Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

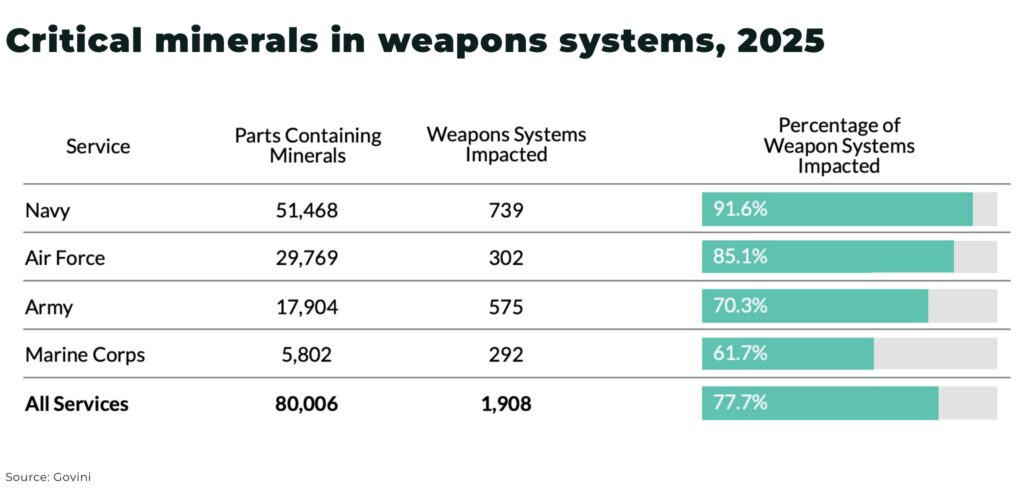

The US Department of Defense relies on Chinese supply chains for components used in 1,900 weapon systems, encompassing over 80,000 individual parts — threatening 78% of US military weapon systems.

A new report from Govini, a defense data analytics firm, entitled Rock to Rocket: Critical Minerals and the Trade War for National Security, warns China dominates global production and processing of five essential elements: antimony, gallium, germanium, tungsten, and tellurium.

Some of the systems most impacted include the Arleigh Burke Class destroyers, America Class amphibious assault ships, Nimitz Class aircraft carriers, and the Minuteman III nuclear missile program.

91.6% of Navy systems and 61.7% of Marine Corps systems rely on these five minerals.

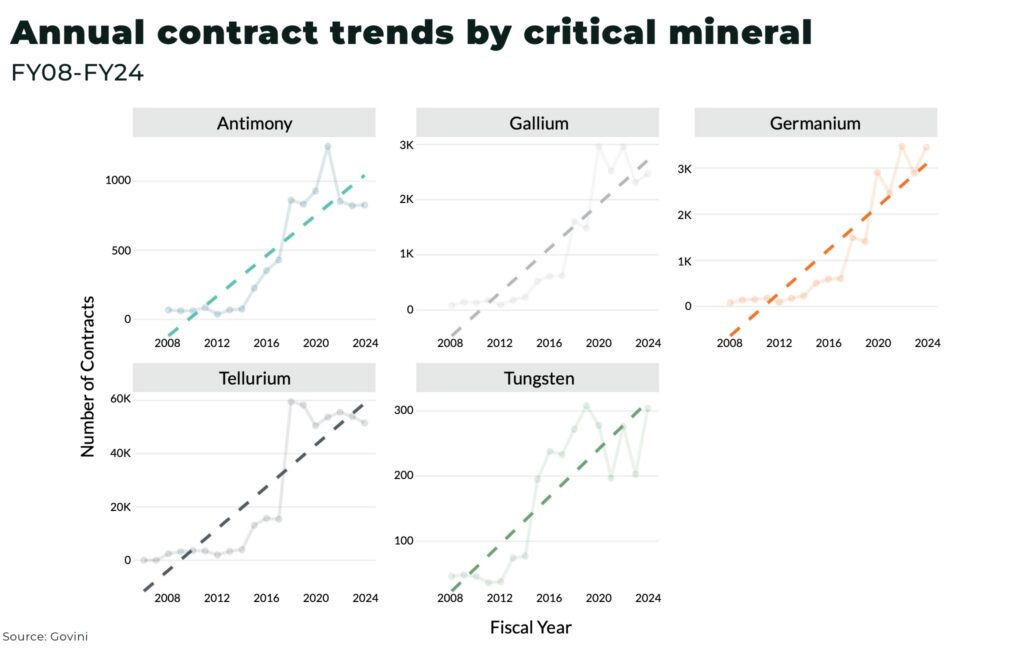

Department of Defense (DoD) contracts for parts containing these minerals have grown at an average of 23.2% annually since 2010. Gallium-related contracts alone surged by 41.8% per year.

