Kerry Knoll is chairman and co-founder of Generation Mining (TSX:GENM OTCQB: GENMF)

As Generation Mining gets ready to build its large copper and palladium mine in Northwestern Ontario, management of the Oregon Group asked me to reflect on some of the mines I’ve been involved with over the four and a half decades that I’ve been plugging away in this industry.

The idea of building mines myself first occurred to me back in the mid-1980s, when I was editor of The Northern Miner Magazine. At the time, most of the people running mining startups fell into one of two categories, the dreamers and the liars. The dreamers simply hoped to get lucky and discover a big mine, which was rarer than getting hit by lightning. Often they would drill holes with money they didn’t have, hoping to settle up with the outstanding account with shares. The liars were interested in selling shares and not much else. As one friend put it, their real goal was mining the investor’s bank accounts. There were also the occasional true entrepreneurs, people who wanted to discover or build an actual mine, like Robert Friedland and Jim Gill, but these were rare, and I made it a point to profile them in the magazine.

I wrote a long article about a new technology that would transform the gold mining business, and at first, not in a good way. Newmont was the leader of this transformative idea, which was a cheaper technique of processing ore known as heap leaching. Rather than spending big money on grinding ore to the fineness of baby powder, with heap leaching you could just crush it, spread the chemicals on top with sprinklers, and wait for the gold to trickle out. An unintended consequence of this new technology was a dramatic increase in world gold production, which in turn put a 20-year cap on the gold price.

I found this kind of exciting and started asking the staid bunch of people running Canadian gold mining companies why there wasn’t any heap leaching going on in Canada. “Too cold,” was the usual answer. But I read about an American company named Pegasus that had several heap leach mines in Montana and Idaho, some at very high altitudes, and very cold in the winter. I reasoned that metallurgy doesn’t suddenly change at the U.S.-Canada border. And I was getting disillusioned at my job, and thought maybe it would be more interesting to make the news rather than just write about other people’s success. That was it, I was going to quit my job and start the first Canadian heap leach mine.

It took me nearly a year to get my first company trading publicly, which was underwritten by my friend and broker Ian McDonald at Yorkton Securities, who then joined me as my business partner. There was one goal, and that was to build a heap leach gold mine. None of the smoke and mirrors and bullshit that permeated the junior miners of the day. The company we started, Glencairn Exploration, initially got side-tracked building a diamond mine in Brazil, which employed about 100 people at its peak but never did make any money. That was probably a lucky thing, because had I found myself suitcase full of diamonds out there in the Brazilian outback, I very likely would have been murdered for the treasure. At the time the Amazon basin was being over-run by cut-throat garimpeiros, illegal miners who burned the rain forest, murdered Indigenous tribes that got in their way, and dumped a reported two tonnes of mercury into the ecosystem on a daily basis. We’d heard that they usually only mined down to the water table, and that there were heap leaching opportunities to continue mining where they had stopped.

One spring day we flew into the jungle in the interior state of Matta Grosso, where a guy owned the mineral rights which were being pillaged by more than 1000 garimpeiros. The result was an ocean of red mud as far as the eye could see, with clusters of miners here and there across the horizon. Suddenly a bunch of them hopped into a pickup truck and sped over to where we were standing. The mine owner fibbed to them that we were from the university, and here to study the geology, a lie which nevertheless seemed to satisfy them. I asked him why he told this story and he said if he told them the truth they might kill us. The year before not far away a group of garimpeiros had crucified a company geologist. Ian and I decided that Matta Grosso wasn’t going to be the place we built our first gold mine.

Another time in Rio de Janeiro, my lawyer Roberto Negrao de Lima called me on a Saturday morning and said to come to his home office, it was important. Roberto had been the in-house counsel for De Beers and Anglo American for Brazil but had recently inherited a bunch of money and mostly retired. Another client of his was sitting there with an espresso when I arrived. His story could have been made into an action-adventure movie. His crew had discovered a very rich gold deposit in the state of Matta Grosso, with the almost unheard grade of 10 grams per tonne in an open pit. But he was being attacked by garimpeiros, with an estimated 2000 of them camped in the jungle around his mine. The state militia had been guarding the site but the governor had just called them off. The guy told me that the state leaders were heavily involved in the cocaine trade across the border with neighboring Bolivia, and since the Brazilian currency with nearly worthless (70% monthly inflation at the time), the suppliers would only take gold in payment. He said the governor was financing the garimpeiros to get the gold.

