equal, underscoring the site’s role as a true multi-metal critical-mineral mine. This makes the Marathon project strategically vital, with robust economics: a C$1.07 billion NPV (6% discount rate) and a projected IRR of 28%, calculated using trailing 3-year average metal prices.

With all key permits secured, the final hurdle is construction financing. Generation Mining has a “shovel-ready” plan and meaningful community and Indigenous support, positioning Marathon to proceed as financing is arranged. Once built, projects like Marathon would substantially enhance North America’s palladium supply, supporting both economic security and the region’s critical mineral strategy.

Conclusion

For years, palladium was written off as a sunset metal. As EV forecasts climbed, analysts assumed autocatalyst demand would collapse and that persistent deficits — which ran for more than a decade — were irrelevant to price. The market treated them that way: palladium drifted lower even as consumption regularly exceeded supply.

That narrative has now broken. EV adoption is slowing, hybrids are surging, emissions rules are tightening, and global palladium supply is shrinking from every major source.

The result is a market that finally has to reckon with fundamentals that were long dismissed. Deficits matter again. With South African output sliding, Russian flows increasingly fragile, and North American production contracting, palladium is no longer trading like a metal in retreat. The structural forces underpinning demand are firmer than expected, while the supply base is weaker than assumed.

For this sunset metal, the sun is rising again.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.