In 2025, there have been at least 6 major approvals or construction starts for small modular reactors (SMRs) globally — a record number.

For years, SMRs have been treated as nuclear’s “next big thing” that never actually delivers. But now, projects across the US, Canada, the UK, China and Middle East, are no longer just designs on paper, they’re being green-lit, permitted and, in some case, built.

And, the potential for small nuclear reactor modules to be deployed quickly from the assembly line would have a significant impact on uranium demand.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

What are SMRs and why do they matter for uranium?

Firstly, what are SMRs? These small, modular reactors are an advanced generation of reactors designed to deliver between 5-300 MWe per module (in comparison to more than 1,000 MWe for conventional size reactors).

The idea is not new, with all US submarines now powered by nuclear reactors, as well as 10 nuclear powered Nimitz Class aircraft carriers.

But, the potential application for baseload energy is new, with advantages over larger sized nuclear reactors including:

- modular construction: factory fabrication reduces on-site complexity, cost overruns, and build time

- smaller footprint: SMRs can be built on compact sites, including former coal plants or military bases

- deployment flexibility: units can be scaled in stages (1–12+ modules), tailored to grid needs

- assembly line: one of the major issues with large-scale reactor design is that, once a fleet has been built, they are built much less frequently, and so the expertise required retires — but a smaller assembly line of reactors promises to fix that

- passive safety systems: designs like GE Hitachi’s BWRX‑300 or NuScale’s VOYGR rely on gravity, convection, and natural circulation, minimizing operator intervention

For example, 300 SMRs generate enough electricity to power 68 million homes (half the homes in the US), with the equivalent carbon emissions avoided of 100 million cars off the road (97% of all passenger vehicles on the road annually in the US)

Although smaller in size, many SMR designs require similar or even higher uranium input per megawatt compared to conventional reactors due to higher enrichment levels or compact core designs.

| SMR Type | Power Output (MWe) | Estimated U Demand (tU/year) |

| GE Hitachi BWRX‑300 | 300 | 200–300 |

| Rolls‑Royce SMR | 470 | 350–500 |

| NuScale VOYGR-6 | 462 (6×77) | 350–500 |

| Holtec SMR-300 | 300 | ~250 |

| China HTR‑PM (2 units) | 210 (total) | ~130–180 (varies) |

Source: WNA, IAEA, vendor technical data

SMRs are not intended to replace large reactors, but to open nuclear markets where traditional builds are unviable. That includes:

- regions, like the US, UK, and EU, where permitting and approvals for larger reactors can take decades

- remote regions with weak grids

- coal-replacement sites, industrial parks, and desalination plants

- export markets with lower capital capacity

If even a fraction of proposed SMR fleets are built, let’s say, 100–200 units globally by 2040, that would translate into an estimated 20,000–40,000 tonnes of uranium demand annually, or up to 50% of current global production.

(Construction of ~100–200 SMRs globally by 2040 would add ~30–90 GWe of capacity. Using an average consumption rate of ~200–300 tU per 300 MWe unit, this scales to approximately 20,000–40,000 tU/year, or approx 30–60% of current annual demand (~65,000 tU/yr))

SMRs are an important accelerant to the uranium bull market thesis, as outlined in our recent report “The Great Uranium Disconnect“.

Canada’s SMR bet moves from paper to concrete

In May 2025, Ontario Power Generation received the final approval to begin construction on the first of North America’s first grid-scale SMR: the GE Hitachi BWRX‑300 at Darlington.

What began as a pilot in the late 2010s is now a CAD$6.1 billion construction project, part of a broader C$20.9 billion buildout for four units at the site to be completed by 2028-29.

For uranium, the implications are material. Each 300 MWe unit requires roughly 200–300 tonnes of uranium annually. Four units in Darlington equates to an estimated 1,000–1,200 tU/year, or roughly 3% of current global uranium production.

The UK approves the Rolls Royce of SMRs

Across the Atlantic, the UK has (finally) approved its own SMR pivot.

On June 10, 2025, the government announced a US$3.4bn commitment to Rolls-Royce SMR, selecting it as the lead technology for three new reactors to be built by the mid-2030s.

The funding is part of a wider US$25bn push to expand domestic nuclear capacity, including the large-scale Sizewell C and a prototype fusion plant. But the SMR announcement stands out because its targeting not just power generation — but exports. Rolls-Royce has already partnered with the Czech Republic to develop a “strategic partnership” over.

If the UK moves ahead with a full fleet — 16 units were originally proposed — annual uranium demand could exceed 4,000 tU. Even the initial three reactors will require an estimated 1,000 tU/year.

(Each 470 MWe Rolls‑Royce SMR is expected to consume approximately 350–500 tU/year, based on estimated scaling from 300 MWe designs and industry data (WNA fuel usage benchmarks)

China leads on SMR deployment

As countries in the West finalise approvals and pilot schemes, China is already building and operating SMRs.

The high-temperature gas-cooled HTR‑PM reactor, a Generation IV design using pebble-bed fuel, reached commercial status in 2023 at Shidao Bay — the world’s first grid-connected, commercially operating SMR.