The guy was desperate. He came up with a plan to offer the illegal miners half of the deposit in return for peace, but when his chief of security, mine manager and geologist set up a meeting in what sounded like a very rough jungle bar, the trio was machine-gunned to death before any of them could utter a word. By the time of our meeting he’d hired a retired Brazilian army general who was bringing in planeloads of ruthless mercenaries fresh from the civil war in Mozambique, and was even trying to negotiate the purchase of napalm from Russia. But he reckoned his only hope was to get the Brazilian army in to protect the mine. His proposal to me was, “If you can get this story on the front page of the New York Times or Wall Street Journal, I’ll give you a quarter of the mine.”

“What good would that do?” I inquired.

“The Brazilian government is petrified about bad press in the United States,” he replied. The situation had been well-covered in the Brazilian press, and he handed me some articles to help the effort. I did have a few connections from my journalism days and said I’d do my best. Roberto called me a few days later and said it was too late, the garimpeiros had attacked the mine and all was lost.

When our diamond mine in Brazil closed down and we returned to Canada with our tails between our legs, we decided to build a new company by acquiring mothballed gold mills. Our mantra was that the best place to look for a new mine is near an old mine, and having a permitted mill would make production much easier. We acquired two of these and put them into a new company which I named Wheaton River Minerals after staring at a map of the Yukon where the projects were located. We later heard that the Golden Bear mine in British Columbia was going to be shut down by its American owner, the storied Homestake Mining Company, founded in the 1870s by the patriarch George Hearst. So we decided to go after that one as well.

