- Flowcarbon has raised US$70million to sell carbon credits on blockchain

- estimated 99.9% of Verra credits transferred to Toucan Protocol credited before 2016

- for investors, focus not on crypto-backed carbon credits but on premium credits

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The crypto carbon market is transforming carbon credit trading.

The latest entrant, Flowcarbon, co-founded by WeWork’s Adam Neuman has just raised US$70million to sell carbon credits on blockchain; a single carbon credit was sold by Save Planet Earth as an NFT for nearly US$70,000 in November 2021; the Toucan Protocol, launched last year, already accounts for purchases of over 25% of all carbon credits verified by Verra, the market leader in voluntary carbon credit registries.

Tokenizing carbon credits — turning them into blockchain units — is taking off, but it is going to be a bumpy road while the details are worked out.

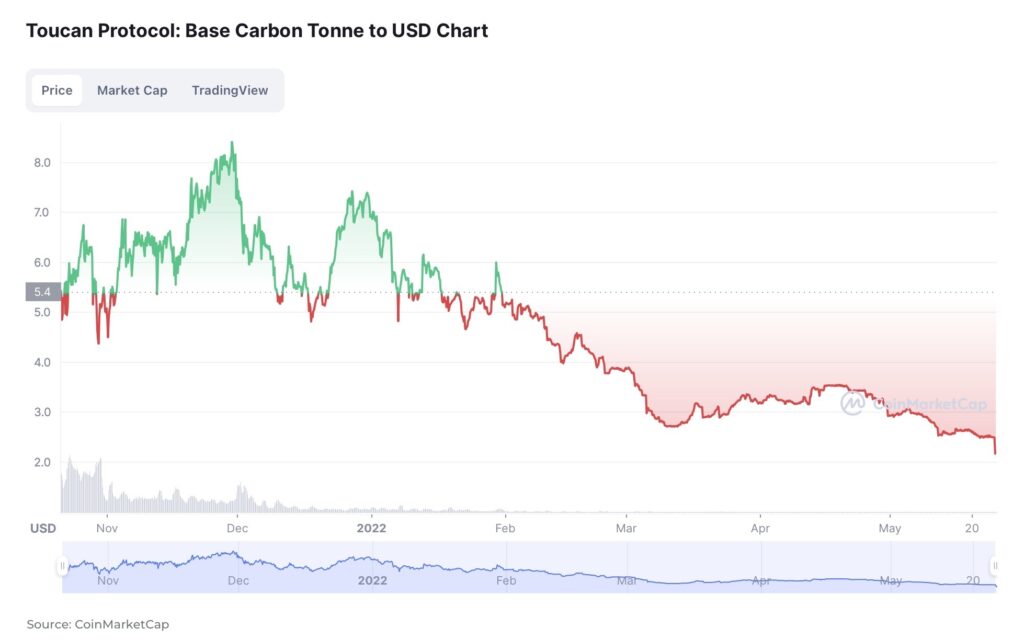

A recent report suggests Save Planet Earth does not have the necessary agreements in place to make good on their carbon credit promises; blockchain has a significant impact on the environment (if Bitcoin and Ethereum were their own country, they would have the thirteenth highest energy consumption, just behind the UK and Italy); and, in the latest crypto crash, Toucan Protocol has gone from highs of over US$100million market cap last year, to just over $150,000 in May 2022.

Then Verra, the market leader in voluntary carbon credit registries, has just announced — effective immediately — they are prohibiting the practice of creating instruments or tokens based on their retired credits.

But let’s back up a moment.

Carbon crypto enthusiasts suggest blockchain can solve the challenges of fragmentation in the voluntary carbon credit markets. In particular, carbon crypto promises a transparent, efficient and secure mechanism to enable significant scalability and growth in the market. This is particularly important after Article 6, agreed at COP26 last year, set the foundations for international transfers of voluntary carbon credits.

So is the tokenizing of carbon credits a good or bad thing for investors?

I would not recommend anyone buy a carbon credit for US$70,000 when the underlying credit is trading in a 10-15 dollar range, as was the ask earlier in the year for a carbon NFT. So, let’s focus on the promise for blockchain to revolutionize the voluntary market infrastructure.