The increases are larger within specific critical minerals —contracts for parts with gallium have surged by 41.8% each year, and spending on germanium-containing parts has risen by 16.1% year-over-year. And, after China’s ban on gallium, germanium, and antimony, prices for associated components rose 5.2% on average. Gallium-linked parts saw a 6% increase.

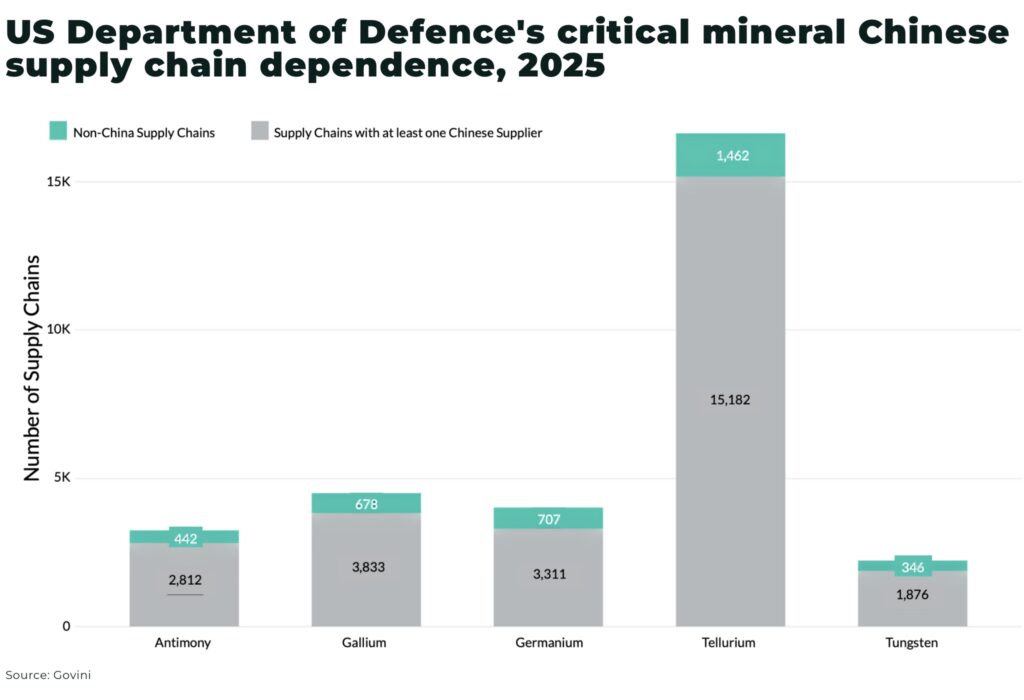

Over 43,000 different supply chains have some level of Chinese dependence extending down to six tiers of suppliers, with 88% of supply chains for these minerals contain at least one Chinese vendor. Even when mined elsewhere, processing often occurs in China, rendering the material inaccessible under new restrictions.

China’s influence also extends beyond direct exports. Its state-backed firms operate globally, like Tibet Huayu in Tajikistan, entrenching supply chain control. For antimony alone, 81% of the material used in key platforms like the Minuteman III missile and Arleigh Burke destroyer originates from China-linked sources.

The report also flags future risks. China controls:

- 80% of global graphite (used in batteries and propulsion systems)

- 62% of fluorspar (for semiconductors and nuclear fuel)

- majority of magnesium (used in aircraft and missile structures), none of which are currently stockpiled by the US government

Govini recommends aggressive investment in domestic refining, expanded national stockpiles, and leveraging “mineral companionality” to extract critical elements from existing operations.

The US defense supply chain is deeply vulnerable to Chinese leverage. Without urgent and sustained intervention, America’s ability to manufacture advanced military systems may be compromised, rock to rocket.

Our recent analysis on how America’s critical mineral strategy threatens disaster:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.