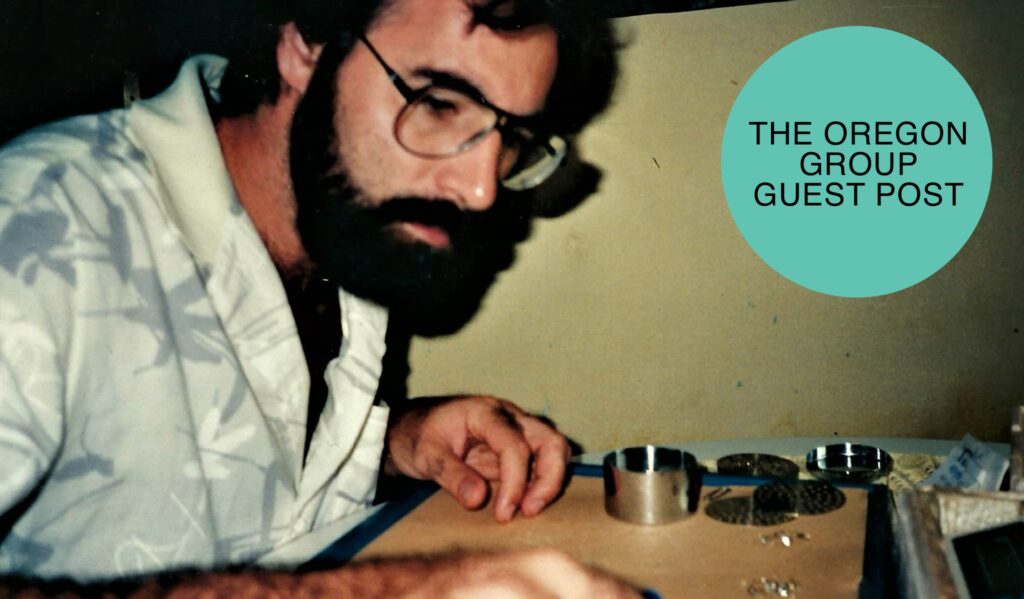

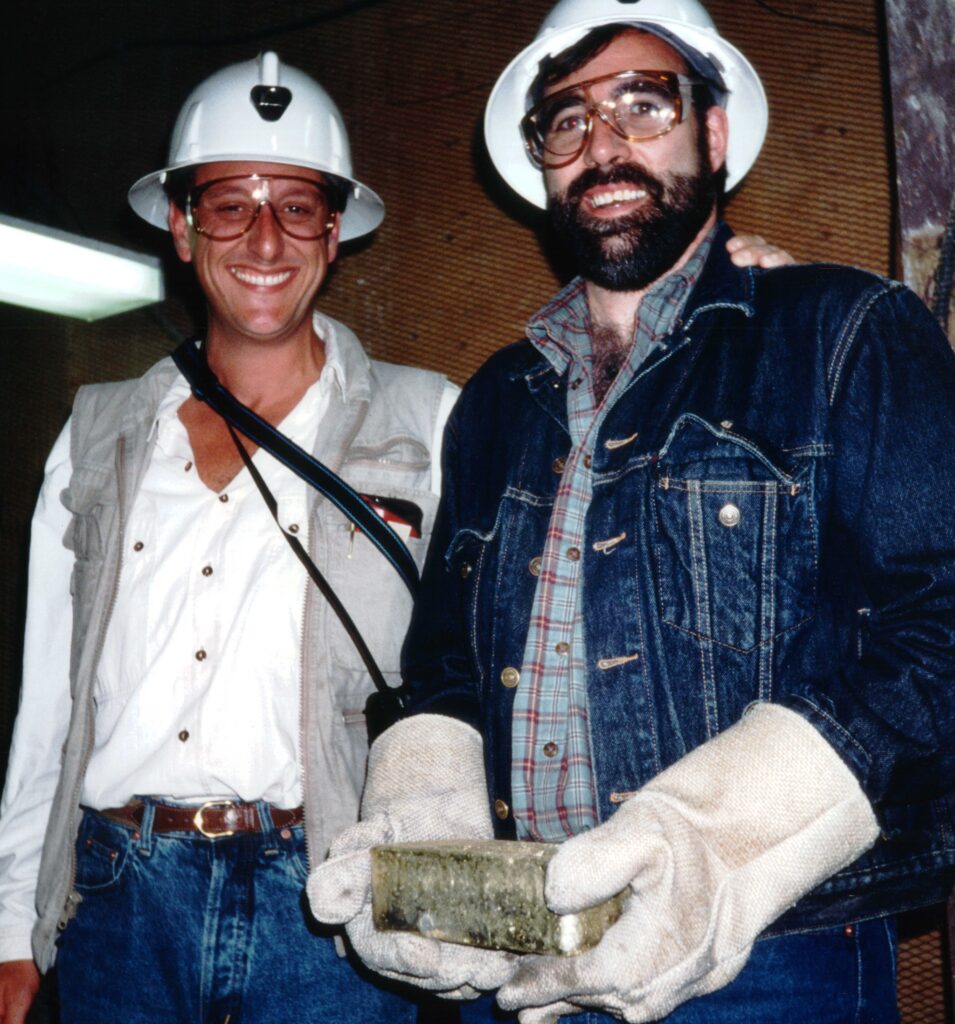

It was still operating with about a year of reserves when a Homestake executive came to our office in Toronto in 1993. We asked him what he wanted for the mine, and he said, “Look at it this way, imagine that today is Christmas and my name is Santa Claus.” We wound up buying it for a dollar, and they even put up the reclamation funds and employee severance. A couple of months later we were operating a real-life gold mine. We secured a bunch of financing from Jonathan Goodman at Dundee, and Glen Milne at Canaccord, along with a new name in the mining business, an excitable fellow named Eric Sprott. And we started drilling. In October that year our brilliant geologist Dunham Craig discovered two new deposits the same day. The first one was an intersection of 15 grams gold per tonne over 15 metres down below the old workings, while a second pulled a spectacular 62 metres grading 5 grams from surface. The latter one was oxidized and so a good candidate for heap leaching. We ran some tests and voila, it showed unusually fast leach times. It took a couple of years but we managed to borrow 100% of the $10 million price tag to build Canada’s first and to this date only successful heap leach mine. It was probably the richest in the world at 5 grams gold per tonne, and we were getting more than 90% of the gold out in only three months. We were producing gold at the bargain price of $125 per ounce, though unfortunately for the first few years we had to sell it at $275.

In 2001 we caught the attention of financiers Frank Giustra and Pierre Lassonde, who were correctly anticipating a new bull market for gold. They were looking for a vehicle to start buying up gold mines while they were still cheap and settled on Wheaton River as their first choice. We were all in favor, especially when they let it be known that Ian Telfer would be taking the helm. I’d met Telfer in Brazil when he was running the successful gold company TVX and thought the world of him. They were right about the gold price and acquired several mines over the next couple of years. They eventually merged as equals with Goldcorp and the company was ultimately sold to Newmont for US$12 billion. They replaced most of our staff but wisely kept on the talented geologist Randy Smallwood, who we’d hired on in 1993 when he was logging core in the Alaskan bush. When Wheaton invented streaming and spun out a subsidiary named Silver Wheaton, Randy became their analyst and later President and CEO, a position he still holds 32 years after joining the Wheaton team. The company, now called Wheaton Precious Metals, has a market cap of US$50 billion as I write.