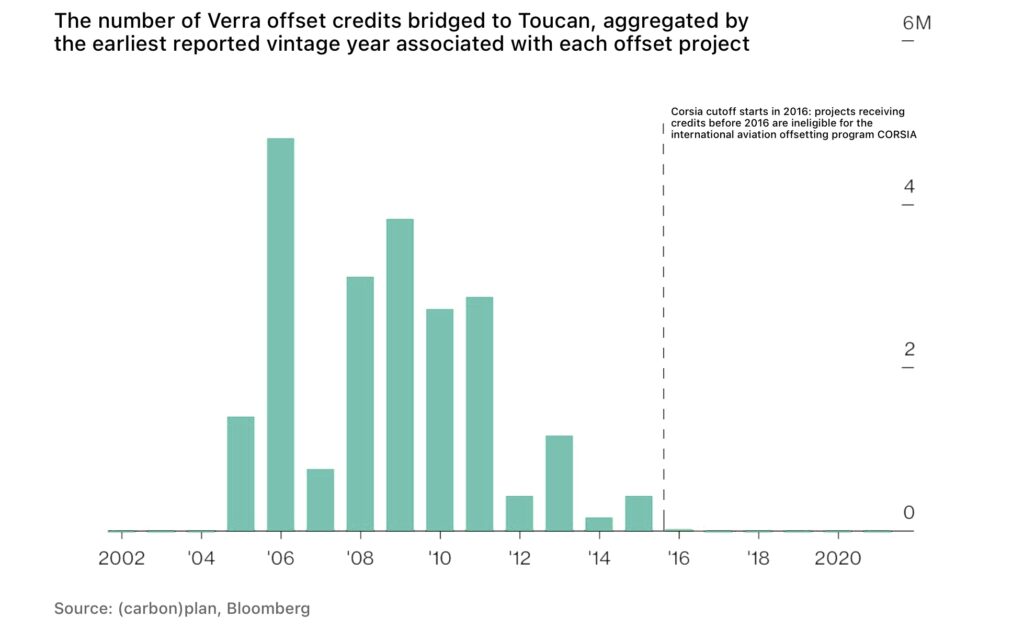

To date, many of the carbon credits bought up by the blockchain platforms are from older, cheaper vintages. It’s estimated 99.9% of Verra credits transferred to the Toucan Protocol were initially credited before 2016 when verification standards were not as rigorous. A new report by (carbon)plan found approximately 28% of Toucan Protocol credits are from so-called “zombie projects” that have a questionable impact on the environment.

In fact, the issue of low-quality credits has even been flagged on Toucan’s governance board and now welcomed by Toucan in their response to Verra’s decision.

Verification registries such as Verra and Gold Standard have been essential in building trust in the value of carbon credits so people feel safe to invest. It is critical that, as the tokenization of credits continues, these registries are able to maintain the trust of carbon credit buyers through their protocols.

Ironically, carbon crypto threatens to undermine this trust. So much so that the new demand by blockchain platforms for older vintage credits has pushed developers who haven’t issued credits for over a decade to start selling again.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

An example of such a zombie project outlined in the (carbon)plan’s report is worth quoting in full: “A natural gas project located just outside of Shanghai in China’s Jiangsu province. Prior to Toucan, the project’s last recorded retirement in Verra’s database occurred on April 30, 2013. Since November 2021, over half a million of the project’s credits have been bridged by Toucan. Having lain dormant for the better part of a decade, these neglected credits now find new life on the blockchain.”

Verra warned in November 2021 that anyone transacting in retired or cancelled carbon crypto tokens generated by third parties do so at their own risk. Now they’re stopping blockchain platforms, such as Toucan Protocol, from generating tokens from verified carbon credits that have been retired.

This makes sense. If a credit is retired — ie the carbon credit has been purchased and its value of one ton of CO₂ has been reduced from the purchaser’s carbon footprint — it is used and should have no value.

Verra is exploring the possibility of “immobilizing” credits in accounts in its registry which could be tokenized with “transparency and traceability.” But this will take time.

The voluntary carbon markets need to establish efficient and trustworthy mechanisms to trade credits, as well as raising awareness and finance. Blockchain may hold the answers to all of these challenges. But, first and foremost, the foundation of any marketplace is trust.

The arrival of crypto into the carbon markets was inevitable and so too are the changes required for the carbon industry to adapt. Verra’s announcement on crypto — and we expect to see the other major registries announce similar restrictions* — is the right call to maintain the trust carbon markets have built in recent years. For now, we recommend investors focus, not on crypto-backed carbon credits, but on premium credits from quality projects until the registries and the industry as a whole has adjusted.

*Update, May 26, 2022: Gold Standard registry have also revised their Registry of Terms to clarify that the creation of tokens, cryptocurrencies or other digital instruments or assets is not permitted without Gold Standard’s express written consent.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.