And, in April 2025, the first of four main pumps were installed at the ACP100 small modular reactor demonstration project, under construction at the Changjiang site on China’s island province of Hainan.

These projects sit alongside China’s aggressive large-scale reactor program, with an estimated 23 reactors under construction.

The US playing catch-up — fast

In May 2025, US President Trump signed an Executive Order “to accelerate the secure and responsible development, demonstration, deployment, and export of United States designed advanced nuclear technologies.”

Trump’s order builds on recent momentum with the Accelerating Deployment of Versatile, Advance Nuclear for Clean Energy Act (the ADVANCE Act) in 2024, new design approvals, utility construction permits, and more than US$900 million in latest funding from the Department of Energy (DoE), including:

- Holtec, once sidelined in the global SMR race, is preparing to install two SMR-300 units at the Palisades site in Michigan, after securing a US$1.5 billion conditional loan from the Department of Energy

- the Tennessee Valley Authority and GE Hitachi are advancing a BWRX-300 at the Clinch River site in Oak Ridge with a new application for a US$800 million in DoE funding

- NuScale, once the poster child for US SMRs, stumbled with project cost inflation and lost its Utah backers in 2023 — but has had its newer design approved

- Westinghouse Electric Company is planning a rollout of SMR fleet

What’s driving the second nuclear renaissance

As we outline in our analysis “Nuclear energy is back“, the main reasons driving this second nuclear renaissance are a demand for clean baseload energy that can power the huge demands from new data centers to power artificial intelligence, as well as meeting national security and clean energy concerns.

SMR risks

SMRs are not immune to cost overruns or political blowback — in particular, many of the cost estimates apply when several reactors have been built with factory scaling, and lead times (Darlington’s first unit won’t be online until 2030) mean delays can push projects into the the next decade.

And, technically, many experts argue that it is more efficient to just build out larger scale reactors instead.

But, politically and financially, SMRs offer a more palatable path with smaller upfront costs, modular deployment, and better alignment with today’s funding and regulatory environments.

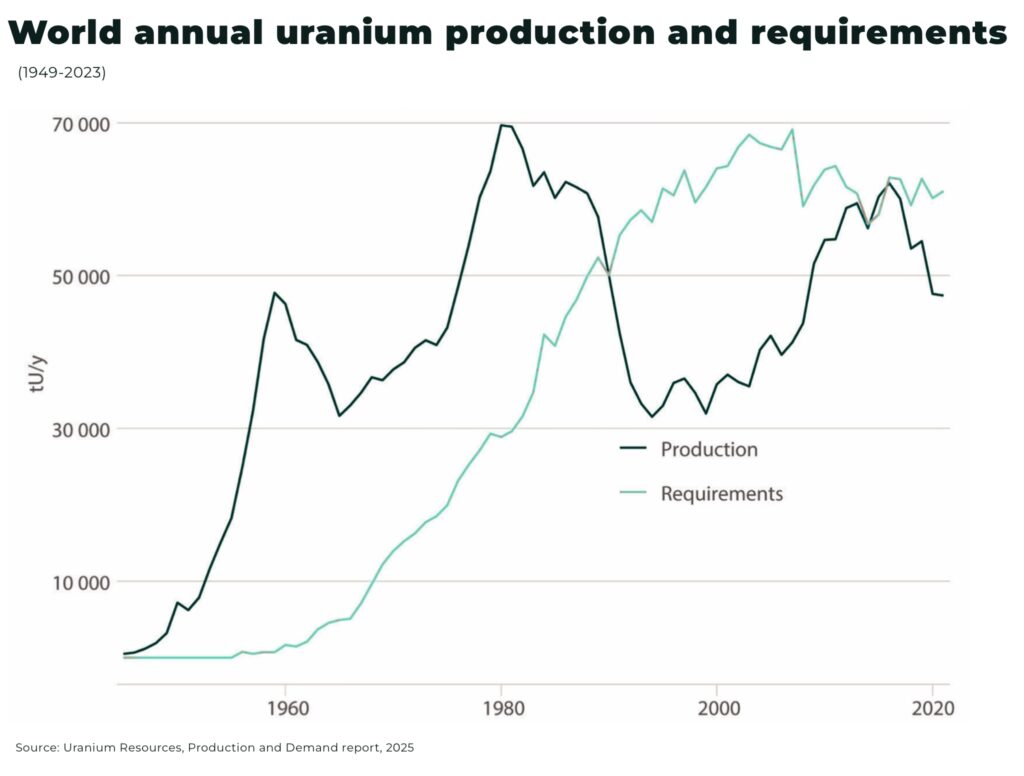

Uranium market: structural tightness

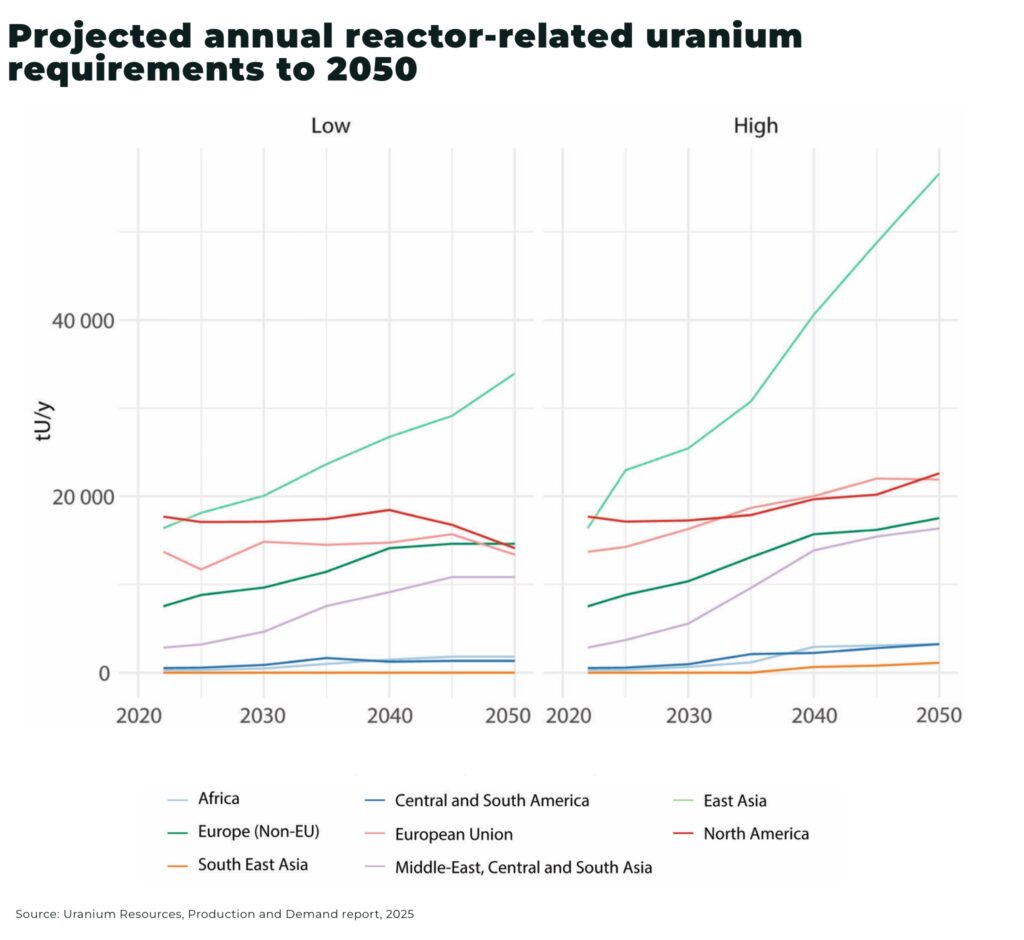

World annual reactor-related uranium requirements are projected to rise to between around 90,000 tU/y and 142,000 tU/y by 2050, from 59,000 tU in 2023 — an increase of 53% and 140% respectively.

But global uranium supply will struggle to meet the high-demand growth requirements by the 2080s, with high-demand growth requirements by 2050 set to use approx 50% of the currently identified recoverable resource base at costs below USD 130/kgU and about 35% at costs below USD 260/kgU. Beyond 2050, however, even if nuclear capacity remains at 2050 levels, cumulative uranium requirements would surpass 100% of the current total identified resource base in the highest cost category by the 2080s under high demand or by the 2110s under low demand — according to the latest “Red Book” report by the Nuclear Energy Agency and International Atomic Energy Agency.

SMRs — with their shorter build times — are a potent accelerant to this mix. This is especially so as, once an SMR is under construction, fuel delivery contracts are signed years in advance.

If most SMR designs (300–500 MWe range) typically consume 200–500 tU/year, projecting to 2035, industry proposals and country roadmaps (Canada, UK, US, China) suggest deploying 10–15 units — leading to 2,000–3,000 tU/year additional demand. This is equivalent to two major mines’ output, but new mines can 10-15 years to develop.

SMRs will increasingly require enriched uranium, often HALEU (High-Assay Low-Enriched Uranium), creating additional bottlenecks and demand drivers beyond mined U₃O₈.

“SMRs are turning theoretical demand into real contracts — and for explorers like us, that’s the signal we’ve been waiting for. With governments now funding buildouts and fuel delivery locked in years ahead, the race is on to discover and develop the next tier of uranium supply.

F3 Uranium is emerging as one of the most active and high-grade uranium explorers in Canada’s Athabasca Basin. Our flagship PLN Project continues to deliver standout drill results, with recent drilling producing high assays of up to 66.8% U₃O₈ — among the highest grades reported globally in 2024. Backed by a strong technical team and strategic positioning near infrastructure, F3 is well-placed to supply the next wave of demand from SMRs and large-scale reactors alike.”

Dev Randhawa, CEO and Chairman, F3 Uranium Corp (TSXV: FUU, OTCQB: FUUFF)

Conclusion

With SMRs advancing and utilities starting to shift procurement strategies, the floor is rising in the uranium market — and a new structural bull case is forming, not with mega-project headlines, but with funded, staged rollouts that lock in fuel supply along the way.

The impact will not be small.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.