By 2005, my original company Glencairn had three operating gold mines in Central America and 1200 employees, one of which we had built in Costa Rica. Yes, another heap leach mine. The company was later sold to B2 Gold which did a fine job extending the life of two of the mines, and now those are owned by Equinox. In the meantime, Ian and I had a shell company and were looking for something new. We were tired of gold – the big secret of our industry was that long term, most gold companies didn’t make much money. Whenever the gold price would go up, production costs would mysteriously follow. So we segued into a commodity almost nobody had heard about and couldn’t even pronounce, molybdenum. Moly for short.

In late 2004 we had optioned the Davidson deposit near Smither’s, B.C. It had potential as a large underground mine, originally discovered by the American company Amax. Moly, an important steel alloy, had just nearly doubled in price to $7, though it was hard even to find a price quoted anywhere. I remember being by myself in the office between Christmas and New Years creating the new PowerPoint when the phone rang, it was a corporate finance type from one of the brokerage firms. He said, “I’ve been looking at that moly project you guys have, did you know the price just doubled again to $14?” I didn’t know. We had just passed the hat to friends and family to raise a million bucks at a dime, and when the shares started trading a couple of months later they opened at a quarter and started moving up. We did some infill drilling and then a PEA on the deposit as the moly price moved higher, and suddenly our shares were trading at 80 cents.

There was a private company named Thompson Creek operating the Endako moly mine down the road near Fraser Lake and we made a deal with them to rail our ore to their mill, alleviating the need to build a mill or permit a tailings facility. The market loved it, and our shares eventually moved up to $2.50. Then we made the bold move to buy Endako, which was making money for the first time in several years, for $200 million. Gene McBourney over at GMP Securities agreed to do the raise. This mine was the smaller of two operated by Thompson Creek, the other one being in Idaho. As we were preparing for the road show, Ian got a strange call from some bankers at UBS in New York. They said, “if you can raise $200 million to buy Endako, do you think you could raise $300 million to buy the whole company? We think its worth $700 million at long term moly prices, and we’d loan you $400 million of that.” No junior company had ever raised that kind of money before so we were a little skeptical. But the owner of Thompson Creek was looking to retire and a deal was cut. GMP was on side, and we prepared the announcement. At the conference call to answer questions about the deal, Eric Sprott, then our largest shareholder, came on the line and announced to the world that he was subscribing for $50 million of the issue. This was before it was even priced. When a company is doing a big financing the shares usually plummet but Blue Pearl opened at $7 a share, up $4.50 on the day. Moly prices kept going up, into the mid-twenties, and Thompson Creek was making a $1 million profit every day. Ian went on the road and did 90 presentations in three weeks and pulled it off, settling on a $5.50 share issue.

The market loved the story. Our purchase price was based on $12 moly and the actual commodity was trading at more than double that. The share price kept rising, through $8 and then $10. We got listed on the New York Stock Exchange and the Mad Money television celebrity Jim Cramer made us one of his top picks. The shares roared through $20, giving us a market cap north of $2 billion. The Financial Post initiated a column which rated the top performing stocks on the Toronto Stock Exchange over the past 12 months, and we were number one for the full year that it ran. By 2008 we had paid off half the loan, and did a financing at $22 to pay off the rest. We were debt free and getting ready to pay a hefty dividend when the crash of 2008 ended the party for a while, and Ian and I eventually stepped aside.

Not all of my adventures in mining were as successful, but I fully expect that Generation Mining’s Marathon copper and palladium mine will be among the winners. And what goes around comes around. Generation has a streaming deal with Wheaton Precious for C$240 million to help our build. We have the banks lined up and the permits in place.

No two mine builds are the same, and they aren’t for the faint of heart either. During a build there is a new hair-raising adventure nearly every day and how those trials are dealt with determines whether a build is going to be successful or not. If I’ve learned anything in this business, from watching the likes of Robert Friedland and Ross Beaty, it’s hire the best people available to build your mine, and don’t start construction until you have them on the payroll.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.