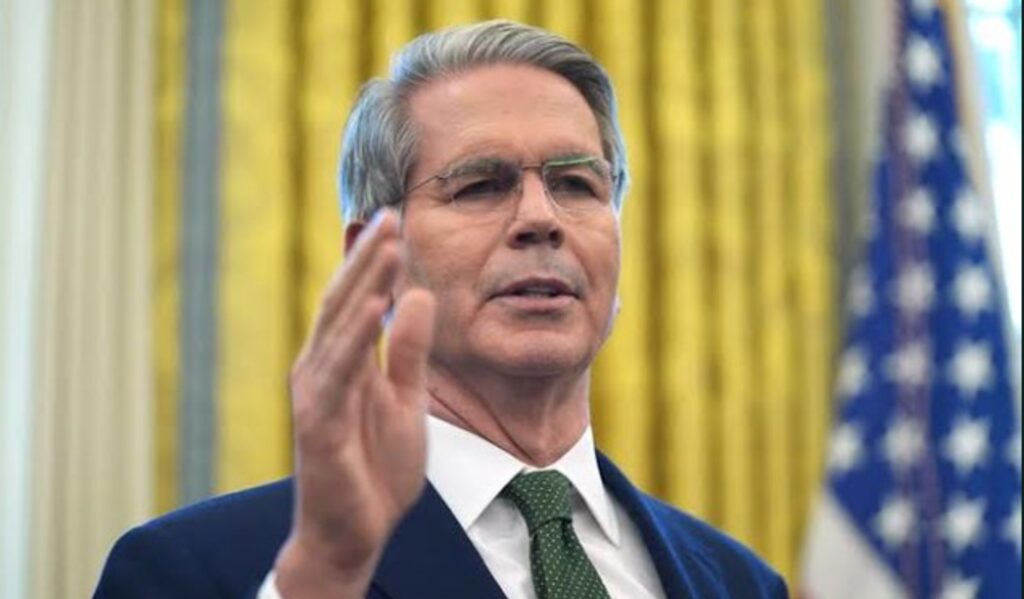

The United States is weighing price floors and “forward-buying” for critical minerals such as rare earths and graphite to counter China’s use of below-cost exports to control global supply chains, according to statements from President Trump adviser Scott Bessent.

The policy under consideration would reportedly set minimum guaranteed prices for producers of strategically important minerals to prevent market collapses triggered by Chinese oversupply. It would mark the most direct US intervention in mineral markets since wartime stockpiling programs and comes alongside plans for expanded US government equity stakes in mining and processing companies.

The move comes after Bessent after President Trump threatened an additional 100% tariff on Chinese goods in response to Beijing tightened rare earth exports, reducing the flow of batteries, magnets and semiconductors to the US.

“I think things can de-escalate. We have things that are more powerful than the rare earth export controls that the Chinese want to put on — and to be clear, this is China versus the world… If China wants to be an unreliable partner to the world, then the world will have to decouple,” — US Treasury Secretary Scott Bessent

Basically, a price floor would work something like this: if rare earth or graphite prices fall below a minimum level, the US government compensates producers for the gap or purchases material into a strategic stockpile. Variants already exist in agriculture and oil, and it appears mining may now enter into a similar system.

Trump’s planned Oct. 29 meeting with Chinese President Xi Jinping remains on the schedule — despite the US president’s threat to cancel the summit.

Find out more on our analysis on why America’s critical mineral strategy threatens disaster: