Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

China continues to restrict exports of rare earths and other critical minerals to defense manufacturers in the West, according to the Wall Street Journal, impacting the production of everything from jet fighters to night-vision goggles.

Industry sources confirm China’s restrictions are already delaying production for US and European defense companies, forcing them to use stockpiles and delay production.One US drone-parts supplier reported order delays of up to two months as it scrambled to replace Chinese-sourced rare earth magnets, while traders say prices for certain materials have surged at least x5.

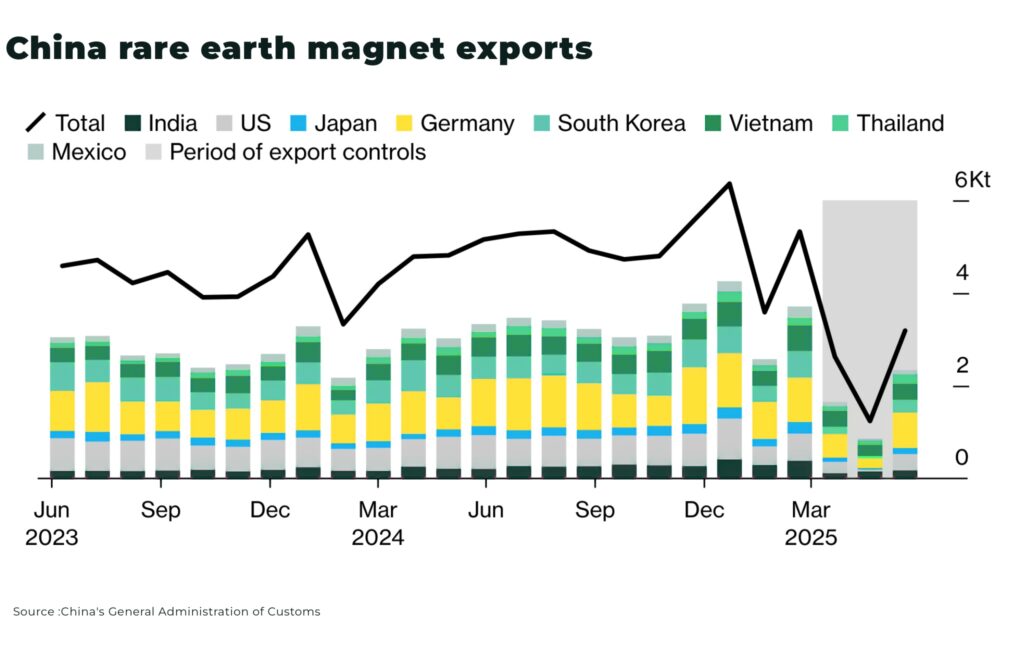

Flows of rare earth magnets from China to the US have eased for civilian purposes since restrictions were introduced in April, rising to 353 tons in June, up from just 46 tons in May, according to the latest customs data.

Meanwhile, US Trade Representative Jamieson Greer described the current state of talks over rare earths as “about halfway there,” following a new round of negotiations aimed at stabilizing critical minerals flows between the world’s top economies.

“We’re focused on making sure that magnets from China to the United States and the adjacent supply chain can flow as freely as it did before the control… And I would say we’re about halfway there” — Jamieson Greer, US Trade Representative said in an interview on CBS.

China supplies around 90% of the world’s rare earths and dominates the production of other strategic minerals, including germanium, gallium, and antimony—materials now subject to outright bans or strict export licensing. Beijing’s new requirements force Western buyers to provide detailed information about the intended use of these materials, with approvals for military applications often delayed or denied outright.

US industry is urging the Trump administration to act against China’s monopolistic practices.

“Dumping is a malicious trade practice used by China to undercut competition and wield geopolitical influence,” said Erik Olson, spokesperson for the American Active Anode Material Producers (AAAMP), following a recent US anti-dumping tariff of 93.5% on Chinese synthetic graphite.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.